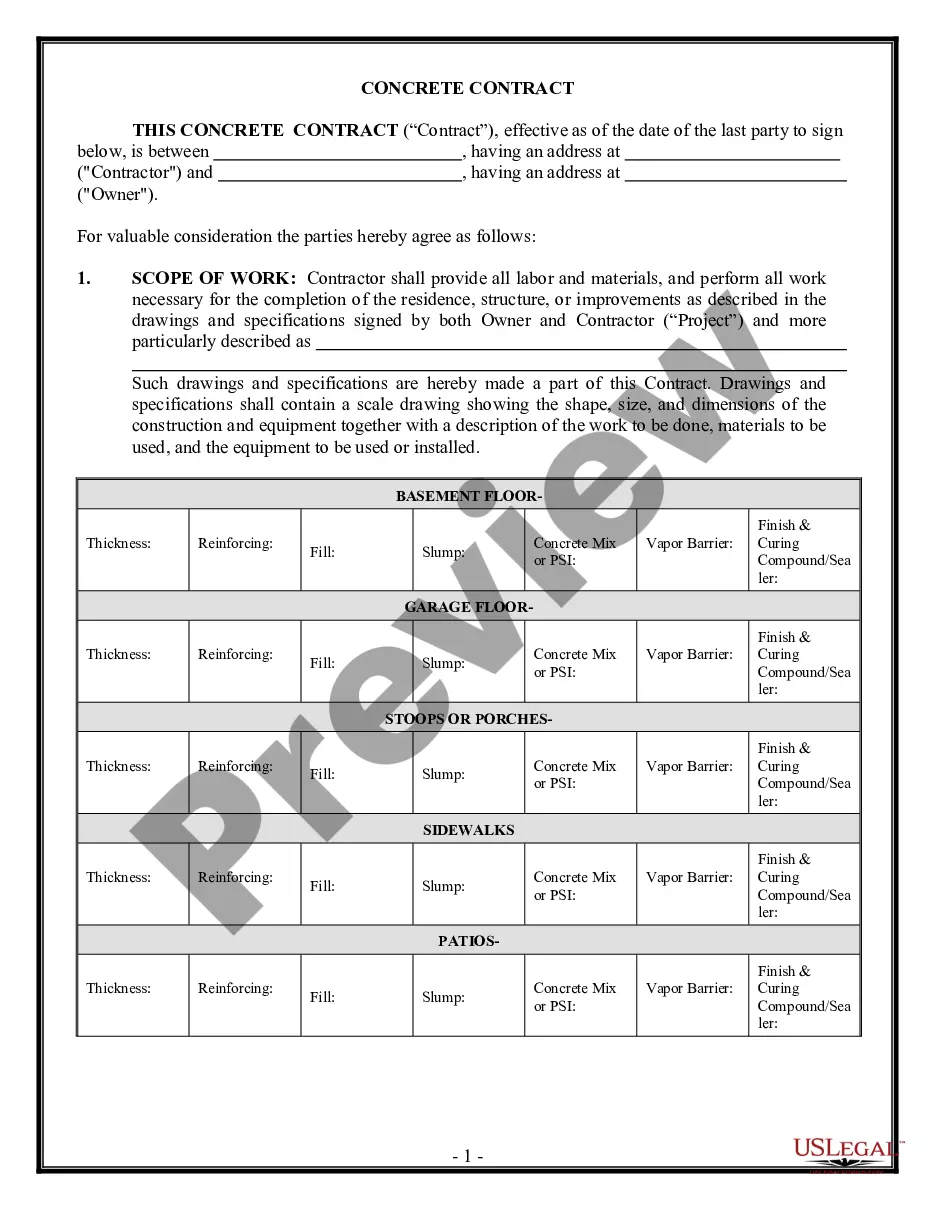

The Schedule for the Distributions of Earnings to Partners assures that all factors to be considered are spelled out in advance of such decisions. It lists the minimun participation amounts and defines what the term "normal participation" means. It also discuses fees and benefits for each partner.

Pennsylvania Recommendation for Partner Compensation is a crucial aspect of business partnerships in the state. Partner compensation refers to the methods and guidelines used to determine how partners in a business should be remunerated for their contributions and efforts. In Pennsylvania, there are several types of recommendations for partner compensation, including: 1. Profit-Sharing: Profit-sharing is a common method used to compensate partners in Pennsylvania. Under this recommendation, partners receive a percentage of the profits generated by the business. The percentage is usually based on each partner's ownership stake or a predetermined allocation. 2. Fixed Salary: Some businesses prefer to provide partners with a fixed salary as their compensation. This method ensures a predictable income for partners regardless of the company's profitability. The fixed salary is determined based on factors such as experience, responsibilities, and the partner's contribution to the business. 3. Draws: A draw-based compensation system allows partners to receive regular distributions from the business's profits. Draws can be taken on a monthly or quarterly basis, and they are debited against the partner's share of profits. This method helps partners maintain a consistent cash flow while still linking compensation to the business's performance. 4. Capital Interest: In certain cases, compensation is tied to a partner's percentage of ownership or capital interest in the business. Partners receive compensation based on their equity stake, with higher percentages equating to larger shares of profits. 5. Performance-Based Compensation: Some Pennsylvania businesses opt for performance-based compensation to incentivize partners to achieve specific targets or milestones. Under this recommendation, partners are rewarded based on their individual or team performance, which may include metrics like sales targets, client satisfaction ratings, or project completion goals. When determining partner compensation in Pennsylvania, businesses should consider factors such as the nature of the partnership agreement, capital contributions, dedication of time and effort, expertise brought into the business, and any unique circumstances. It is vital to draft a comprehensive partnership agreement that outlines the chosen method of partner compensation, the allocation of profits and losses, and the criteria for adjusting compensation in case of changes in the business's financial circumstances. Pennsylvania's businesses are advised to consult with legal and financial professionals to ensure their partner compensation recommendations adhere to state laws and regulations governing partnerships.