Pennsylvania Credit Agreement regarding extension of credit is a legal document that outlines the terms and conditions under which a lender agrees to extend credit to a borrower. This agreement is crucial as it ensures both parties understand their rights and obligations when it comes to borrowing and lending money. It establishes a framework for the lending relationship and provides clarity on key aspects such as interest rates, repayment terms, and penalties for default. In Pennsylvania, there are different types of credit agreements that can be used to extend credit. Some common types include: 1. Revolving Credit Agreement: This type of agreement allows the borrower to have a predetermined credit limit, which can be borrowed and repaid multiple times within a specified period. The borrower has the flexibility to draw funds as needed and is only required to make payments based on the utilized amount. 2. Installment Credit Agreement: This agreement involves borrowing a fixed amount of money, which is repaid through equal monthly installments over a set period. The interest rate and repayment duration are agreed upon upfront, providing the borrower with a clear timeline for full repayment. 3. Line of Credit Agreement: This type of credit agreement establishes a maximum borrowing limit, but the borrower has the flexibility to draw funds as needed. Interest is charged only on the borrowed amount, and the borrower can repay and borrow again within the predetermined limit during the agreement term. 4. Secured Credit Agreement: In this agreement, the borrower pledges collateral (such as property or assets) to secure the loan. Collateral provides the lender with a means of recovering their money if the borrower defaults. This agreement typically offers lower interest rates due to reduced risk for the lender. In all Pennsylvania Credit Agreements regarding extension of credit, it is important to include essential details such as the parties involved, the amount of credit to be extended, the interest rate, the repayment schedule, and any applicable fees or penalties for late payment or default. The agreement should also outline the conditions under which the lender can terminate the credit agreement and the borrower's rights to prepayment or early termination. Overall, a Pennsylvania Credit Agreement regarding extension of credit is a legally binding contract that protects the rights and interests of both the borrower and the lender, ensuring transparency and clarity throughout the lending process.

Pennsylvania Credit Agreement regarding extension of credit

Description

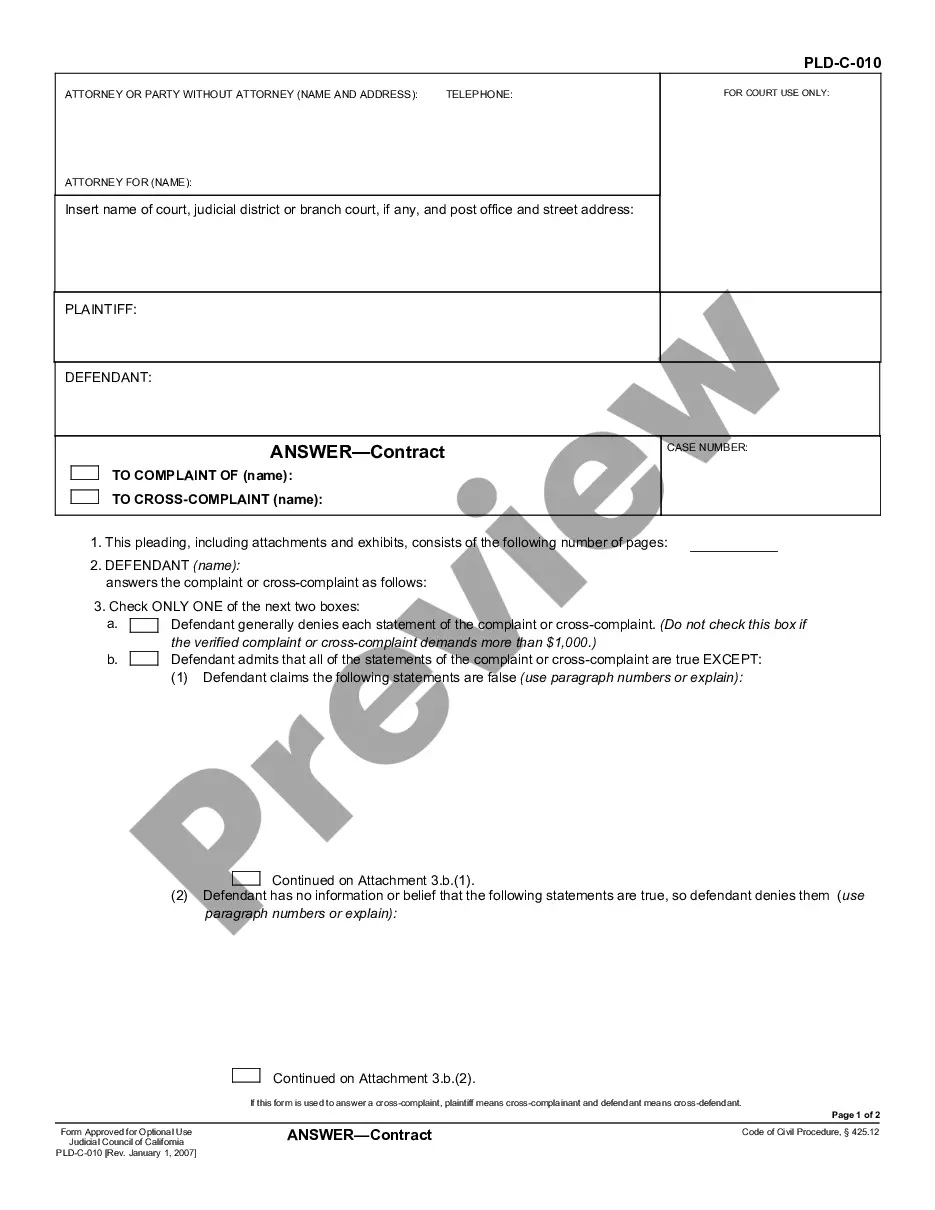

How to fill out Pennsylvania Credit Agreement Regarding Extension Of Credit?

Are you within a position the place you need papers for either organization or individual reasons just about every day time? There are tons of authorized papers layouts available on the net, but getting types you can rely isn`t simple. US Legal Forms gives 1000s of kind layouts, such as the Pennsylvania Credit Agreement regarding extension of credit, that are composed in order to meet state and federal needs.

When you are already knowledgeable about US Legal Forms website and also have an account, merely log in. After that, you may acquire the Pennsylvania Credit Agreement regarding extension of credit template.

Should you not have an accounts and need to start using US Legal Forms, adopt these measures:

- Discover the kind you want and make sure it is for that proper area/region.

- Take advantage of the Preview switch to examine the form.

- Browse the description to ensure that you have chosen the proper kind.

- When the kind isn`t what you`re looking for, utilize the Search field to obtain the kind that meets your requirements and needs.

- Once you discover the proper kind, click Get now.

- Select the rates prepare you would like, fill out the desired information and facts to produce your account, and buy an order making use of your PayPal or charge card.

- Choose a handy file formatting and acquire your backup.

Find all the papers layouts you have purchased in the My Forms menu. You can get a extra backup of Pennsylvania Credit Agreement regarding extension of credit whenever, if required. Just click on the required kind to acquire or produce the papers template.

Use US Legal Forms, the most substantial variety of authorized types, to save time as well as avoid blunders. The support gives professionally produced authorized papers layouts that you can use for a selection of reasons. Make an account on US Legal Forms and begin producing your way of life a little easier.

Form popularity

FAQ

Lenders must provide a full disclosure of all of the loan's terms in the credit agreement. That can include the annual interest rate (APR), how the interest is applied to outstanding balances, any fees associated with the account, the duration of the loan, the payment terms, and any consequences for late payments.

Section 61 of the Consumer Credit Act. Section 61 of the Consumer Credit Act stipulates that a credit agreement is not properly executed unless it contains all the prescribed terms and conforms to regulations made under section 60(1) of the Act, and is signed in the prescribed manner.

Loan agreements typically include covenants, value of collateral involved, guarantees, interest rate terms and the duration over which it must be repaid.

The NCA does not require that a credit agreement must be in writing and signed by both parties to the agreement, although this is implied throughout the Act.

Usually, an IOU and a promissory note form are only signed by the borrower, although they may be signed by both parties. A loan agreement is a single document that contains all of the terms of the loan, and is signed by both parties.

A credit agreement is a legally binding contract between a borrower and a lender that documents all of the terms of a loan. Credits agreements are created for both individual and business loans.

Available credit is related to the account balance of a credit card or other form of debt. It refers to how much credit you have left to spend. The amount of available credit can be calculated by subtracting your purchases (and the interest on those purchases) from the total credit limit on the account.

Loans and credits are different finance mechanisms. While a loan provides all the money requested in one go at the time it is issued, in the case of a credit, the bank provides the customer with an amount of money, which can be used as required, using the entire amount borrowed, part of it or none at all.