Pennsylvania Trust Agreement between Nike Securities, L.P., The Chase Manhattan Bank and First Trust Advisors, L.P.

Description

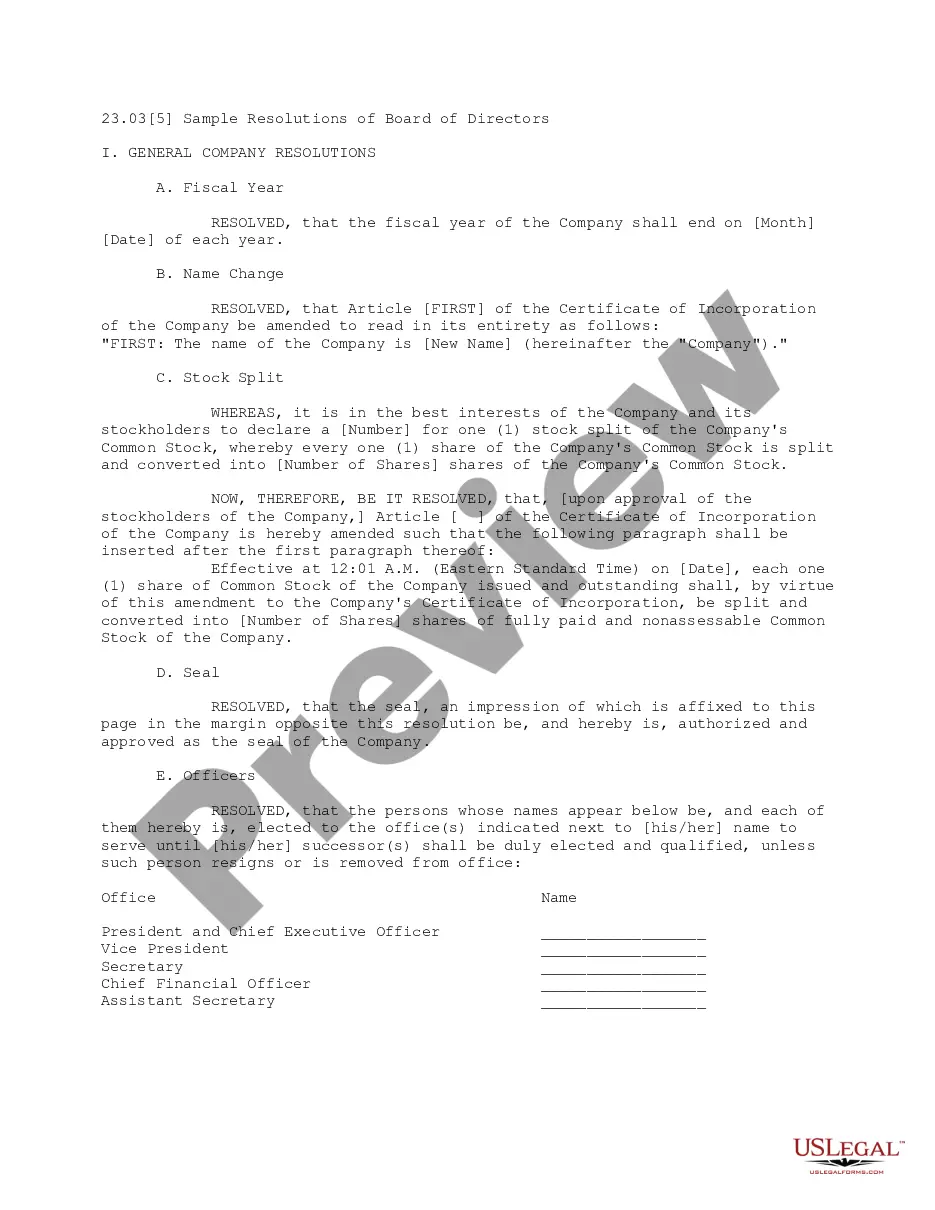

How to fill out Trust Agreement Between Nike Securities, L.P., The Chase Manhattan Bank And First Trust Advisors, L.P.?

Choosing the best lawful papers template could be a battle. Of course, there are a lot of templates available on the Internet, but how will you get the lawful type you require? Take advantage of the US Legal Forms web site. The support provides a huge number of templates, such as the Pennsylvania Trust Agreement between Nike Securities, L.P., The Chase Manhattan Bank and First Trust Advisors, L.P., that can be used for business and private requirements. All the kinds are examined by specialists and fulfill state and federal needs.

In case you are presently authorized, log in to the accounts and click the Acquire switch to have the Pennsylvania Trust Agreement between Nike Securities, L.P., The Chase Manhattan Bank and First Trust Advisors, L.P.. Use your accounts to look throughout the lawful kinds you have bought earlier. Proceed to the My Forms tab of your accounts and obtain an additional copy of your papers you require.

In case you are a brand new customer of US Legal Forms, allow me to share easy recommendations for you to stick to:

- First, ensure you have chosen the appropriate type to your metropolis/state. It is possible to examine the form making use of the Preview switch and look at the form information to make certain it is the best for you.

- When the type will not fulfill your needs, utilize the Seach discipline to discover the appropriate type.

- Once you are positive that the form is suitable, select the Acquire now switch to have the type.

- Select the rates prepare you want and enter the needed information and facts. Create your accounts and purchase the transaction using your PayPal accounts or bank card.

- Choose the data file file format and download the lawful papers template to the product.

- Full, edit and print out and signal the attained Pennsylvania Trust Agreement between Nike Securities, L.P., The Chase Manhattan Bank and First Trust Advisors, L.P..

US Legal Forms is the greatest library of lawful kinds where you can discover various papers templates. Take advantage of the company to download appropriately-manufactured documents that stick to status needs.