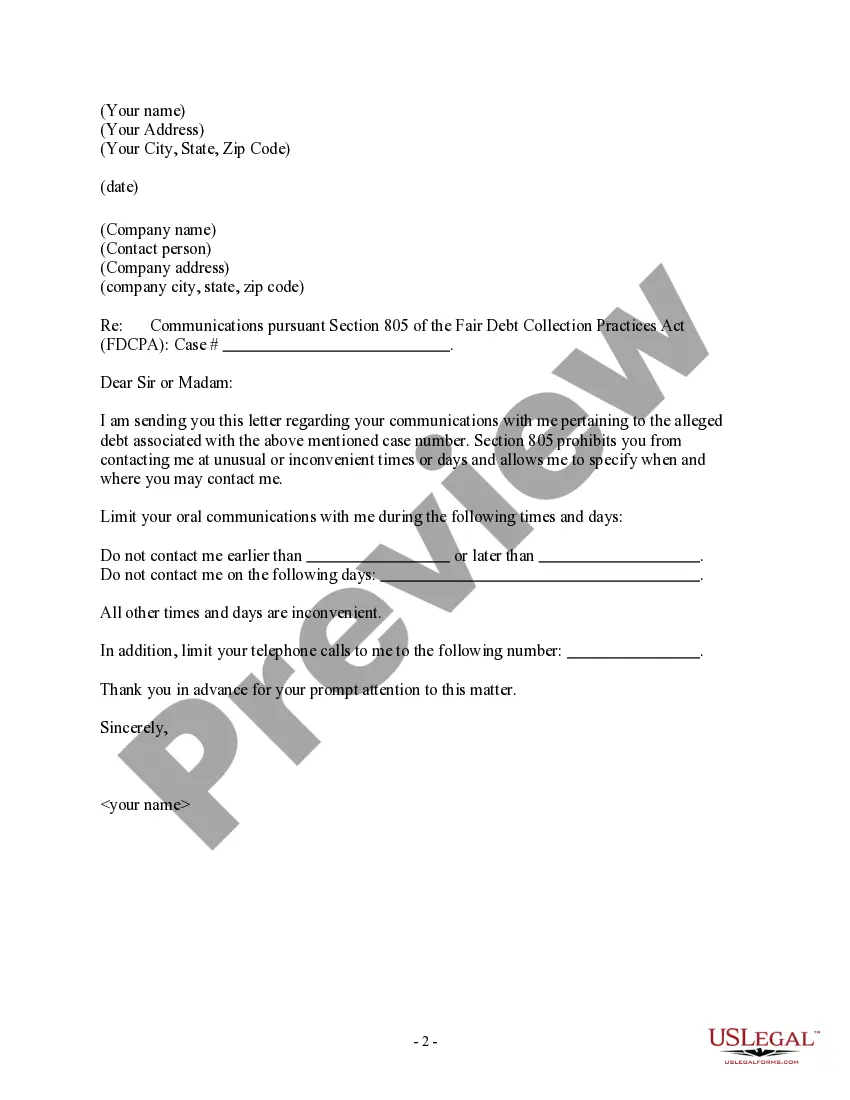

Pennsylvania Letter to Debt Collector - Only call me on the following days and times

Description

How to fill out Pennsylvania Letter To Debt Collector - Only Call Me On The Following Days And Times?

US Legal Forms - among the largest libraries of authorized kinds in the United States - provides a wide range of authorized papers web templates you are able to download or print out. Using the internet site, you can find a large number of kinds for enterprise and specific functions, sorted by types, states, or key phrases.You will find the latest versions of kinds just like the Pennsylvania Letter to Debt Collector - Only call me on the following days and times in seconds.

If you have a registration, log in and download Pennsylvania Letter to Debt Collector - Only call me on the following days and times in the US Legal Forms library. The Obtain option will show up on each and every type you perspective. You gain access to all in the past delivered electronically kinds from the My Forms tab of your own profile.

If you would like use US Legal Forms for the first time, listed below are simple guidelines to get you started:

- Be sure to have picked out the right type for the metropolis/county. Select the Review option to analyze the form`s articles. Look at the type outline to actually have selected the proper type.

- When the type doesn`t fit your requirements, use the Research industry at the top of the screen to discover the one which does.

- In case you are pleased with the shape, confirm your selection by visiting the Acquire now option. Then, opt for the prices program you want and supply your qualifications to sign up on an profile.

- Procedure the financial transaction. Make use of bank card or PayPal profile to complete the financial transaction.

- Pick the formatting and download the shape in your device.

- Make changes. Complete, change and print out and signal the delivered electronically Pennsylvania Letter to Debt Collector - Only call me on the following days and times.

Every template you added to your bank account lacks an expiration date which is your own property eternally. So, if you want to download or print out yet another copy, just proceed to the My Forms section and then click about the type you need.

Gain access to the Pennsylvania Letter to Debt Collector - Only call me on the following days and times with US Legal Forms, by far the most substantial library of authorized papers web templates. Use a large number of professional and status-particular web templates that satisfy your business or specific needs and requirements.

Form popularity

FAQ

Dear Debt collector name, I am responding to your contact about collecting a debt. You contacted me by phone/mail, on date and identified the debt as any information they gave you about the debt. I do not have any responsibility for the debt you're trying to collect.

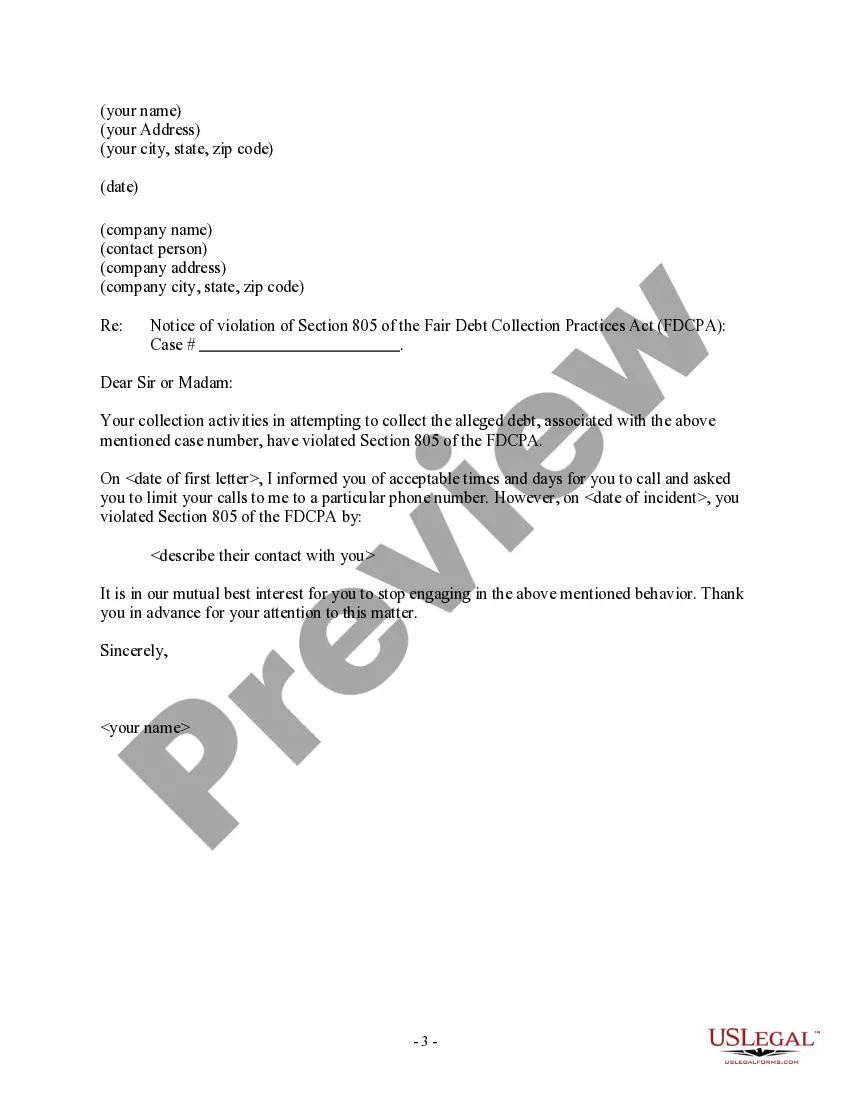

You may ask a debt collector to contact you only by mail, or through your attorney, or set other limitations. Make sure you send your request in writing, send it by certified mail with a return receipt, and keep a copy of the letter and receipt.

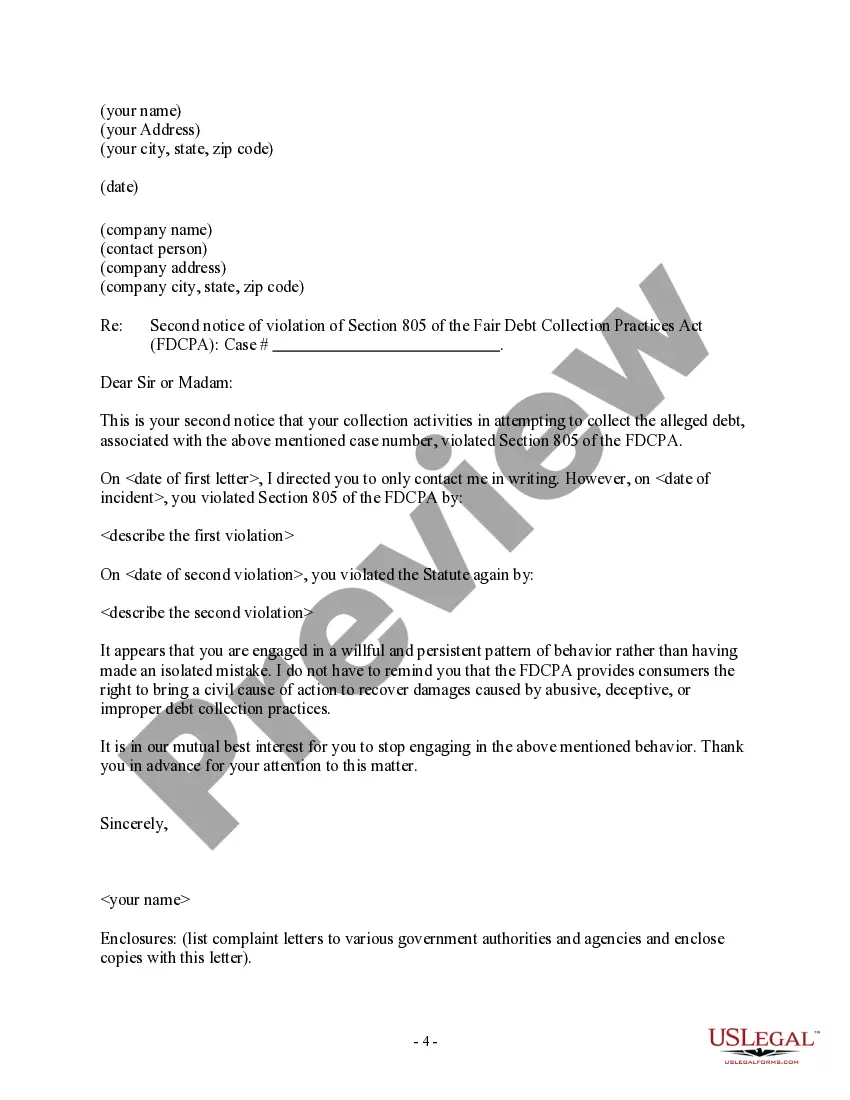

You can report a debt collector's failure to respond to your state's attorney general, the Consumer Financial Protection Bureau (CFPB), or the FTC. You may also file a counterclaim against the debt collector for up to $1,000 for each violation.

Yes, a debt collector can call on Sunday, unless you've told them that Sunday is inconvenient for you. If you tell them not to call on Sunday, and they do so anyway, then the call violates the Fair Debt Collection Practices Act.

Also, debt collectors can't call you numerous times a day. Doing so is considered a form of harassment by the Federal Trade Commission (FTC) and is explicitly not allowed.

The only permissible means of communicating is by regular mail. Alberta and Nova Scotia have a similar "three strikes" rule limiting the amount of contact from collectors within a seven-day consecutive period.

Federal law doesn't give a specific limit on the number of calls a debt collector can place to you. A debt collector may not call you repeatedly or continuously intending to annoy, abuse, or harass you or others who share the number.

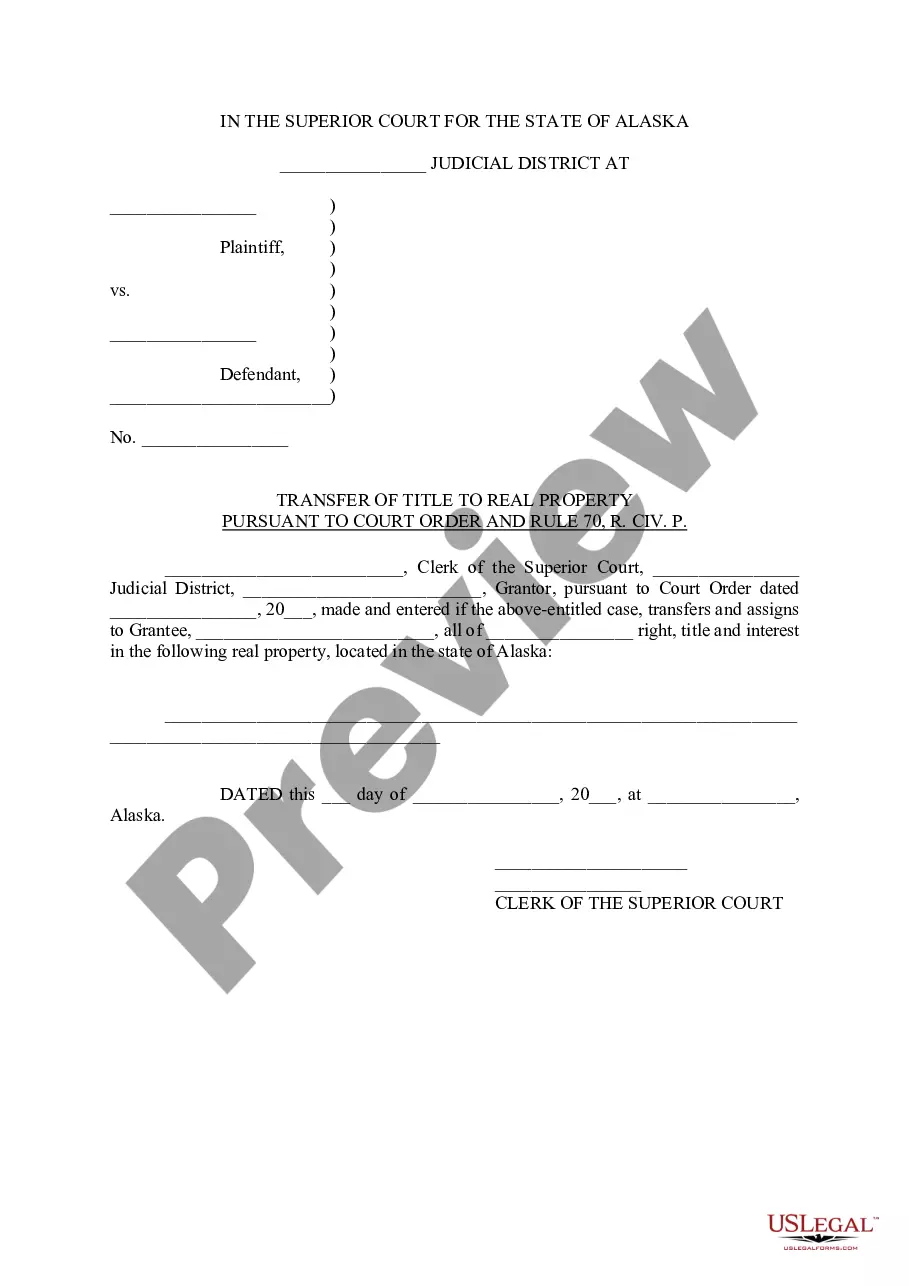

The statute of limitations is a law that limits how long debt collectors can legally sue consumers for unpaid debt. The statute of limitations on debt varies by state and type of debt, ranging from three years to as long as 20 years.

Also, debt collectors can't call you numerous times a day. Doing so is considered a form of harassment by the Federal Trade Commission (FTC) and is explicitly not allowed.