Pennsylvania Affidavit of Heirship - Descent

Description

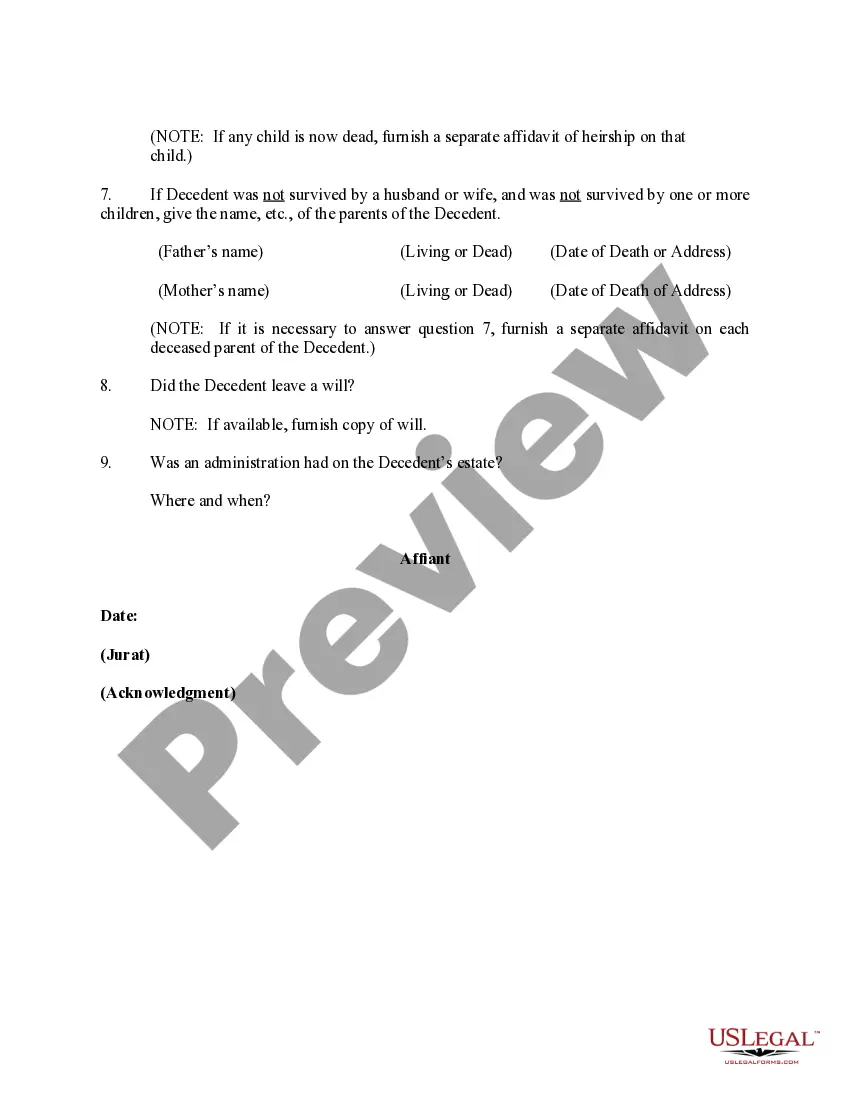

How to fill out Affidavit Of Heirship - Descent?

Choosing the best authorized document design could be a have a problem. Needless to say, there are a lot of templates available on the Internet, but how can you find the authorized kind you will need? Take advantage of the US Legal Forms internet site. The service delivers a huge number of templates, for example the Pennsylvania Affidavit of Heirship - Descent, that you can use for business and private requires. Each of the kinds are checked out by professionals and fulfill federal and state requirements.

Should you be already registered, log in in your bank account and then click the Acquire option to have the Pennsylvania Affidavit of Heirship - Descent. Make use of bank account to search with the authorized kinds you might have bought formerly. Proceed to the My Forms tab of the bank account and obtain an additional duplicate of your document you will need.

Should you be a brand new consumer of US Legal Forms, here are basic directions that you should adhere to:

- Very first, be sure you have selected the proper kind to your town/area. You can look through the shape utilizing the Preview option and look at the shape outline to ensure it is the right one for you.

- If the kind will not fulfill your needs, utilize the Seach discipline to find the proper kind.

- Once you are sure that the shape is proper, select the Acquire now option to have the kind.

- Pick the costs plan you would like and enter in the required details. Design your bank account and purchase the transaction making use of your PayPal bank account or credit card.

- Select the file formatting and acquire the authorized document design in your system.

- Comprehensive, revise and printing and indication the attained Pennsylvania Affidavit of Heirship - Descent.

US Legal Forms will be the greatest library of authorized kinds where you will find numerous document templates. Take advantage of the service to acquire skillfully-created paperwork that adhere to state requirements.

Form popularity

FAQ

Specific information is needed to determine the identity of the Heirs at Law of the Heir Property. A properly prepared Texas Affidavit of Heirship must provide the following information: The deceased owner's full name, last address, date of birth and date and place of death. Affidavit of Heirship for a House | Texas Property Deeds texaspropertydeeds.com ? affidavit-of-heirs... texaspropertydeeds.com ? affidavit-of-heirs...

Successors Under Oklahoma law, successors (usually children) can file an affidavit of heirship if the deceased individual's estate qualified as a ?small estate.? The affidavit of heirship must contain specific information if its to be used to avoid the probate process. Affidavit Of Heirship - Tulsa Oklahoma Probate Lawyer - Kania Law kanialaw.com ? tulsa-estate-planning-attorneys kanialaw.com ? tulsa-estate-planning-attorneys

The Declaration of Heirs aims to legally establish the quality of heirs who succeed in an inheritance, establishing their legitimacy to proceed to the division of that inheritance. As a rule, the declaration is made to designate the heirs; and not some legatees who also succeed in that inheritance. Declaration of Heirs - Consular services mne.gov.pt ? declarati... mne.gov.pt ? declarati...

An affidavit of heirship is used to transfer personal property and/or real property written by a disinterested third party who can testify to the relationship of the surviving spouse(s) and/or heir(s). Download Pennsylvania Affidavit of Heirship Documents | BoloForms boloforms.com ? contracts ? personal-family boloforms.com ? contracts ? personal-family

The disinterested witnesses must be someone who knew the decedent and was familiar with the decedent's family history. The disinterested witness can be a friend of the decedent, a friend of the family, or a neighbor, but it cannot be an individual who will directly benefit from the estate financially.

If the deceased property owner had a Will stating who the property should be transferred to, the Will should be filed for Probate within 4 years of the date of death. The property may subsequently be transferred or sold by the Executor named in the Will ing to the wishes of the deceased owner.

The mailing address is: Harris County Clerk, P.O. Box 1525, Houston, TX 77251-1525.

A ballpark fee for preparation of the affidavit is between $750 for a very simple estate with few heirs to several thousand dollars for a more complicated estate with many heirs. The filing fees to record the affidavit in each county where the real property is located usually run about $50 to $75 in Texas.