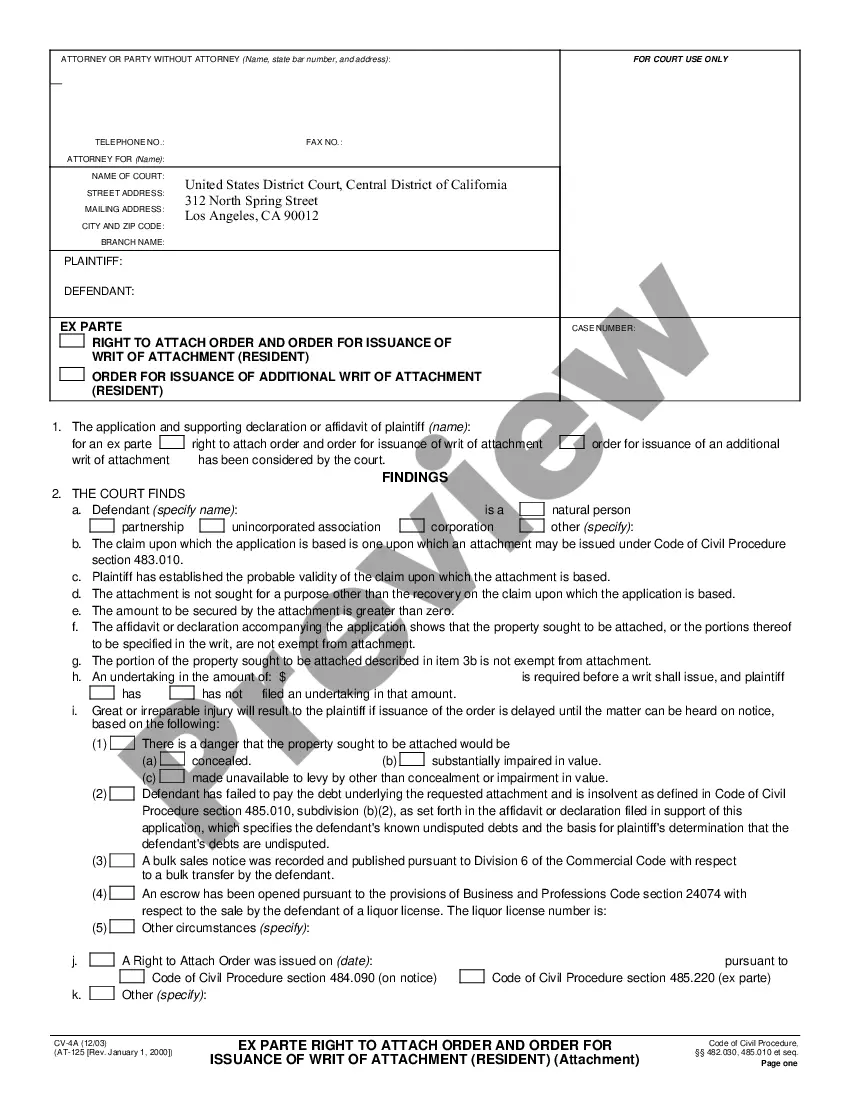

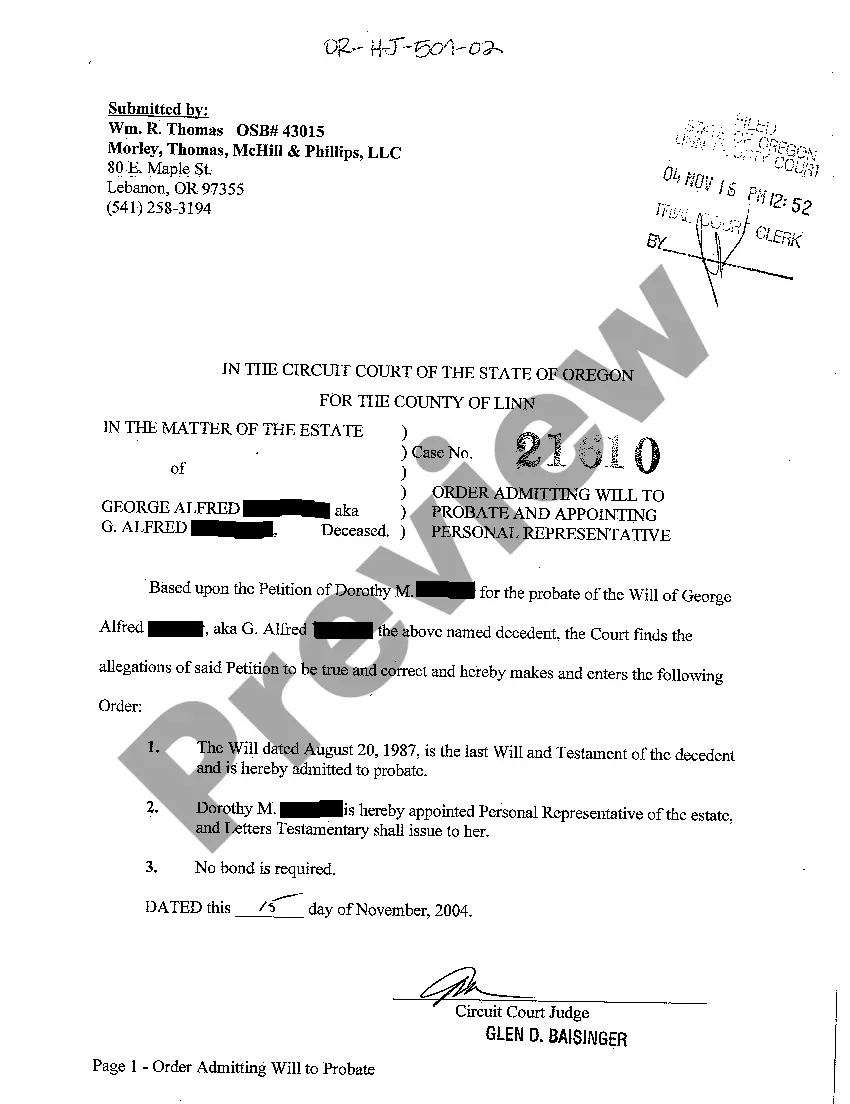

This office lease clause lists a way to provide for variances between the rentable area of a "to be built" demised premises and the actual area after construction.

The Pennsylvania Remeasurement Clause is a legal provision used in commercial real estate leases to address discrepancies between the rentable and actual area of a space being constructed. This clause serves as a safeguard to ensure the fair determination of rent and other lease calculations by allowing for adjustments when variances in area exist. In commercial real estate construction, it is common for discrepancies to arise between the intended rentable area outlined in lease agreements and the actual usable or leasable area that is delivered. These variances can occur due to various factors such as changes in design plans, construction errors, or alterations made during the building process. To handle such situations, the Pennsylvania Remeasurement Clause provides a mechanism for tenants and landlords to resolve these discrepancies fairly. This clause typically specifies the circumstances under which remeasurement can occur and outlines the process to determine the adjusted rent or other lease provisions affected by the variance. Different types of Pennsylvania Remeasurement Clauses may exist, depending on the specific terms and conditions set forth in the lease agreement. These variations can pertain to factors such as remeasurement triggers, remeasurement frequency, methodology for determining discrepancies, and adjustments made to the rental rates. Remeasurement triggers can be contingent upon specific events or milestones, such as substantial completion of construction, issuance of a certificate of occupancy, or any other mutually agreed-upon point in time. By establishing these triggers, the clause ensures that remeasurement occurs at the appropriate stage of the construction process. The frequency of remeasurement can also vary depending on the lease agreement. Some clauses may specify a one-time remeasurement at the conclusion of the construction, while others may allow for periodic remeasurements at predetermined intervals throughout the lease term. The frequency of remeasurement is usually determined based on the complexity of the project and its potential for significant variations. Methodology for determining discrepancies is another critical aspect of the Pennsylvania Remeasurement Clause. This may involve engaging an independent third party, such as a surveyor or an architect, to measure and calculate the variances between the actual and rentable areas. The clause can outline specific guidelines for the remeasurement process to ensure fairness and objectivity. Once the discrepancies in area are determined, adjustments are made to reflect the revised rentable area and corresponding lease calculations. This may involve modifying the rental rates, common area maintenance charges, real estate taxes, or any other financial provisions based on the remeasured floor area. In conclusion, the Pennsylvania Remeasurement Clause is a vital component of commercial real estate leases. It safeguards the interests of both tenants and landlords by establishing a fair mechanism to address discrepancies between the rentable and actual area of a space being constructed. By incorporating this clause into lease agreements, parties can ensure transparency, avoid potential disputes, and maintain a mutually beneficial relationship throughout the lease term.

The Pennsylvania Remeasurement Clause is a legal provision used in commercial real estate leases to address discrepancies between the rentable and actual area of a space being constructed. This clause serves as a safeguard to ensure the fair determination of rent and other lease calculations by allowing for adjustments when variances in area exist. In commercial real estate construction, it is common for discrepancies to arise between the intended rentable area outlined in lease agreements and the actual usable or leasable area that is delivered. These variances can occur due to various factors such as changes in design plans, construction errors, or alterations made during the building process. To handle such situations, the Pennsylvania Remeasurement Clause provides a mechanism for tenants and landlords to resolve these discrepancies fairly. This clause typically specifies the circumstances under which remeasurement can occur and outlines the process to determine the adjusted rent or other lease provisions affected by the variance. Different types of Pennsylvania Remeasurement Clauses may exist, depending on the specific terms and conditions set forth in the lease agreement. These variations can pertain to factors such as remeasurement triggers, remeasurement frequency, methodology for determining discrepancies, and adjustments made to the rental rates. Remeasurement triggers can be contingent upon specific events or milestones, such as substantial completion of construction, issuance of a certificate of occupancy, or any other mutually agreed-upon point in time. By establishing these triggers, the clause ensures that remeasurement occurs at the appropriate stage of the construction process. The frequency of remeasurement can also vary depending on the lease agreement. Some clauses may specify a one-time remeasurement at the conclusion of the construction, while others may allow for periodic remeasurements at predetermined intervals throughout the lease term. The frequency of remeasurement is usually determined based on the complexity of the project and its potential for significant variations. Methodology for determining discrepancies is another critical aspect of the Pennsylvania Remeasurement Clause. This may involve engaging an independent third party, such as a surveyor or an architect, to measure and calculate the variances between the actual and rentable areas. The clause can outline specific guidelines for the remeasurement process to ensure fairness and objectivity. Once the discrepancies in area are determined, adjustments are made to reflect the revised rentable area and corresponding lease calculations. This may involve modifying the rental rates, common area maintenance charges, real estate taxes, or any other financial provisions based on the remeasured floor area. In conclusion, the Pennsylvania Remeasurement Clause is a vital component of commercial real estate leases. It safeguards the interests of both tenants and landlords by establishing a fair mechanism to address discrepancies between the rentable and actual area of a space being constructed. By incorporating this clause into lease agreements, parties can ensure transparency, avoid potential disputes, and maintain a mutually beneficial relationship throughout the lease term.