Pennsylvania Pooling and Servicing Agreement contemplating the sale of mortgage loans to Trustee for inclusion in the Trust Fund by the company

Description

How to fill out Pooling And Servicing Agreement Contemplating The Sale Of Mortgage Loans To Trustee For Inclusion In The Trust Fund By The Company?

If you need to complete, acquire, or printing legitimate papers templates, use US Legal Forms, the greatest variety of legitimate forms, that can be found on the Internet. Take advantage of the site`s easy and handy search to obtain the documents you want. Various templates for organization and person purposes are sorted by classes and says, or key phrases. Use US Legal Forms to obtain the Pennsylvania Pooling and Servicing Agreement contemplating the sale of mortgage loans to Trustee for inclusion in the Trust Fund by the company within a number of click throughs.

If you are previously a US Legal Forms buyer, log in in your profile and click the Obtain key to have the Pennsylvania Pooling and Servicing Agreement contemplating the sale of mortgage loans to Trustee for inclusion in the Trust Fund by the company. You may also accessibility forms you earlier downloaded inside the My Forms tab of your respective profile.

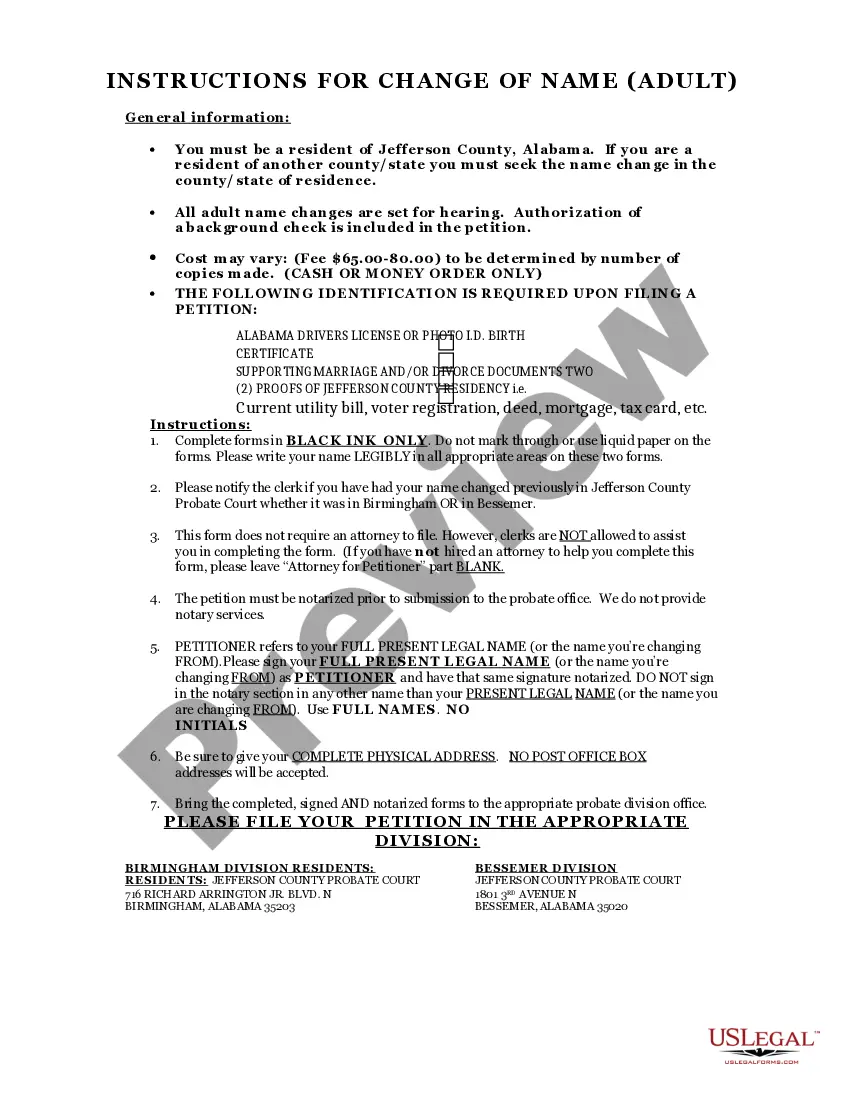

If you work with US Legal Forms the first time, follow the instructions listed below:

- Step 1. Ensure you have chosen the shape for your correct city/land.

- Step 2. Use the Review choice to look over the form`s content. Never forget to read through the outline.

- Step 3. If you are unhappy together with the develop, make use of the Research field towards the top of the monitor to locate other variations in the legitimate develop design.

- Step 4. Upon having identified the shape you want, click on the Buy now key. Choose the costs plan you choose and add your credentials to register on an profile.

- Step 5. Process the deal. You can use your bank card or PayPal profile to finish the deal.

- Step 6. Choose the structure in the legitimate develop and acquire it on the device.

- Step 7. Comprehensive, edit and printing or signal the Pennsylvania Pooling and Servicing Agreement contemplating the sale of mortgage loans to Trustee for inclusion in the Trust Fund by the company.

Each and every legitimate papers design you acquire is the one you have forever. You might have acces to every develop you downloaded in your acccount. Select the My Forms segment and decide on a develop to printing or acquire again.

Contend and acquire, and printing the Pennsylvania Pooling and Servicing Agreement contemplating the sale of mortgage loans to Trustee for inclusion in the Trust Fund by the company with US Legal Forms. There are many expert and express-certain forms you can utilize for your organization or person demands.

Form popularity

FAQ

Home Equity Line of Credit (HELOC) It allows the borrower to take out money against the credit line up to a preset limit, make payments, and then take out money again. Home Equity Loan vs. HELOC: What's the Difference? - Investopedia investopedia.com ? mortgage ? home-equity... investopedia.com ? mortgage ? home-equity...

A mortgage pool is a group of home and other real estate loans that have been bundled so they can be sold. A mortgage pool is a group of home and other real estate loans that have been bundled so they can be sold.

What is a Loan Servicing Agreement? A loan servicing agreement is a legal agreement between a lender and a third party, the servicer, that outlines the terms and conditions for which that third party will provide loan servicing services.

The ?Pooling and Servicing Agreement? is the legal document that contains the responsibilities and rights of the servicer, the trustee, and others over a pool of mortgage loans. Finding Pooling And Servicing Agreements (PSA's) For ... Supreme Court of Ohio (.gov) ? JCS ? PSA Supreme Court of Ohio (.gov) ? JCS ? PSA PDF

An MBS is made up of a pool of mortgages purchased from issuing banks and then sold to investors. An MBS allows investors to benefit from the mortgage business without needing to buy or sell home loans themselves.

Mortgage Pool Insurance means one or more policies of insurance issued by a Qualified Insurer or Qualified Insurers insuring against loss resulting or arising from an event of default under any or all Mortgage Loans financed with the proceeds of a Series of Bonds resulting from the mortgagor's failure to make any ...