This lease rider form may be used when you are involved in a lease transaction, and have made the decision to utilize the form of Oil and Gas Lease presented to you by the Lessee, and you want to include additional provisions to that Lease form to address specific concerns you may have, or place limitations on the rights granted the Lessee in the “standard” lease form.

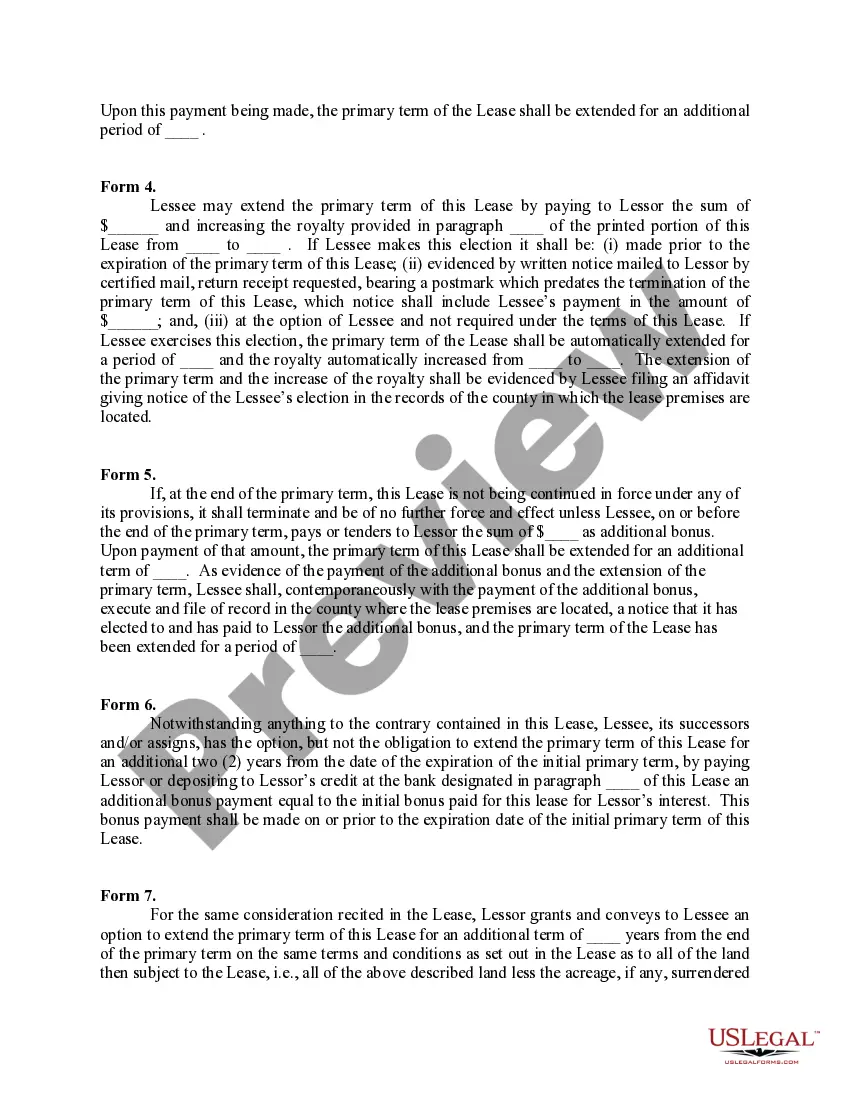

Pennsylvania Extension of Primary Term of the Lease

Description

How to fill out Extension Of Primary Term Of The Lease?

You can invest hrs on-line trying to find the legal record format which fits the state and federal demands you require. US Legal Forms supplies 1000s of legal types which can be reviewed by pros. You can easily acquire or print out the Pennsylvania Extension of Primary Term of the Lease from the assistance.

If you already have a US Legal Forms accounts, you are able to log in and then click the Download switch. After that, you are able to comprehensive, revise, print out, or signal the Pennsylvania Extension of Primary Term of the Lease. Every legal record format you purchase is yours forever. To acquire an additional version of the purchased form, visit the My Forms tab and then click the related switch.

Should you use the US Legal Forms site initially, keep to the easy guidelines under:

- Initial, be sure that you have chosen the right record format for the state/city of your choice. Look at the form explanation to ensure you have picked out the proper form. If offered, use the Review switch to look throughout the record format at the same time.

- If you want to find an additional edition from the form, use the Lookup area to discover the format that suits you and demands.

- Once you have identified the format you desire, just click Purchase now to proceed.

- Select the rates program you desire, key in your credentials, and sign up for an account on US Legal Forms.

- Complete the purchase. You can utilize your bank card or PayPal accounts to cover the legal form.

- Select the format from the record and acquire it to the product.

- Make changes to the record if possible. You can comprehensive, revise and signal and print out Pennsylvania Extension of Primary Term of the Lease.

Download and print out 1000s of record layouts utilizing the US Legal Forms website, which offers the largest assortment of legal types. Use specialist and state-specific layouts to deal with your company or individual demands.

Form popularity

FAQ

The Pugh Clause ? A clause in the Oil and Gas Lease which modifies usual pooling language to provide that drilling operations on or production from a pooled unit will not preserve the whole lease.

Pennsylvania realty transfer tax is imposed at a rate of 1 percent on the value of real estate (including contracted-for improvements to property) transferred by deed, instrument, long-term lease or other writing. Both grantor and grantee are held jointly and severally liable for payment of the tax.

Most real estate transfers between family members are exempt from this tax, such as transfers between: Spouses. Direct ascendants and descendants (grandparents to grandchildren, parents to children, etc.) Siblings (including legally adopted and half siblings)

Real Estate Transfer Tax There is a Transfer Tax of 2% (1% to the state and 1% to the municipality and school district) for all property sales in Pennsylvania on the value of the property or interest being conveyed. This value is not necessarily the sales price. The 2% Transfer Tax is paid at the time of recording.

In such a transaction, a seller immediately conveys 89 percent of its interests in a real estate company, with the remaining 11 percent subject to an option that can be exercised by the buyer one day after the three-year period ends. The option price is set so that it is very unlikely that it will not be exercised.

Under Pennsylvania law, a real estate lease is subject to a transfer tax if the lease is for a term of thirty or more years. It is reasoned that long-term leases are analogous to transferring title to real estate and therefore, a transfer tax should apply.

A landlord must provide at least 30 days' written notice to the tenant with the good cause reasons to terminate or not renew the lease. The notice must be sent by hand delivery or first-class mail with proof of mailing.