Pennsylvania Ratification of Oil, Gas and Mineral Lease by Mineral Owner, Paid-Up Lease

Description

How to fill out Ratification Of Oil, Gas And Mineral Lease By Mineral Owner, Paid-Up Lease?

Have you been inside a placement where you need papers for both organization or individual purposes virtually every day time? There are plenty of lawful document layouts available on the net, but discovering versions you can rely on is not easy. US Legal Forms delivers a huge number of form layouts, much like the Pennsylvania Ratification of Oil, Gas and Mineral Lease by Mineral Owner, Paid-Up Lease, that happen to be composed to meet federal and state specifications.

When you are currently knowledgeable about US Legal Forms internet site and possess a free account, merely log in. Following that, you can acquire the Pennsylvania Ratification of Oil, Gas and Mineral Lease by Mineral Owner, Paid-Up Lease format.

Should you not come with an profile and would like to start using US Legal Forms, follow these steps:

- Get the form you will need and make sure it is for that proper metropolis/region.

- Use the Preview button to review the form.

- See the outline to ensure that you have selected the appropriate form.

- If the form is not what you are searching for, use the Look for area to get the form that fits your needs and specifications.

- When you discover the proper form, click on Purchase now.

- Opt for the prices prepare you want, submit the specified info to generate your money, and pay money for the transaction with your PayPal or charge card.

- Decide on a practical file format and acquire your backup.

Locate all of the document layouts you possess bought in the My Forms menus. You can obtain a more backup of Pennsylvania Ratification of Oil, Gas and Mineral Lease by Mineral Owner, Paid-Up Lease whenever, if possible. Just select the required form to acquire or printing the document format.

Use US Legal Forms, by far the most extensive variety of lawful forms, to save lots of time as well as steer clear of faults. The services delivers expertly produced lawful document layouts that you can use for a selection of purposes. Create a free account on US Legal Forms and commence generating your lifestyle easier.

Form popularity

FAQ

Mineral rights can be sold in any Pennsylvania county for anything from $500/acre to $5,000+/acre. Isn't that a pretty wide range? The reason for such a range is because the ranges depend on where you are located in Pennsylvania. The cost of your property is heavily influenced by where you are located.

On July 11, 2006, the Pennsylvania General Assembly enacted the Dormant Oil and Gas Act. The purpose of the Act is to permit the development of underground oil and gas reserves when all owners of oil or gas interests cannot be located or identified.

What is the granting clause? The granting clause is the clause under which the owner of the oil and gas rights leases the oil and gas rights to the oil and gas company along with the right to develop the oil and gas on a specifically described piece of real estate.

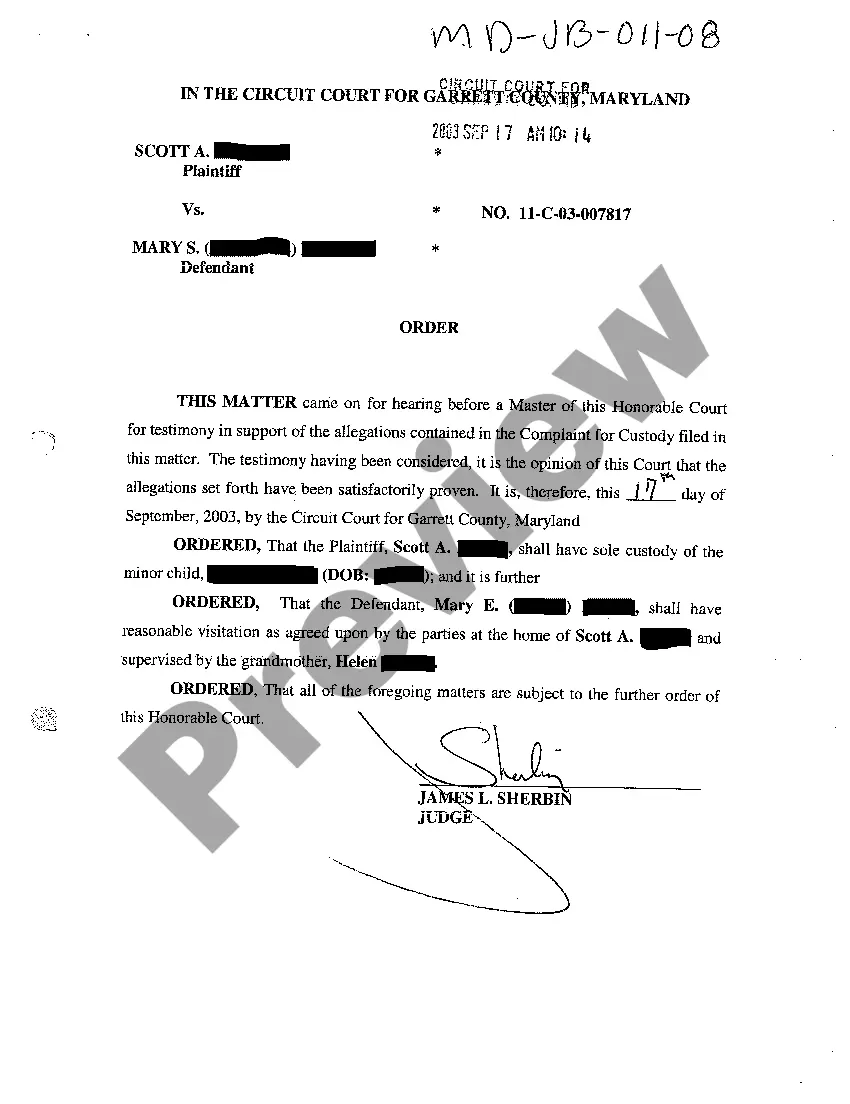

To ?ratify? a lease means that the landowner and oil & gas producer, as current lessor and lessee of the land, agree (or re-agree) to the terms of the existing lease.

72 P.S. § 7303(a)(3). If a mineral rights estate owner sells the mineral rights, the consideration less the owner's basis in the mineral rights and other costs associated with the sale is taxable. The gain is reported on Schedule D of the PA-40.

Pennsylvania allows property owners to separate the surface rights and the subsurface rights, which are oil, gas or mineral rights. When nothing is done, the property owner owns everything, surface and subsurface rights. The property owner may choose to sell or lease these subsurface rights.

Oil, gas, and mineral lease (?OGML?) disputes arise between the mineral rights owner (?lessor?) and the companies that leased those rights (?lessee?). A typical OGML will be ?Paid-Up,? meaning an amount of money is paid when the OGML is executed; that money is the only guaranteed payment.

In the United States, mineral rights can be sold or conveyed separately from property rights. As a result, owning a piece of land does not necessarily mean you also own the rights to the minerals beneath it. If you didn't know this, you're not alone. Many property owners do not understand mineral rights.