Pennsylvania Carpentry Services Contract - Self-Employed Independent Contractor

Description

How to fill out Pennsylvania Carpentry Services Contract - Self-Employed Independent Contractor?

Have you been in the situation where you need to have papers for possibly enterprise or specific reasons almost every time? There are a lot of legitimate document templates available on the Internet, but locating types you can rely isn`t effortless. US Legal Forms offers a large number of type templates, just like the Pennsylvania Carpentry Services Contract - Self-Employed Independent Contractor, which are created to fulfill federal and state requirements.

If you are presently informed about US Legal Forms web site and possess an account, basically log in. Following that, you may down load the Pennsylvania Carpentry Services Contract - Self-Employed Independent Contractor template.

Unless you provide an accounts and wish to begin using US Legal Forms, follow these steps:

- Discover the type you need and ensure it is for your right town/county.

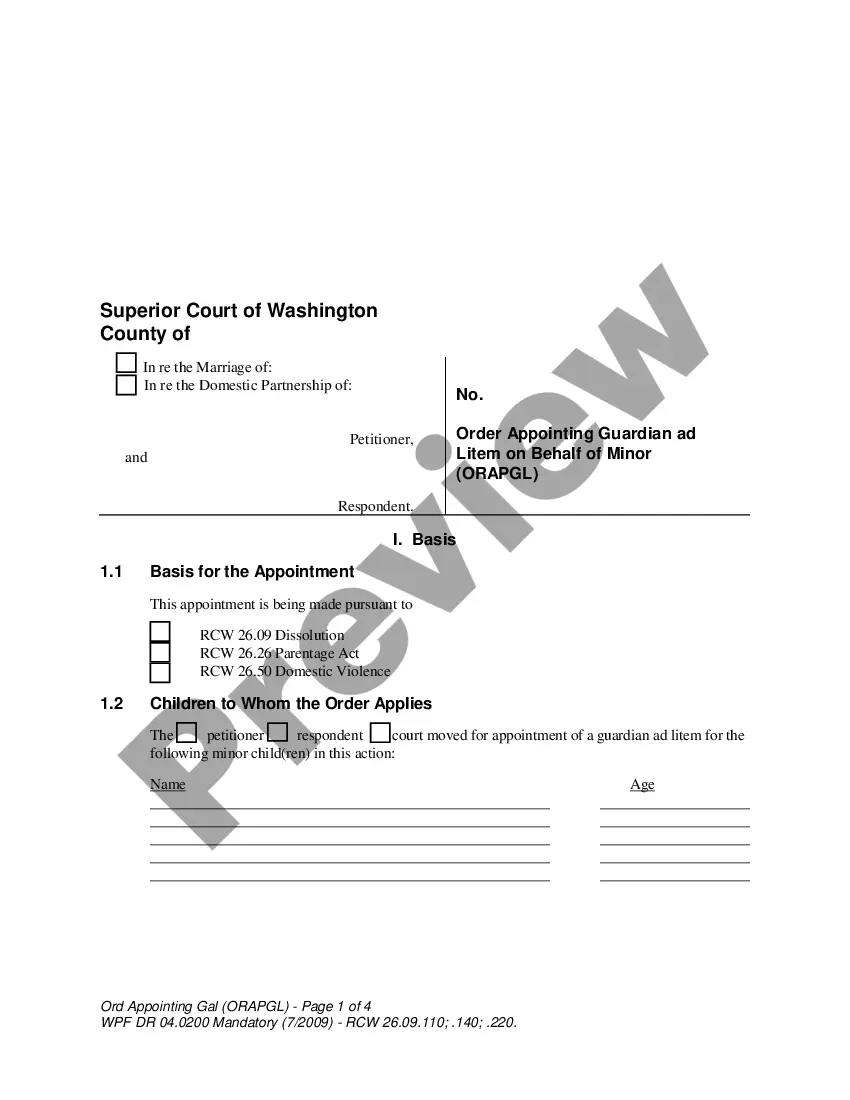

- Utilize the Preview button to analyze the form.

- See the description to actually have chosen the correct type.

- If the type isn`t what you are trying to find, utilize the Research industry to discover the type that fits your needs and requirements.

- When you obtain the right type, click Get now.

- Opt for the rates program you need, fill in the required information and facts to make your money, and purchase the order using your PayPal or credit card.

- Select a convenient data file format and down load your copy.

Discover all of the document templates you might have bought in the My Forms food selection. You can get a further copy of Pennsylvania Carpentry Services Contract - Self-Employed Independent Contractor anytime, if possible. Just go through the needed type to down load or printing the document template.

Use US Legal Forms, one of the most extensive variety of legitimate kinds, to save time as well as stay away from errors. The support offers appropriately created legitimate document templates that you can use for a selection of reasons. Make an account on US Legal Forms and begin making your lifestyle a little easier.

Form popularity

FAQ

An independent contractor agreement is a legally binding document signed by a 1099 employee and the company that hires them. It outlines the scope of work and the terms under which that work will be completed, which goes a long way to making sure both parties are on the same page about the project from the start.

Ten Tips for Making Solid Business Agreements and ContractsGet it in writing.Keep it simple.Deal with the right person.Identify each party correctly.Spell out all of the details.Specify payment obligations.Agree on circumstances that terminate the contract.Agree on a way to resolve disputes.More items...

To set yourself up as a self-employed taxpayer with the IRS, you simply start paying estimated taxes (on Form 1040-ES, Estimated Tax for Individuals) and file Schedule C, Profit or Loss From Business, and Schedule SE, Self-Employment Tax, with your Form 1040 tax return each April.

How do I create an Independent Contractor Agreement?State the location.Describe the type of service required.Provide the contractor's and client's details.Outline compensation details.State the agreement's terms.Include any additional clauses.State the signing details.

Becoming an independent contractor is one of the many ways to be classified as self-employed. By definition, an independent contractor provides work or services on a contractual basis, whereas, self-employment is simply the act of earning money without operating within an employee-employer relationship.

What Should Be in a Construction Contract?Identifying/Contact Information.Title and Description of the Project.Projected Timeline and Completion Date.Cost Estimate and Payment Schedule.Stop-Work Clause and Stop-Payment Clause.Act of God Clause.Change Order Agreement.Warranty.More items...

For most types of projects you hire an independent contractor (IC) to do, the law does not require you to put anything in writing. You can meet with the IC, agree on the terms of your arrangement, and have an oral contract or agreement that is legally binding. Just because you can doesn't mean you should, however.

Other professions within health care are NOT exempt from AB 5 and therefore must meet the law's stated criteria in order to be appropriately classified as independent contractors, such as: nurse practitioners. physician assistants.

The PA Supreme Court interpreted the Pennsylvania Unemployment Statute, which states that a worker is an independent contractor if the individual is free from control and direction over the performance of the services both under his contract of service and in fact and, in regard to such services, if the individual is

For some business-minded physician assistants (PAs), independent contracting offers a versatile and entrepreneurial way to practice medicine allowing for significant flexibility in hours, increased freedom of choice and income.