Puerto Rico Accounts Receivable - Assignment

Description

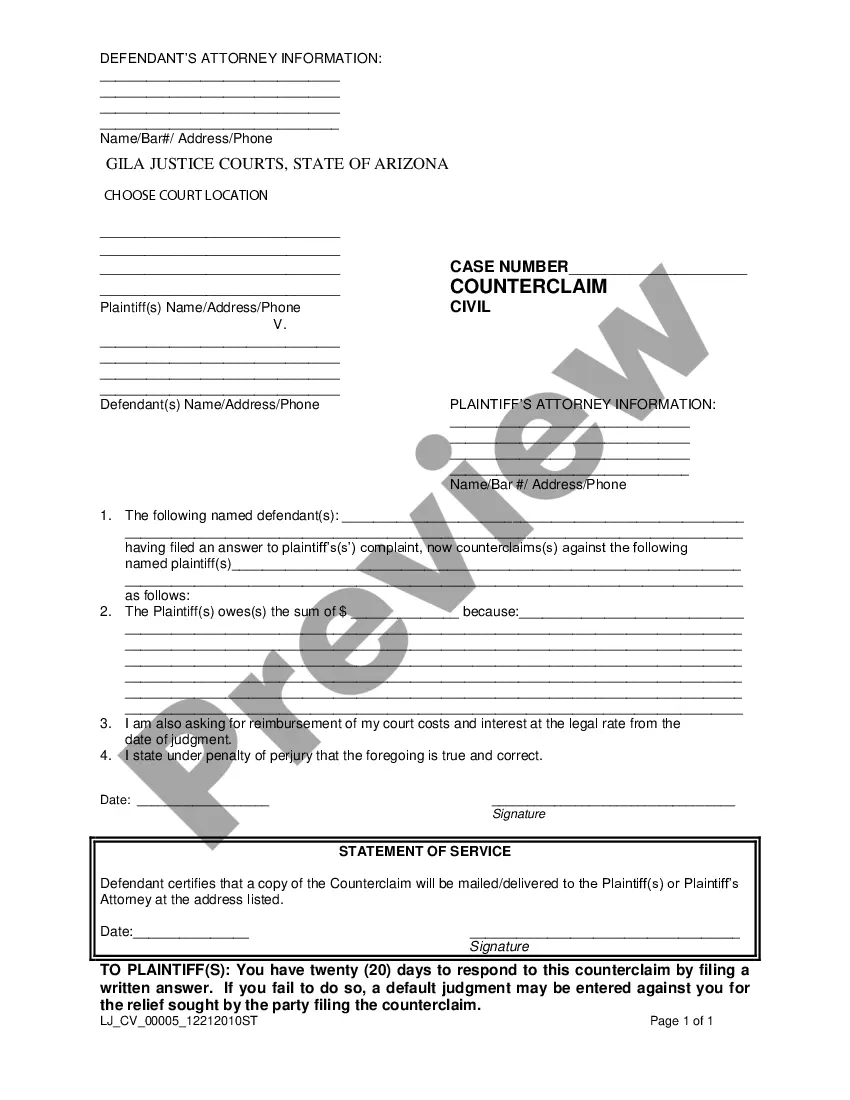

How to fill out Accounts Receivable - Assignment?

Finding the appropriate legal document web template can be a challenge. Of course, there are numerous templates available online, but how can you locate the legal form you require? Visit the US Legal Forms website. The service offers thousands of templates, including the Puerto Rico Accounts Receivable - Assignment, which can be utilized for both business and personal purposes. All documents are reviewed by experts and comply with federal and state regulations.

If you are already a member, Log In to your account and click the Obtain button to find the Puerto Rico Accounts Receivable - Assignment. Use your account to browse through the legal documents you have purchased previously. Visit the My documents section of your account to get another copy of the documents you need.

If you are a new user of US Legal Forms, here are simple instructions for you to follow: First, make sure you have selected the correct form for your city/region. You can review the document using the Review button and check the document details to ensure this is suitable for you. If the form does not satisfy your requirements, use the Search field to find the appropriate form. Once you are confident that the form is suitable, click the Purchase now button to acquire the form. Choose the pricing plan you desire and enter the required information. Create your account and pay for the order using your PayPal account or credit card. Select the file format and download the legal document template to your device. Complete, modify, print, and sign the obtained Puerto Rico Accounts Receivable - Assignment. US Legal Forms is the largest collection of legal documents that provides numerous paper templates. Use the service to access professionally crafted paperwork that adheres to state regulations.

Form popularity

FAQ

In the context of Puerto Rico Accounts Receivable - Assignment, accounts receivable can be classified as either current or noncurrent, depending on their expected collection timeframe. Current accounts receivable typically include amounts due within a year, while noncurrent accounts receivable are due over a longer period. Understanding this classification is essential for effective financial management. For guidance and solutions on managing your accounts receivable assignments, consider using the US Legal Forms platform.

The 183-day rule in Puerto Rico is a guideline used to determine residency for tax purposes. Individuals who spend more than 183 days in Puerto Rico may be considered residents and subject to local tax laws. This rule is vital for anyone managing Puerto Rico Accounts Receivable - Assignment, as residency status can influence tax obligations.

Proposition 60 in Puerto Rico refers to a law that impacts property tax exemptions for certain individuals, particularly seniors. This legislation can affect financial planning and property management. If you are managing Puerto Rico Accounts Receivable - Assignment, understanding Proposition 60 can help you navigate related financial responsibilities.

Yes, Puerto Rico adopts U.S. GAAP for its accounting practices. This allows businesses and organizations in Puerto Rico to align their financial reporting with the standards observed in the mainland U.S. When dealing with Puerto Rico Accounts Receivable - Assignment, familiarity with U.S. GAAP can enhance your financial operations.

Filing taxes while serving in the military and residing in Puerto Rico can be complex. Service members need to consider both federal and local tax obligations, which may differ from those on the mainland. Utilizing reliable resources, such as US Legal Forms, can simplify the process for managing Puerto Rico Accounts Receivable - Assignment.

Several countries implement GAAP accounting, including the United States, Canada, and some regions in the Caribbean. While international standards are becoming more common, GAAP remains a staple for many businesses. If you are handling Puerto Rico Accounts Receivable - Assignment, being aware of these standards can enhance your financial reporting.

Puerto Rico has its own tax structure, which is distinct from the U.S. tax code, though there are some similarities. Residents and businesses may have different obligations compared to those in the mainland U.S. Understanding tax regulations is crucial for managing Puerto Rico Accounts Receivable - Assignment and ensuring compliance.

Puerto Rico does utilize GAAP, or Generally Accepted Accounting Principles, for financial reporting. This adherence ensures that businesses maintain consistency and transparency in their accounting practices. If you are managing Puerto Rico Accounts Receivable - Assignment, knowledge of GAAP will help you navigate financial statements effectively.

Yes, Puerto Rico operates within the U.S. banking system. This means that banks in Puerto Rico follow federal regulations and can offer services similar to those found on the mainland. When dealing with Puerto Rico Accounts Receivable - Assignment, understanding the banking system is essential for efficient financial transactions.