This due diligence questionnaire is provided to gather information required to evaluate antitrust aspects of the proposed transaction. It lists certain information that is required in order to assess the competitive consequences of the proposed acquisition, and, to determine is preparation of any required Hart-Scott-Rodino filing is necessary.

Pennsylvania Hart Scott Rodino Questionnaire

Description

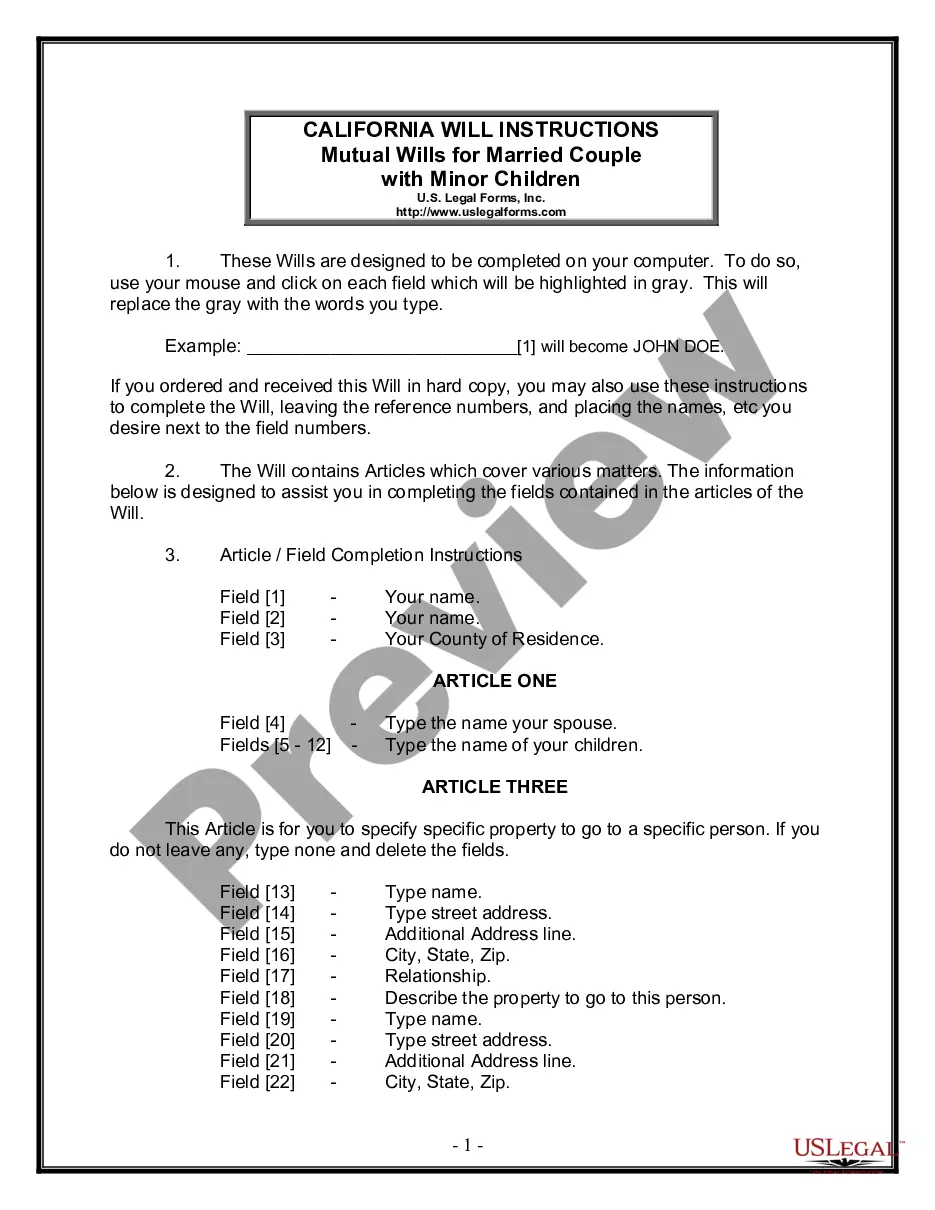

How to fill out Pennsylvania Hart Scott Rodino Questionnaire?

If you want to complete, download, or printing legitimate papers templates, use US Legal Forms, the greatest assortment of legitimate kinds, which can be found on-line. Utilize the site`s simple and easy practical search to find the files you need. A variety of templates for business and personal functions are sorted by types and suggests, or search phrases. Use US Legal Forms to find the Pennsylvania Hart Scott Rodino Questionnaire in a number of mouse clicks.

In case you are presently a US Legal Forms consumer, log in for your bank account and click on the Obtain option to find the Pennsylvania Hart Scott Rodino Questionnaire. You can even accessibility kinds you in the past downloaded inside the My Forms tab of your respective bank account.

Should you use US Legal Forms for the first time, refer to the instructions under:

- Step 1. Be sure you have selected the shape for that correct town/land.

- Step 2. Utilize the Review method to check out the form`s articles. Never neglect to read the information.

- Step 3. In case you are not satisfied using the form, use the Research industry at the top of the display to locate other versions from the legitimate form design.

- Step 4. Once you have found the shape you need, click the Acquire now option. Pick the prices prepare you like and put your accreditations to sign up on an bank account.

- Step 5. Process the transaction. You can use your Мisa or Ьastercard or PayPal bank account to perform the transaction.

- Step 6. Pick the formatting from the legitimate form and download it on your system.

- Step 7. Comprehensive, modify and printing or sign the Pennsylvania Hart Scott Rodino Questionnaire.

Every single legitimate papers design you purchase is your own property eternally. You have acces to each form you downloaded within your acccount. Select the My Forms area and select a form to printing or download yet again.

Be competitive and download, and printing the Pennsylvania Hart Scott Rodino Questionnaire with US Legal Forms. There are many professional and status-specific kinds you can use for the business or personal demands.

Form popularity

FAQ

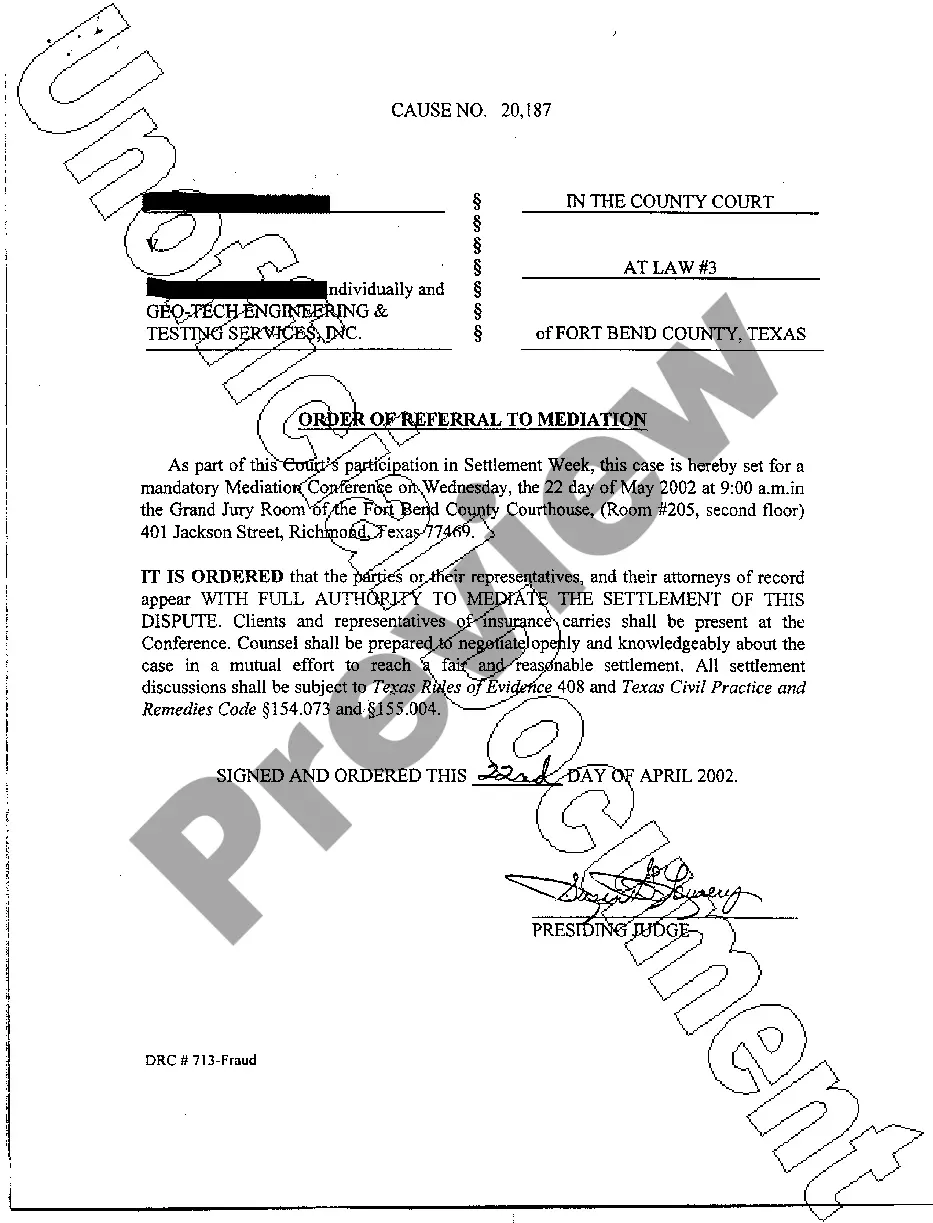

The HSR Act requires that parties to mergers and acquisitions, including acquisitions of voting securities and assets, notify the DOJ and the FTC, and observe a statutory waiting period if the acquisition meets specified size-of-person and size-of-transaction thresholds and doesn't fall within an exemption to the

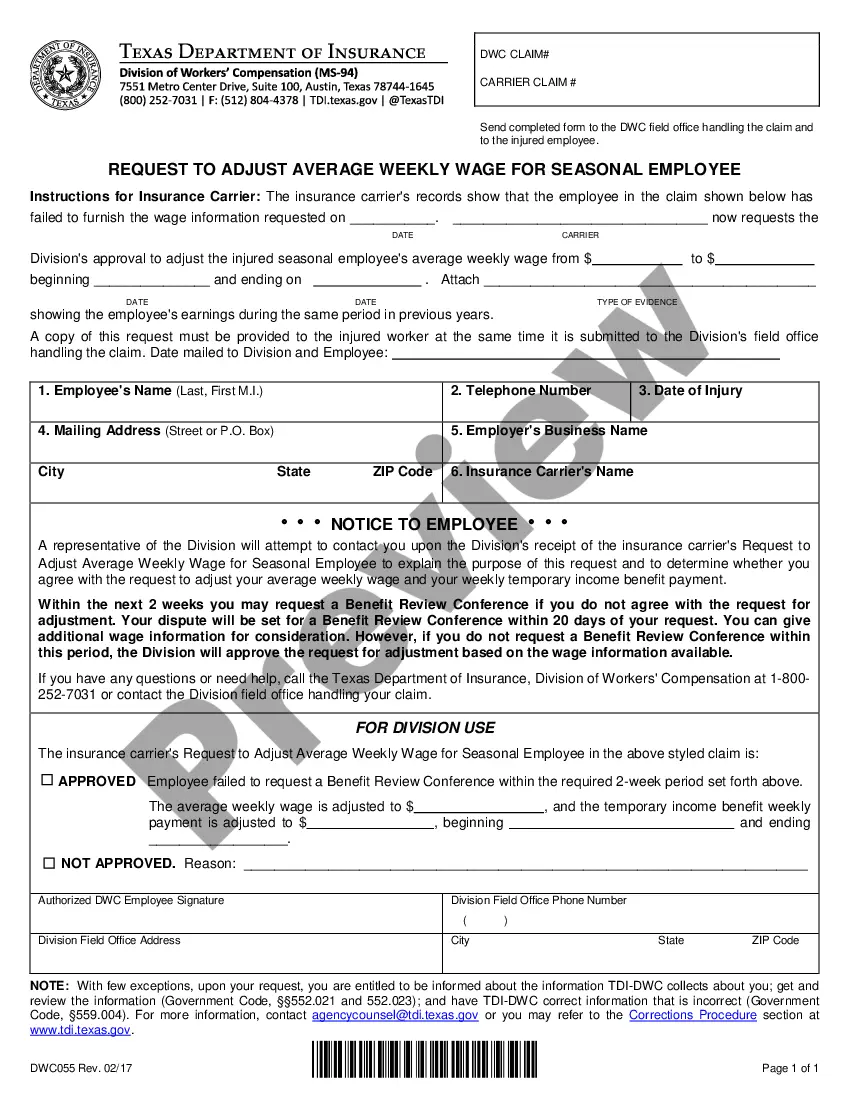

The HSR "size of parties" threshold generally requires that one party to the transaction have annual net sales or total assets of $202 million or more (up from $184 million in 2021), and that the other party have annual net sales or total assets of $20.2 million (up from $18.4 million).

HSR filings are premerger notifications that parties to a proposed merger transaction make with both the Federal Trade Commission and the Department of Justice. Subject to minor exceptions, both the seller and the buyer must each separately file with both agencies.

HSR Approval means the waiting period applicable to the Transaction under the Hart-Scott-Rodino Antitrust Improvements Act of 1976 shall have expired or been terminated, and no Governmental Entity shall have applied for an injunction or other order under the antitrust laws of the United States or any state thereof with

If the transaction is valued in excess of $50 million (as adjusted) but is $200 million (as adjusted) or less, only those transactions that also meet the size of person test require a filing.

If the transaction is valued at $50 million (as adjusted) or less, no filing is required. If the transaction is valued at more than $200 million (as adjusted), and no exemption applies, an HSR filing must be made and parties must wait until the statutory waiting period has expired before closing the deal.

The most significant threshold in determining reportability is the minimum size of transaction threshold. This is often referred to as the $50 million (as adjusted) threshold because it started at $50 million and is now adjusted annually. For 2022, that threshold will be $101 million.

What is the Hart-Scott-Rodino Act? The Hart-Scott-Rodino Antitrust Improvements Act of 1976 requires parties to report large transactions to both the Federal Trade Commission and the US Department of Justice Antitrust Division for antitrust review.

The HSR "size of parties" threshold generally requires that one party to the transaction have annual net sales or total assets of $202 million or more (up from $184 million in 2021), and that the other party have annual net sales or total assets of $20.2 million (up from $18.4 million).

Your filing will not be published or accessible to the public, and there is a spe- cific statute that prevents members of the public from accessing HSR filings through Freedom of Information Act requests.