Pennsylvania Plan of Merger and Reorganization by and among Digital Insight Corp., Black Transitory Corp. and nFront, Inc.

Description

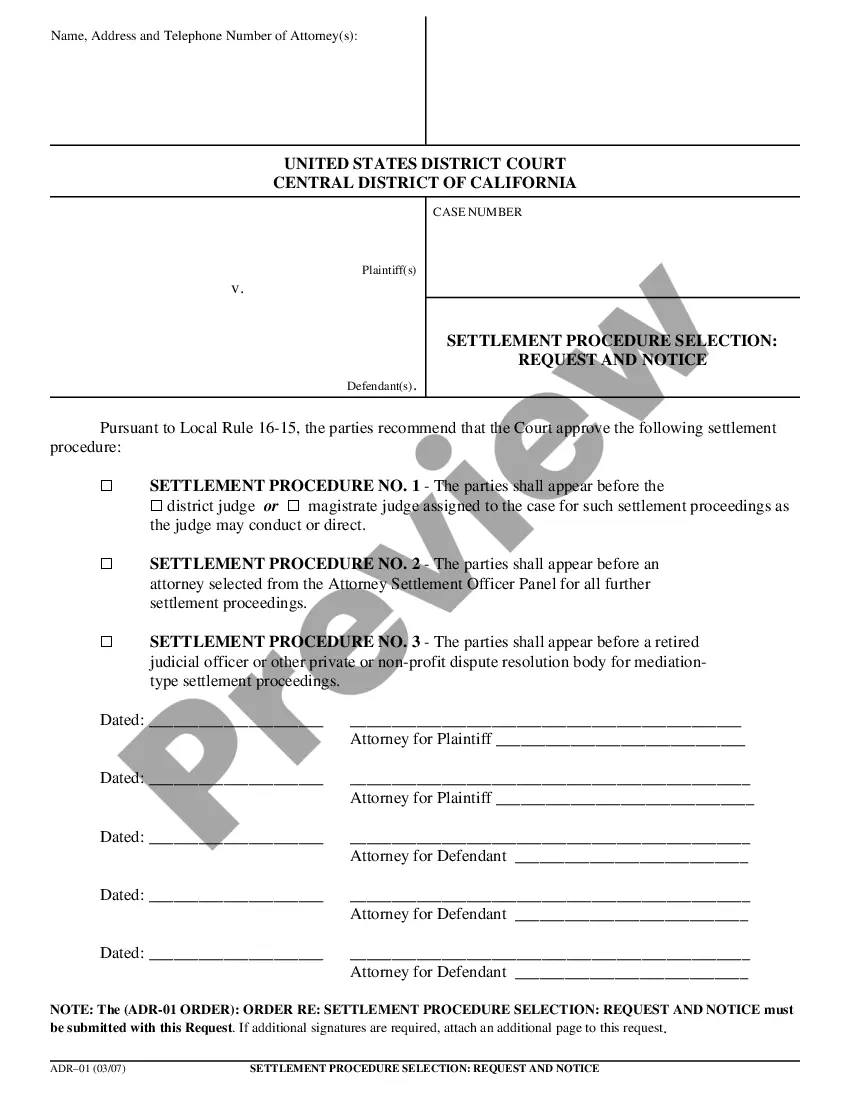

How to fill out Plan Of Merger And Reorganization By And Among Digital Insight Corp., Black Transitory Corp. And NFront, Inc.?

If you wish to comprehensive, obtain, or print legitimate record layouts, use US Legal Forms, the biggest collection of legitimate types, which can be found online. Make use of the site`s simple and convenient research to obtain the paperwork you want. Numerous layouts for business and specific functions are sorted by classes and says, or keywords. Use US Legal Forms to obtain the Pennsylvania Plan of Merger and Reorganization by and among Digital Insight Corp., Black Transitory Corp. and nFront, Inc. with a few clicks.

In case you are presently a US Legal Forms customer, log in in your account and then click the Download button to have the Pennsylvania Plan of Merger and Reorganization by and among Digital Insight Corp., Black Transitory Corp. and nFront, Inc.. You can even gain access to types you formerly saved in the My Forms tab of your respective account.

Should you use US Legal Forms the first time, follow the instructions below:

- Step 1. Be sure you have selected the shape for the appropriate area/region.

- Step 2. Utilize the Review choice to look over the form`s information. Do not neglect to learn the explanation.

- Step 3. In case you are not satisfied using the kind, utilize the Lookup discipline towards the top of the screen to find other variations in the legitimate kind design.

- Step 4. After you have found the shape you want, click the Buy now button. Choose the rates plan you favor and put your credentials to sign up for the account.

- Step 5. Process the purchase. You can use your bank card or PayPal account to complete the purchase.

- Step 6. Choose the structure in the legitimate kind and obtain it in your product.

- Step 7. Complete, edit and print or sign the Pennsylvania Plan of Merger and Reorganization by and among Digital Insight Corp., Black Transitory Corp. and nFront, Inc..

Every single legitimate record design you get is your own property permanently. You possess acces to every kind you saved in your acccount. Click the My Forms segment and pick a kind to print or obtain yet again.

Be competitive and obtain, and print the Pennsylvania Plan of Merger and Reorganization by and among Digital Insight Corp., Black Transitory Corp. and nFront, Inc. with US Legal Forms. There are millions of skilled and condition-specific types you can utilize to your business or specific requires.