Pennsylvania Accredited Investor Certification is a process that grants individuals the recognition of being an accredited investor as per the guidelines set by the Pennsylvania Securities Act. Accredited investor status is crucial because it allows individuals to invest in certain securities and opportunities that are otherwise limited to only accredited investors. To obtain Pennsylvania Accredited Investor Certification, individuals must meet specific criteria defined by the Pennsylvania Securities Commission. One of the key factors is their financial status, which includes a minimum income threshold or net worth requirement. The Pennsylvania Securities Act recognizes various types of Pennsylvania Accredited Investor Certification, each catering to different qualifications and circumstances. These types include: 1. Income-Based Certification: This type requires individuals to demonstrate a consistent income level above a certain threshold for the past two years, with a reasonable expectation of maintaining the same level in the current year. 2. Net Worth-Based Certification: In this type, individuals can qualify for accreditation if their net worth exceeds a predetermined amount. Factors such as their assets minus liabilities, real estate holdings, and investment portfolios are considered in determining net worth. 3. Asset-Based Certification: Aimed at individuals who possess specific types of assets, this certification requires a minimum asset value, excluding primary residence, to be met for accreditation. Assets considered may include cash, securities, real estate, or other valuables. It is essential to note that these certifications are regulated by the Pennsylvania Securities Commission and comply with federal securities laws, ensuring the protection of investors and maintaining fair and transparent market practices. Pennsylvania Accredited Investor Certification offers individuals the opportunity to access investments that may have restricted access for non-accredited investors. A certified accredited investor can explore investment opportunities such as private equity funds, hedge funds, venture capital investments, and other alternative investment options. By obtaining Pennsylvania Accredited Investor Certification, individuals gain increased opportunities to diversify their investment portfolios, potentially generating higher returns compared to traditional investment avenues. However, it is crucial to thoroughly evaluate all investment opportunities and assess potential risks before making any investment decisions. In summary, Pennsylvania Accredited Investor Certification is a recognition granted to individuals who meet specific financial criteria outlined by the Pennsylvania Securities Act. These certifications allow individuals to access a wider range of investment opportunities typically limited to accredited investors, enhancing their investment potential.

Pennsylvania Accredited Investor Certification

Description

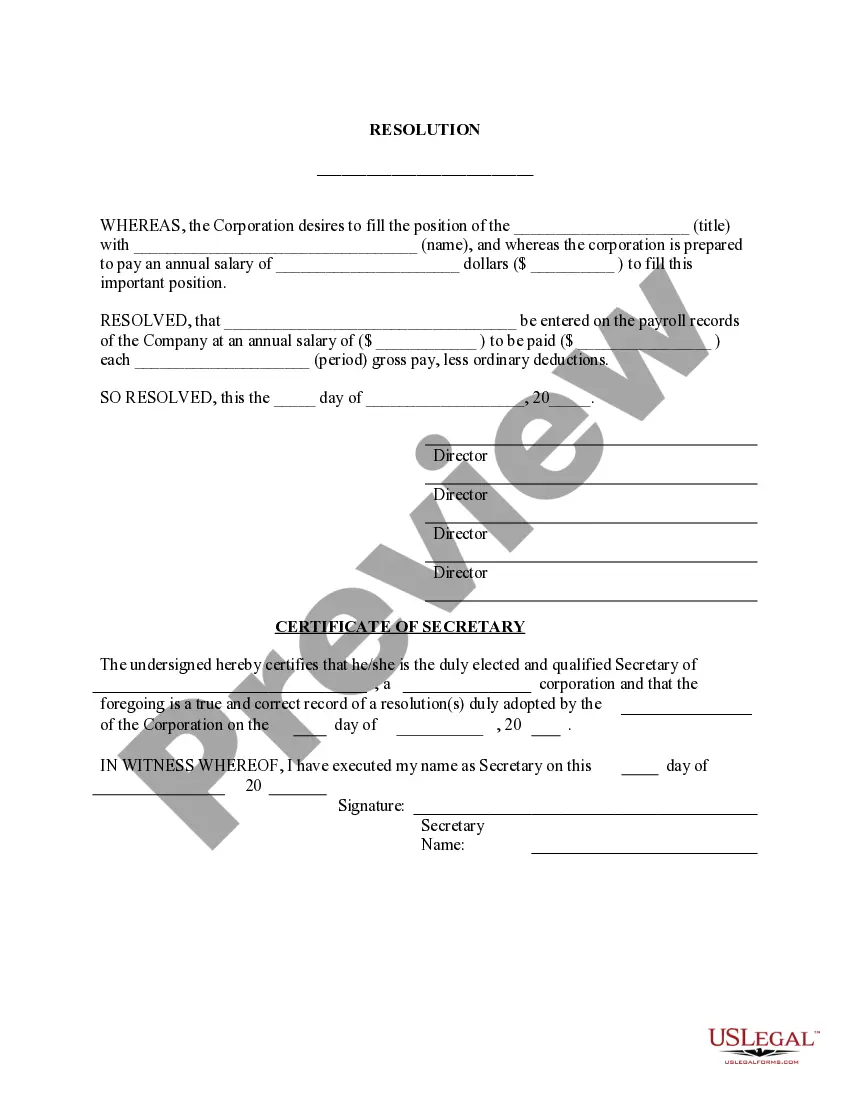

How to fill out Pennsylvania Accredited Investor Certification?

It is possible to devote hours on the Internet attempting to find the legitimate record web template that meets the federal and state requirements you want. US Legal Forms offers 1000s of legitimate varieties which are analyzed by pros. It is possible to obtain or print out the Pennsylvania Accredited Investor Certification from your assistance.

If you already possess a US Legal Forms profile, you can log in and click the Obtain key. After that, you can complete, modify, print out, or indicator the Pennsylvania Accredited Investor Certification. Every legitimate record web template you purchase is yours eternally. To have one more copy associated with a bought form, visit the My Forms tab and click the corresponding key.

If you work with the US Legal Forms site for the first time, follow the basic instructions listed below:

- First, ensure that you have chosen the proper record web template for that area/metropolis of your choosing. Read the form description to ensure you have chosen the right form. If offered, take advantage of the Preview key to appear with the record web template at the same time.

- If you want to find one more version of your form, take advantage of the Look for field to get the web template that meets your requirements and requirements.

- Once you have identified the web template you would like, simply click Purchase now to carry on.

- Select the rates prepare you would like, key in your accreditations, and register for a merchant account on US Legal Forms.

- Complete the deal. You can use your charge card or PayPal profile to fund the legitimate form.

- Select the structure of your record and obtain it to the device.

- Make alterations to the record if needed. It is possible to complete, modify and indicator and print out Pennsylvania Accredited Investor Certification.

Obtain and print out 1000s of record themes while using US Legal Forms website, which provides the greatest variety of legitimate varieties. Use skilled and status-certain themes to handle your organization or specific needs.