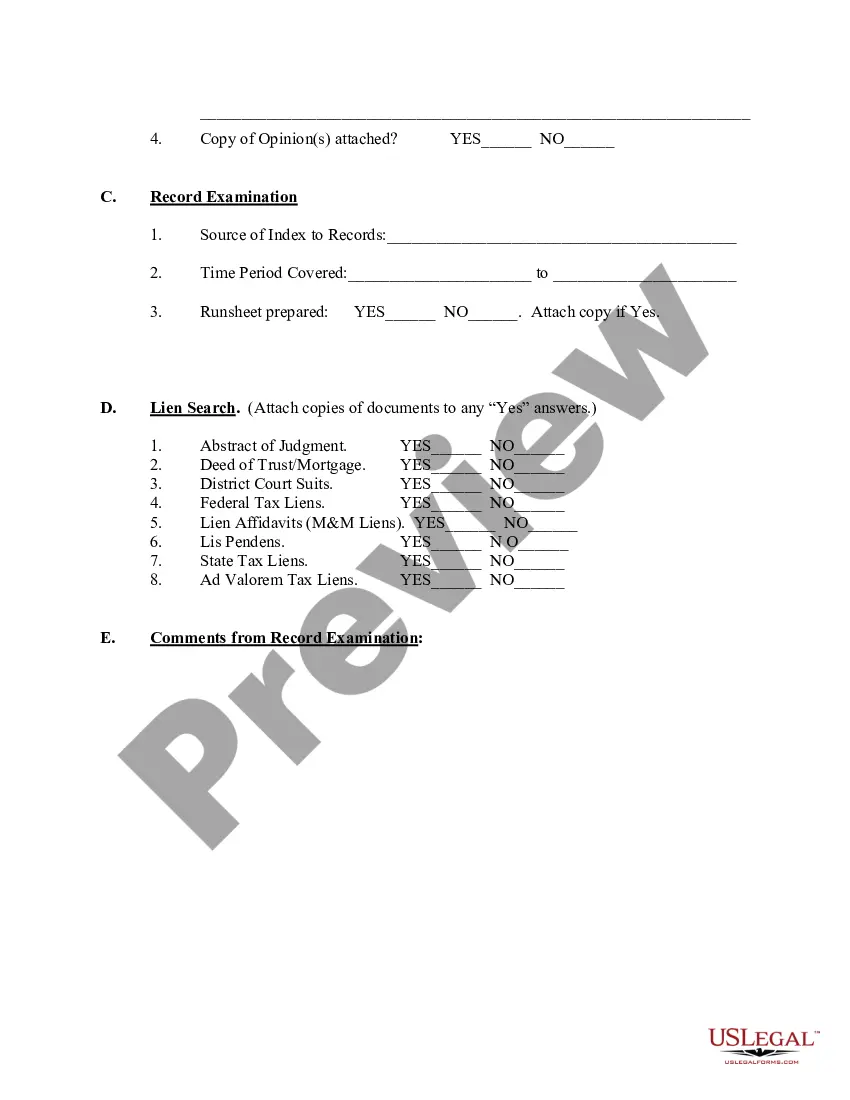

Pennsylvania Due Diligence Field Review and Checklist is an essential process that evaluates and examines the various aspects of a property or business transaction in the state of Pennsylvania. This comprehensive process aids in ensuring that all relevant details, legal obligations, and potential risks are thoroughly understood and accounted for before the completion of a real estate transaction or business deal. The Pennsylvania Due Diligence Field Review and Checklist encompass a wide range of factors, including but not limited to property condition, legal documentation, environmental considerations, zoning compliance, financial analysis, and market feasibility. By undertaking this thorough examination, buyers, lenders, and investors can make informed decisions and mitigate potential risks associated with the property or business they are acquiring. The Pennsylvania Due Diligence Field Review and Checklist are crucial for both buyers and sellers. For buyers, it assists in identifying any hidden liabilities, underlying issues, or outstanding debts associated with the property. For sellers, the due diligence process provides an opportunity to rectify any discrepancies, improve marketability, and thus secure a more favorable transaction. Key components of the Pennsylvania Due Diligence Field Review and Checklist include property surveys, title searches, environmental assessments, building inspections, financial audits, permit and zoning verifications, lease and contract analysis, and comprehensive market research. These components help evaluate the property's physical condition, legal standing, financial viability, and marketability. In Pennsylvania, various types of due diligence reviews and checklists exist, depending on the nature of the transaction. Some common types include: 1. Real Estate Due Diligence Checklist: This checklist focuses on evaluating properties, including residential, commercial, or industrial real estate. It encompasses factors such as property condition, title searches, easements, encroachments, liens, leases, and zoning compliance. 2. Business Acquisition Due Diligence Checklist: This checklist concentrates on evaluating the financial and operational aspects of a business that is being acquired. It involves examining financial statements, tax returns, contracts, licenses, permits, intellectual property, customer relationships, and employee agreements. 3. Environmental Due Diligence Checklist: This checklist aims to assess any potential environmental liabilities or concerns associated with a property. It involves conducting Phase I and Phase II environmental site assessments to determine the presence of hazardous substances, soil and groundwater contamination, and compliance with environmental regulations. The Pennsylvania Due Diligence Field Review and Checklist serve as critical tools in minimizing risks and ensuring a successful transaction for both parties involved. Adhering to these comprehensive review processes ultimately leads to well-informed decisions and successful acquisitions in Pennsylvania's real estate and business sectors.

Pennsylvania Due Diligence Field Review and Checklist

Description

How to fill out Pennsylvania Due Diligence Field Review And Checklist?

US Legal Forms - one of several most significant libraries of authorized varieties in the USA - provides a wide array of authorized record themes you may down load or print. Using the internet site, you can get a large number of varieties for company and individual purposes, sorted by classes, says, or search phrases.You will find the newest models of varieties just like the Pennsylvania Due Diligence Field Review and Checklist in seconds.

If you currently have a subscription, log in and down load Pennsylvania Due Diligence Field Review and Checklist in the US Legal Forms catalogue. The Down load key will show up on every kind you perspective. You get access to all formerly downloaded varieties inside the My Forms tab of the bank account.

If you wish to use US Legal Forms initially, here are straightforward guidelines to help you started out:

- Make sure you have chosen the best kind for your town/region. Click the Preview key to analyze the form`s articles. See the kind description to ensure that you have chosen the correct kind.

- In the event the kind doesn`t match your needs, make use of the Research industry towards the top of the display screen to discover the the one that does.

- In case you are happy with the shape, verify your decision by clicking on the Get now key. Then, select the costs program you prefer and give your accreditations to register to have an bank account.

- Procedure the purchase. Make use of Visa or Mastercard or PayPal bank account to perform the purchase.

- Find the file format and down load the shape on your gadget.

- Make changes. Complete, change and print and indication the downloaded Pennsylvania Due Diligence Field Review and Checklist.

Every design you put into your bank account lacks an expiry date and it is your own permanently. So, in order to down load or print one more duplicate, just go to the My Forms area and then click on the kind you will need.

Get access to the Pennsylvania Due Diligence Field Review and Checklist with US Legal Forms, the most substantial catalogue of authorized record themes. Use a large number of specialist and state-particular themes that fulfill your small business or individual requires and needs.