Pennsylvania Term Sheet - Series A Preferred Stock Financing of a Company

Description

The Term Sheet is not a commitment to invest, and is conditioned on the completion of the conditions to closing set forth.

How to fill out Term Sheet - Series A Preferred Stock Financing Of A Company?

You may invest hours on the Internet looking for the lawful document web template that suits the federal and state specifications you want. US Legal Forms gives 1000s of lawful kinds which can be evaluated by specialists. You can actually download or produce the Pennsylvania Term Sheet - Series A Preferred Stock Financing of a Company from our support.

If you already possess a US Legal Forms bank account, you can log in and click on the Acquire key. Following that, you can total, change, produce, or indicator the Pennsylvania Term Sheet - Series A Preferred Stock Financing of a Company. Each lawful document web template you get is yours for a long time. To obtain an additional copy of the purchased type, go to the My Forms tab and click on the related key.

If you use the US Legal Forms site the first time, adhere to the basic directions under:

- Very first, ensure that you have chosen the best document web template for your region/town of your liking. Browse the type outline to make sure you have picked out the proper type. If offered, use the Review key to look throughout the document web template at the same time.

- If you would like get an additional version of the type, use the Lookup field to obtain the web template that suits you and specifications.

- After you have identified the web template you desire, click on Acquire now to carry on.

- Pick the prices plan you desire, type your references, and register for a free account on US Legal Forms.

- Comprehensive the purchase. You should use your Visa or Mastercard or PayPal bank account to cover the lawful type.

- Pick the structure of the document and download it for your gadget.

- Make adjustments for your document if necessary. You may total, change and indicator and produce Pennsylvania Term Sheet - Series A Preferred Stock Financing of a Company.

Acquire and produce 1000s of document web templates utilizing the US Legal Forms site, which offers the most important collection of lawful kinds. Use expert and state-particular web templates to handle your small business or person requirements.

Form popularity

FAQ

The first round of stock made available to the public by a startup is referred to as Series A preferred stock. This type of stock is generally offered for purchase during the seed stage of a new startup and can be converted into common stock in the event of an initial public offering or sale of the company.

The first round of stock made available to the public by a startup is referred to as Series A preferred stock. This type of stock is generally offered for purchase during the seed stage of a new startup and can be converted into common stock in the event of an initial public offering or sale of the company.

Preference shares, more commonly referred to as preferred stock, are shares of a company's stock with dividends that are paid out to shareholders before common stock dividends are issued. If the company enters bankruptcy, preferred stockholders are entitled to be paid from company assets before common stockholders.

What Is a Term Sheet? A term sheet is a nonbinding agreement that shows the basic terms and conditions of an investment. The term sheet serves as a template and basis for more detailed, legally binding documents.

Series A financing refers to an investment in a privately-held start-up company after it has shown progress in building its business model and demonstrates the potential to grow and generate revenue. It often refers to the first round of venture money a firm raises after seed and angel investors.

Preferred shares are an asset class somewhere between common stocks and bonds, so they can offer companies and their investors the best of both worlds. Companies can get more funding with preferred shares because some investors want more consistent dividends and stronger bankruptcy protections than common shares offer.

Class A, common stock: Each share confers one vote and ordinary access to dividends and assets. Class B, preferred stock: Each share confers one vote, but shareholders receive $2 in dividends for every $1 distributed to Class A shareholders. This class of stock has priority distribution for dividends and assets.

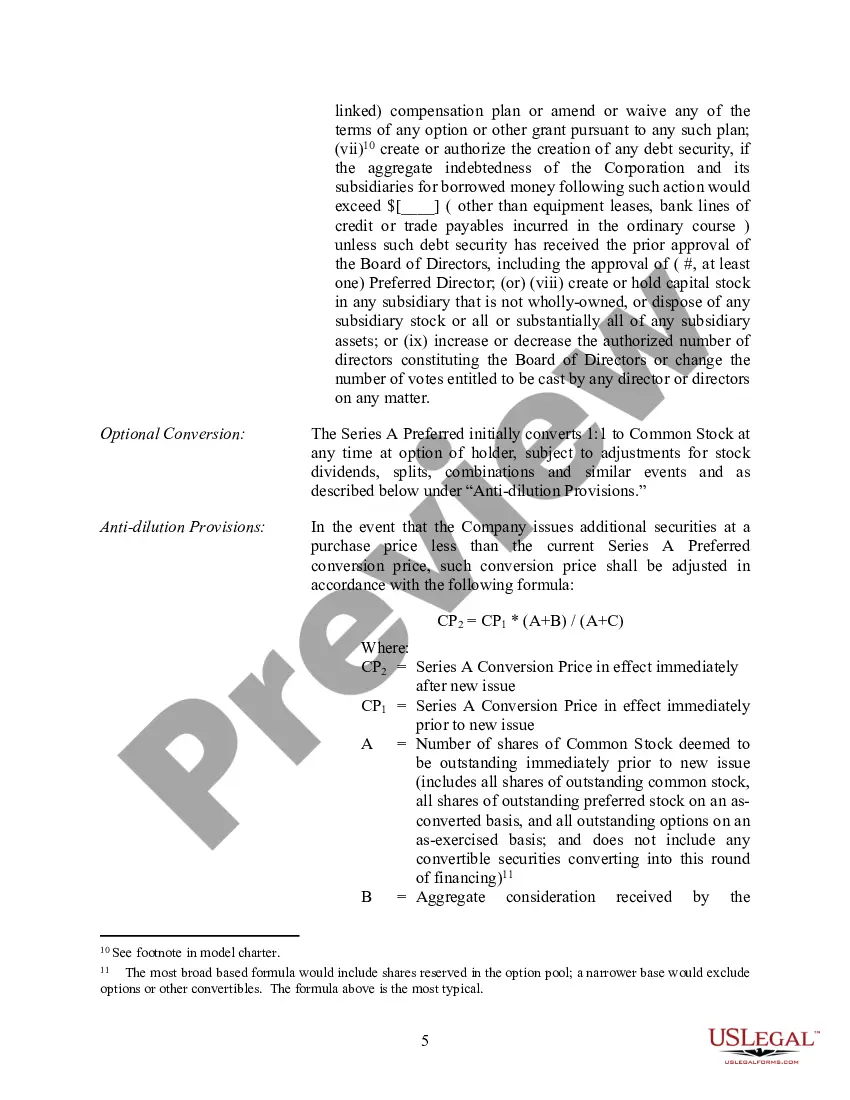

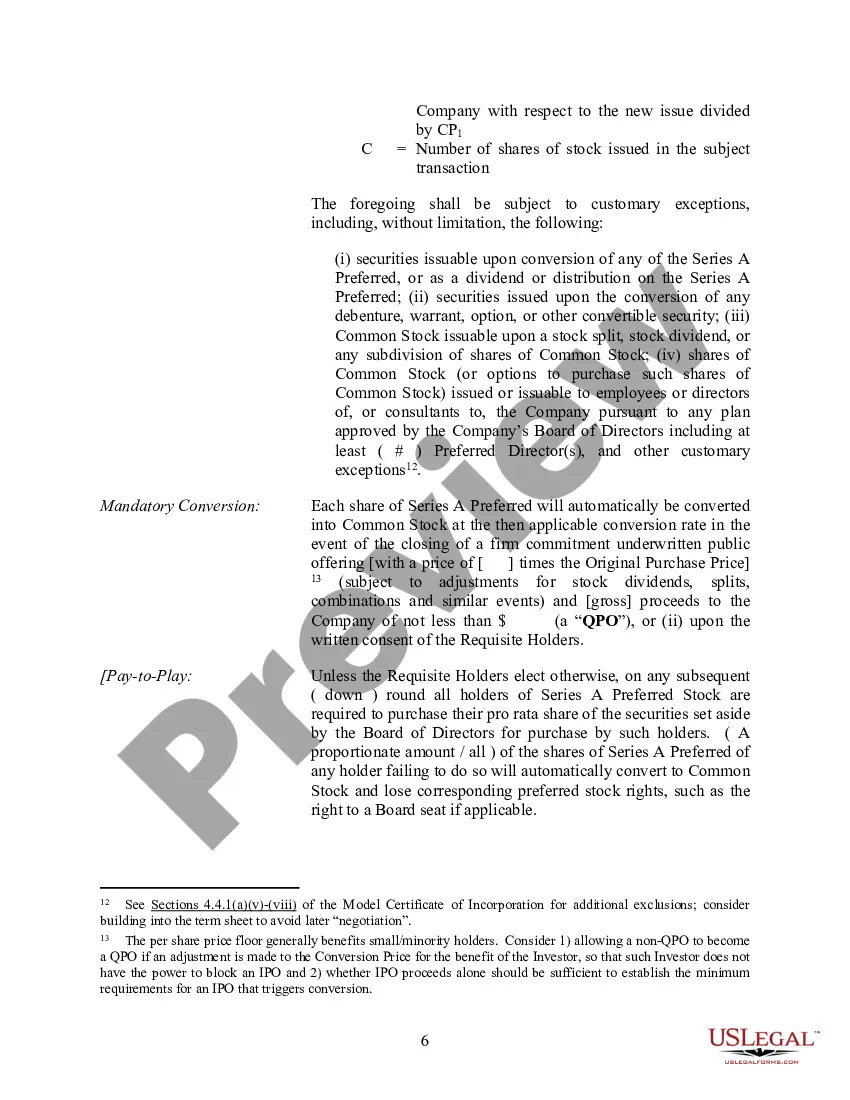

Term sheets for venture capital financings include detailed provisions describing the terms of the preferred stock being issued to investors. Some terms are more important than others. The following brief description of certain material terms divides them into two categories: economic terms and control rights.

The first round of stock offered during the seed or early stage round by a portfolio company to the venture investor or fund. This stock is convertible into common stock in certain cases such as an IPO or the sale of the company.

But no matter who the investor is, a term sheet will always contain six key components, including: A valuation. An estimate of what a company is worth as an investment opportunity. ... Securities being issued. ... Board rights. ... Investor protections. ... Dealing with shares. ... Miscellaneous provisions.