This stock option plan provides employees with a way to gain ownership in the company for which they work. The plan addresses SARs, stock awards, dividends and divided equivalents, deferrals and settlements, and all other subject matter generally included in stock option plans.

The Pennsylvania Employee Stock Option Plan (ESOP) is a compensation program offered by employers to reward employees with ownership stakes in the company through stock options. This plan is specific to Pennsylvania and complies with the relevant state laws and regulations. Sops provide employees the opportunity to purchase company stock at a predetermined price, known as the exercise price, usually lower than the market value. By offering stock options, employers aim to align the interests of the employees with the company's success, motivating them to contribute to its growth and profitability. Pennsylvania Sops typically come in different types, each with its own set of features and benefits. Some common types include: 1. Incentive Stock Options (SOS): These options are usually reserved for key employees and offer potential tax advantages. SOS must meet certain requirements, such as a minimum time period before selling the stock, to qualify for special tax treatment. 2. Non-Qualified Stock Options (Nests): These stock options are more flexible in terms of who can receive them and are not subject to the same tax advantages as SOS. Nests can be granted to employees at all levels, including executives, and may be subject to different tax implications upon exercise. 3. Restricted Stock Units (RSS): Unlike traditional stock options, RSS do not grant employees the right to purchase stock at a predetermined price. Instead, RSS represent the promise of future shares of company stock upon meeting certain conditions, such as a specified vesting period or meeting performance targets. 4. Employee Stock Purchase Plans (ESPN): Although not classified as traditional stock options, ESPN is another form of employee ownership plan commonly offered in Pennsylvania. ESPN allow employees to purchase company stock at a discounted price through regular payroll deductions. Pennsylvania Sops are governed by a combination of state laws, federal regulations, and specific plan provisions drafted by the employer. Employers, along with legal and financial advisors, need to carefully design and administer these plans to ensure compliance with all applicable laws while maximizing the benefits and incentives for participating employees. By implementing a Pennsylvania ESOP, employers demonstrate their commitment to fostering a sense of ownership among their workforce, encouraging long-term loyalty and dedication. Additionally, employees participating in these plans have the opportunity to share in the company's success, potentially accumulating wealth over time.Pennsylvania Employee Stock Option Plan

Description

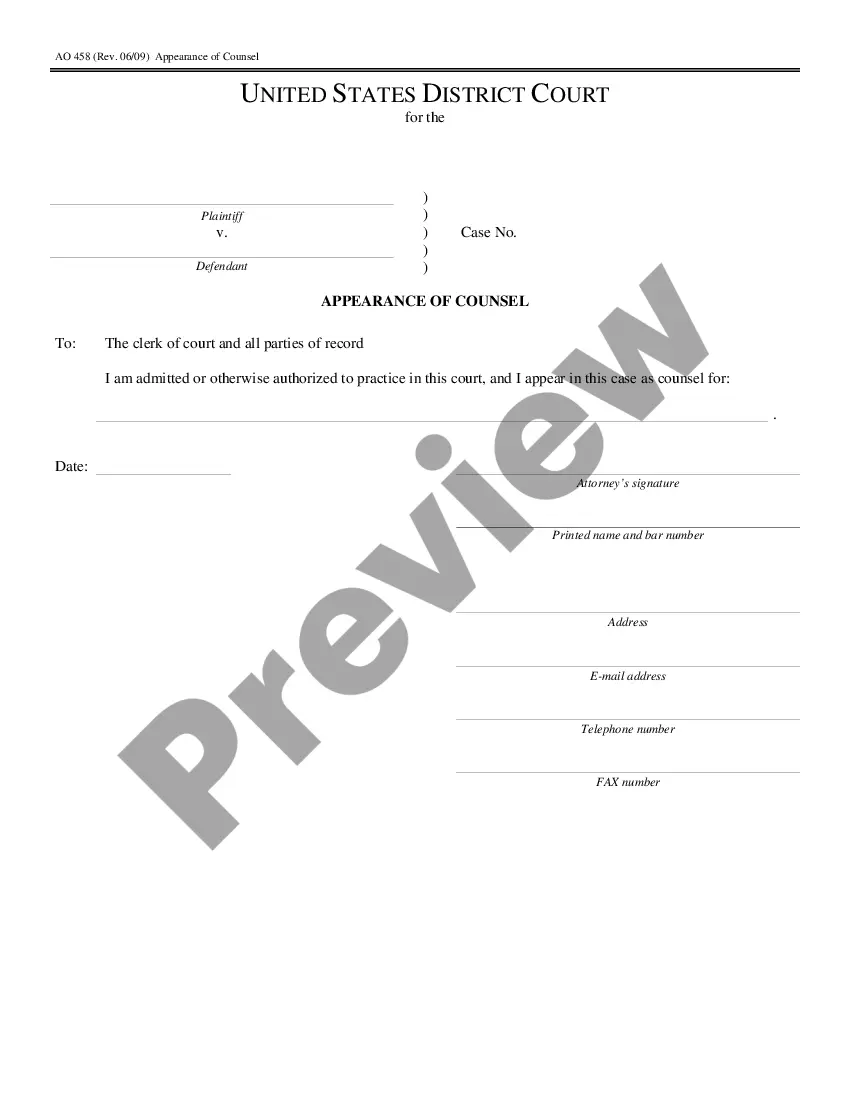

How to fill out Pennsylvania Employee Stock Option Plan?

US Legal Forms - one of the greatest libraries of legal forms in the United States - offers an array of legal papers web templates you are able to down load or print out. While using site, you will get 1000s of forms for business and personal reasons, sorted by classes, states, or keywords and phrases.You can get the newest variations of forms such as the Pennsylvania Employee Stock Option Plan in seconds.

If you currently have a subscription, log in and down load Pennsylvania Employee Stock Option Plan in the US Legal Forms catalogue. The Obtain key will show up on each type you look at. You gain access to all formerly delivered electronically forms from the My Forms tab of your own bank account.

If you would like use US Legal Forms the first time, here are easy directions to help you get started out:

- Be sure to have chosen the proper type for the city/state. Select the Preview key to check the form`s content. See the type information to actually have selected the correct type.

- If the type doesn`t suit your demands, take advantage of the Look for discipline at the top of the display screen to discover the one which does.

- In case you are happy with the shape, confirm your choice by simply clicking the Buy now key. Then, opt for the prices plan you favor and provide your qualifications to register for an bank account.

- Method the transaction. Use your Visa or Mastercard or PayPal bank account to perform the transaction.

- Pick the format and down load the shape on your product.

- Make modifications. Fill out, edit and print out and signal the delivered electronically Pennsylvania Employee Stock Option Plan.

Each format you included with your account does not have an expiry day and is the one you have eternally. So, if you would like down load or print out an additional version, just check out the My Forms area and click on around the type you want.

Obtain access to the Pennsylvania Employee Stock Option Plan with US Legal Forms, one of the most substantial catalogue of legal papers web templates. Use 1000s of specialist and status-specific web templates that satisfy your company or personal requires and demands.