Pennsylvania Notice of Violation of Fair Debt Act - Improper Contact at Work

Description

How to fill out Pennsylvania Notice Of Violation Of Fair Debt Act - Improper Contact At Work?

If you wish to complete, down load, or print lawful record layouts, use US Legal Forms, the most important assortment of lawful forms, which can be found on the Internet. Make use of the site`s easy and hassle-free research to discover the papers you will need. Various layouts for organization and person uses are categorized by categories and states, or key phrases. Use US Legal Forms to discover the Pennsylvania Notice of Violation of Fair Debt Act - Improper Contact at Work in a few clicks.

In case you are previously a US Legal Forms client, log in for your account and click the Down load switch to get the Pennsylvania Notice of Violation of Fair Debt Act - Improper Contact at Work. Also you can access forms you previously downloaded from the My Forms tab of your account.

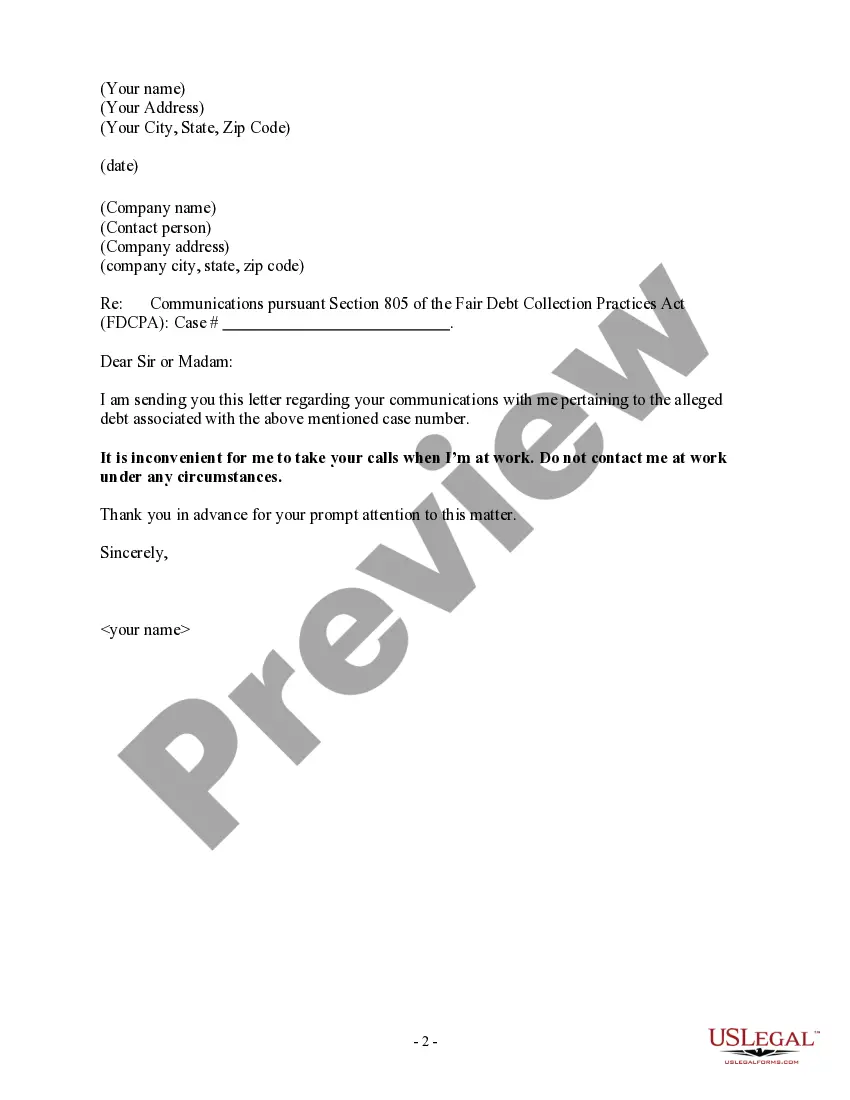

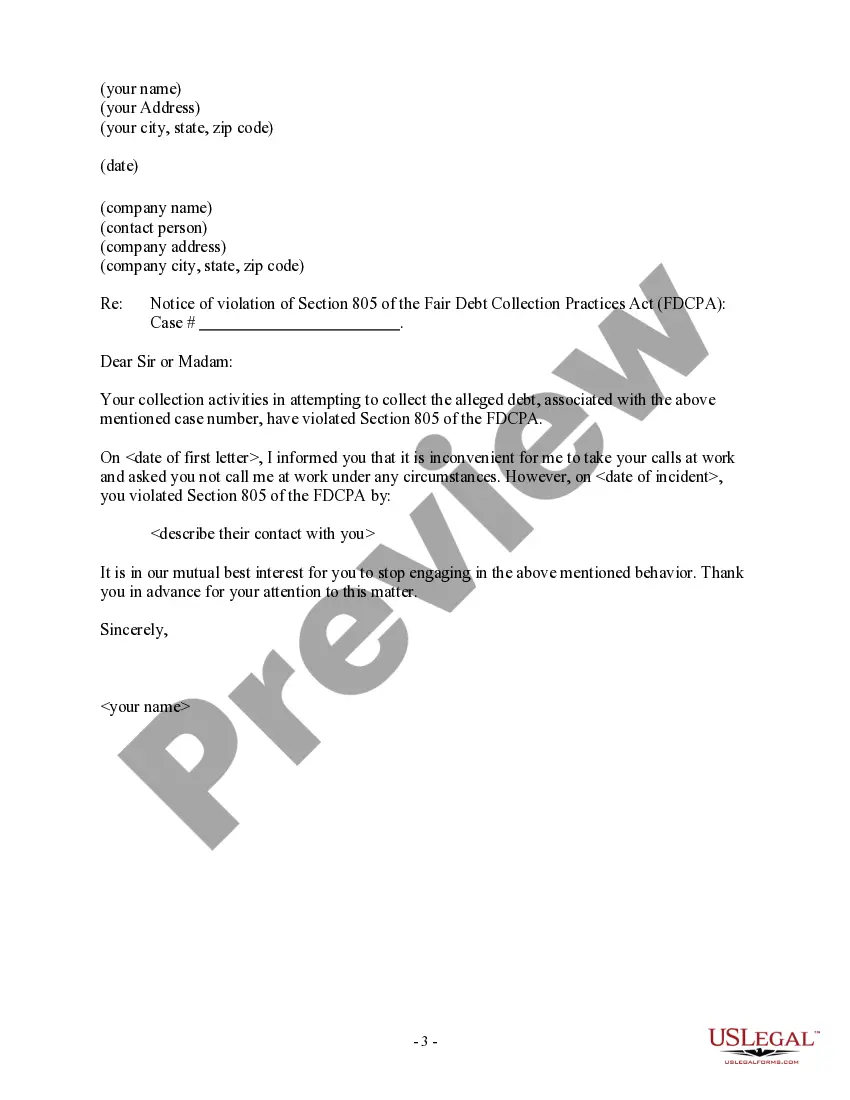

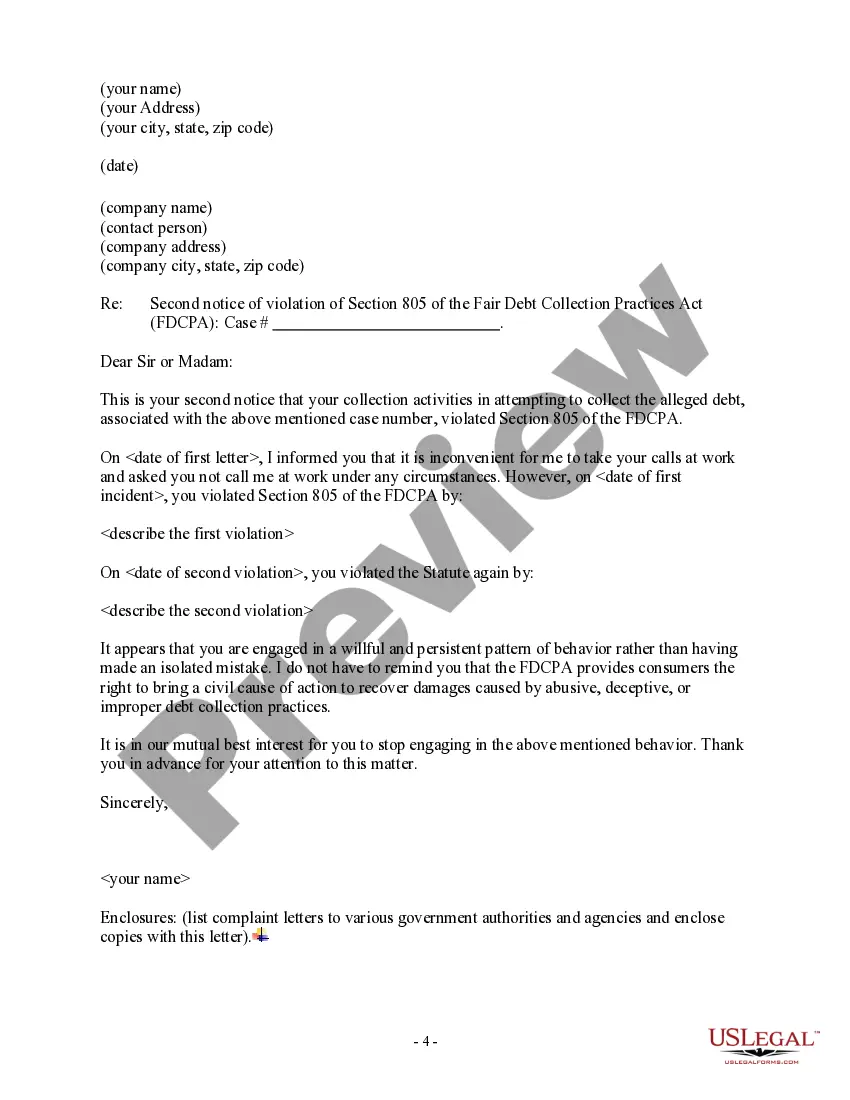

Should you use US Legal Forms for the first time, refer to the instructions below:

- Step 1. Make sure you have selected the shape for that proper city/land.

- Step 2. Take advantage of the Preview option to look over the form`s content. Don`t overlook to see the information.

- Step 3. In case you are unsatisfied together with the kind, utilize the Research field near the top of the display to locate other versions of your lawful kind format.

- Step 4. Upon having identified the shape you will need, select the Buy now switch. Choose the prices program you choose and put your credentials to sign up for an account.

- Step 5. Approach the purchase. You can use your credit card or PayPal account to complete the purchase.

- Step 6. Choose the format of your lawful kind and down load it in your gadget.

- Step 7. Comprehensive, revise and print or signal the Pennsylvania Notice of Violation of Fair Debt Act - Improper Contact at Work.

Every single lawful record format you buy is your own permanently. You might have acces to each kind you downloaded in your acccount. Select the My Forms portion and choose a kind to print or down load once more.

Remain competitive and down load, and print the Pennsylvania Notice of Violation of Fair Debt Act - Improper Contact at Work with US Legal Forms. There are thousands of skilled and express-specific forms you can utilize for your personal organization or person requirements.

Form popularity

FAQ

Simply tell the debt collector that your employer doesn't want them calling your job or that you're not allowed to receive personal calls at work. Once the debt collector is aware of either situation, they are legally required to stop calling you at work.

If a debt collector violates the FDCPA, you may sue that collector in state or federal court. You can even sue in small claims court. You must do this within one year from the date on which the violation occurred.

This means that debt collectors cannot harass you in-person at your work. However, a debt collector, like a credit card company, may call you at work, though they can't reveal to your co-workers that they are debt collectors. If you ask the debt collector not to contact you at work, by law they must stop.

Debt collectors must be truthful The Fair Debt Collection Practices Act states that debt collectors cannot use any false, deceptive or misleading representation to collect the debt. Along with other restrictions, debt collectors cannot misrepresent: The amount of the debt. Whether it's past the statute of limitations.

Debt collectors aren't allowed to shame you into paying them back. So they can't call your job to tell your boss or other employees how bad you are about paying back your debts.

You have the right to be treated fairly by debt collectors. The Fair Debt Collection Practices Act (FDCPA) applies to personal, family, and household debts. This includes money you owe for the purchase of a car, for medical care, or for charge accounts.

7 Most Common FDCPA ViolationsContinued attempts to collect debt not owed.Illegal or unethical communication tactics.Disclosure verification of debt.Taking or threatening illegal action.False statements or false representation.Improper contact or sharing of info.Excessive phone calls.

Come to your workplace However, a debt collector, like a credit card company, may call you at work, though they can't reveal to your co-workers that they are debt collectors. If you ask the debt collector not to contact you at work, by law they must stop. Ready to conquer your debt?

7 Most Common FDCPA ViolationsContinued attempts to collect debt not owed.Illegal or unethical communication tactics.Disclosure verification of debt.Taking or threatening illegal action.False statements or false representation.Improper contact or sharing of info.Excessive phone calls.16-Sept-2020

Problems Faced by Debt Collection Agents and How to Solve Them!Oral Contracts:Faulty Written Agreements:Money Recovery Issues:Collection Methods Are Not Real-Time:Mobile Borrowers:Too Many Calls:Contacting Wrong People:Customer Bankruptcy:More items...?30-Nov-2019