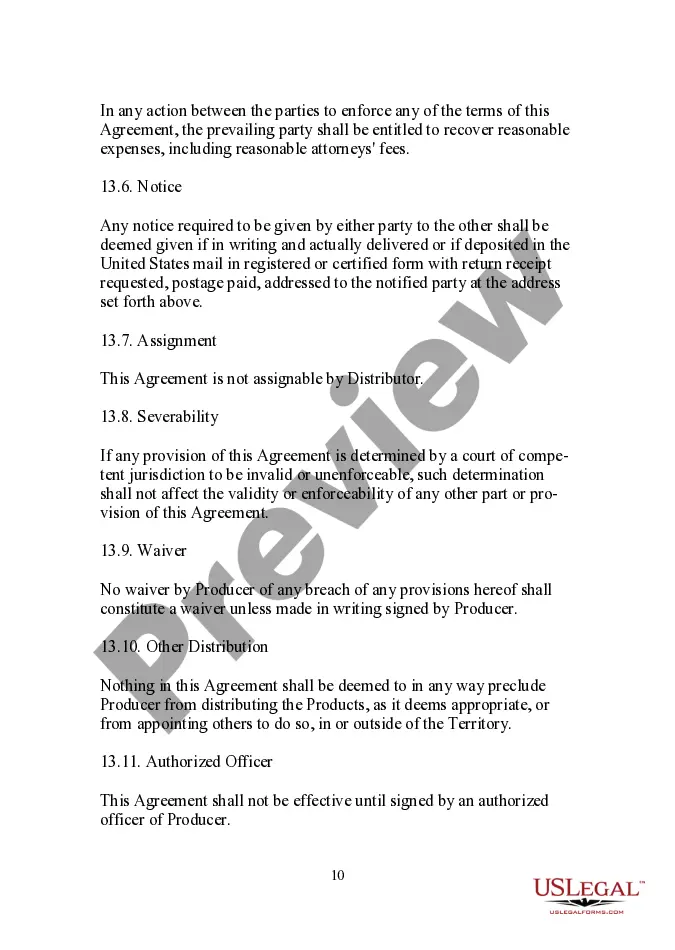

Pennsylvania Reproduction and Distribution Agreement

Description

How to fill out Reproduction And Distribution Agreement?

US Legal Forms - one of the greatest libraries of legal forms in the USA - gives an array of legal record templates you are able to obtain or produce. Using the internet site, you can find 1000s of forms for enterprise and personal uses, sorted by groups, states, or keywords.You will discover the latest versions of forms like the Pennsylvania Reproduction and Distribution Agreement in seconds.

If you have a monthly subscription, log in and obtain Pennsylvania Reproduction and Distribution Agreement through the US Legal Forms collection. The Obtain option will show up on each develop you see. You have accessibility to all previously saved forms in the My Forms tab of your own bank account.

If you would like use US Legal Forms for the first time, here are straightforward guidelines to help you started out:

- Be sure you have picked out the proper develop for your personal metropolis/county. Go through the Preview option to review the form`s information. Look at the develop outline to actually have chosen the appropriate develop.

- In the event the develop does not satisfy your specifications, make use of the Look for area at the top of the monitor to obtain the one that does.

- Should you be satisfied with the form, validate your decision by simply clicking the Get now option. Then, select the rates prepare you want and provide your qualifications to register for the bank account.

- Process the transaction. Make use of bank card or PayPal bank account to complete the transaction.

- Pick the file format and obtain the form on your product.

- Make modifications. Complete, modify and produce and indicator the saved Pennsylvania Reproduction and Distribution Agreement.

Every single design you included with your account lacks an expiration particular date and is also your own forever. So, if you want to obtain or produce an additional duplicate, just check out the My Forms portion and then click about the develop you need.

Gain access to the Pennsylvania Reproduction and Distribution Agreement with US Legal Forms, by far the most substantial collection of legal record templates. Use 1000s of expert and express-certain templates that meet your business or personal needs and specifications.

Form popularity

FAQ

If you are filing a paper return, you should attach any forms (such as a W-2) that show state withholding. If you are e-filing your return, there is no need to attach your W-2 to any of the forms.

Every resident, part-year resident or nonresident individual must file a Pennsylvania Income Tax Return (PA-40) when he or she realizes income generating $1 or more in tax, even if no tax is due (e.g., when an employee receives compensation where tax is withheld).

2 form from each employer. Other earning and interest statements (1099 and 1099INT forms) Receipts for charitable donations; mortgage interest; state and local taxes; medical and business expenses; and other taxdeductible expenses if you are itemizing your return. How to file your federal income tax return | USAGov usa.gov ? filetaxes usa.gov ? filetaxes

Arrange your documents in the following order when submitting your 2022 PA tax return: Original PA-40. Do not mail a photocopy of your PA-40 or a copy of your electronic PA tax return. Federal Forms, W-2, 1099-R, 1099-MISC, 1099-NEC.

How Income Taxes Are Calculated. First, we calculate your adjusted gross income (AGI) by taking your total household income and reducing it by certain items such as contributions to your 401(k). Next, from AGI we subtract exemptions and deductions (either itemized or standard) to get your taxable income.

N Use the coded envelope included with your tax package to mail your return. If you did not receive an envelope, check the section called "Where Do You File?" inside the back cover of the your tax instruction booklet. IRS Tax Tip 2001-30: How To Prepare Your Tax Return for Mailing irs.gov ? pub ? irs-news irs.gov ? pub ? irs-news

Most common Pennsylvania Personal Income Tax forms used to report income: PA-40 - Personal Income Tax Return. PA-40 W-2S - Schedule W-2S - Wage Statement Summary. PA-40 A - Schedule A - Interest Income. PA-40 B - Schedule B - Dividend Income. PA-40 T - Schedule T - Gambling and Lottery Winnings. Forms needed to file Pennsylvania Personal Income Tax Oracle ? app ? detail ? a_id Oracle ? app ? detail ? a_id

You should have a Form W-2 from each employer. If you file a paper return, be sure to attach a copy of Form W-2 in the place indicated on the front page of your return. Attach it only to the front page of your paper return, not to any attachments. Form 1040 - Attachments for Paper-Filed Return - TaxAct taxact.com ? support ? form-1040-attachme... taxact.com ? support ? form-1040-attachme...