Puerto Rico Corporate Resolution for PPP Loan is a legal document issued by a corporation located in Puerto Rico, outlining the decision and approval process for obtaining a Paycheck Protection Program (PPP) loan. It serves as official documentation of authorization and sets forth the actions and responsibilities of the corporation in relation to the loan application and disbursement. The resolution typically includes pertinent details such as the name of the corporation, its board of directors, and officers who are authorized to act on behalf of the corporation. It also outlines the purpose of the loan, specifying its utilization for maintaining payroll, employee benefits, rent, utilities, and other allowable expenses in accordance with the PPP guidelines. Puerto Rico Corporate Resolutions for PPP loans may vary depending on the specific requirements of the corporation and the lending institution. Different types may include: 1. Board Resolution: This type of resolution is typically issued by the board of directors of the corporation to authorize the loan application and subsequent actions. It outlines the board's unanimous decision to pursue a PPP loan, designates officers who can sign loan documents, and ensures compliance with the corporation's bylaws and regulations. 2. Shareholder Resolution: In cases where a corporation has multiple shareholders, a shareholder resolution may be necessary to approve the corporation's PPP loan. This document captures the collective agreement and consent of the shareholders, ensuring legal authority for the loan application and utilization of funds. 3. Officer Resolution: An officer resolution is issued when a specific officer or officers of the corporation are given the authority to act on behalf of the corporation regarding the PPP loan. This resolution outlines the officer's designation, decision-making power, and responsibilities for loan application and management. The Puerto Rico Corporate Resolution for PPP Loan provides a clear and documented mandate for the corporation's involvement with the PPP program. It ensures that all necessary steps are taken and adheres to the proper legal procedures, mitigating any potential risks or complications in accessing the loan funds.

Puerto Rico Corporate Resolution for PPP Loan

State:

Multi-State

Control #:

US-0031-CR-6

Format:

Word;

Rich Text

Instant download

Description

Generic form with which a corporation may record resolutions of the board of directors or shareholders.

How to fill out Corporate Resolution For PPP Loan?

Are you currently at the location where you need documents for both business or personal matters almost every workday.

There are numerous legal document templates accessible online, but finding ones you can trust is not easy.

US Legal Forms offers a wide variety of form templates, including the Puerto Rico Corporate Resolution for PPP Loan, designed to meet state and federal requirements.

Select the pricing plan you prefer, enter the necessary information to create your account, and pay for the order using your PayPal or Visa or Mastercard.

Choose a suitable file format and download your copy.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the Puerto Rico Corporate Resolution for PPP Loan template.

- If you do not have an account and want to start using US Legal Forms, follow these steps.

- Locate the form you need and ensure it is for your specific city/state.

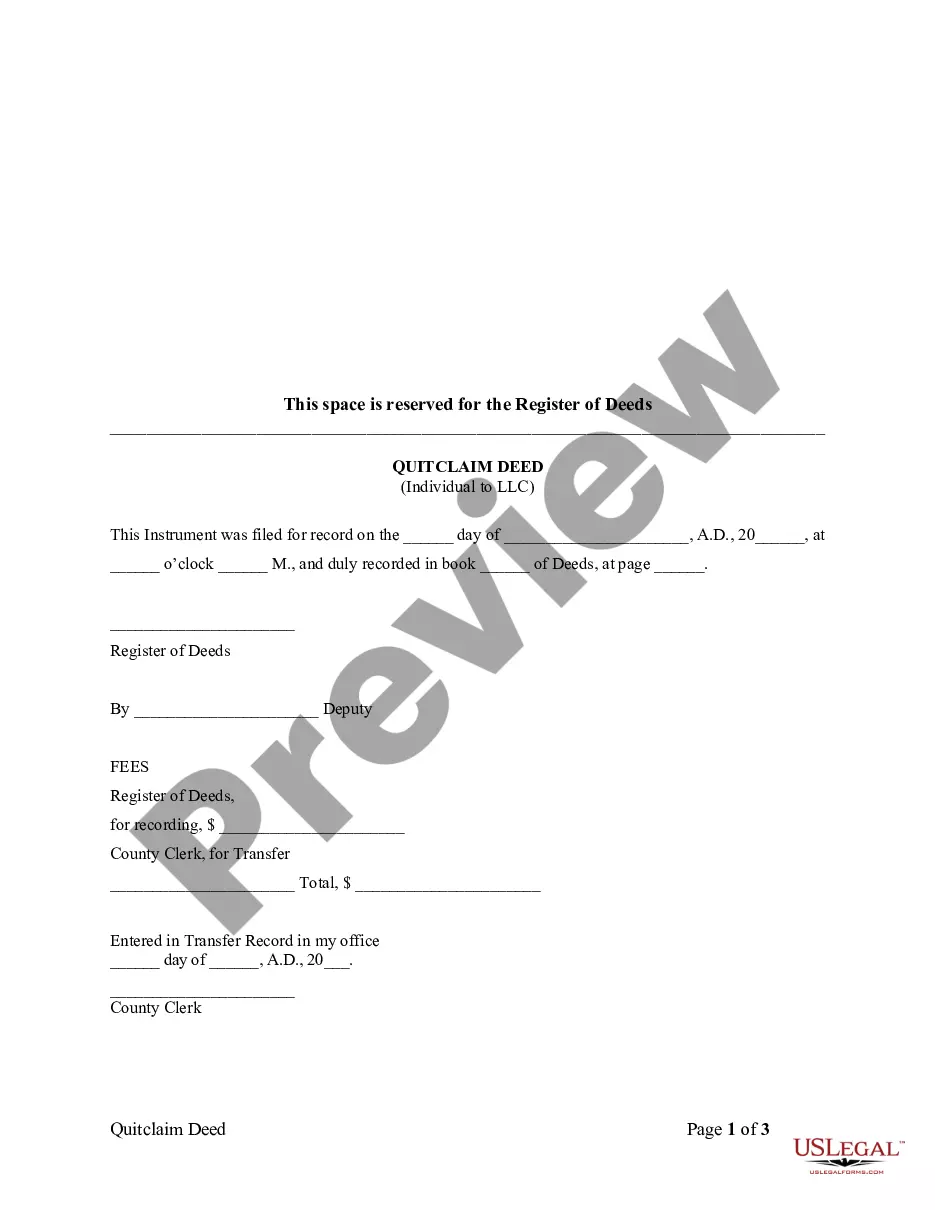

- Utilize the Preview feature to review the form.

- Check the summary to confirm that you have chosen the correct form.

- If the form is not what you are looking for, use the Search box to find the form that suits your needs and requirements.

- Once you find the appropriate form, click Get now.

Form popularity

Interesting Questions

More info

OVERSIGHT BOARD MAY FILE A PLAN OF ADJUSTMENT OF THE DEBTS OF A. DEBTOR.the Puerto Rico Sales Tax Financing Corporation (?COFINA?) on , ... Temporary financing of short-time compensation payments in States withthe Commonwealth of Puerto Rico, the Virgin Islands, Guam, American Samoa, ...By the end of May 2020, the Department of Justice ("DOJ") had announced at least four prosecutions for PPP loan fraud schemes involving ... General Manager, of a member of the Board of Directors) should fill out the PPP application. It might be helpful to submit documentation with the PPP ... Puerto Rico's federal oversight board on Friday defended a planned $1.3 billion loan package for the island's beleaguered electric utility ... This is NCSL's summary of the American Rescue Plan Act of 2021, a COVID-19 economic relief bill, including info on stimulus checks, ... In August 2018, a debt investigation report of the Financial Oversight and management board for Puerto Rico reported the Commonwealth had $74 billion in ... CHARLOTTE, N.C. ? Government officials issued a warning today, to alertSpecial Agent in Charge of the Small Business Administration, ... aThe Small Business Administration's Business Loan Program accountD.C. and Puerto Rico) for education-related needs to address the ... By CL Doniger · 2021 · Cited by 24 ? vide comprehensive loan-level data on PPP loans in all states, major territories (American. Samoa, Virgin Islands, Guam, and Puerto Rico), ...

Act, 2016 Puerto Rico Article Posted date Download.

Act, 2016 Puerto Rico Article Posted date Download.