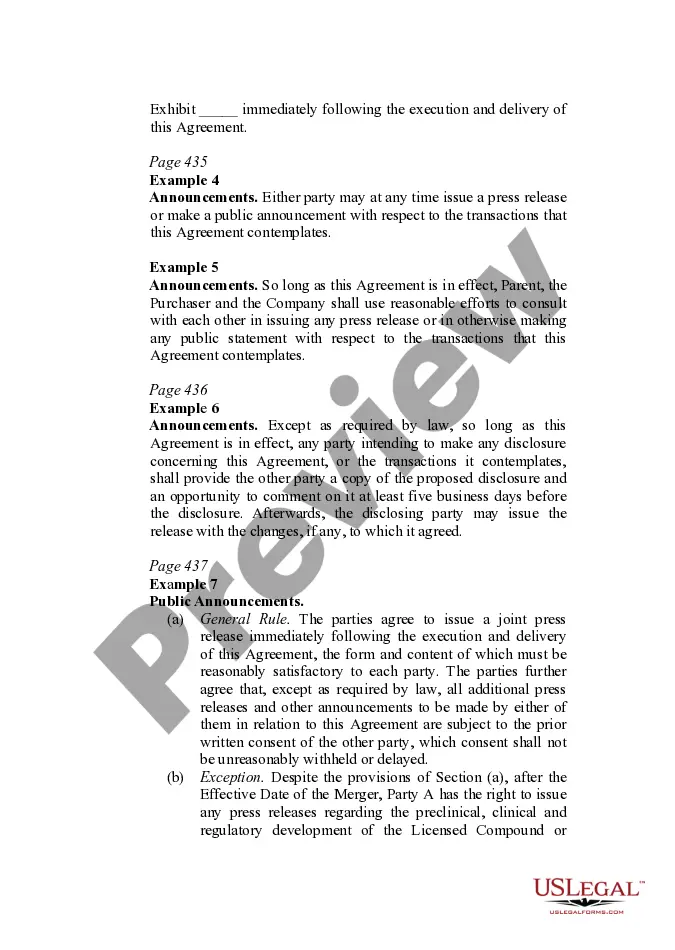

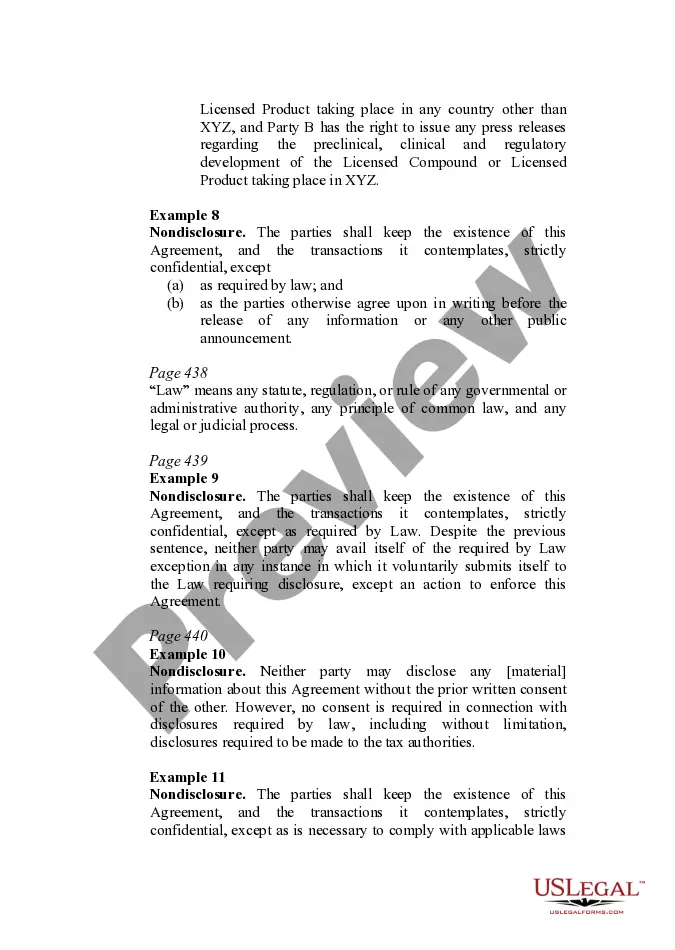

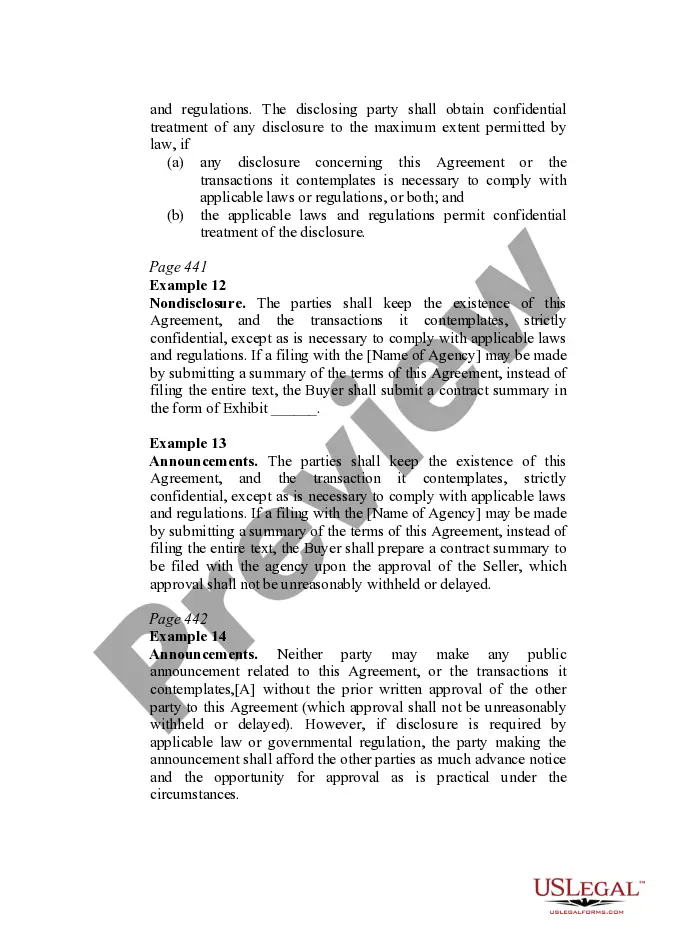

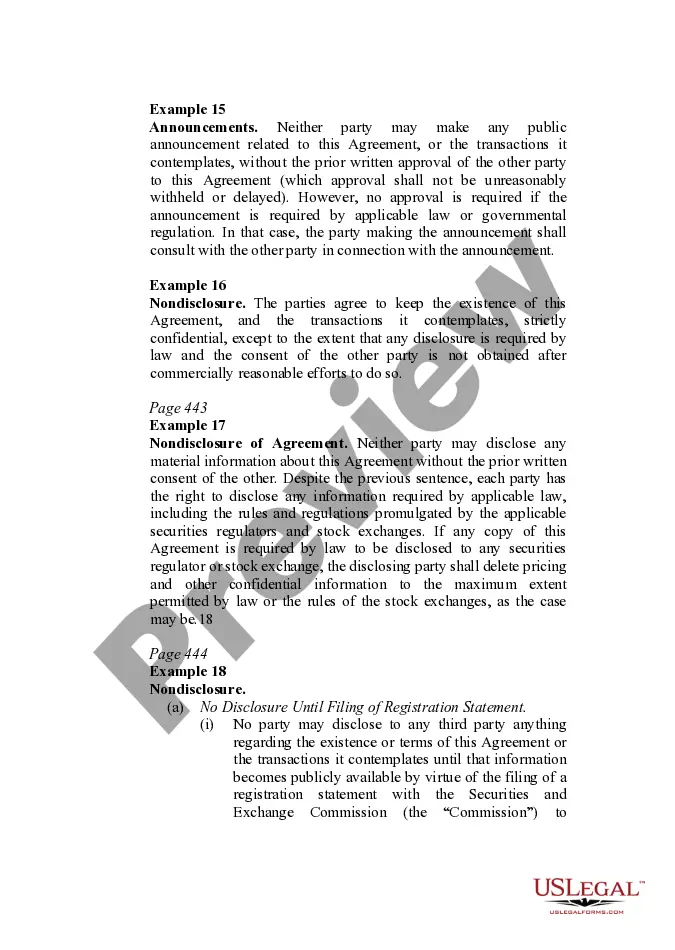

This form provides boilerplate contract clauses that outline the obligations of nondisclosure and the restrictions that apply to public announcements regarding the existence or terms of the contract agreement. Several different language options representing various levels of restriction are included to suit individual needs and circumstances.

Pennsylvania Announcement Provisions in the Transactional Context

Description

How to fill out Announcement Provisions In The Transactional Context?

Are you currently in the position where you require documents for both company or person reasons almost every day? There are a lot of legitimate file templates available online, but finding types you can trust isn`t simple. US Legal Forms gives a large number of form templates, like the Pennsylvania Announcement Provisions in the Transactional Context, that happen to be created in order to meet state and federal specifications.

In case you are already informed about US Legal Forms website and possess your account, basically log in. After that, you can download the Pennsylvania Announcement Provisions in the Transactional Context design.

Unless you offer an profile and wish to begin using US Legal Forms, adopt these measures:

- Obtain the form you require and make sure it is to the right area/county.

- Utilize the Review button to check the form.

- Read the information to ensure that you have chosen the correct form.

- If the form isn`t what you are trying to find, take advantage of the Research field to get the form that fits your needs and specifications.

- Whenever you obtain the right form, click on Purchase now.

- Choose the prices program you need, fill in the required information and facts to generate your money, and buy the transaction using your PayPal or charge card.

- Choose a hassle-free paper format and download your backup.

Discover each of the file templates you may have bought in the My Forms menu. You can obtain a extra backup of Pennsylvania Announcement Provisions in the Transactional Context any time, if necessary. Just select the required form to download or printing the file design.

Use US Legal Forms, one of the most considerable selection of legitimate varieties, to conserve time and stay away from faults. The service gives expertly produced legitimate file templates which you can use for a variety of reasons. Create your account on US Legal Forms and commence making your lifestyle easier.