This form is an assumption agreement for a Small Business Administration (SBA) loan. Party assuming the loan agrees to continue payments thereon. SBA agrees to the assumption of the loan and release of original debtor. Adapt to fit your circumstances.

Puerto Rico Assumption Agreement of SBA Loan

Description

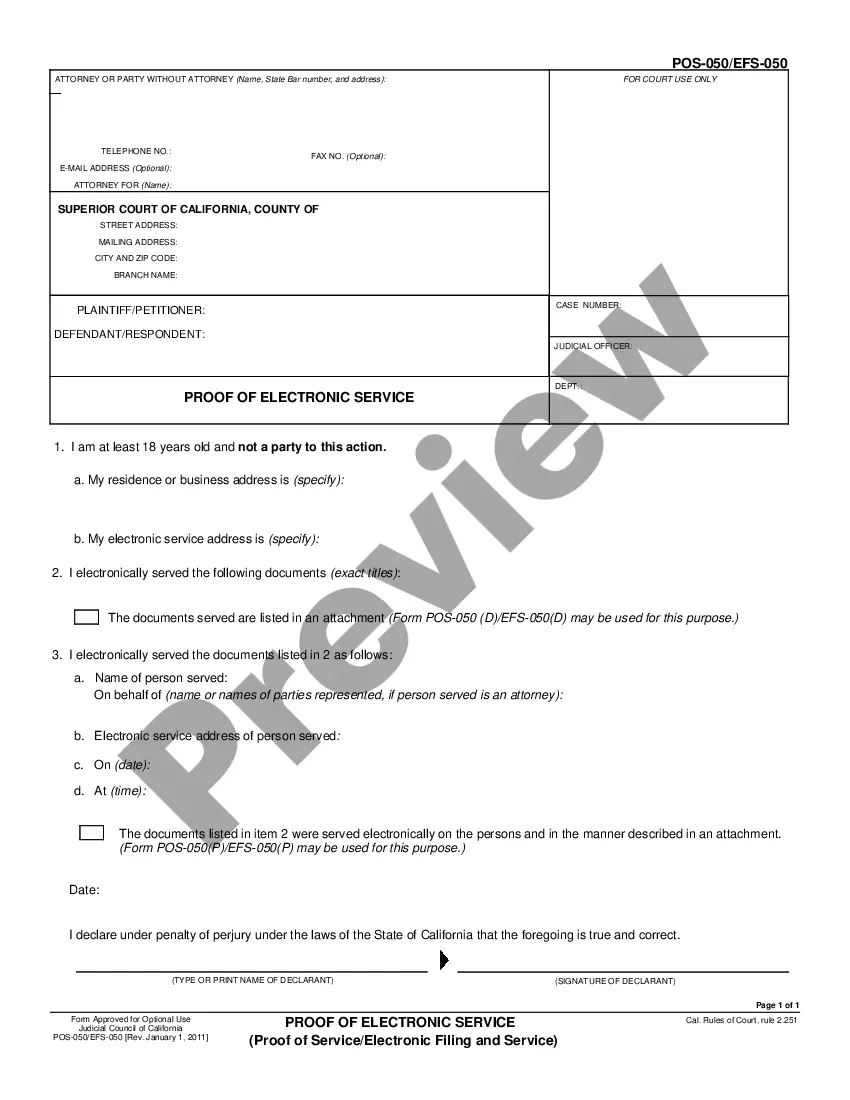

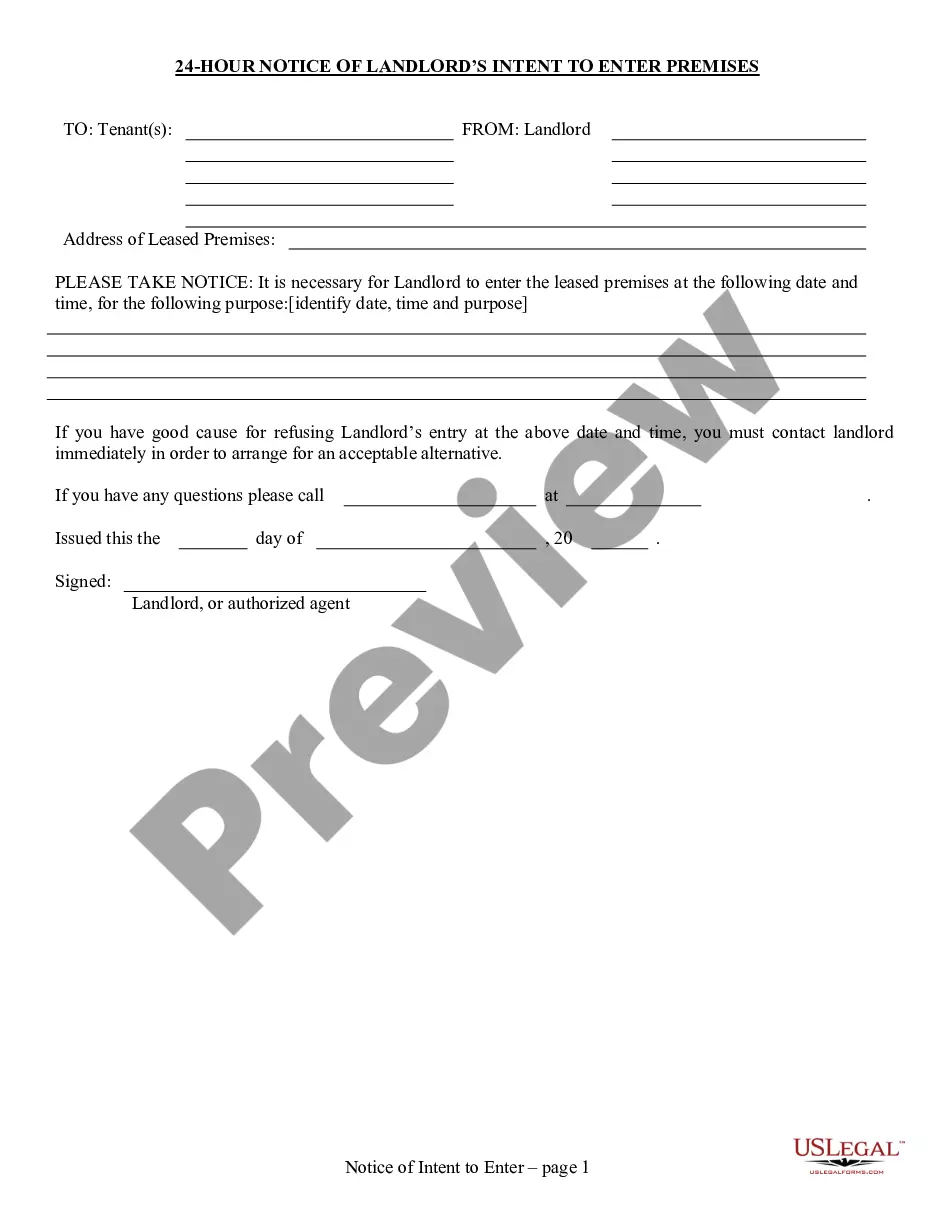

How to fill out Assumption Agreement Of SBA Loan?

You can invest multiple hours online trying to locate the legal document template that meets the state and federal requirements you need.

US Legal Forms offers numerous legal forms that can be assessed by professionals.

It is easy to obtain or print the Puerto Rico Assumption Agreement of SBA Loan through our services.

If available, utilize the Review button to examine the document format as well.

- If you already possess a US Legal Forms account, you can Log In and click the Download button.

- Then, you can complete, modify, print, or sign the Puerto Rico Assumption Agreement of SBA Loan.

- Every legal document template you obtain is yours permanently.

- To obtain an additional copy of any acquired form, navigate to the My documents section and click the relevant button.

- If it's your first time utilizing the US Legal Forms site, follow the simple instructions below.

- Initially, ensure that you have chosen the correct document format for the county/area of your preference.

- Review the document description to confirm you have selected the appropriate template.

Form popularity

FAQ

Assumption of SBA Loan. A borrower may request for another person to assume the borrower's legal obligations and benefits under the SBA loan documents. Essentially, the assignor-borrower is requesting that another person step into their shoes as it relates to the loan.

Yes, a business can be transferred to another person, by sale, reapportionment of multiowner businesses or lease-purchase.

SBA loans are fully assumable with SBA approval. Getting this approval, however, can be very complex. Any borrower attempting to assume an SBA loan will be carefully examined by the SBA and must meet a lengthy list of requirements.

The SBA will provide you with the reason your application was declined. If you can refute this, you should outline why you want your application to be reconsidered in your letter. You'll also want to include any supporting documents that can strengthen your case like tax returns or revenue reports.

Assumption of SBA Loan. A borrower may request for another person to assume the borrower's legal obligations and benefits under the SBA loan documents.

EIDL Reconsideration Can Take Several Weeks, Or Longer Thus, in total it can take about six weeks. However, many business owners have been in reconsideration for months, making it difficult to exactly pinpoint how long reconsideration can take. The important part is to apply for reconsideration as quickly as possible.

SBA loans are fully assumable with SBA approval. Getting this approval, however, can be very complex. Any borrower attempting to assume an SBA loan will be carefully examined by the SBA and must meet a lengthy list of requirements.

SBA approval is required if there is a change of ownership of a Borrower in the first 12 months of final disbursement of the loan. The assumption of a PPP loan with the release of the original borrower also requires SBA approval.

SBA loans are fully assumable with SBA approval. Getting this approval, however, can be very complex. Any borrower attempting to assume an SBA loan will be carefully examined by the SBA and must meet a lengthy list of requirements.

Can I deposit my PPP/SBA loan into my individual or joint Checking account? We currently only offer personal and joint checking accounts. As such, we are not able to accept PPP loans for your business into your personal or joint checking accounts.