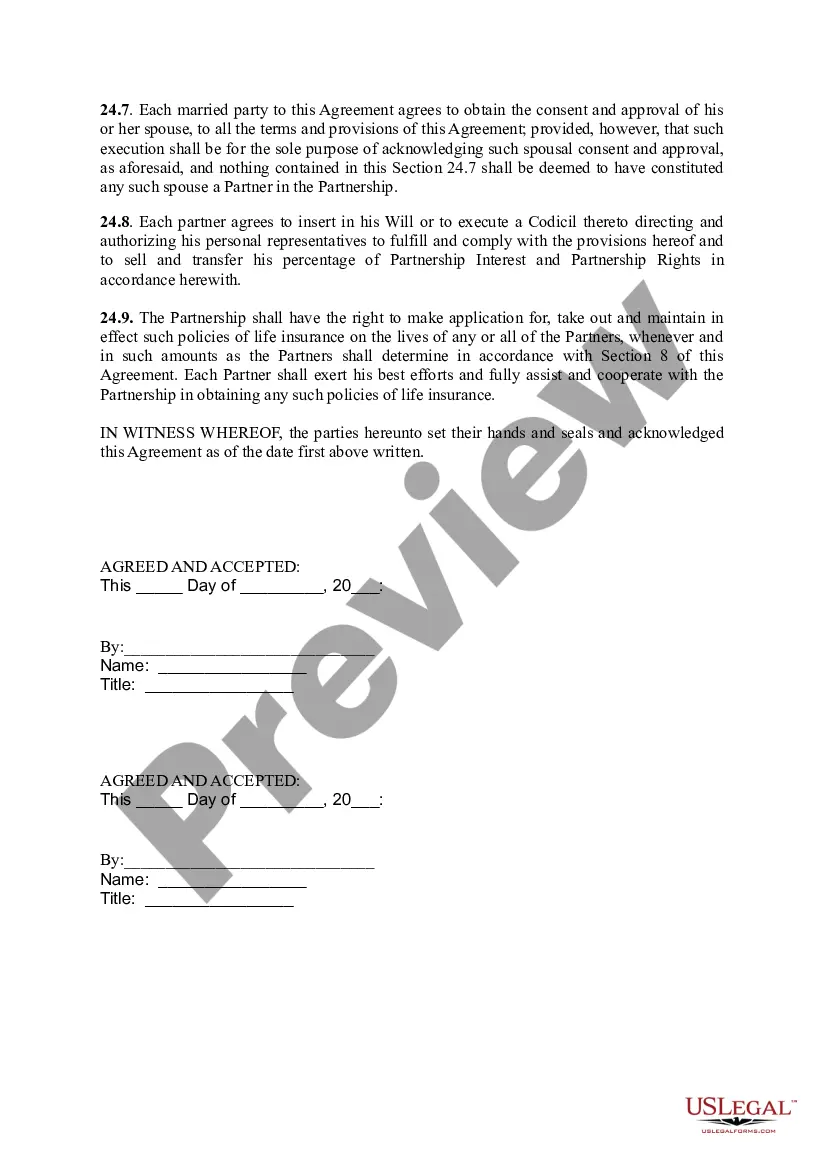

A Pennsylvania Partnership Agreement is a legally binding contract outlining the terms and conditions of a partnership formed in the state of Pennsylvania. It serves as an official document that establishes the rights, responsibilities, and obligations of each partner involved in the partnership. In Pennsylvania, there are primarily two types of partnership agreements: general partnerships and limited partnerships. 1. General Partnership: A general partnership is formed when two or more individuals (partners) agree to carry on a business together and share profits, losses, and managerial responsibilities. The partnership is not considered a separate legal entity from its partners, meaning each partner is personally liable for the partnership's debts and obligations. 2. Limited Partnership: A limited partnership consists of both general partners and limited partners. General partners have unlimited liability, just like in a general partnership, and actively participate in managing the business. On the other hand, limited partners contribute capital but have limited liability, meaning their personal assets are not at risk beyond their investment. Limited partners also have no say in the daily operations and management of the partnership. The Pennsylvania Partnership Agreement typically includes the following key provisions: 1. Partnership Name and Purpose: Clearly stating the legal name of the partnership and defining its intended business activities. 2. Contributions: Outlining the contribution of each partner, whether it's capital, property, or skills, and determining the value of these contributions. 3. Profit and Loss Allocation: Establishing how profits and losses will be distributed among partners. This may be based on their contributions or a mutually agreed percentage. 4. Management and Decision-Making: Detailing how decisions will be made within the partnership, including who will have authority and responsibility for various aspects of the business. 5. Partner Withdrawal or Transfer of Interest: Establishing the process for a partner to withdraw from the partnership or transfer their interest to another party, including any buy-out provisions. 6. Dispute Resolution: Outlining the preferred method for resolving disputes, such as mediation or arbitration, to prevent potential legal conflicts. 7. Dissolution and Winding Up: Defining the conditions under which the partnership may be dissolved and how the assets, liabilities, and remaining profits will be distributed among the partners. Pennsylvania Partnership Agreements must comply with state law and can be customized based on the specific needs and requirements of the partners involved. It is strongly recommended that partners seek legal counsel to draft or review the agreement to ensure its enforceability and protection of their individual interests.

Pennsylvania Partnership Agreement

Description

How to fill out Pennsylvania Partnership Agreement?

Are you currently in the placement that you will need paperwork for either enterprise or specific reasons almost every working day? There are tons of legitimate papers templates accessible on the Internet, but finding types you can depend on is not straightforward. US Legal Forms provides 1000s of develop templates, much like the Pennsylvania Partnership Agreement, that are composed to satisfy state and federal requirements.

If you are presently informed about US Legal Forms web site and possess a merchant account, basically log in. After that, you are able to acquire the Pennsylvania Partnership Agreement design.

If you do not offer an bank account and want to start using US Legal Forms, follow these steps:

- Find the develop you require and make sure it is for the correct area/region.

- Use the Review key to analyze the shape.

- Look at the description to ensure that you have chosen the proper develop.

- If the develop is not what you`re trying to find, utilize the Look for discipline to discover the develop that suits you and requirements.

- When you discover the correct develop, click on Buy now.

- Opt for the rates program you desire, fill out the required info to produce your bank account, and purchase your order making use of your PayPal or credit card.

- Choose a practical file formatting and acquire your duplicate.

Find all the papers templates you may have bought in the My Forms food list. You can get a more duplicate of Pennsylvania Partnership Agreement at any time, if possible. Just click on the essential develop to acquire or print the papers design.

Use US Legal Forms, by far the most substantial assortment of legitimate kinds, in order to save time as well as stay away from errors. The service provides professionally created legitimate papers templates which can be used for an array of reasons. Make a merchant account on US Legal Forms and start making your life a little easier.

Form popularity

FAQ

A partnership agreement is a legal document that dictates how a small for-profit business will operate under two or more people. The agreement lays out the responsibilities of each partner in the business, how much of the business each partner owns, and how much profit and loss each partner is responsible for.

A written partnership agreement should show the following to avoid confusion and disagreements: The name of your business. The contributions of each partner and the percentage of ownership. Division of profits and losses between the partners.

Forming a Partnership in Pennsylvania Choose a business name for your partnership and check for availability. ... Register the business name with local, state, and/or federal authorities. ... Draft and sign a partnership agreement. ... Obtain any required local licenses.

The partnership agreement spells out who owns what portion of the firm, how profits and losses will be split, and the assignment of roles and duties. The partnership agreement will also typically spell how out disputes are to be adjudicated and what happens if one of the partners dies prematurely.

Any domestic or foreign limited liability partnership/ limited liability limited partnership in existence on December 31 of any year is required to file a Certificate of Annual Registration [DSCB:15-8221/8998).

Filing Requirements ? Partnership A partnership must file a PA-20S/PA-65 Information Return to report the income, deductions, gains, losses etc. from their operations. The partnership passes through any profits (losses) to the resident and nonresident partners.

Elements of a Partnership Agreement Name Include the name of your business. Purpose Explain what your business does. Partners' information Provide all partner's names and contact information. Capital contributions Describe the capital (money, assets, tangible items, property, etc.)

How to Write a Partnership Agreement Outline Partnership Purpose. ... Document Partner's Name and Business Address. ... Document Ownership Interest and Partner Shares. ... Outline Partner Responsibilities and Liabilities. ... Consult With a Lawyer.