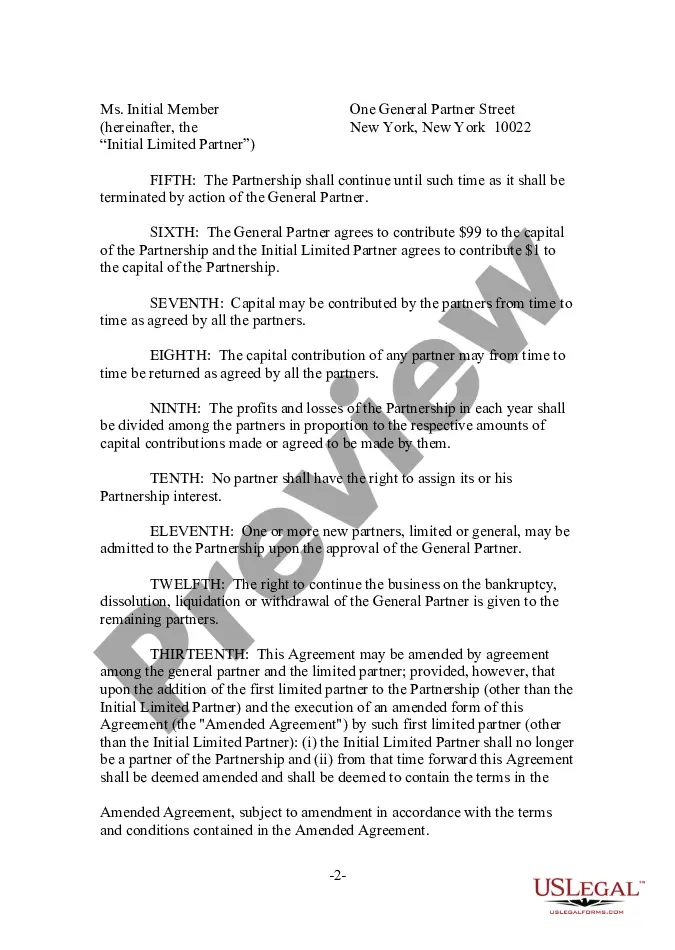

The Pennsylvania Partnership Agreement — Short Form serves as a legal contract that outlines the terms and conditions of a partnership business in the state of Pennsylvania. This agreement is used when two or more individuals decide to join forces and establish a business together. It provides a clear understanding of the rights, responsibilities, and obligations of each partner involved. The Pennsylvania Partnership Agreement — Short Form covers various essential aspects related to the partnership, including ownership distribution, profit and loss sharing, decision-making processes, and dispute resolution mechanisms. It outlines the contributions of each partner, whether they are financial, intellectual, or in the form of skills and resources. This agreement also addresses the management structure of the partnership, delineating the roles and responsibilities of each partner. It may specify if any partner will act as a general partner or a limited partner, as each role carries different levels of liability and decision-making authority. The agreement also highlights the rules for partner meetings, voting procedures, and the process for admitting new partners. While the Pennsylvania Partnership Agreement — Short Form provides a general framework for partnerships, there are different types that can be customized to suit specific business needs. These variations may include: 1. General Partnership Agreement: This is the most common form of partnership agreement where all partners equally share management duties, profits, and losses. Each partner has unlimited personal liability for the partnership's debts. 2. Limited Partnership Agreement: In this type of agreement, there are general partners who manage the business and have personal liability, and limited partners who contribute capital but have limited involvement in management and liability. Limited partners' liability is restricted to the amount they invested in the partnership. 3. Limited Liability Partnership (LLP) Agreement: This agreement is suitable for professionals, such as lawyers or accountants, who want to form a partnership while limiting personal liability. Laps protect individual partners from being held responsible for partnership debts and the actions of other partners. It is important for partners to seek legal advice when drafting a Pennsylvania Partnership Agreement — Short Form. Customization of the agreement based on the specific needs of the partners and the type of partnership is crucial to ensure a fair and mutually beneficial business arrangement.

Pennsylvania Partnership Agreement - Short Form

Description

How to fill out Pennsylvania Partnership Agreement - Short Form?

If you have to full, acquire, or printing authorized papers templates, use US Legal Forms, the biggest selection of authorized types, which can be found on-line. Make use of the site`s basic and practical look for to find the files you will need. Numerous templates for organization and specific uses are categorized by categories and states, or search phrases. Use US Legal Forms to find the Pennsylvania Partnership Agreement - Short Form within a number of mouse clicks.

If you are presently a US Legal Forms customer, log in to your account and click the Obtain button to find the Pennsylvania Partnership Agreement - Short Form. You can also gain access to types you formerly downloaded inside the My Forms tab of your respective account.

If you use US Legal Forms for the first time, follow the instructions below:

- Step 1. Be sure you have selected the form for the proper area/country.

- Step 2. Use the Review option to examine the form`s information. Don`t neglect to learn the explanation.

- Step 3. If you are unsatisfied with the develop, make use of the Research industry towards the top of the screen to locate other models of the authorized develop format.

- Step 4. Upon having found the form you will need, go through the Get now button. Select the rates plan you prefer and add your qualifications to register for an account.

- Step 5. Approach the deal. You can utilize your Мisa or Ьastercard or PayPal account to finish the deal.

- Step 6. Select the file format of the authorized develop and acquire it in your system.

- Step 7. Complete, modify and printing or indicator the Pennsylvania Partnership Agreement - Short Form.

Every authorized papers format you buy is the one you have permanently. You may have acces to each and every develop you downloaded with your acccount. Click the My Forms portion and choose a develop to printing or acquire again.

Remain competitive and acquire, and printing the Pennsylvania Partnership Agreement - Short Form with US Legal Forms. There are many professional and state-particular types you may use for the organization or specific needs.