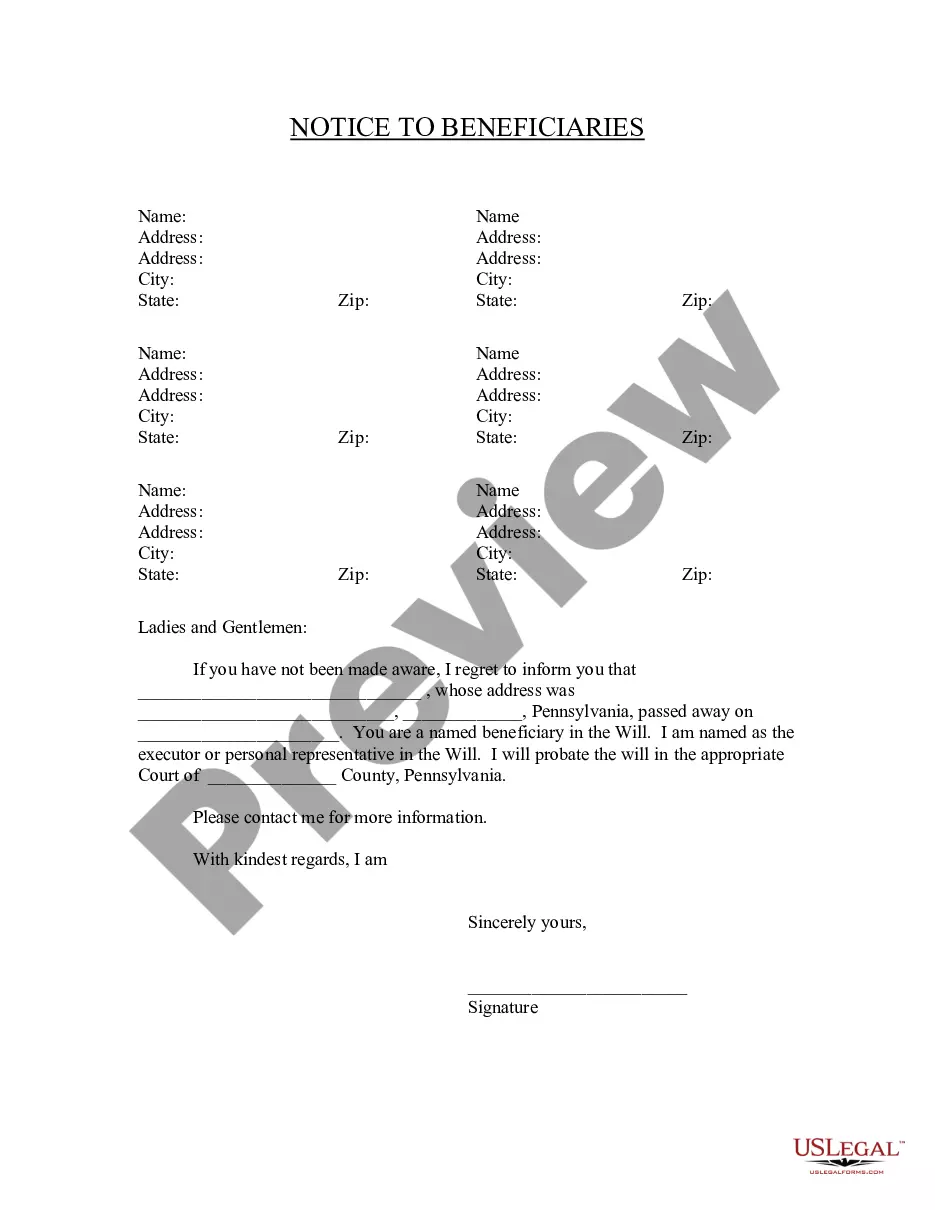

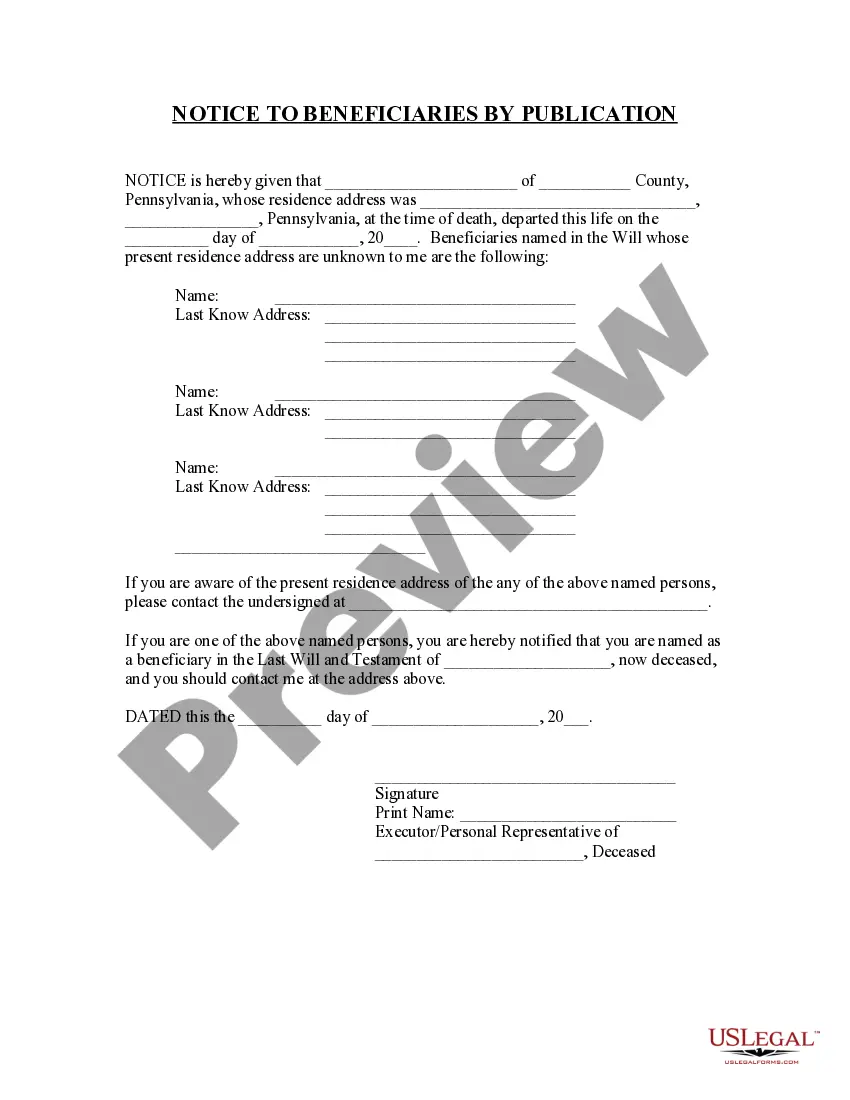

Pennsylvania Notice to Beneficiaries of being Named in Will

Description Pennsylvania Notice Form

How to fill out State Pennsylvania Beneficiaries?

The work with documents isn't the most simple task, especially for people who almost never work with legal papers. That's why we advise utilizing correct Pennsylvania Notice to Beneficiaries of being Named in Will templates made by professional attorneys. It gives you the ability to stay away from difficulties when in court or working with official organizations. Find the templates you want on our website for high-quality forms and correct information.

If you’re a user with a US Legal Forms subscription, just log in your account. When you are in, the Download button will automatically appear on the file webpage. Soon after getting the sample, it’ll be stored in the My Forms menu.

Customers with no an activated subscription can easily get an account. Make use of this brief step-by-step help guide to get the Pennsylvania Notice to Beneficiaries of being Named in Will:

- Be sure that the sample you found is eligible for use in the state it is needed in.

- Confirm the file. Make use of the Preview option or read its description (if available).

- Click Buy Now if this template is the thing you need or use the Search field to get another one.

- Choose a suitable subscription and create your account.

- Use your PayPal or credit card to pay for the service.

- Download your document in a preferred format.

Right after doing these straightforward steps, you are able to fill out the sample in your favorite editor. Check the filled in data and consider asking a legal professional to examine your Pennsylvania Notice to Beneficiaries of being Named in Will for correctness. With US Legal Forms, everything becomes easier. Give it a try now!

Notice Beneficiaries Form Pa Form popularity

Notice Will Form Pa Other Form Names

Beneficiaries Named Will FAQ

No. The person must be appointed by the probate court as the personal representative and letters issued for the appointment as personal representative to be effective. California Probate Code §8400(a).To learn about the duties of a personal representative in California probate, click here.

Can I appoint a beneficiary as my executor? Yes, your executor may also be a beneficiary to your estate. In fact, if you are leaving everything to your spouse or adult children who are capable of managing their finances, it is a natural choice to appoint your spouse or one or more of your children as your executor(s).

The Will must be filed with the Register of Wills in the county where the decedent lived. A Petition for Probate must be filed with the local probate court (the "Orphan's Court" ) as well.

Generally, probating a will costs between $200 $1,000 depending on the size of the estate. Although probate is generally easier in Pennsylvania compared to other states, an Executor still has legal obligations and a fiduciary duty to beneficiaries of the estate.

The Probate Process in Pennsylvania Inheritance Laws Essentially any estate worth more than $50,000, not including real property like land or a home and other final expenses, must go through the probate court process under Pennsylvania inheritance laws.

At its most basic level, the probate process in Pennsylvania involves two steps: paying your debts and transferring any assets to your beneficiaries. A probate proceeding begins when the court appoints someone to handle the administration of estate, i.e. a personal representative.

After someone dies, it can be a number of months before the assets are distributed to the beneficiaries. If a Grant of Probate is necessary, the Supreme Court needs to be informed of the current assets and liabilities of the deceased before probate can occur.

Step 1: Consider Hiring a Lawyer to Help You. Step 2: Gather Documentation. Step 3: Determine Assets that Can Skip Probate, if Any. Step 4: File the Will and Petition for Probate.

One particularly important deadline to be aware of is the deadline for creditors of the decedent to bring a claim against the estate. In Pennsylvania, a creditor has one year from the date of first publication of the grant of letters to bring a claim against the estate.