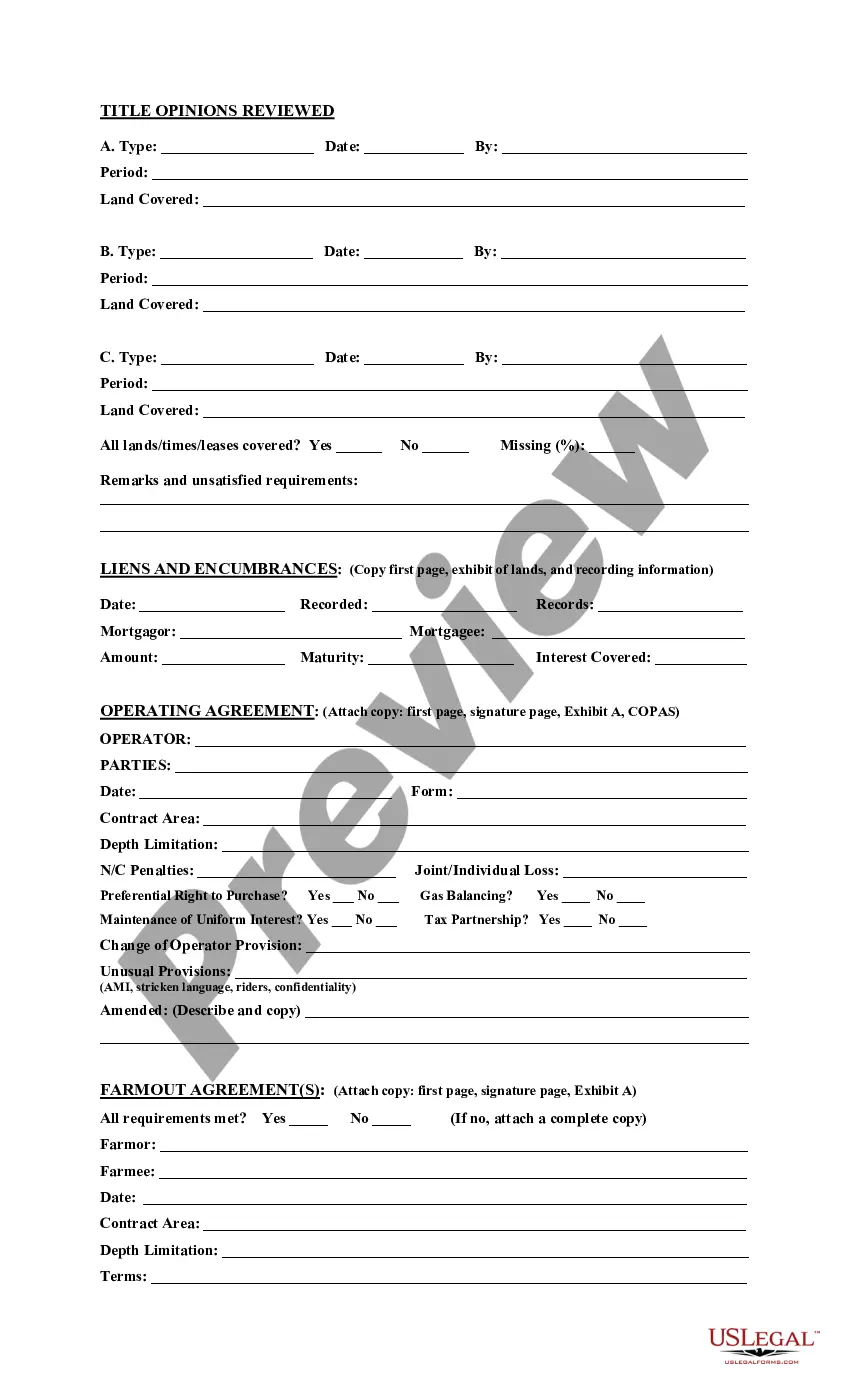

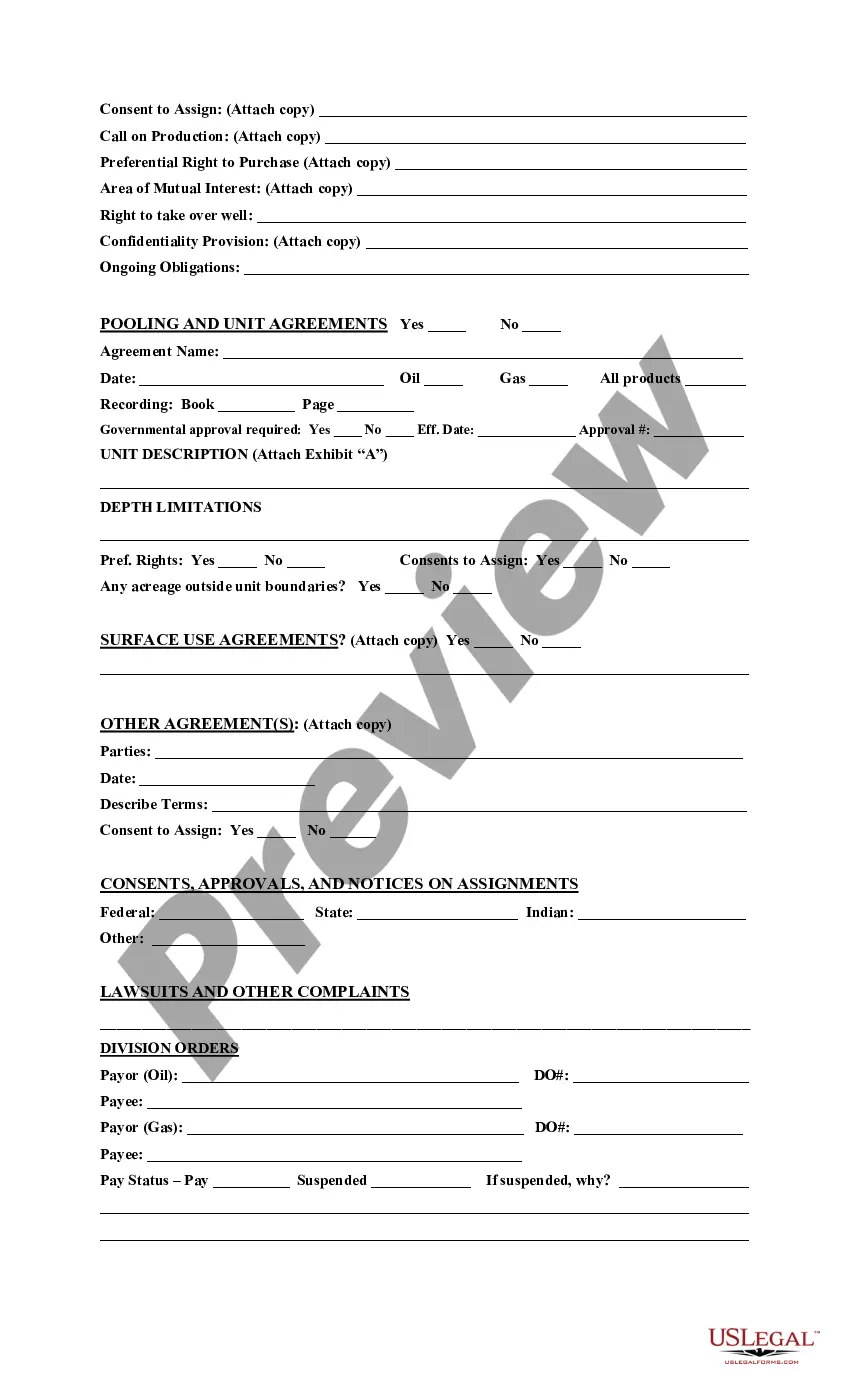

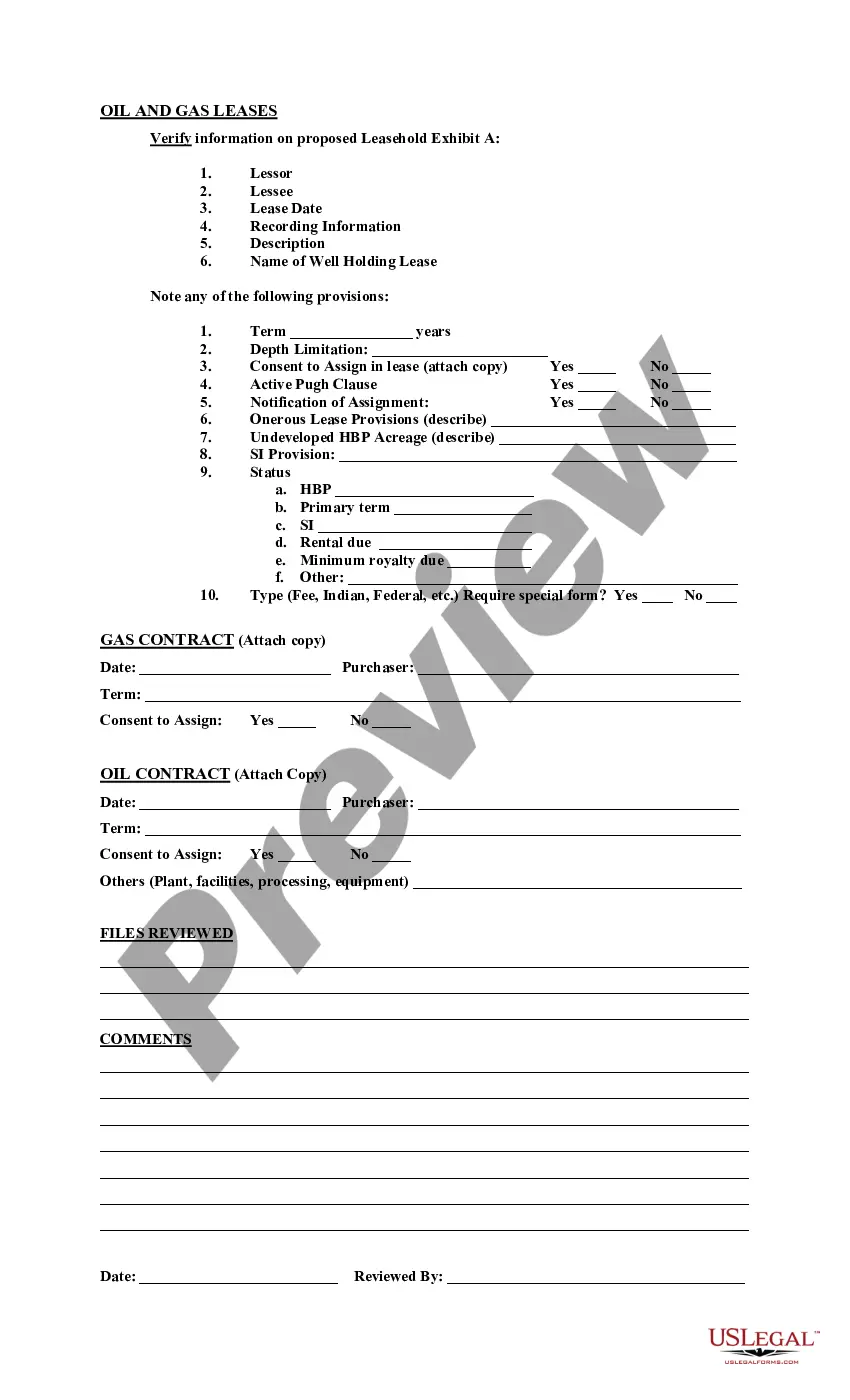

Pennsylvania Acquisition Due Diligence Report

Description

How to fill out Acquisition Due Diligence Report?

US Legal Forms - among the biggest libraries of lawful varieties in the United States - offers a wide range of lawful papers layouts you can acquire or produce. Using the internet site, you can find a large number of varieties for organization and specific functions, sorted by categories, suggests, or key phrases.You can get the most recent versions of varieties such as the Pennsylvania Acquisition Due Diligence Report within minutes.

If you already have a subscription, log in and acquire Pennsylvania Acquisition Due Diligence Report from your US Legal Forms collection. The Obtain switch can look on each and every form you view. You get access to all in the past acquired varieties within the My Forms tab of the accounts.

In order to use US Legal Forms initially, here are simple guidelines to help you started out:

- Be sure to have chosen the best form for your city/region. Go through the Preview switch to check the form`s content material. See the form description to ensure that you have selected the right form.

- In case the form does not match your requirements, make use of the Lookup field at the top of the monitor to get the the one that does.

- When you are happy with the form, affirm your choice by clicking on the Purchase now switch. Then, choose the rates prepare you want and provide your credentials to register to have an accounts.

- Method the financial transaction. Make use of your credit card or PayPal accounts to finish the financial transaction.

- Pick the file format and acquire the form in your system.

- Make alterations. Complete, revise and produce and sign the acquired Pennsylvania Acquisition Due Diligence Report.

Every single format you included in your account does not have an expiration day and is yours eternally. So, in order to acquire or produce one more duplicate, just visit the My Forms portion and click on the form you will need.

Obtain access to the Pennsylvania Acquisition Due Diligence Report with US Legal Forms, probably the most extensive collection of lawful papers layouts. Use a large number of skilled and condition-certain layouts that meet your business or specific needs and requirements.

Form popularity

FAQ

The primary objective of due diligence in mergers and acquisitions is to validate and verify the seller's critical information, including financials, contracts, and compliance standards.

The due diligence report offers a comprehensive exploration and explanation of a property, a company's financial records, or a company's overall standing in the marketplace. The information in a due diligence report varies depending on the industry and the purpose.

Due diligence allows companies to corroborate the information provided by the business that is being acquired. By doing the proper due diligence a purchaser of a company can identify any possible problems so they can avoid a potentially bad deal.

Who Creates a Due Diligence Report? There can often be many groups involved in preparing the due diligence document. Companies may carry out the analysis internally with their corporate development team, or they may hire external advisers like investment bankers or the Due Diligence Team at an accounting firm.

A due diligence inquiry should establish the following key information about the target business: confirm that the seller has good title to the stock or assets of the target business; investigate potential liabilities or risks; confirm the value of the target business; identify steps necessary to integrate the target ...

There are quantitative and qualitative aspects to diligence, and it can take anywhere from 6-12 weeks depending on the size and complexity of the business. While all processes are different, it certainly takes substantial time to gather information and respond to requests, all while you continue to run a business.

Due diligence is the process of gathering and verifying relevant information about a company or person to enable the ordering party to make an informed decision. The ordering party can be the buyer or the seller ? due diligence has value for both parties in any M&A scenario.

A due diligence report is key to finalizing an investment, merger, acquisition, or legal agreement. The due diligence report offers a comprehensive exploration and explanation of a property, a company's financial records, or a company's overall standing in the marketplace.