Pennsylvania Partial Release of Mortgage / Deed of Trust on A Mineral / Royalty Interest Sold by Grantor

Description

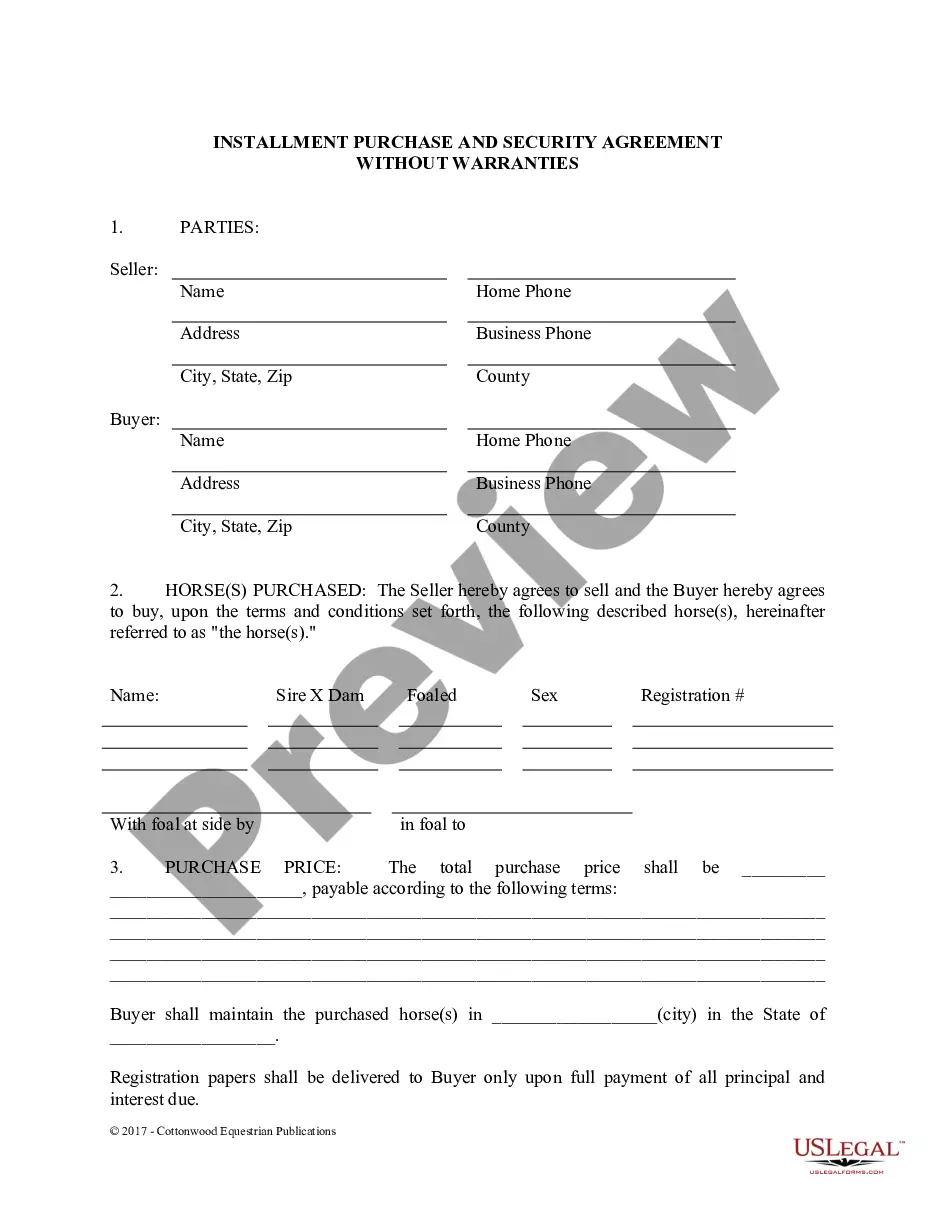

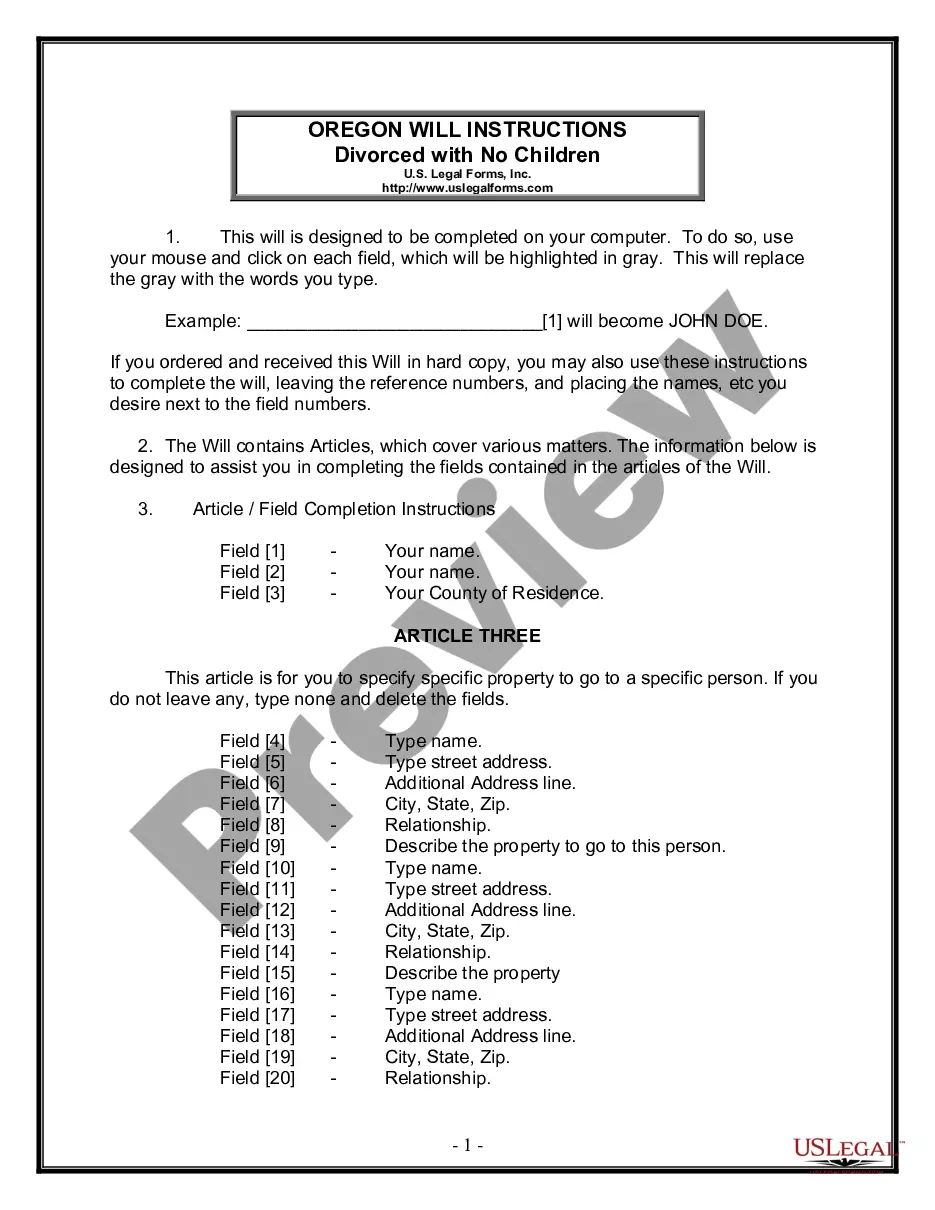

How to fill out Partial Release Of Mortgage / Deed Of Trust On A Mineral / Royalty Interest Sold By Grantor?

Are you currently inside a position the place you require papers for possibly company or personal reasons almost every day? There are tons of legal file themes available online, but finding kinds you can trust isn`t easy. US Legal Forms gives 1000s of develop themes, such as the Pennsylvania Partial Release of Mortgage / Deed of Trust on A Mineral / Royalty Interest Sold by Grantor, which are published in order to meet state and federal requirements.

When you are presently informed about US Legal Forms internet site and possess your account, basically log in. Following that, you are able to download the Pennsylvania Partial Release of Mortgage / Deed of Trust on A Mineral / Royalty Interest Sold by Grantor design.

Unless you come with an profile and would like to start using US Legal Forms, abide by these steps:

- Discover the develop you require and ensure it is for that correct area/area.

- Use the Preview switch to analyze the form.

- Read the description to ensure that you have chosen the right develop.

- If the develop isn`t what you are trying to find, utilize the Lookup industry to discover the develop that meets your requirements and requirements.

- Whenever you get the correct develop, just click Buy now.

- Select the costs plan you desire, fill out the necessary details to produce your money, and buy the transaction making use of your PayPal or credit card.

- Choose a practical document format and download your copy.

Locate every one of the file themes you have purchased in the My Forms food selection. You can obtain a extra copy of Pennsylvania Partial Release of Mortgage / Deed of Trust on A Mineral / Royalty Interest Sold by Grantor anytime, if required. Just select the needed develop to download or printing the file design.

Use US Legal Forms, one of the most extensive selection of legal varieties, to save lots of time as well as avoid faults. The support gives appropriately made legal file themes that you can use for a selection of reasons. Generate your account on US Legal Forms and start generating your way of life a little easier.

Form popularity

FAQ

A deed of trust can benefit the lender because it typically allows a faster foreclosure on a home. Most deeds of trust have a ?non-judicial foreclosure? clause, which means that the lender won't have to wait for the court system to review and approve the foreclosure process.

Where a person who is not on the mortgage is to have a share in a property a Declaration of Trust will set out what they are contributing and what their share is. A restriction can be entered at the Land Registry to protect the interest of the person not included on the mortgage.

Focusing on this geographical region, the Deed of Trust is the preferred or required security instrument for real property in the following states: Maryland, North Carolina, Tennessee, Virginia and West Virginia. Mortgages are used in Kentucky, Ohio and Pennsylvania.

How long will a Trust Deed usually last for? Once drafted, signed, witnessed and dated, the deed of trust is a formal legal document which is valid until further changes are done or the property is sold. These changes, however, can only be done through either a deed of variation or a deed of surrender.

While with a mortgage the borrower holds the title to the property, with a deed of trust title is held by the third party trustee until the loan is paid off or the trustor defaults. In North Carolina, this third party is typically a title company.

Credit rating ? having a trust deed will affect your credit rating for 6 years from the date the trust deed begins. This can make it harder to get credit like a mortgage or a loan in the future. selling your belongings and property ? you may have to sell some of the things you own (your assets) such as your home.

In most cases, Title Deeds are retained by the mortgagee until such time as the loan is repaid.

Not all states recognize a Trust Deed. Use a Mortgage Deed if you live in: Connecticut, Delaware, Florida, Indiana, Iowa, Kansas, Louisiana, New Jersey, New York, North Dakota, Ohio, Oklahoma, Pennsylvania, South Carolina, Vermont, or Wisconsin.