Puerto Rico Buy Sell or Stock Purchase Agreement Covering Common Stock in Closely Held Corporation with Option to Fund Purchase through Life Insurance

Description

How to fill out Buy Sell Or Stock Purchase Agreement Covering Common Stock In Closely Held Corporation With Option To Fund Purchase Through Life Insurance?

Are you presently in a circumstance where you require documentation for both business and personal purposes almost all the time.

There are numerous legal document templates available online, but finding ones you can trust is challenging.

US Legal Forms provides thousands of template forms, such as the Puerto Rico Buy Sell or Stock Purchase Agreement Covering Common Stock in Closely Held Corporation with Option to Fund Purchase through Life Insurance, that are designed to comply with federal and state regulations.

Select a convenient file format and download your copy.

Access all the document templates you have purchased in the My documents menu. You can retrieve an additional copy of the Puerto Rico Buy Sell or Stock Purchase Agreement Covering Common Stock in Closely Held Corporation with Option to Fund Purchase through Life Insurance whenever needed. Just click on the desired form to download or print the document template.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- Then, you can download the Puerto Rico Buy Sell or Stock Purchase Agreement Covering Common Stock in Closely Held Corporation with Option to Fund Purchase through Life Insurance template.

- If you don’t have an account and wish to use US Legal Forms, follow these instructions.

- Locate the form you need and verify it is for the correct area/state.

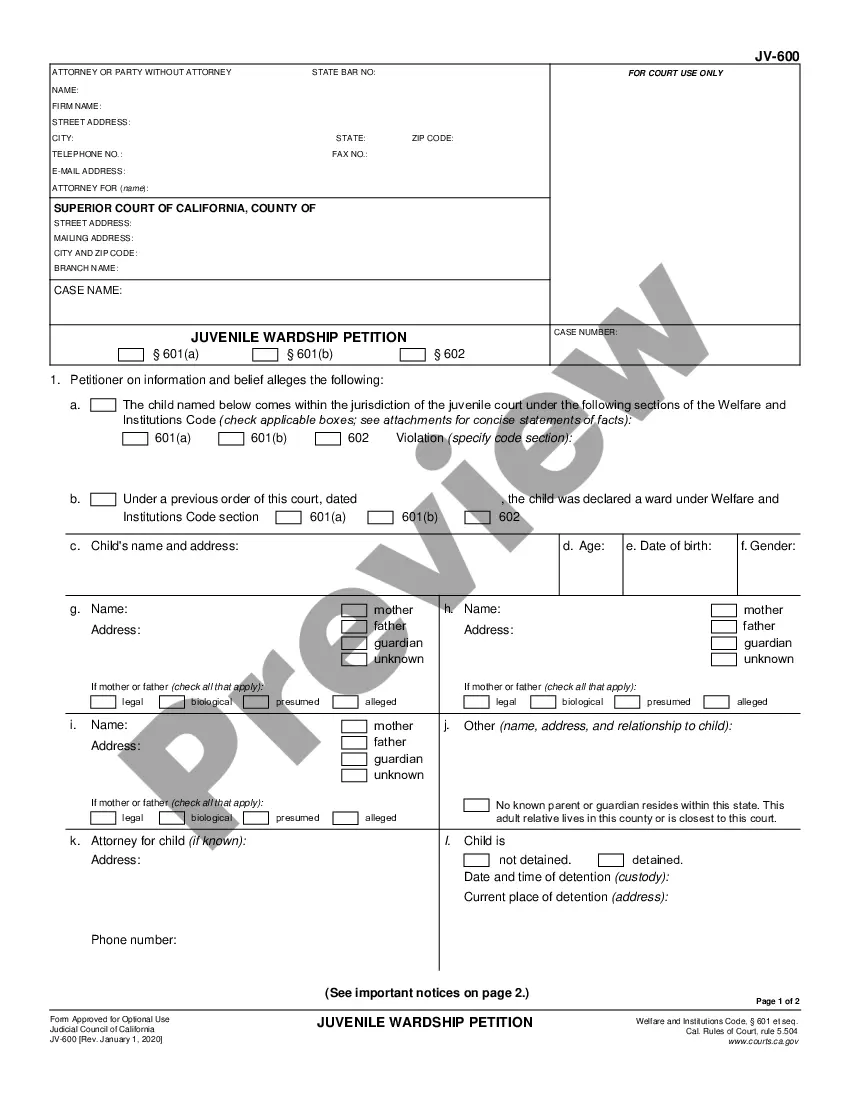

- Utilize the Preview button to examine the document.

- Read the description to ensure you have selected the appropriate form.

- If the form is not what you require, use the Lookup field to find the form that fits your needs and specifications.

- Once you identify the correct form, click on Get now.

- Choose the pricing plan you desire, fill in the necessary information to create your account, and pay for the order using your PayPal or credit card.

Form popularity

FAQ

The premiums used to fund a buy-sell agreement are not tax deductible. The payment of premiums made by a business, where the shareholder or the owner is the insured, are not considered taxable income.

One common question we receive when discussing key person benefits is What is a buy/sell agreement? A buy/sell agreement, also known as a buyout agreement, is a contract funded by a life insurance policy that can help minimize the turmoil caused by the sudden departure, disability or death of a business owner or

More than likely, the agreement is structured such that the purchasing owners receive a step-up in basis. Also, if the remaining owners receive life insurance benefits from the deceased owner, these are received income tax free and don't increase the value of the business.

The premiums used to fund a buy-sell agreement are not tax deductible. The payment of premiums made by a business, where the shareholder or the owner is the insured, are not considered taxable income.

The smartest method for funding a buy-sell agreement is through life insurance. This ensures that funds are immediately available when a death occurs; plus, death benefit proceeds are generally income-tax free.

A purchase and sale agreement is different from a purchase agreement in one particular way. Rather than complete the transaction, a purchase and sale agreement will facilitate it while providing clear guidance regarding party responsibility. By signing the contract, you do not agree to buy or sell the house.

The business owners individually own the policies insuring each other's lives. When a business owner dies, the proceeds are paid to those surviving owners who hold one or more policies on the deceased owner, and these surviving owners buy the shares from the deceased owner's personal representative.

The smartest method for funding a buy-sell agreement is through life insurance. This ensures that funds are immediately available when a death occurs; plus, death benefit proceeds are generally income-tax free.

The purpose of a buy-and-sell agreement is to provide the surviving co-owners with cash to purchase the interest of a deceased co-owner. According to the agreement, each co-owner takes out life cover on the other co-owners' lives.