Pennsylvania Translator And Interpreter Agreement - Self-Employed Independent Contractor

Description

How to fill out Pennsylvania Translator And Interpreter Agreement - Self-Employed Independent Contractor?

Are you currently within a situation where you need documents for both business or person functions just about every time? There are tons of legal record themes available on the Internet, but getting versions you can rely is not effortless. US Legal Forms delivers a large number of form themes, such as the Pennsylvania Translator And Interpreter Agreement - Self-Employed Independent Contractor, that are created to meet federal and state demands.

If you are already familiar with US Legal Forms internet site and also have a free account, basically log in. Following that, you may download the Pennsylvania Translator And Interpreter Agreement - Self-Employed Independent Contractor design.

Unless you provide an accounts and want to begin using US Legal Forms, abide by these steps:

- Find the form you want and ensure it is for your correct area/area.

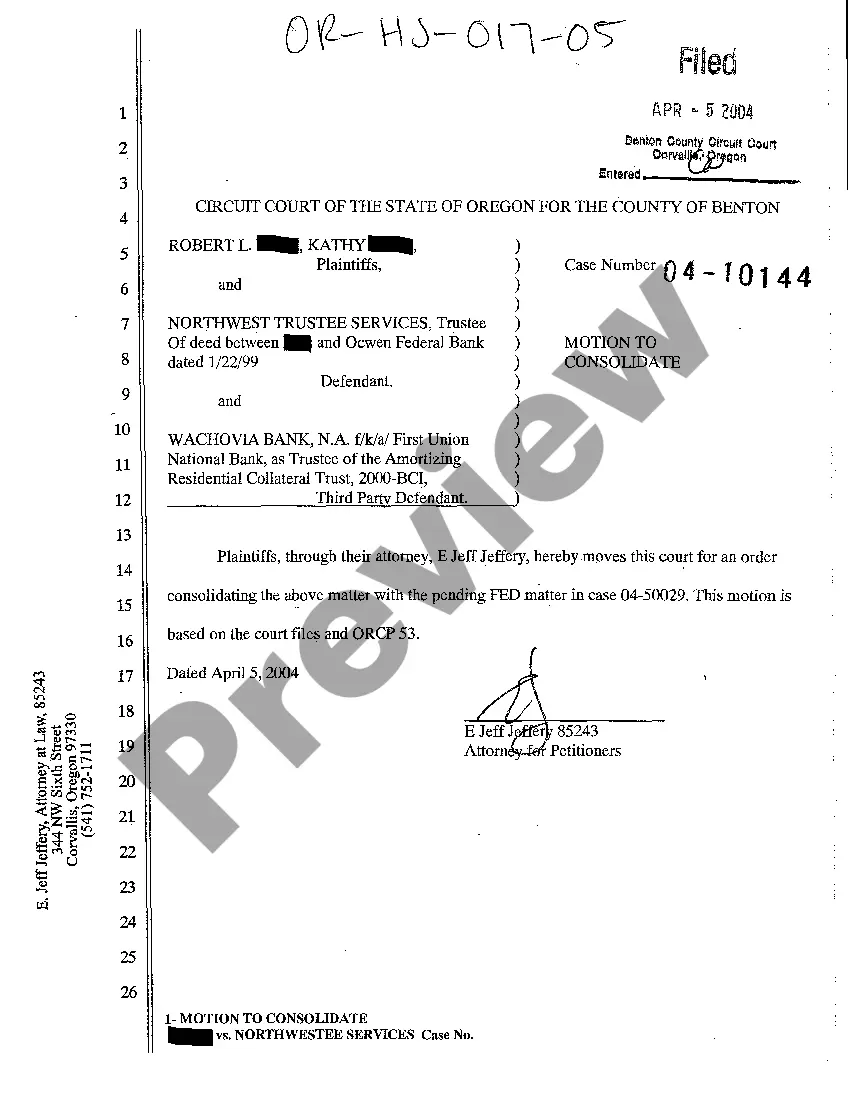

- Take advantage of the Preview button to examine the form.

- Look at the outline to actually have chosen the appropriate form.

- If the form is not what you`re trying to find, utilize the Search industry to find the form that meets your needs and demands.

- Whenever you find the correct form, simply click Purchase now.

- Opt for the costs prepare you would like, fill in the necessary information to produce your account, and buy an order utilizing your PayPal or credit card.

- Decide on a hassle-free file formatting and download your copy.

Discover each of the record themes you may have purchased in the My Forms menus. You can get a extra copy of Pennsylvania Translator And Interpreter Agreement - Self-Employed Independent Contractor whenever, if needed. Just select the required form to download or printing the record design.

Use US Legal Forms, probably the most considerable collection of legal forms, to save some time and prevent blunders. The services delivers skillfully produced legal record themes which you can use for an array of functions. Generate a free account on US Legal Forms and initiate creating your way of life a little easier.

Form popularity

FAQ

Becoming an independent contractor is one of the many ways to be classified as self-employed. By definition, an independent contractor provides work or services on a contractual basis, whereas, self-employment is simply the act of earning money without operating within an employee-employer relationship.

Freelance interpreters or translators work on a self-employed basis converting written texts from one language to another or providing verbal translations in live situations, such as conferences, performances, or meetings.

Simply put, being an independent contractor is one way to be self-employed. Being self-employed means that you earn money but don't work as an employee for someone else.

Fact #1: A large percentage of all interpreters and translators are independent contractors. There are many reasons that language professionals choose to work as independent contractors. Many prefer the flexibility of making their own schedule and being able to choose their assignments.

Interpreters and translators in California have been granted an exemption from AB 5. It's been almost 9 months since the controversial AB 5 bill went into effect, which reclassified independent interpreters and translators in California as employees, and no longer as independent contractors.

Freelancers are independent contractors who should receive 1099 from the company using their services and are subject to paying their own taxes, including self-employment tax.

Many freelance journalists, musicians, translators and other workers in California can operate as independent contractors under a new law signed by Gov. Gavin Newsom on Sept. 4.

Highly skilled and experienced interpreters who travel to interpret at conferences are often contractors, working directly for the conference or through an LSP. They typically have a contract to provide services at a specific conference (i.e., a short-term commitment with a clearly-stated end date).

The IRS says that someone is self-employed if they meet one of these conditions:Someone who carries on a trade or business as a sole proprietor or independent contractor,A member of a partnership that carries on a trade or business, or.Someone who is otherwise in business for themselves, including part-time business.

The law does not require you to complete a contract with your self-employed or freelance workers - a verbal contract can exist even when there is nothing in writing.