Pennsylvania Physical Therapist Agreement - Self-Employed Independent Contractor

Description

How to fill out Pennsylvania Physical Therapist Agreement - Self-Employed Independent Contractor?

Are you currently in a placement in which you need papers for sometimes business or specific purposes virtually every time? There are plenty of legal papers templates accessible on the Internet, but locating versions you can rely on is not simple. US Legal Forms offers a huge number of form templates, such as the Pennsylvania Physical Therapist Agreement - Self-Employed Independent Contractor, which can be published to meet federal and state requirements.

Should you be presently knowledgeable about US Legal Forms website and also have a merchant account, basically log in. Afterward, it is possible to down load the Pennsylvania Physical Therapist Agreement - Self-Employed Independent Contractor web template.

Unless you come with an account and need to begin using US Legal Forms, abide by these steps:

- Discover the form you will need and ensure it is for your appropriate city/county.

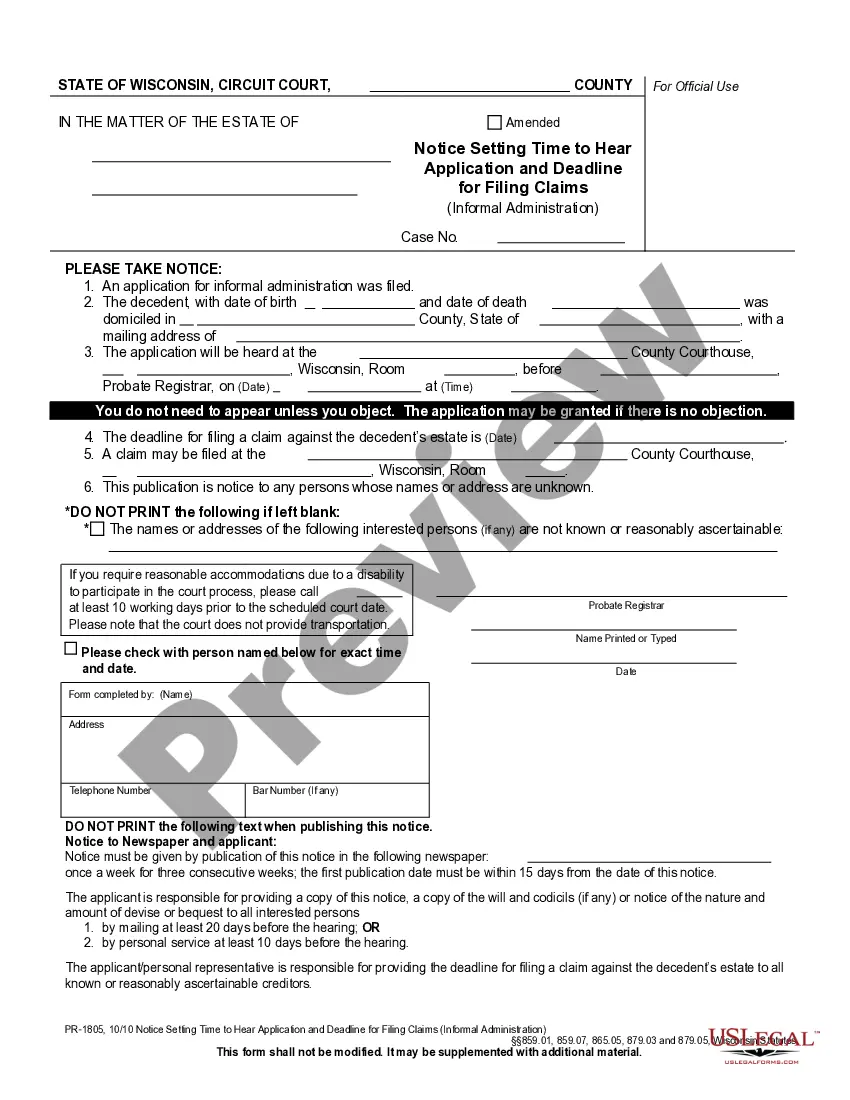

- Use the Preview option to examine the shape.

- Read the explanation to ensure that you have selected the correct form.

- In case the form is not what you`re searching for, make use of the Research discipline to discover the form that fits your needs and requirements.

- Whenever you find the appropriate form, just click Buy now.

- Pick the pricing prepare you desire, fill in the necessary info to generate your bank account, and buy an order using your PayPal or charge card.

- Choose a handy file formatting and down load your duplicate.

Get every one of the papers templates you may have purchased in the My Forms menu. You can get a additional duplicate of Pennsylvania Physical Therapist Agreement - Self-Employed Independent Contractor any time, if possible. Just select the needed form to down load or print out the papers web template.

Use US Legal Forms, the most extensive variety of legal kinds, to save lots of time and steer clear of mistakes. The assistance offers skillfully produced legal papers templates which can be used for a variety of purposes. Make a merchant account on US Legal Forms and begin generating your lifestyle easier.

Form popularity

FAQ

What Should an Independent Contractor Agreement Contain?Terms. This is the first section of any agreement or contract and states the names and locations of the parties involved.Responsibilities & Deliverables.Payment-Related Details.Confidentiality Clause.Contract Termination.Choice of Law.

How do I create an Independent Contractor Agreement?State the location.Describe the type of service required.Provide the contractor's and client's details.Outline compensation details.State the agreement's terms.Include any additional clauses.State the signing details.

The three types of self-employed individuals include:Independent contractors. Independent contractors are individuals hired to perform specific jobs for clients, meaning that they are only paid for their jobs.Sole proprietors.Partnerships.

An independent contractor agreement is a legally binding document signed by a 1099 employee and the company that hires them. It outlines the scope of work and the terms under which that work will be completed, which goes a long way to making sure both parties are on the same page about the project from the start.

Becoming an independent contractor is one of the many ways to be classified as self-employed. By definition, an independent contractor provides work or services on a contractual basis, whereas, self-employment is simply the act of earning money without operating within an employee-employer relationship.

Ten Tips for Making Solid Business Agreements and ContractsGet it in writing.Keep it simple.Deal with the right person.Identify each party correctly.Spell out all of the details.Specify payment obligations.Agree on circumstances that terminate the contract.Agree on a way to resolve disputes.More items...

The general rule is that you will be: An employee if you work for someone and do not have the risks of running a business. Self-employed if you have a trade, profession or vocation, are in business on your own account and are responsible for the success or failure of that business.

Here are some steps you may use to guide you when you write an employment contract:Title the employment contract.Identify the parties.List the term and conditions.Outline the job responsibilities.Include compensation details.Use specific contract terms.Consult with an employment lawyer.Employment.More items...?

What the service is and how much the contractor will be paid. If the client/customer will cover expenses or provide resources. When the contract will end. If either party will be penalized for things such as late payments or unfinished work.

If you are an independent contractor, then you are self-employed. The earnings of a person who is working as an independent contractor are subject to self-employment tax. To find out what your tax obligations are, visit the Self-Employed Individuals Tax Center.