Pennsylvania Division Orders

Description

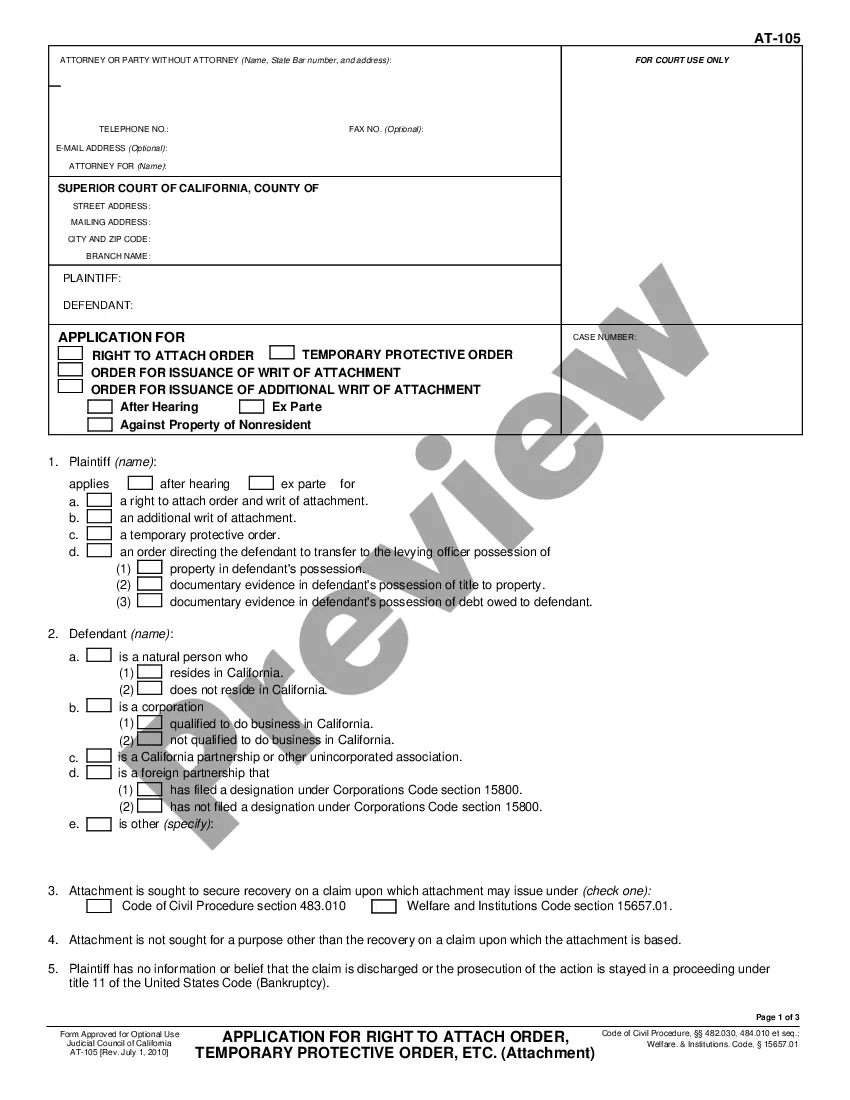

How to fill out Division Orders?

Are you presently within a position the place you need papers for sometimes enterprise or individual reasons virtually every time? There are plenty of legitimate record themes available on the net, but finding kinds you can rely on isn`t easy. US Legal Forms offers a large number of form themes, just like the Pennsylvania Division Orders, that happen to be written to fulfill federal and state needs.

If you are already knowledgeable about US Legal Forms web site and get a merchant account, just log in. Following that, it is possible to obtain the Pennsylvania Division Orders template.

Unless you have an profile and want to begin using US Legal Forms, abide by these steps:

- Discover the form you want and ensure it is to the appropriate metropolis/state.

- Make use of the Preview option to review the shape.

- See the information to ensure that you have chosen the correct form.

- In case the form isn`t what you`re searching for, take advantage of the Look for area to obtain the form that meets your needs and needs.

- Whenever you get the appropriate form, simply click Acquire now.

- Opt for the prices program you need, complete the required information to make your bank account, and purchase the transaction using your PayPal or charge card.

- Decide on a convenient paper structure and obtain your copy.

Find every one of the record themes you possess purchased in the My Forms food selection. You may get a extra copy of Pennsylvania Division Orders anytime, if required. Just click the required form to obtain or print out the record template.

Use US Legal Forms, the most comprehensive variety of legitimate forms, to save efforts and avoid faults. The services offers appropriately manufactured legitimate record themes which can be used for a variety of reasons. Create a merchant account on US Legal Forms and commence generating your way of life easier.

Form popularity

FAQ

The payor may not require a division order, however, that requires much more than is necessary for it to verify the interest you claim to be entitled to. You may insist that the payor submit a division order containing no more than is required by Texas law.

A division order analyst works for a petroleum company and oversees company records. As a division order analyst, you establish, prepare, review, approve, and maintain documents regarding production and land ownership for royalty owners. You generally work as a part of the land department at an oil company.

Natural gas rights and mineral rights must be reported like all other types of assets on Schedule E of the Inheritance Tax returns. Mineral rights taxable value is determined by the same method used to value any real or tangible personal property.

To put it another way the formula is: lessor's acres in unit ÷ total number of acres in unit × lessor's ownership interest × lessor's royalty percentage = lessor's decimal interest.

A division order is a contract between you and the operator (an oil and gas company). Typically, receiving a division order means that the operator is about to drill, or that the operator has already drilled a well and your minerals are producing.

A division order is a contract between you and the operator (an oil and gas company). Typically, receiving a division order means that the operator is about to drill, or that the operator has already drilled a well and your minerals are producing.

The division order describes the minerals, it asks for information about yourself, and often asks you to agree to certain things related to the payment of royalties. But beware, in Oklahoma you are not required to sign and return a division order. In fact, you may be unnecessarily impairing or giving away your rights.

A Division order is an instrument that records an owner's interest in a specific well. It should include the name of the well, the well number, interest type, and your decimal interest.