This office lease states the conditions of the annual rental rate currently specified to be paid by the tenant (the "Base Rent"). This shall be used as a basis to calculate additional rent as of the times and in the manner set forth in this form to be paid by the tenant.

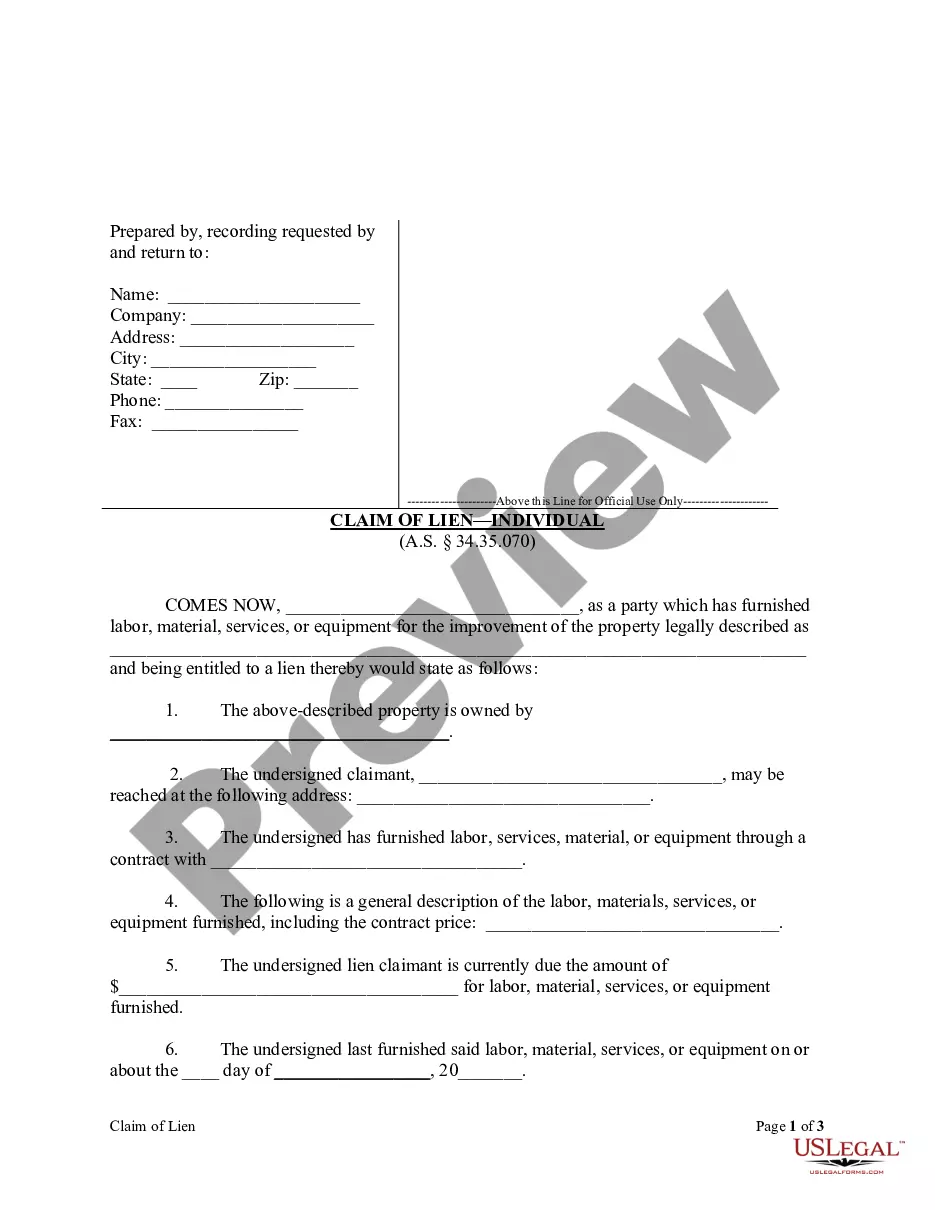

Pennsylvania Consumer Price Index

Description

How to fill out Consumer Price Index?

Are you presently within a position where you need to have files for either enterprise or specific functions just about every time? There are tons of legitimate document layouts available on the net, but finding versions you can rely on is not easy. US Legal Forms gives 1000s of type layouts, like the Pennsylvania Consumer Price Index, that happen to be created in order to meet state and federal requirements.

If you are currently acquainted with US Legal Forms internet site and get a free account, simply log in. Following that, you are able to acquire the Pennsylvania Consumer Price Index format.

Unless you offer an account and would like to begin to use US Legal Forms, abide by these steps:

- Obtain the type you will need and make sure it is for the appropriate area/county.

- Use the Preview button to examine the shape.

- Browse the information to ensure that you have selected the proper type.

- If the type is not what you are looking for, take advantage of the Look for field to discover the type that fits your needs and requirements.

- If you discover the appropriate type, click Acquire now.

- Select the prices strategy you want, complete the required details to create your account, and buy the order with your PayPal or credit card.

- Pick a practical data file structure and acquire your backup.

Get all of the document layouts you possess purchased in the My Forms menu. You can obtain a further backup of Pennsylvania Consumer Price Index at any time, if required. Just go through the essential type to acquire or produce the document format.

Use US Legal Forms, probably the most considerable collection of legitimate varieties, in order to save some time and prevent faults. The support gives expertly manufactured legitimate document layouts that can be used for a range of functions. Generate a free account on US Legal Forms and begin generating your daily life a little easier.

Form popularity

FAQ

The Consumer Price Index for All Urban Consumers (CPI-U) increased 3.7 percent over the last 12 months to an index level of 307.789 (1982-84=100). For the month, the index increased 0.2 percent prior to seasonal adjustment.

US Consumer Price Index is at a current level of 307.48, up from 306.27 last month and up from 296.54 one year ago. This is a change of 0.40% from last month and 3.69% from one year ago.

November 2023 Prices (BLS/Haver, AAA)Most RecentPrior MonthCPI-U Inflation3.0%4.0%"Core" CPI Inflation4.1%4.3%National Gas/gal. Updated 11/10/23 AM$3.39$3.683 more rows

The Consumer Prices Index (CPI) rose by 4.6% in the 12 months to October 2023, down from 6.7% in September.

The all items index rose 3.2 percent for the 12 months ending October, a smaller increase than the 3.7-percent increase for the 12 months ending September. The all items less food and energy index rose 4.0 percent over the last 12 months, its smallest 12-month change since the period ending in September 2021.

Consumer Price Index, Los Angeles area ? September 2023 MonthAll itemsAll items less food and energyDec 20224.94.5Jan 20235.84.5Feb 20235.14.5Mar 20233.74.333 more rows

The all items index rose 3.2 percent for the 12 months ending October, a smaller increase than the 3.7-percent increase for the 12 months ending September. The all items less food and energy index rose 4.0 percent over the last 12 months, its smallest 12-month change since the period ending in September 2021.

US Consumer Price Index YoY (I:USCPIYY) US Consumer Price Index YoY is at 3.24%, compared to 3.70% last month and 7.75% last year.