Puerto Rico Employment Agreement — Percentage of Sale— - Self-Employed Independent Contractor A Puerto Rico Employment Agreement — Percentage of Sale— - Self-Employed Independent Contractor is a legal document that outlines the terms and conditions between a self-employed individual and their employer in Puerto Rico. This agreement is specifically designed for individuals or businesses that operate on a commission or percentage of sales basis. Keywords: Puerto Rico, employment agreement, percentage of sales, self-employed, independent contractor This type of employment agreement is commonly used in industries such as sales, real estate, insurance, and other commission-based fields. It is essential to have a well-drafted agreement to protect the rights and responsibilities of both parties involved. The Puerto Rico Employment Agreement — Percentage of Sale— - Self-Employed Independent Contractor typically includes the following key elements: 1. Parties involved: The agreement clearly identifies the self-employed individual (contractor) and their employer. 2. Scope of work: The agreement outlines the specific products, services, or tasks that the contractor will be responsible for. It defines the expectations and parameters of the role. 3. Commission structure: This agreement establishes the commission rate or percentage of sales that the contractor will receive. It may also include information about different commission tiers or bonuses. 4. Payment terms: The agreement specifies how and when the contractor will be paid. It may include details about invoicing, payment schedules, and any deductions or withholding. 5. Non-competition and non-solicitation: This clause prevents the contractor from engaging in activities that directly compete with their employer or luring away the employer's clients after termination of the agreement. 6. Intellectual property: If applicable, the agreement may address the ownership and rights to any intellectual property developed or utilized by the contractor during the course of their work. Different types of Puerto Rico Employment Agreement — Percentage of Sale— - Self-Employed Independent Contractor may vary based on the industry, specific job roles, and individual preferences. Some possible variations include: 1. Real Estate Agent Agreement: This type of agreement is tailored for real estate agents who work on a commission basis, earning a percentage of the total sales price for each property they sell. 2. Insurance Sales Representative Agreement: This agreement is designed for independent insurance agents who earn their income through commissions on insurance policies sold. 3. Direct Sales Representative Agreement: This type of agreement is commonly used by companies that rely on independent contractors to sell their products through direct sales, such as door-to-door or party-based sales. 4. Affiliate Marketing Agreement: This agreement is used by individuals who promote products or services on behalf of a company and earn a commission for each sale or lead generated through their marketing efforts. In conclusion, a Puerto Rico Employment Agreement — Percentage of Sale— - Self-Employed Independent Contractor is a crucial legal document for individuals and businesses operating on a commission or percentage of sales basis in Puerto Rico. It outlines the specific terms, payment structure, and expectations between the contractor and their employer.

Puerto Rico Employment Agreement - Percentage of Sales - Self-Employed Independent Contractor

Description

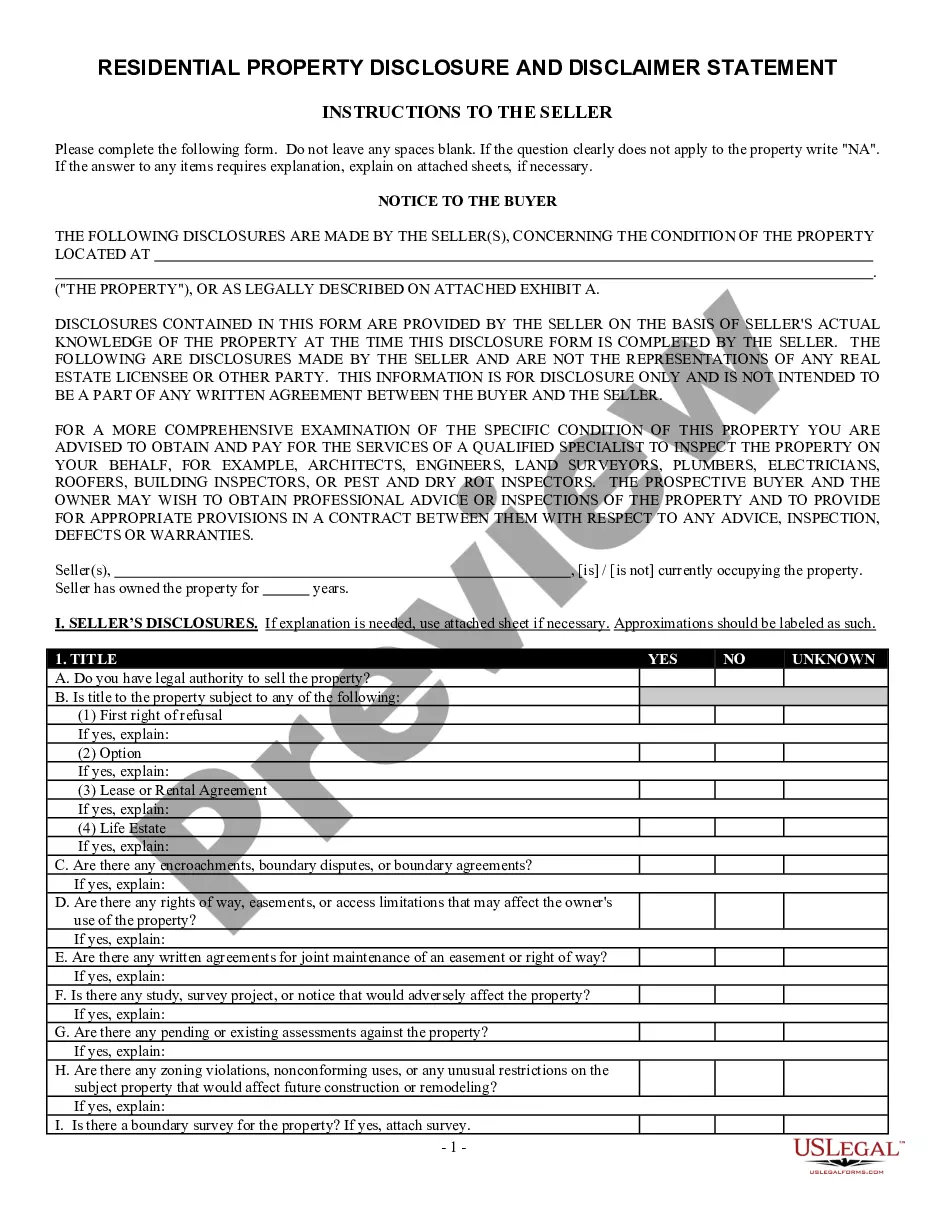

How to fill out Puerto Rico Employment Agreement - Percentage Of Sales - Self-Employed Independent Contractor?

Are you currently in a role where you require documents for both the company or specific tasks almost every workday.

There are numerous legal document templates accessible online, but finding reliable ones is not simple.

US Legal Forms offers a wide variety of form templates, such as the Puerto Rico Employment Agreement - Percentage of Sales - Self-Employed Independent Contractor, which are designed to meet federal and state regulations.

If you find the right form, simply click Get Now.

Choose a convenient file format and download your copy. You can view all the document templates you have purchased in the My documents section. You can obtain another copy of the Puerto Rico Employment Agreement - Percentage of Sales - Self-Employed Independent Contractor at any time, if needed. Just click the necessary form to download or print the document template.

- If you're already familiar with the US Legal Forms website and have an account, just Log In.

- Then, you can download the Puerto Rico Employment Agreement - Percentage of Sales - Self-Employed Independent Contractor template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it is for the correct area/region.

- Utilize the Preview button to review the form.

- Check the description to confirm you have selected the correct form.

- If the form isn’t what you are looking for, use the Search field to find the one that fits your needs and requirements.

Form popularity

FAQ

Unemployment refers to the share of the labor force that is without work but available for and seeking employment. Puerto Rico unemployment rate for 2020 was 11.17%, a 2.87% increase from 2019. Puerto Rico unemployment rate for 2019 was 8.30%, a 0.9% decline from 2018.

According to Puerto Rico Act Number 379 of (Law No 379), which covers non-exempt (hourly) employees, eight hours of work constitutes a regular working day in Puerto Rico and 40 hours of work constitutes a workweek. Working hours exceeding these minimums must be compensated as overtime.

The general rule is that an individual is an independent contractor if the payer has the right to control or direct only the result of the work and not what will be done and how it will be done. If you are an independent contractor, then you are self-employed.

Puerto Rico is not an 'employment at will' jurisdiction. Thus, an indefinite-term employee discharged without just cause is entitled to receive a statutory discharge indemnity (or severance payment) based on the length of service and a statutory formula.

From an employment law perspective, this means federal statutes such as Title VII, FLSA, ADA, ADEA, FMLA, USERRA, OSHA, ERISA, COBRA, among others, apply to Puerto Rico.

Because Puerto Ricans are U.S. citizens, there are no federally-required paperwork or VISA applications needed. Additionally, there are no wage requirements other than U.S. state and federal laws to adhere to.

Wage and hour coverage in Puerto Rico for non-exempt employees is governed by the US Fair Labor Standards Act (FLSA) as well as local laws.

Section 403 of PROMESA modified Section 6(g) of the Fair Labor Standards Act (FLSA) to allow employers to pay employees in Puerto Rico who are under the age of 25 years a subminimum wage of not less than $4.25 per hour for the first 90 consecutive calendar days after initial employment by their employer.

If you're looking to hire employees in Puerto Rico, check out the job bank maintained by the Puerto Rico Department of Labor. It's an entirely free service that allows you to create an employer account and sift through the resumes of potential employees.

Interesting Questions

More info

We have worked as a business lawyer in your situation, ensuring that your employment agreement complies with the regulations and corporate rules.