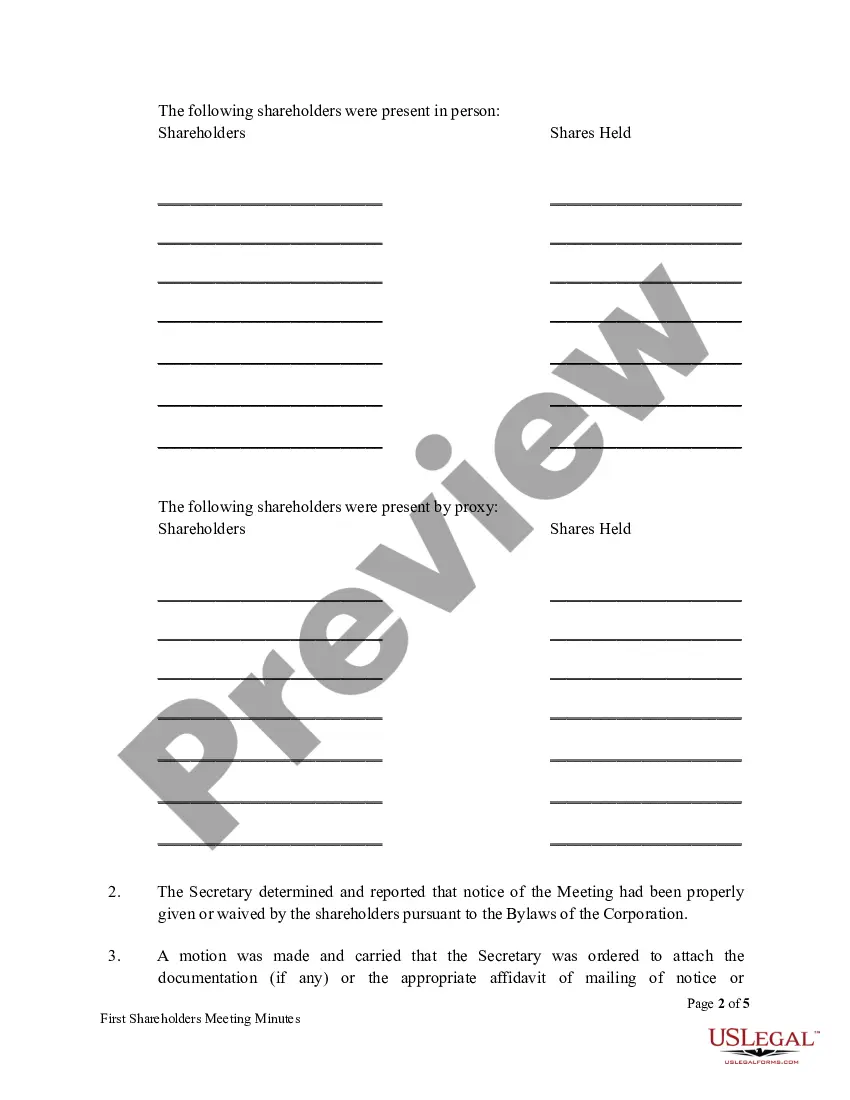

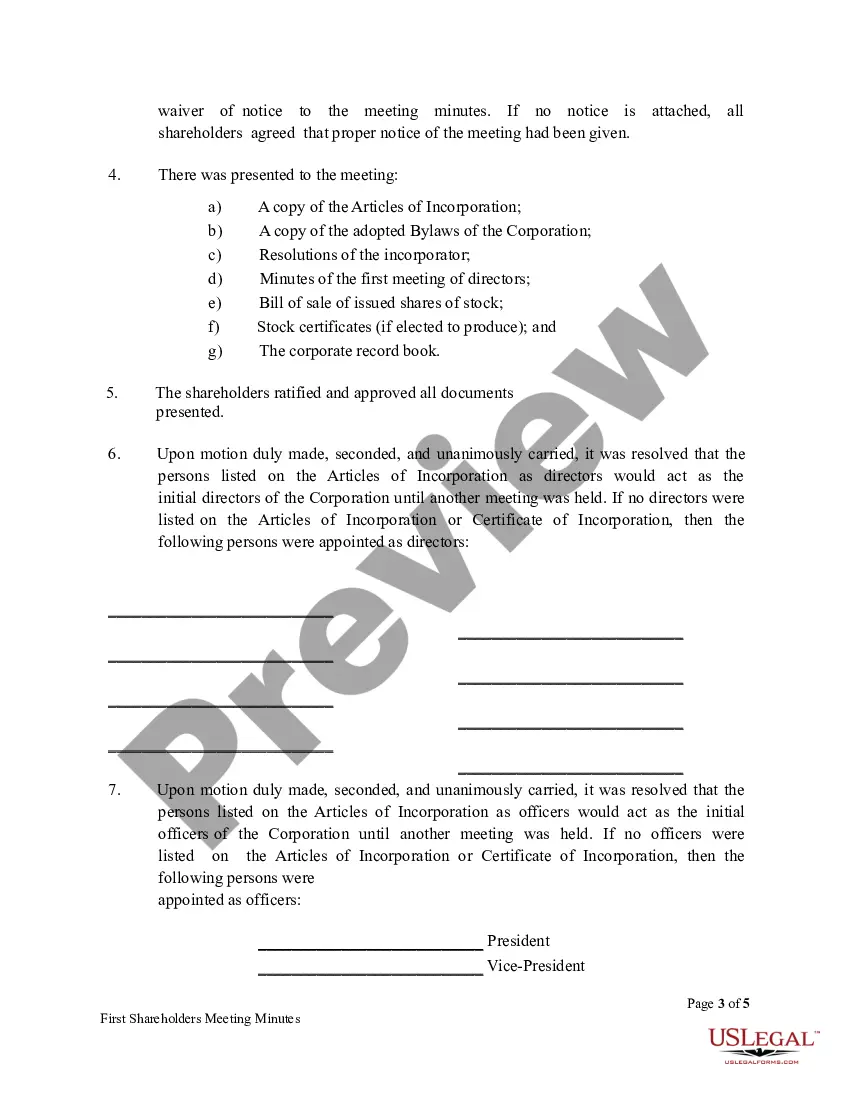

Pennsylvania First Meeting Minutes of Shareholders are important legal documents that capture the initial proceedings and decisions made during the first shareholder meeting of a company registered in the state of Pennsylvania. These minutes serve as an official record of the meeting and are usually required to be maintained as part of the company's corporate governance process. During the first meeting, shareholders gather to discuss and decide on various essential matters that shape the direction and functioning of the company. The exact content of the minutes may vary depending on the company's specific circumstances, but some key elements typically included are: 1. Meeting Details: The minutes start by stating the date, time, and location of the meeting, as well as the names of shareholders present, either in person or represented by proxy. 2. Call to Order: It is mentioned if the meeting was called to order by the Chairman of the Board or any other designated individual, and their introduction may be provided. 3. Appointment of a Temporary Chairperson: If the Chairman of the Board or the designated individual is absent, the shareholders may elect a temporary chairperson to preside over the meeting. 4. Adoption of Bylaws: The minutes reflect the approval and adoption of the company's bylaws, which are a set of internal rules and regulations governing various aspects of its operations and management. 5. Election of Board Members: Shareholders may elect individuals to serve on the Board of Directors, outlining their names, qualifications, and the specific roles they will undertake within the board. 6. Appointment of Officers: The minutes detail the appointment of officers such as CEO, CFO, Secretary, etc., and their respective responsibilities. 7. Determination of Fiscal Year: Shareholders may agree on the starting and ending dates of the company's fiscal year during this meeting. 8. Approval of Initial Transactions: This section mentions any significant transactions or agreements taken up during the meeting, such as approving a lease agreement, authorizing the opening of bank accounts, or engaging legal counsel. 9. Share Issuance: The minutes document any issuance of shares, outlining the details of the shares, such as the number, class, and price. 10. Adjournment: The meeting concludes with the announcement of its adjournment, including the next meeting date if applicable. Different types of Pennsylvania First Meeting Minutes of Shareholders may vary based on the nature and size of the company. For example, minutes for a publicly traded corporation may have additional sections related to the approval of a stock issuance plan, the appointment of auditors, or the establishment of committees. On the other hand, minutes for a small privately held company may focus more on fundamental decisions like selecting a bank for opening a company account or authorizing the issuance of initial shares among the founders. In summary, Pennsylvania First Meeting Minutes of Shareholders hold significant importance in the corporate governance and legal compliance of a Pennsylvania-based company. They serve as an authentic record of the decisions made during the initial meeting and help establish the foundation for the company's operations and future growth.

Pennsylvania First Meeting Minutes of Shareholders

Description

How to fill out Pennsylvania First Meeting Minutes Of Shareholders?

If you wish to complete, download, or printing authorized document layouts, use US Legal Forms, the largest collection of authorized varieties, that can be found online. Utilize the site`s simple and easy hassle-free research to discover the files you will need. A variety of layouts for enterprise and person reasons are categorized by types and says, or keywords. Use US Legal Forms to discover the Pennsylvania First Meeting Minutes of Shareholders in a couple of mouse clicks.

In case you are presently a US Legal Forms buyer, log in for your profile and click the Obtain button to obtain the Pennsylvania First Meeting Minutes of Shareholders. You can also gain access to varieties you formerly downloaded in the My Forms tab of your profile.

If you are using US Legal Forms for the first time, follow the instructions under:

- Step 1. Be sure you have selected the shape for your appropriate area/region.

- Step 2. Utilize the Preview solution to look through the form`s content material. Do not neglect to learn the description.

- Step 3. In case you are unhappy using the develop, take advantage of the Look for field near the top of the display screen to discover other variations of the authorized develop template.

- Step 4. When you have discovered the shape you will need, click on the Get now button. Opt for the pricing program you prefer and add your accreditations to sign up for the profile.

- Step 5. Process the financial transaction. You may use your credit card or PayPal profile to accomplish the financial transaction.

- Step 6. Select the formatting of the authorized develop and download it on the device.

- Step 7. Complete, change and printing or sign the Pennsylvania First Meeting Minutes of Shareholders.

Every authorized document template you purchase is yours for a long time. You have acces to every single develop you downloaded within your acccount. Click the My Forms segment and choose a develop to printing or download once again.

Remain competitive and download, and printing the Pennsylvania First Meeting Minutes of Shareholders with US Legal Forms. There are thousands of expert and condition-specific varieties you may use to your enterprise or person requirements.