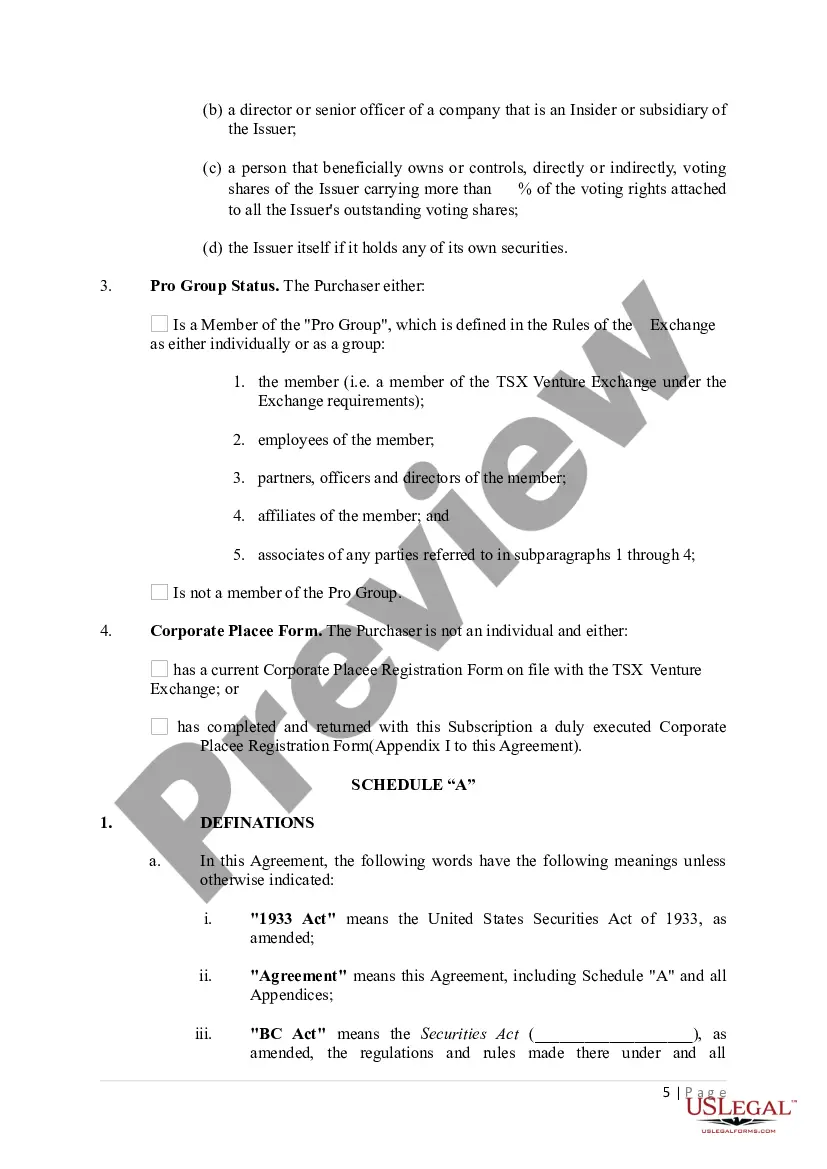

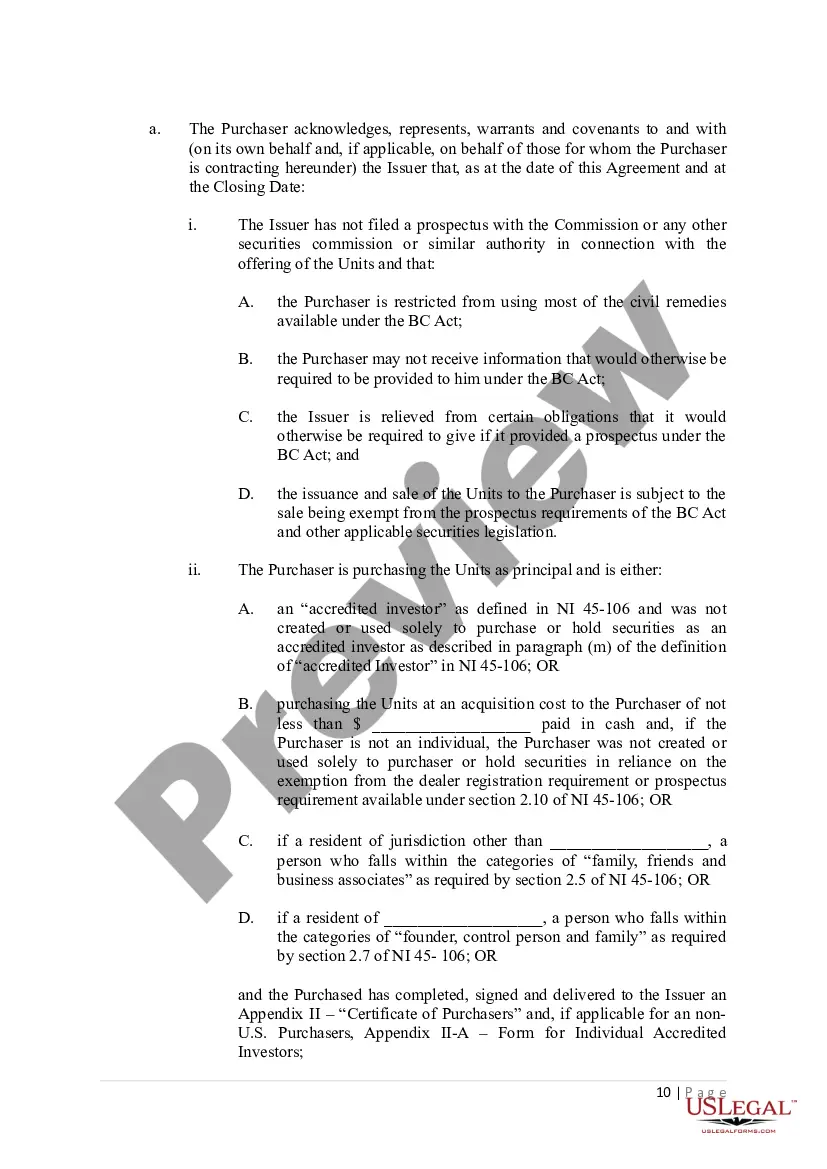

A Pennsylvania Subscription Agreement is a legal document that outlines the terms and conditions of a subscription to purchase securities or shares in a company based in Pennsylvania. This agreement defines the rights and obligations of both the company seeking investors and the subscribers who are interested in purchasing these securities. It is a crucial component of fundraising for businesses, particularly in the startup phase. The Pennsylvania Subscription Agreement typically includes key details such as the company's name, address, and purpose, as well as the subscriber's personal information and the number of shares they intend to purchase. It also outlines the purchase price, payment terms, and any additional considerations or collateral involved. Importantly, the agreement contains representations and warranties made by both parties to ensure transparency and compliance with applicable laws and regulations. In Pennsylvania, there are several types of Subscription Agreements that may be used based on the specific circumstances or purpose. Some common variations include: 1. Equity Subscription Agreement: This type of agreement is used when individuals or entities subscribe to purchase shares of stock or equity interests in a company. It outlines the terms of the investment, the purchase price per share, and the percentage of ownership that the subscriber will hold. 2. Convertible Note Subscription Agreement: In cases where a company seeks financing through convertible notes, this agreement is employed. Convertible notes serve as loans that can be converted into equity at a later stage, usually at the occurrence of a specific event, such as a future equity financing round. 3. SAFE (Simple Agreement for Future Equity) Subscription Agreement: This relatively new type of agreement is often used by startups as an alternative to convertible notes or traditional equity financing. The SAFE agreement allows investors to provide capital in exchange for the right to obtain equity in the event of specific trigger events, like a subsequent equity financing round or an acquisition. 4. Debt Subscription Agreement: In situations where a company decides to raise funding through debt instruments, such as bonds or promissory notes, a debt subscription agreement is employed. This agreement sets out the terms of the loan, including the principal amount, interest rate, repayment schedule, and other relevant conditions. Pennsylvania Subscription Agreements are vital documents for companies and investors alike, as they establish the legally binding relationship and provide a clear framework for the investment process. It is crucial to consult with legal professionals specializing in securities law to ensure compliance with all relevant federal and state regulations, as well as to tailor the agreement to the specific needs of the parties involved.

A Pennsylvania Subscription Agreement is a legal document that outlines the terms and conditions of a subscription to purchase securities or shares in a company based in Pennsylvania. This agreement defines the rights and obligations of both the company seeking investors and the subscribers who are interested in purchasing these securities. It is a crucial component of fundraising for businesses, particularly in the startup phase. The Pennsylvania Subscription Agreement typically includes key details such as the company's name, address, and purpose, as well as the subscriber's personal information and the number of shares they intend to purchase. It also outlines the purchase price, payment terms, and any additional considerations or collateral involved. Importantly, the agreement contains representations and warranties made by both parties to ensure transparency and compliance with applicable laws and regulations. In Pennsylvania, there are several types of Subscription Agreements that may be used based on the specific circumstances or purpose. Some common variations include: 1. Equity Subscription Agreement: This type of agreement is used when individuals or entities subscribe to purchase shares of stock or equity interests in a company. It outlines the terms of the investment, the purchase price per share, and the percentage of ownership that the subscriber will hold. 2. Convertible Note Subscription Agreement: In cases where a company seeks financing through convertible notes, this agreement is employed. Convertible notes serve as loans that can be converted into equity at a later stage, usually at the occurrence of a specific event, such as a future equity financing round. 3. SAFE (Simple Agreement for Future Equity) Subscription Agreement: This relatively new type of agreement is often used by startups as an alternative to convertible notes or traditional equity financing. The SAFE agreement allows investors to provide capital in exchange for the right to obtain equity in the event of specific trigger events, like a subsequent equity financing round or an acquisition. 4. Debt Subscription Agreement: In situations where a company decides to raise funding through debt instruments, such as bonds or promissory notes, a debt subscription agreement is employed. This agreement sets out the terms of the loan, including the principal amount, interest rate, repayment schedule, and other relevant conditions. Pennsylvania Subscription Agreements are vital documents for companies and investors alike, as they establish the legally binding relationship and provide a clear framework for the investment process. It is crucial to consult with legal professionals specializing in securities law to ensure compliance with all relevant federal and state regulations, as well as to tailor the agreement to the specific needs of the parties involved.