Pennsylvania Disability Services Contract - Self-Employed

Description

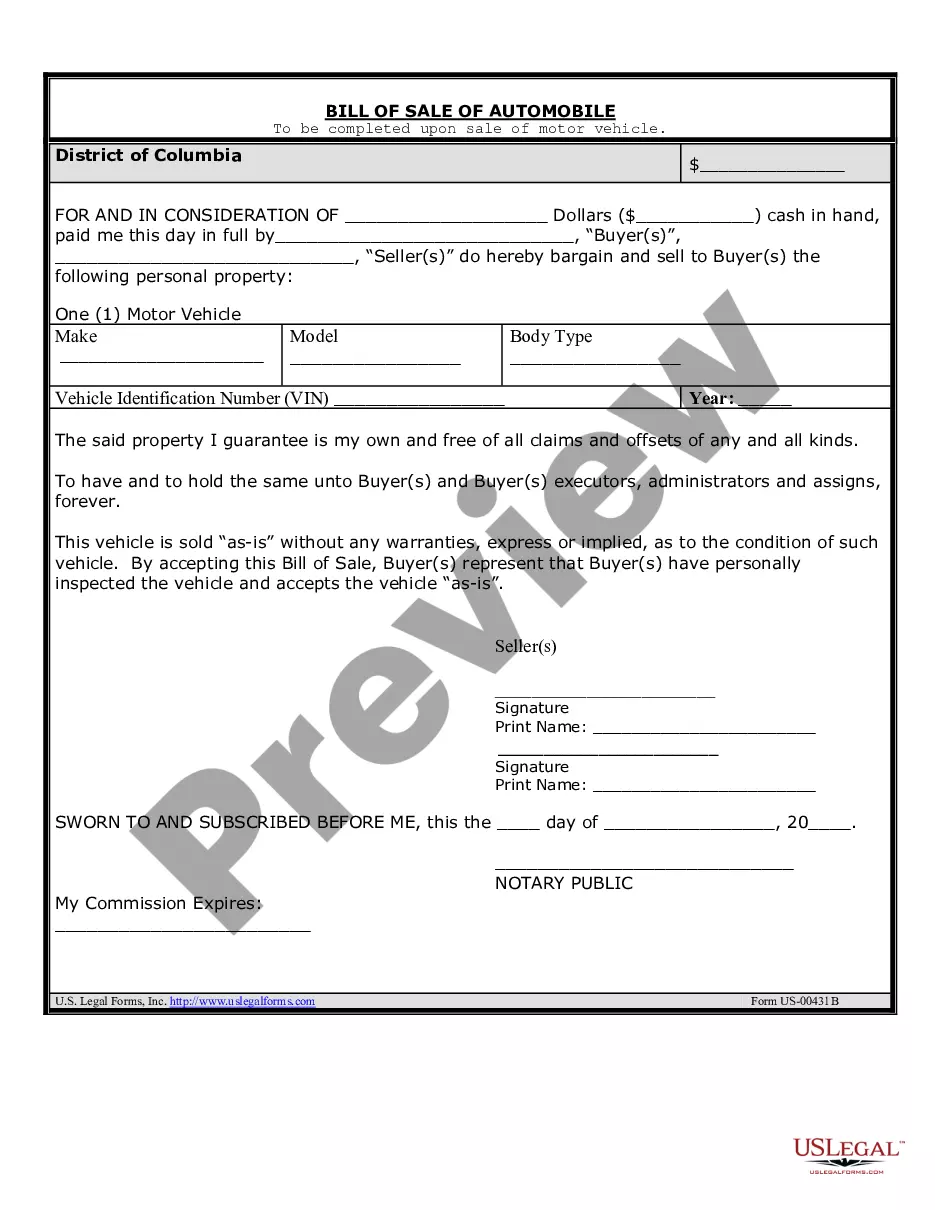

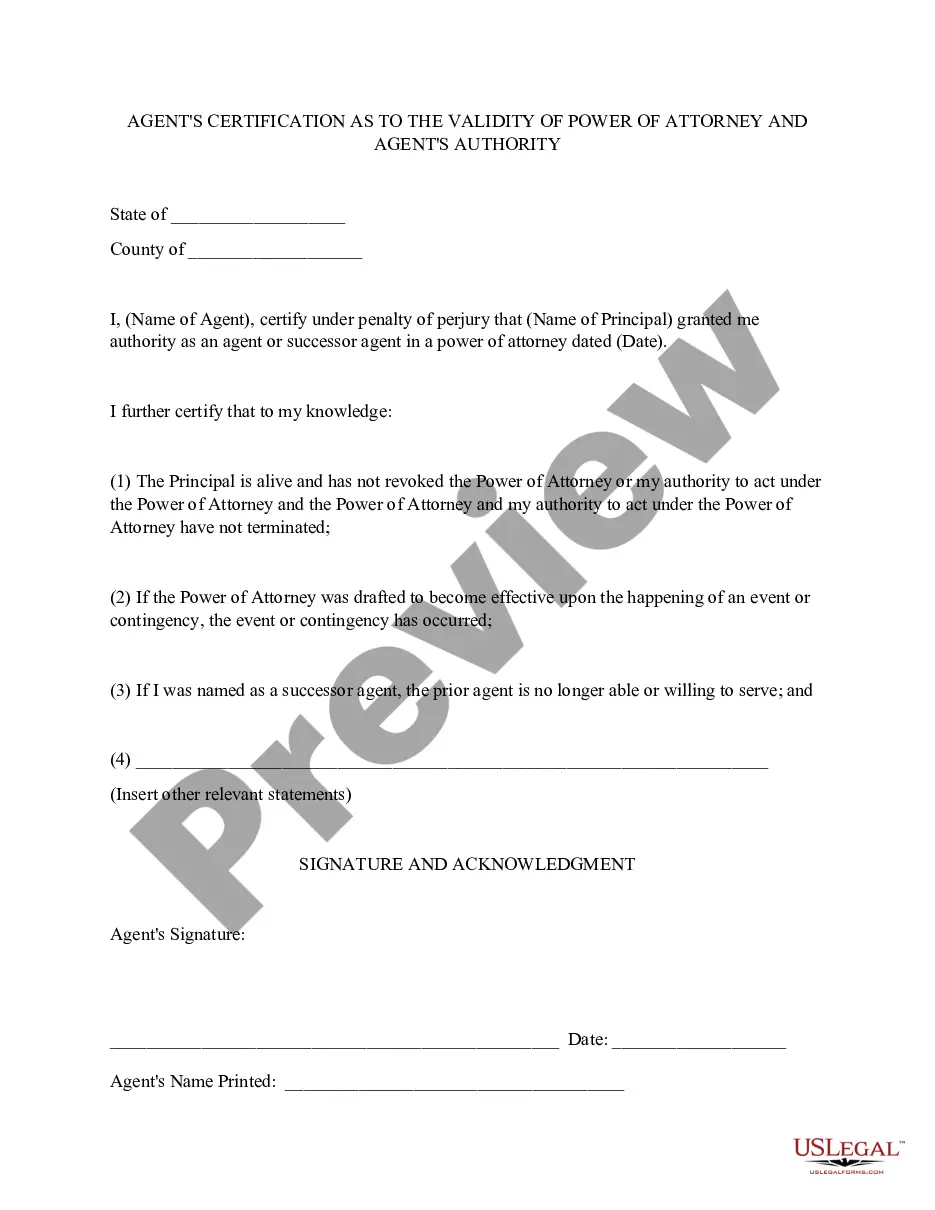

How to fill out Pennsylvania Disability Services Contract - Self-Employed?

If you need to total, obtain, or produce legitimate file layouts, use US Legal Forms, the largest assortment of legitimate varieties, which can be found on the Internet. Utilize the site`s simple and easy practical research to discover the papers you will need. A variety of layouts for company and person purposes are categorized by categories and suggests, or search phrases. Use US Legal Forms to discover the Pennsylvania Disability Services Contract - Self-Employed with a couple of click throughs.

When you are already a US Legal Forms consumer, log in for your account and then click the Acquire key to get the Pennsylvania Disability Services Contract - Self-Employed. You may also gain access to varieties you earlier saved inside the My Forms tab of your account.

If you use US Legal Forms the first time, follow the instructions beneath:

- Step 1. Make sure you have selected the form to the proper city/country.

- Step 2. Utilize the Review method to examine the form`s content material. Don`t forget about to see the explanation.

- Step 3. When you are unhappy using the form, use the Search discipline at the top of the display to find other variations of the legitimate form format.

- Step 4. Once you have identified the form you will need, click on the Purchase now key. Opt for the costs strategy you prefer and put your accreditations to sign up to have an account.

- Step 5. Process the transaction. You should use your Мisa or Ьastercard or PayPal account to finish the transaction.

- Step 6. Choose the formatting of the legitimate form and obtain it on the device.

- Step 7. Full, revise and produce or indicator the Pennsylvania Disability Services Contract - Self-Employed.

Each legitimate file format you purchase is your own forever. You possess acces to every form you saved within your acccount. Go through the My Forms section and pick a form to produce or obtain again.

Contend and obtain, and produce the Pennsylvania Disability Services Contract - Self-Employed with US Legal Forms. There are many skilled and condition-distinct varieties you can use for your company or person demands.

Form popularity

FAQ

To set yourself up as a self-employed taxpayer with the IRS, you simply start paying estimated taxes (on Form 1040-ES, Estimated Tax for Individuals) and file Schedule C, Profit or Loss From Business, and Schedule SE, Self-Employment Tax, with your Form 1040 tax return each April.

According to Pennsylvania law, independent contractors are not eligible for workers' compensation coverage. State law does not require employers purchase to coverage for independent contractors.

No, in most cases, independent contractors working for your business do not require workers' compensation insurance. You will have to prove the contractor is not an employee, and if you cannot provide this documentation, then you may be required to pay workers' comp insurance fees for them.

Pennsylvania's self-employed, independent contractors, gig workers and others not eligible for unemployment compensation can now begin filing claims for Pandemic Unemployment Assistance (PUA) benefits.

The PA Supreme Court interpreted the Pennsylvania Unemployment Statute, which states that a worker is an independent contractor if the individual is free from control and direction over the performance of the services both under his contract of service and in fact and, in regard to such services, if the individual is

Here's what you need to know to start and build a successful business as a self-employed contractor.Be Sure You Want to Be Self-Employed.Get Financing in Place Beforehand.Create a Business Plan.Name, Register, and Insure Your Contracting Business.Market Your Business.Be Your Own Accountant, for Starters.More items...?

A 1099 worker is one that is not considered an employee. Rather, this type of worker is usually referred to as a freelancer, independent contractor or other self-employed worker that completes particular jobs or assignments. Since they're not deemed employees, you don't pay them wages or a salary.

The PA Supreme Court interpreted the Pennsylvania Unemployment Statute, which states that a worker is an independent contractor if the individual is free from control and direction over the performance of the services both under his contract of service and in fact and, in regard to such services, if the individual is

No, workers' compensation is not required for if you hire contractors. However, keep in mind that you still have the potential to be held liable for any work-related accidents. Requiring a contractor to have their own workers' compensation is a great way to limit liability for accidents.

Sole proprietors with no employees are not required to carry workers' compensation insurance. However, detailed information must be provided to your insurer to prove that the individual is a true independent contractor.