The Puerto Rico Exchange Addendum to Contract — Tax Free Exchange Section 1031 is a legal document that provides necessary provisions for completing a tax-free exchange of properties in Puerto Rico under Section 1031 of the Internal Revenue Code. This addendum serves as an attachment to the standard contract used for real estate transactions. The aim of this addendum is to facilitate the deferment of capital gains taxes that typically arise from the sale of investment or business property. By utilizing this addendum, investors can reinvest their gains into a similar property, known as the replacement property, without incurring immediate tax liabilities. This allows investors to maximize their investment potential by deferring taxes and potentially generating additional income through property appreciation. There are different types of Puerto Rico Exchange Addendum to Contract — Tax Free Exchange Section 1031, which may include variations based on specific circumstances. Some common variations include: 1. Standard Tax-Free Exchange Addendum: This version is the most commonly used addendum for general tax-free exchanges in Puerto Rico. It outlines the terms and conditions for the exchange process, including the identification period, timeline for closing, and requirements for qualifying properties. 2. Reverse Exchange Addendum: This addendum is used when an investor acquires the replacement property before selling their relinquished property. It provides specific provisions for handling the temporary holding of the new property by a qualified intermediary until the relinquished property is sold. 3. Improvement Exchange Addendum: This variation is utilized when an investor wishes to acquire a replacement property but also make additional improvements to it. The addendum outlines the requirements for completing the improvements within a specified timeframe and the process for accounting for the cost of improvements in the tax-free exchange. 4. Build-to-Suit Exchange Addendum: This addendum is relevant when an investor wishes to construct a replacement property according to their specific needs or preferences. It incorporates provisions for constructing a property that best fits the investor's requirements while remaining compliant with the tax-free exchange guidelines. In summary, the Puerto Rico Exchange Addendum to Contract — Tax Free Exchange Section 1031 allows investors in Puerto Rico to defer capital gains taxes by reinvesting in replacement properties. The various types of this addendum cater to different scenarios such as standard exchanges, reverse exchanges, improvement exchanges, and build-to-suit exchanges.

Puerto Rico Exchange Addendum to Contract - Tax Free Exchange Section 1031

Description

How to fill out Puerto Rico Exchange Addendum To Contract - Tax Free Exchange Section 1031?

US Legal Forms - one of the most important collections of legal documents in the USA - provides a variety of legal form templates you can download or create.

Using the website, you can access thousands of forms for business and personal use, categorized by types, states, or keywords.

You can obtain the latest versions of forms such as the Puerto Rico Exchange Addendum to Contract - Tax-Free Exchange Section 1031 in just minutes.

Check the form description to confirm that you have selected the right form.

If the form does not meet your needs, use the Search field at the top of the screen to find one that does.

- If you already have an account, Log In and download Puerto Rico Exchange Addendum to Contract - Tax-Free Exchange Section 1031 from the US Legal Forms library.

- The Download button will be visible on every form you view.

- You can access all previously saved forms in the My documents tab of your account.

- To use US Legal Forms for the first time, here are simple steps to get started.

- Make sure to have selected the correct form for your city/region.

- Click on the Review button to examine the form's content.

Form popularity

FAQ

You will need several tax documents to facilitate a smooth 1031 exchange. Primarily, you should gather your current property’s tax returns, sales documents, and any prior forms related to depreciation. Additionally, maintaining invoices and records of expenses related to the transferral of properties will be beneficial. Consulting with US Legal Forms can provide clarity on these document requirements.

A 1031 exchange that starts with a property in the U.S. can't be exchanged for an asset in another country; the replacement property or properties must also be within the United States.

Steps to Successfully Complete a 1031 ExchangeIdentify Your 1031 Exchange Objectives & Property Search.Find a Qualified Intermediary.Add a Cooperation Clause in Your Sales Contract.Provide a Copy of the Contract to the Intermediary.Funds for the Exchange are Wired to the Exchange Account.More items...?

HOW TO REPORT THE EXCHANGE. Your 1031 exchange must be reported by completing Form 8824 and filing it along with your federal income tax return. If you completed more than one exchange, a different form must be completed for each exchange.

Use Parts I, II, and III of Form 8824 to report each exchange of business or investment property for property of a like kind. Certain members of the executive branch of the Federal Government and judicial officers of the Federal Government use Part IV to elect to defer gain on conflict-of-interest sales.

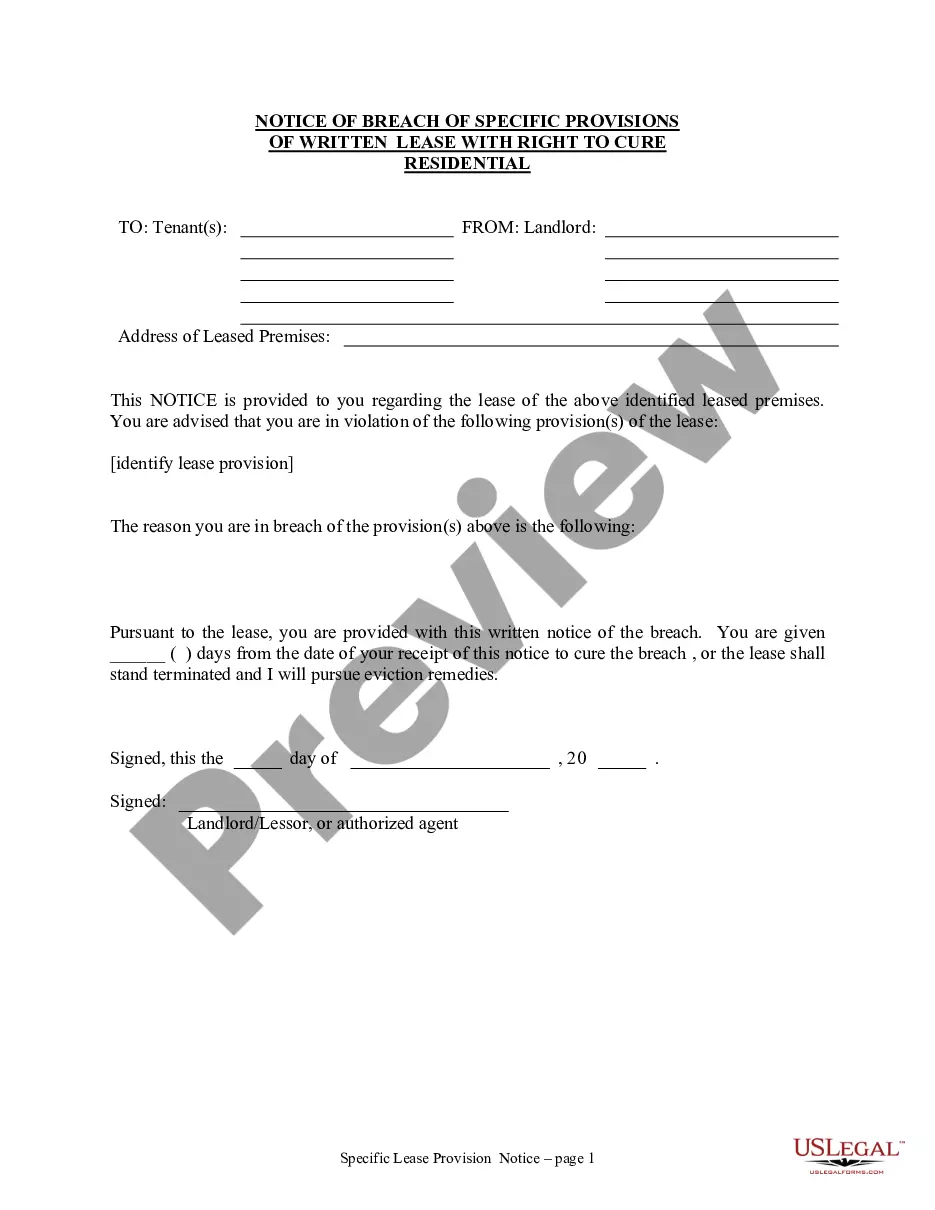

A 1031 addendum will normally clearly show intent to do a 1031 exchange, permit assignment, and advise the other party there will be no expense or liability as a result of the exchange. Sometimes there is cooperation language asserting that both parties to the contract will cooperate with a 1031 exchange.

Meaning that while Puerto Rico is most certainly a United States Territory, you cannot carry out a 1031 exchange selling within the 50 United States and purchasing there.

There are also states that have withholding requirements if the seller of a piece of property in these states is a non-resident of any of the following states: California, Colorado, Hawaii, Georgia, Maryland, New Jersey, Mississippi, New York, North Carolina, Oregon, West Virginia, Maine, South Carolina, Rhode Island,

Line 1: List the address or legal description and type of property relinquished (sold). Line 2: List the address or legal description and type of property received. Line 3: List the month, day, year relinquished property was originally acquired. Line 4: List the date relinquished property was transferred to the buyer.

Areas that are not on the list of coordinated territories do not contain property eligible for a 1031 exchange. However, with islands such as American Samoa and Puerto Rico now considered a Qualified Opportunity Zone, there is more than one way to defer capital gains taxes.

Interesting Questions

More info

Purchase Sale Agree Contract Terms Purchase Sale Agreements Our Purchase Sale Agreement template lets you make a real estate contract on your computer. We take the hassle out and make your home purchasing experience simple. You can even save your agreement, and share it with your friends, family members, and neighbors. These templates also have a button for easy printing and easy sharing. Download or save these Purchase Sale Agreements now to save them on your computer or your printer, and then print and share when you are ready.