Pennsylvania Clauses Relating to Dividends, Distributions: A Detailed Description In the state of Pennsylvania, there are specific clauses that govern the distribution of dividends by corporations. These clauses help regulate the manner in which profits are shared among the shareholders, ensuring fairness and transparency in financial transactions. In this article, we will delve into the details of Pennsylvania clauses relating to dividends and distributions, discussing their types and significance. 1. Mandatory Dividend Clauses: Under this clause, corporations are legally obligated to distribute a specific percentage or amount of their profits as dividends to shareholders. The exact terms of the clause may vary from company to company, but the overarching principle is to ensure that shareholders receive a fair share of the earnings. Mandatory dividend clauses serve as a safeguard against potential withholding of profits for the benefit of a select few stakeholders. 2. Discretionary Dividend Clauses: Alternatively, corporations may choose to have discretionary dividend clauses in their bylaws. These clauses grant the board of directors or another designated authority the discretion to decide whether and how much of the profits will be distributed as dividends. This type of clause provides flexibility to address varying financial situations, allowing for the retention of earnings in years when the company requires additional capital for growth or unforeseen circumstances. 3. Preferred Dividend Clauses: In certain cases, corporations may issue preferred stock with preferred dividend clauses. Preferred shareholders have priority over common shareholders when it comes to receiving dividends. These clauses ensure that preferred shareholders receive a fixed percentage of the profits before common shareholders are paid. Preferred dividend clauses are commonly used to attract investors by providing them with greater assurance of regular income. 4. Cumulative Dividend Clauses: Cumulative dividend clauses entail that if a corporation fails to distribute dividends in a particular year, the unpaid dividends accumulate and must be paid in the future before any dividends can be declared for subsequent years. This protects shareholders from potential losses due to irregular dividend payments. If a company faces a temporary financial setback, cumulative dividend clauses ensure that the accumulated unpaid dividends are eventually paid out to the shareholders. 5. Restriction Clauses: Restriction clauses are designed to restrict the distribution of dividends when a company's financial position falls below a certain threshold, or when specific financial obligations or restrictions are in place. These clauses aim to protect the financial stability of the corporation and ensure that dividends are only distributed when it is financially prudent to do so. Pennsylvania's clauses relating to dividends and distributions play a crucial role in safeguarding the rights and interests of shareholders while maintaining the financial stability of corporations. Understanding these clauses is essential for both shareholders and corporations to navigate the complex landscape of dividend distribution, ensuring a fair and transparent process for all parties involved.

Pennsylvania Clauses Relating to Dividends, Distributions

Description

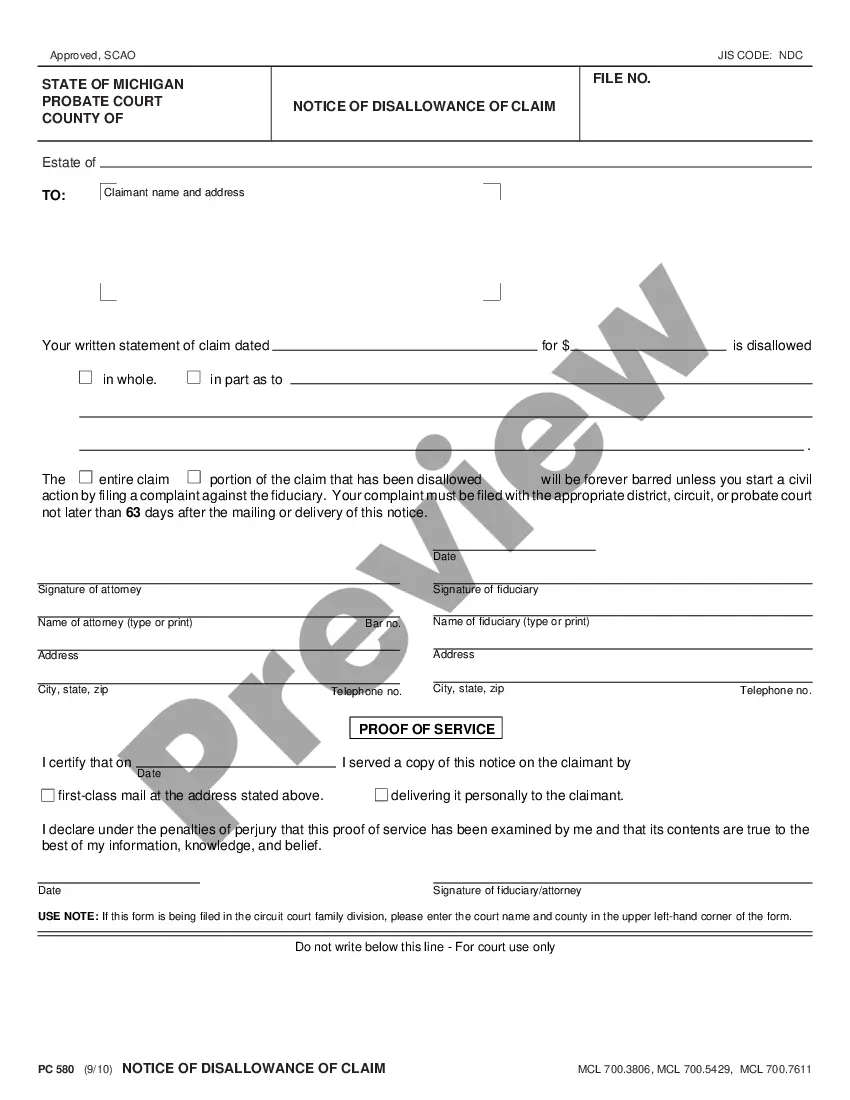

How to fill out Pennsylvania Clauses Relating To Dividends, Distributions?

US Legal Forms - one of several greatest libraries of legitimate varieties in the States - gives a wide array of legitimate file themes you are able to obtain or produce. Utilizing the site, you will get a huge number of varieties for business and individual uses, categorized by groups, claims, or key phrases.You can find the most recent variations of varieties just like the Pennsylvania Clauses Relating to Dividends, Distributions within minutes.

If you already possess a registration, log in and obtain Pennsylvania Clauses Relating to Dividends, Distributions from your US Legal Forms library. The Download key can look on every single develop you view. You have accessibility to all earlier saved varieties in the My Forms tab of your respective accounts.

In order to use US Legal Forms initially, listed here are straightforward directions to get you started out:

- Make sure you have picked the best develop to your area/region. Click on the Review key to examine the form`s information. See the develop outline to actually have chosen the proper develop.

- In case the develop does not suit your needs, utilize the Look for field on top of the monitor to obtain the the one that does.

- If you are pleased with the shape, confirm your decision by visiting the Acquire now key. Then, opt for the prices plan you want and provide your references to sign up for the accounts.

- Procedure the transaction. Make use of your bank card or PayPal accounts to finish the transaction.

- Select the formatting and obtain the shape on your gadget.

- Make alterations. Fill up, change and produce and signal the saved Pennsylvania Clauses Relating to Dividends, Distributions.

Every format you put into your money lacks an expiration day and is yours for a long time. So, if you would like obtain or produce an additional backup, just go to the My Forms segment and then click around the develop you need.

Get access to the Pennsylvania Clauses Relating to Dividends, Distributions with US Legal Forms, by far the most substantial library of legitimate file themes. Use a huge number of skilled and state-particular themes that fulfill your small business or individual requirements and needs.