This form for use in litigation against an insurance company for bad faith breach of contract. Adapt this model form to fit your needs and specific law. Not recommended for use by non-attorney.

Puerto Rico Complaint For Failure Of Insurer To pay Benefits - Jury Trial Demand

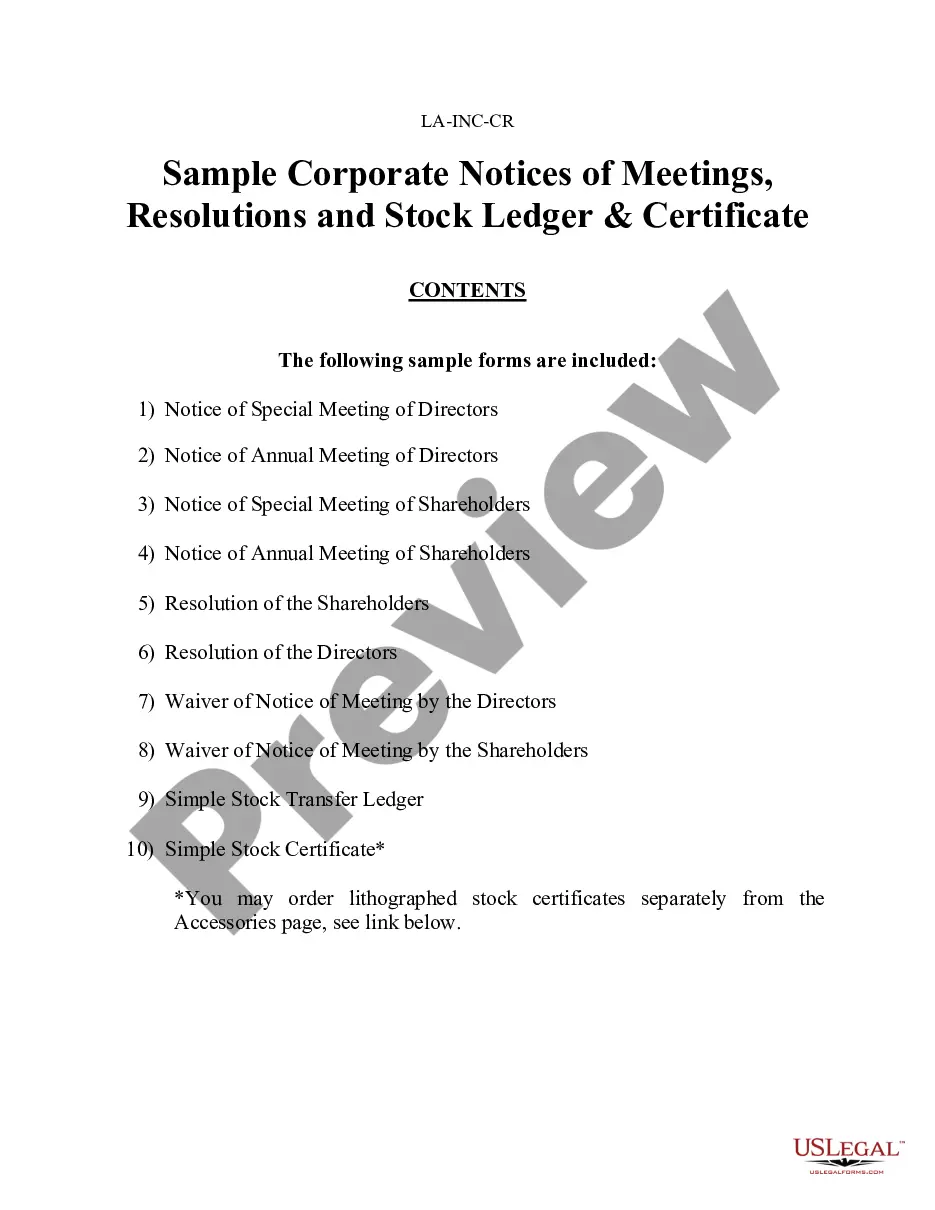

Description

How to fill out Complaint For Failure Of Insurer To Pay Benefits - Jury Trial Demand?

US Legal Forms - one of several greatest libraries of authorized kinds in the United States - gives a wide array of authorized file web templates you are able to obtain or print. Using the website, you may get thousands of kinds for business and specific reasons, categorized by groups, states, or keywords.You can get the newest types of kinds just like the Puerto Rico Complaint For Failure Of Insurer To pay Benefits - Jury Trial Demand within minutes.

If you currently have a subscription, log in and obtain Puerto Rico Complaint For Failure Of Insurer To pay Benefits - Jury Trial Demand from your US Legal Forms local library. The Down load option can look on every single kind you perspective. You get access to all previously downloaded kinds from the My Forms tab of your respective account.

In order to use US Legal Forms the first time, allow me to share easy directions to help you started off:

- Be sure to have picked the correct kind for your metropolis/region. Click on the Preview option to review the form`s content. Browse the kind outline to actually have selected the right kind.

- If the kind does not suit your requirements, make use of the Lookup discipline at the top of the screen to find the one that does.

- When you are content with the shape, verify your option by simply clicking the Buy now option. Then, pick the prices plan you prefer and offer your qualifications to register for the account.

- Process the deal. Use your charge card or PayPal account to finish the deal.

- Pick the formatting and obtain the shape on your own device.

- Make changes. Fill out, edit and print and indication the downloaded Puerto Rico Complaint For Failure Of Insurer To pay Benefits - Jury Trial Demand.

Every format you put into your money lacks an expiry time and is also yours for a long time. So, if you would like obtain or print another duplicate, just check out the My Forms area and click around the kind you want.

Gain access to the Puerto Rico Complaint For Failure Of Insurer To pay Benefits - Jury Trial Demand with US Legal Forms, probably the most substantial local library of authorized file web templates. Use thousands of specialist and status-certain web templates that satisfy your organization or specific demands and requirements.

Form popularity

FAQ

Under Rule 12(f), a part of a pleading can be removed if it is redundant, immaterial, impertinent, or scandalous. The motion can be made by a party within an allotted time frame, or can be raised by the court, called sua sponte.

The time for a response to a motion to dismiss in Florida will depend on the court. In general, the opposing party will have approximately two to three weeks to answer to a motion to dismiss.

A moving party can meet its burden of production in two ways: either produce evidence affirmatively negating an essential element of the nonmoving party's claim or defense, or demonstrate that the nonmoving party does not have sufficient evidence of an essential element to meet its burden of persuasion at trial.

The former Federal Rule of Criminal Procedure 12(b)(3) stated that a party must make the following motions before trial: a motion alleging defect in instituting the prosecution, a motion alleging defect in the indictment or information, a motion to suppress, a Rule 14 motion to sever charges or defendants, and a Rule ...

Rule 12(b)(6), permitting a motion to dismiss for failure of the complaint to state a claim on which relief can be granted, is substantially the same as the old demurrer for failure of a pleading to state a cause of action.

12(b)(6) tests the legal sufficiency of the complaint. In ruling on the motion the allegations of the complaint must be viewed as admitted, and on that basis the court must determine as a matter of law whether the allegations state a claim for which relief may be granted.

If a judge conducting a hearing or trial is unable to proceed, any other judge may proceed upon certifying familiarity with the record and determining that the case may be completed without prejudice to the parties.