Pennsylvania Lessor's Notice of Election to Take Royalty in Kind

Description

How to fill out Lessor's Notice Of Election To Take Royalty In Kind?

If you want to comprehensive, acquire, or print authorized file layouts, use US Legal Forms, the most important selection of authorized types, that can be found online. Use the site`s simple and easy hassle-free lookup to get the files you need. Different layouts for enterprise and individual functions are categorized by categories and states, or key phrases. Use US Legal Forms to get the Pennsylvania Lessor's Notice of Election to Take Royalty in Kind in just a few mouse clicks.

In case you are currently a US Legal Forms client, log in in your account and click the Acquire option to have the Pennsylvania Lessor's Notice of Election to Take Royalty in Kind. Also you can entry types you earlier acquired from the My Forms tab of your account.

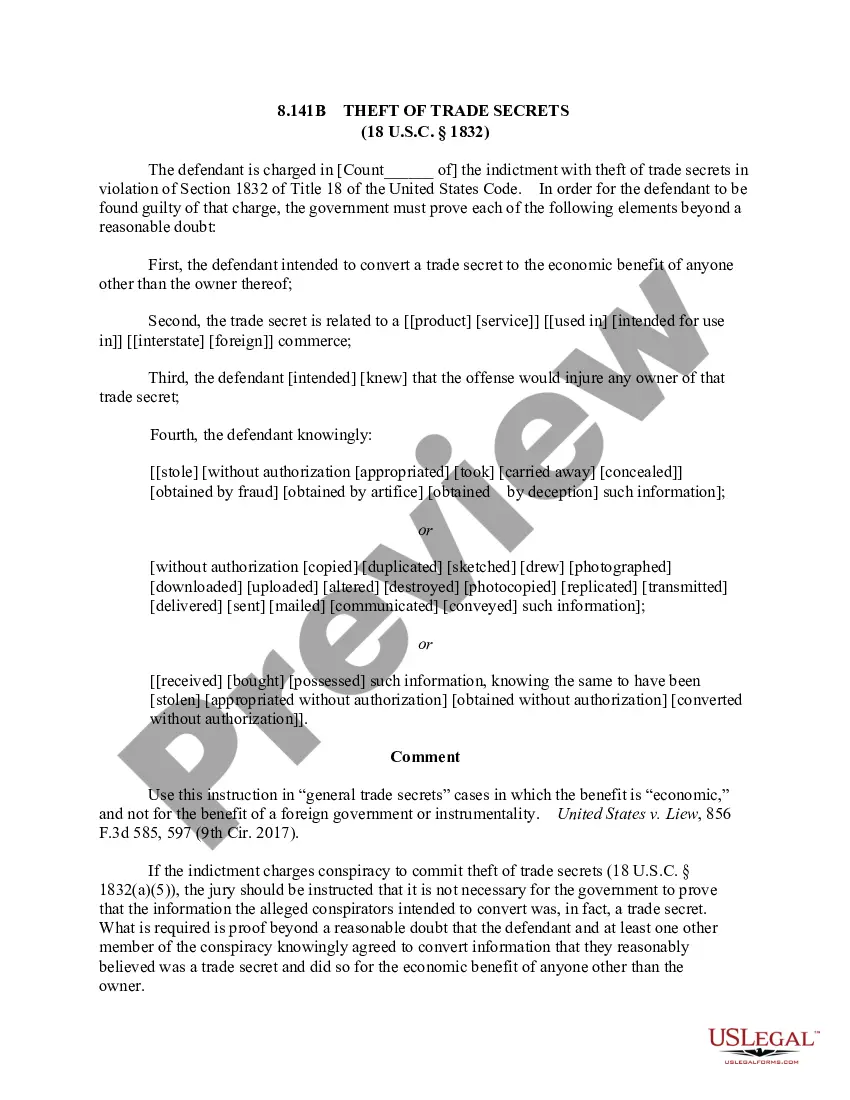

Should you use US Legal Forms initially, refer to the instructions under:

- Step 1. Ensure you have chosen the form for that correct metropolis/region.

- Step 2. Make use of the Preview choice to look over the form`s articles. Do not forget about to read the information.

- Step 3. In case you are not happy using the kind, make use of the Lookup industry on top of the display to discover other models of your authorized kind design.

- Step 4. After you have found the form you need, select the Acquire now option. Select the pricing prepare you favor and add your accreditations to register on an account.

- Step 5. Approach the deal. You may use your charge card or PayPal account to accomplish the deal.

- Step 6. Pick the file format of your authorized kind and acquire it in your gadget.

- Step 7. Total, change and print or indication the Pennsylvania Lessor's Notice of Election to Take Royalty in Kind.

Every single authorized file design you get is your own forever. You possess acces to each and every kind you acquired with your acccount. Select the My Forms portion and decide on a kind to print or acquire yet again.

Be competitive and acquire, and print the Pennsylvania Lessor's Notice of Election to Take Royalty in Kind with US Legal Forms. There are millions of professional and status-certain types you can utilize for your personal enterprise or individual requires.

Form popularity

FAQ

Many landowners signed leases with the statutory minimum royalty of 12.5 percent. This minimum royalty is guaranteed by Pennsylvania's Guaranteed Minimum Royalty Act (GMRA). Pursuant to the GMRA, an oil and gas lease is invalid unless it guarantees the landowner a production royalty of at least 12.5 percent. HB 1391: Putting Teeth Back in Pennsylvania's Minimum Royalty ... hh-law.com ? blogs ? oil-and-gas-addendum ? hb... hh-law.com ? blogs ? oil-and-gas-addendum ? hb...

Pennsylvania allows property owners to separate the surface rights and the subsurface rights, which are oil, gas or mineral rights. When nothing is done, the property owner owns everything, surface and subsurface rights. The property owner may choose to sell or lease these subsurface rights.

Is the money I receive from a gas lease taxable? Yes, the income is taxable and should be reported on PA Schedule E and Line 6 Rents, Royalties, Patents or Copyrights of the PA-40. Income paid under a gas lease is normally reported by the payer on...

Mineral rights can be sold in any Pennsylvania county for anything from $500/acre to $5,000+/acre. Isn't that a pretty wide range? The reason for such a range is because the ranges depend on where you are located in Pennsylvania. The cost of your property is heavily influenced by where you are located.

Pennsylvania's Guaranteed Minimum Royalty Act of 1979 put the figure at 12.5 percent. But some leases allow drillers to share the costs of processing and transporting gas with landowners. These are known as post-production costs or gathering fees, and they show up as deductions from royalty checks.