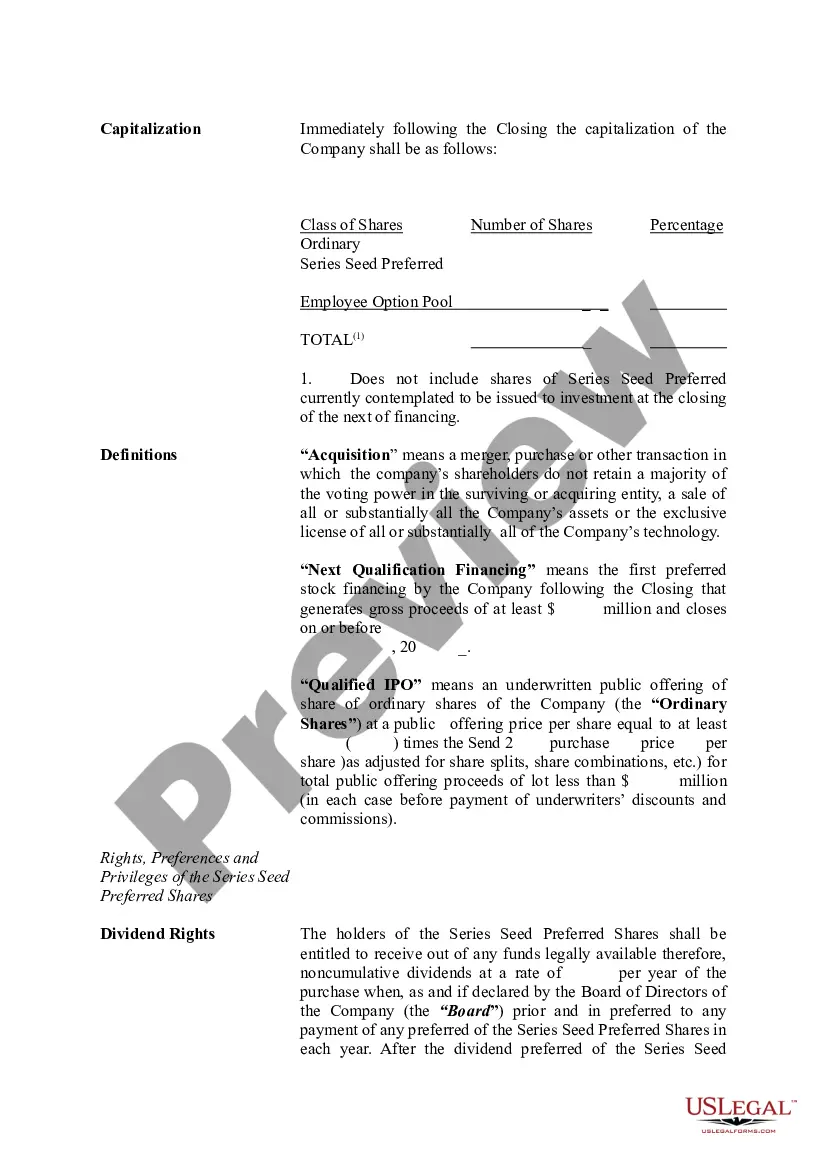

Pennsylvania Term Sheet - Series Seed Preferred Share for Company

Description

How to fill out Term Sheet - Series Seed Preferred Share For Company?

If you want to comprehensive, download, or produce legitimate file templates, use US Legal Forms, the biggest collection of legitimate kinds, which can be found on-line. Make use of the site`s simple and easy handy lookup to find the files you require. Different templates for enterprise and personal uses are categorized by groups and suggests, or search phrases. Use US Legal Forms to find the Pennsylvania Term Sheet - Series Seed Preferred Share for Company with a few clicks.

Should you be previously a US Legal Forms client, log in to the bank account and click the Download key to obtain the Pennsylvania Term Sheet - Series Seed Preferred Share for Company. You can even entry kinds you earlier downloaded from the My Forms tab of your bank account.

If you use US Legal Forms for the first time, follow the instructions below:

- Step 1. Make sure you have chosen the form for the appropriate city/nation.

- Step 2. Take advantage of the Review solution to examine the form`s articles. Do not neglect to read through the explanation.

- Step 3. Should you be unhappy with the kind, use the Lookup discipline on top of the monitor to discover other variations from the legitimate kind template.

- Step 4. Once you have discovered the form you require, go through the Acquire now key. Pick the pricing plan you favor and put your qualifications to register on an bank account.

- Step 5. Approach the purchase. You can use your bank card or PayPal bank account to accomplish the purchase.

- Step 6. Pick the structure from the legitimate kind and download it on the product.

- Step 7. Complete, modify and produce or indication the Pennsylvania Term Sheet - Series Seed Preferred Share for Company.

Every single legitimate file template you get is yours eternally. You possess acces to every kind you downloaded within your acccount. Click the My Forms section and decide on a kind to produce or download once more.

Compete and download, and produce the Pennsylvania Term Sheet - Series Seed Preferred Share for Company with US Legal Forms. There are many expert and state-specific kinds you can use for your enterprise or personal needs.

Form popularity

FAQ

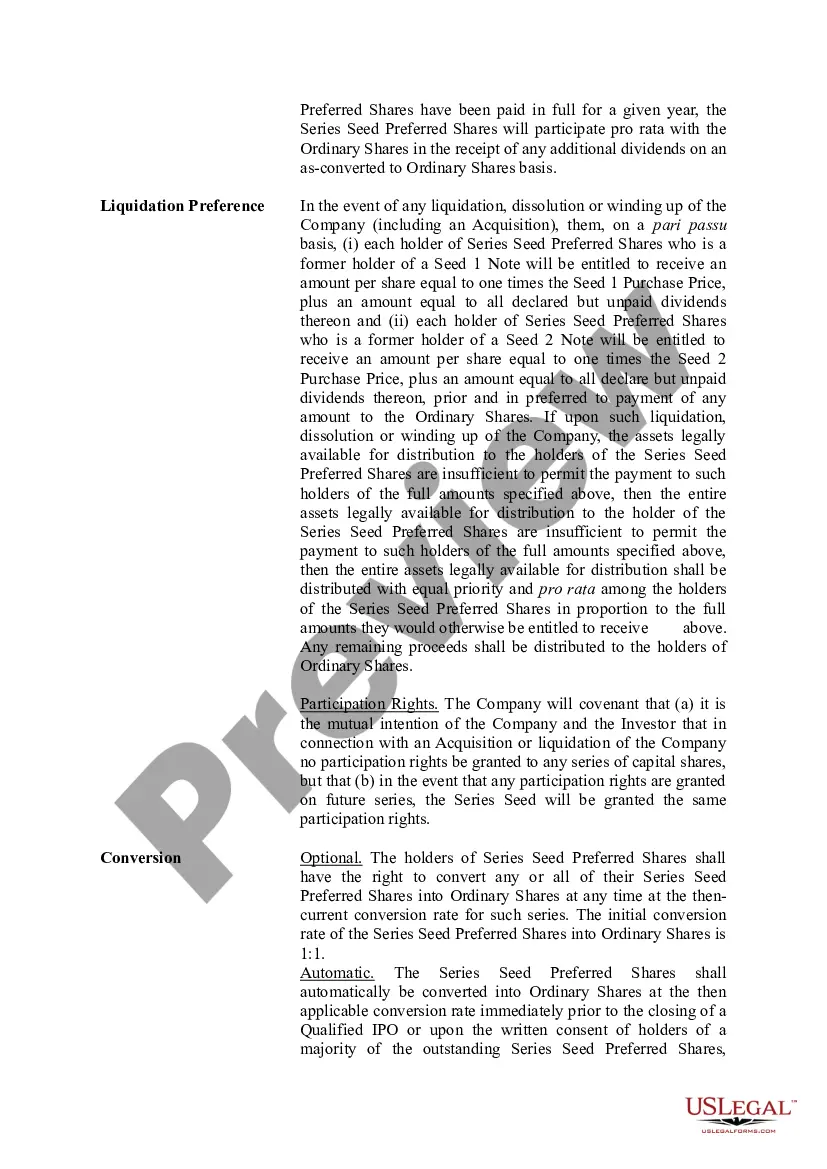

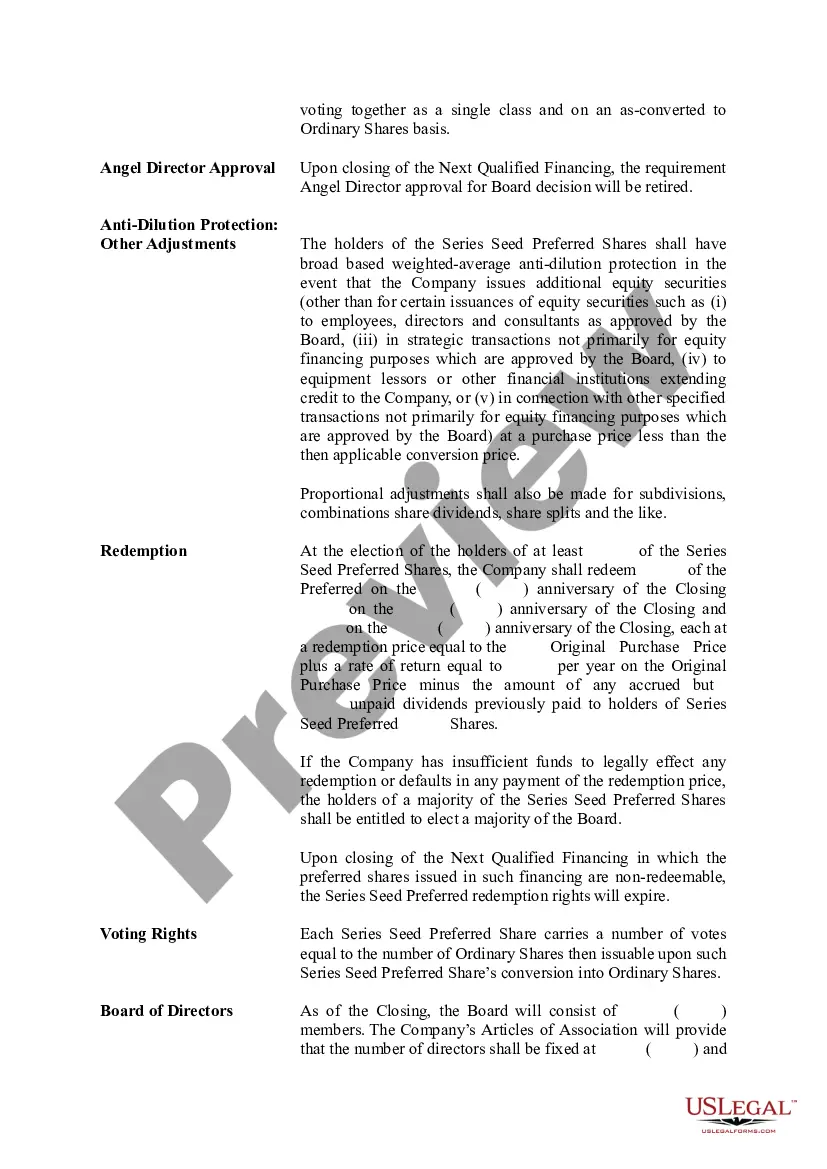

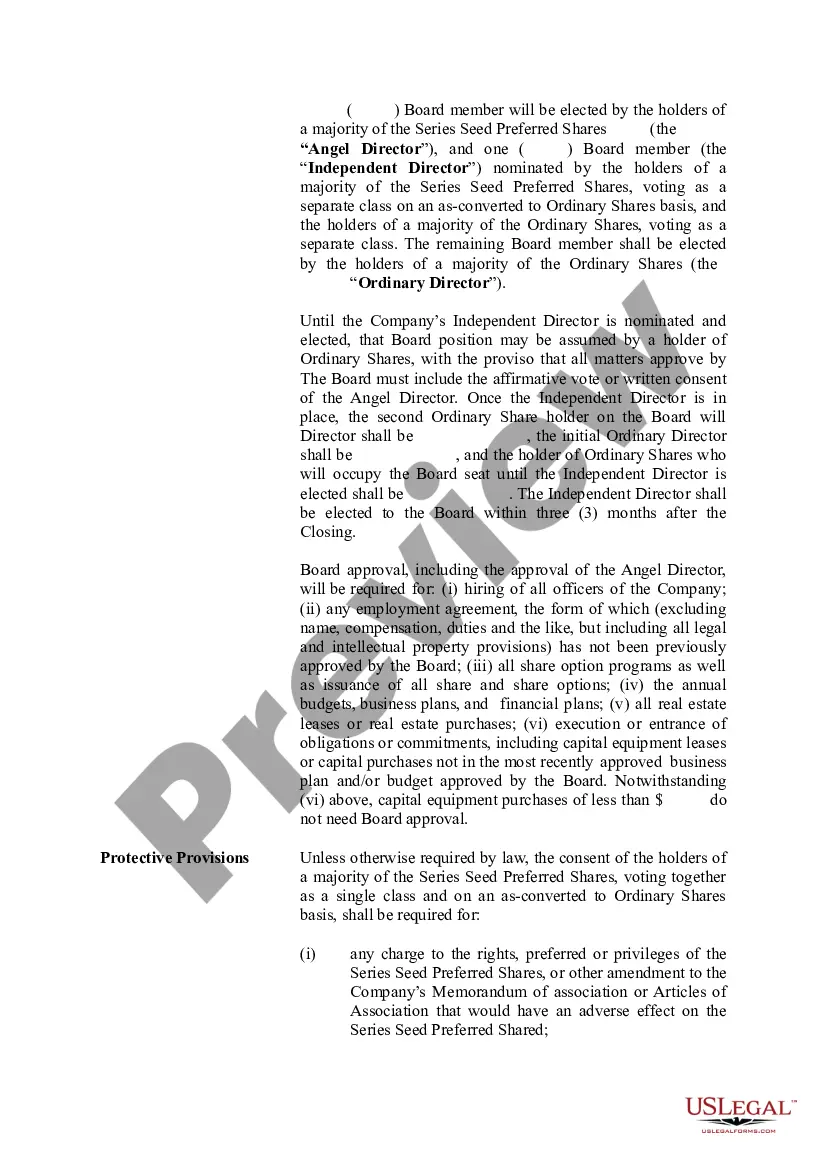

How to Prepare a Term Sheet Identify the Purpose of the Term Sheet Agreements. Briefly Summarize the Terms and Conditions. List the Offering Terms. Include Dividends, Liquidation Preference, and Provisions. Identify the Participation Rights. Create a Board of Directors. End with the Voting Agreement and Other Matters.

A Preference Shares Investment Term Sheet is a record of discussions between the founders of a business and an investor for potential investment by preference shares. A Preference Shares Investment Term Sheet is not legally binding, except for confidentiality and exclusivity obligations (if applicable).

Term sheet examples: What's included? Along with setting the valuation for the company, a term sheet details the amount of the investment and detailed terms around the calculations of pricing for the preferred shares the investor will receive for their money. A term sheet also establishes the investor's rights.

A term sheet is commonly used in mergers and acquisitions, investments, and complex financial talks where clarity on deal structure is critical. Whereas, an MoU is commonly used when it is critical to establish mutual objectives and responsibilities.

Series Seed Preferred Stock is a type of preferred stock issued by startups during their early stage of development. Preferred stock is a hybrid security that combines elements of both debt and equity.

A term sheet is a nonbinding agreement outlining the basic terms and conditions under which an investment will be made. Term sheets are most often associated with start-ups. Entrepreneurs find that this document is crucial to attracting investors, such as venture capitalists (VC) with capital to fund enterprises.

Letters of intent and term sheets are very similar. Both documents outline an agreement that two or more parties expect to make. A letter of intent, as the name implies, is written in the form of a letter whereas a term sheet is more often a list of the important parts of the anticipated contract or agreement.

Series Seed II Preferred Stock means the Series Seed II Preferred Shares of Waitr with such designations, rights, powers and privileges, and the qualifications, limitations and restrictions thereof as provided in the Waitr Articles of Incorporation.