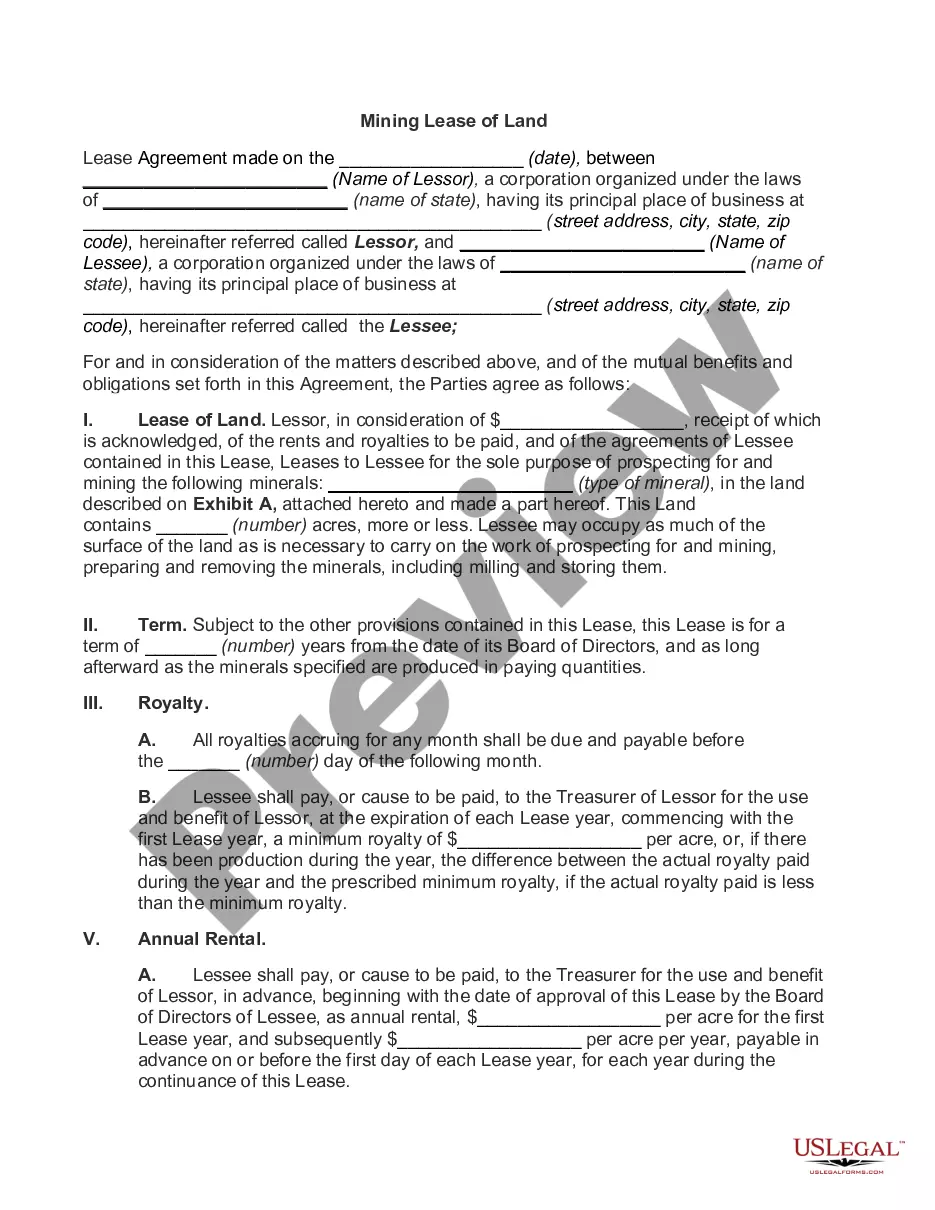

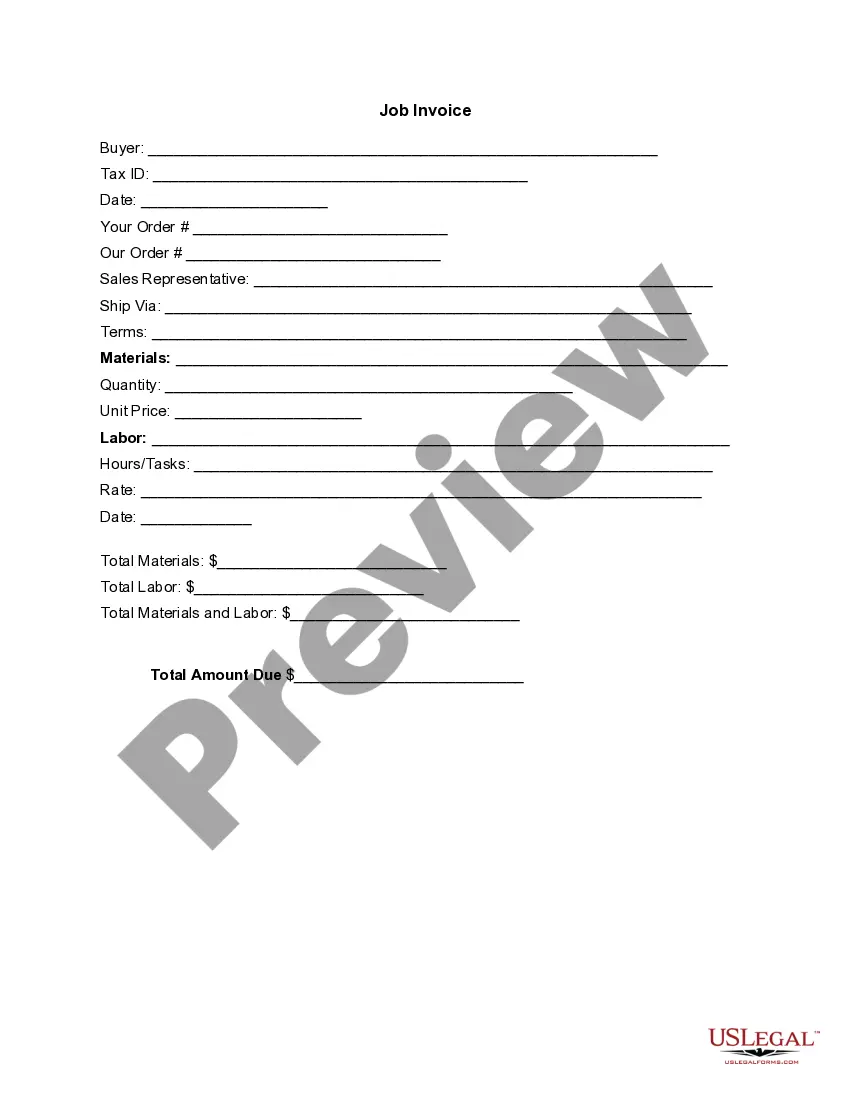

This oil, gas, and minerals document is a report form documenting information of sellers and purchasers that enter into a legally binding obligation to sell and purchase real property at the expiration of or during a lease term. In a lease purchase agreement, a party agrees to purchase a particular piece of real property within a certain timeframe, usually at a price determined beforehand.

Pennsylvania Lease Purchase Report

Description

How to fill out Lease Purchase Report?

You may spend several hours on-line looking for the legitimate file web template that fits the state and federal demands you need. US Legal Forms offers 1000s of legitimate forms which can be analyzed by specialists. It is simple to down load or print out the Pennsylvania Lease Purchase Report from the support.

If you already possess a US Legal Forms accounts, you may log in and click the Obtain switch. After that, you may full, modify, print out, or indicator the Pennsylvania Lease Purchase Report. Each and every legitimate file web template you acquire is yours permanently. To have one more duplicate for any obtained kind, go to the My Forms tab and click the corresponding switch.

Should you use the US Legal Forms web site for the first time, follow the simple recommendations listed below:

- First, make certain you have selected the proper file web template for the region/city that you pick. Browse the kind information to ensure you have picked the appropriate kind. If offered, make use of the Preview switch to search with the file web template as well.

- If you want to discover one more variation of the kind, make use of the Search field to get the web template that fits your needs and demands.

- Upon having located the web template you want, click on Acquire now to move forward.

- Pick the costs program you want, type in your qualifications, and sign up for a merchant account on US Legal Forms.

- Total the financial transaction. You may use your credit card or PayPal accounts to pay for the legitimate kind.

- Pick the structure of the file and down load it to the system.

- Make modifications to the file if needed. You may full, modify and indicator and print out Pennsylvania Lease Purchase Report.

Obtain and print out 1000s of file web templates making use of the US Legal Forms Internet site, that provides the largest collection of legitimate forms. Use expert and state-certain web templates to deal with your company or individual demands.

Form popularity

FAQ

Pennsylvania currently caps a business's NOL carryforward deduction at 40 percent of taxable income. We are one of only two states that cap NOL deductions below the federal limit of 80 percent of taxable income. There are 19 states that align with the federal rules, while 25 states have no deduction cap at all.

Use PA-40 Schedule E to report the amount of net income (loss) from rents royalties, patents and copyrights for indi- vidual or fiduciary (estate or trust) taxpayers. Refer to the PA Personal Income Tax Guide ? Net Income (Loss) from Rents, Royalties, Copyrights and Patents sec- tion for additional information.

Depletion for Pennsylvania Pass Through Entities Pennsylvania personal income tax rules do not allow a deduction for depletion in excess of basis in the property. If the taxpayer's basis is negative, then the taxpayer must adjust the capital account. See PA Personal Income Tax Guide - Pass Through Entities.

Cost depletion may also be deducted when the landowner has clearly identifiable costs of mineral rights included in a purchase agreement. However, percentage depletion is not permitted for Pennsylvania personal income tax purposes.

In Pennsylvania, rental income is taxed as personal income. Personal income in Pennsylvania is taxed at the rate of 3.07%. However, you can offset this cost to be even less by deducting operating expenses from your rental income.

Pennsylvania does not allow carryover of losses. Loss from a pass through entity is included on this line in determining net profits for personal income tax purposes. The pass through loss should be added to business income and reported on PA-20S/PA-65 Information Return, Section I, Line 1b.

Pennsylvania makes no provision for capital gains. There are no provisions for long-term and short-term gains. Losses are recognized only in the year in which some identifiable event closes and completes the transaction and fixes the amount of loss so there is no possibility of any recovery.

The allowable statutory percentage depletion deduction is the lesser of net income or 15% of gross income. If net income is less than 15% of gross income, the deduction is limited to 100% of net income.