A Puerto Rico Bill of Sale for a Coin Collection is a legal document that serves as proof of ownership for buying or selling a coin collection within the territory of Puerto Rico. This document outlines the specific details of the transaction including the buyer and seller's information, the date of the sale, a detailed description of the coin collection, and the agreed-upon purchase price. Keywords: Puerto Rico Bill of Sale, Coin Collection, legal document, proof of ownership, buying, selling, transaction, buyer, seller, information, date, detailed description, purchase price. There are several types of Puerto Rico Bills of Sale for a Coin Collection, each designed to cater to specific circumstances or preferences. These variations include: 1. Simple Puerto Rico Bill of Sale for a Coin Collection: This type of bill of sale includes basic information about the buyer, seller, and the coin collection being sold. It is suitable for straightforward transactions with no additional terms or conditions. 2. Detailed Puerto Rico Bill of Sale for a Coin Collection: This version of the bill of sale provides a comprehensive description of each coin in the collection, including its denomination, mint mark, year of issue, condition, and any unique characteristics or historical significance. It is ideal for high-value or rare coin collections, where an in-depth record of each coin is necessary. 3. As-Is Puerto Rico Bill of Sale for a Coin Collection: This type of bill of sale specifies that the coin collection is being sold in its current condition without any warranties or guarantees from the seller. It protects the seller from future claims if issues arise with the coins after the sale. 4. Installment Puerto Rico Bill of Sale for a Coin Collection: This bill of sale is utilized when the purchase price is paid in installments over a specific period. It outlines the terms of the installment plan, including the amount of each payment, due dates, and any additional fees or penalties for late payments. 5. Notarized Puerto Rico Bill of Sale for a Coin Collection: A notarized bill of sale is one that has been witnessed and verified by a notary public. This type of bill of sale provides an added layer of authenticity and can be required for certain transactions or legal purposes. With these various types of Puerto Rico Bills of Sale for a Coin Collection, collectors and enthusiasts can ensure that their transactions are formalized, documented, and legally binding, providing peace of mind for both buyers and sellers.

Puerto Rico Bill of Sale for a Coin Collection

Description

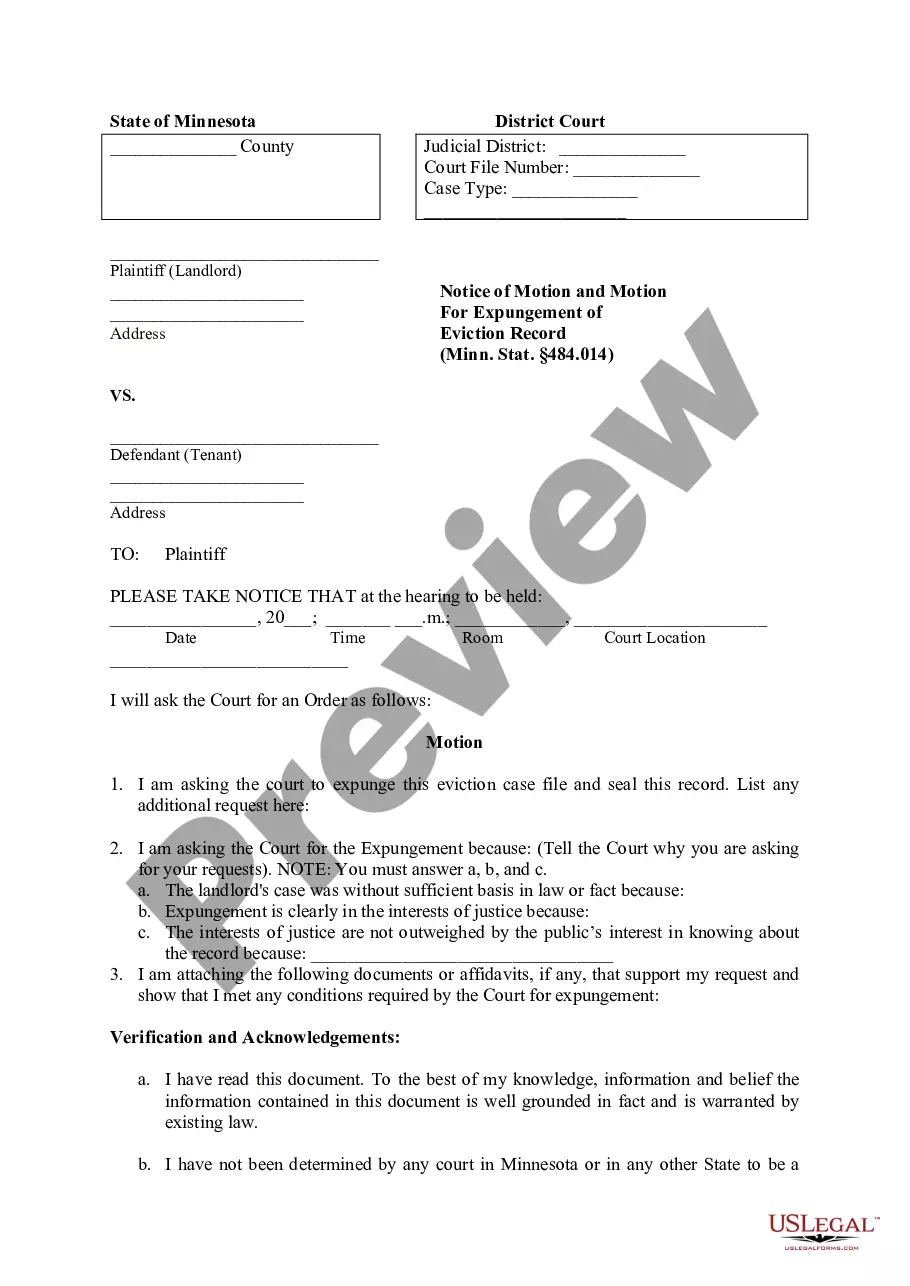

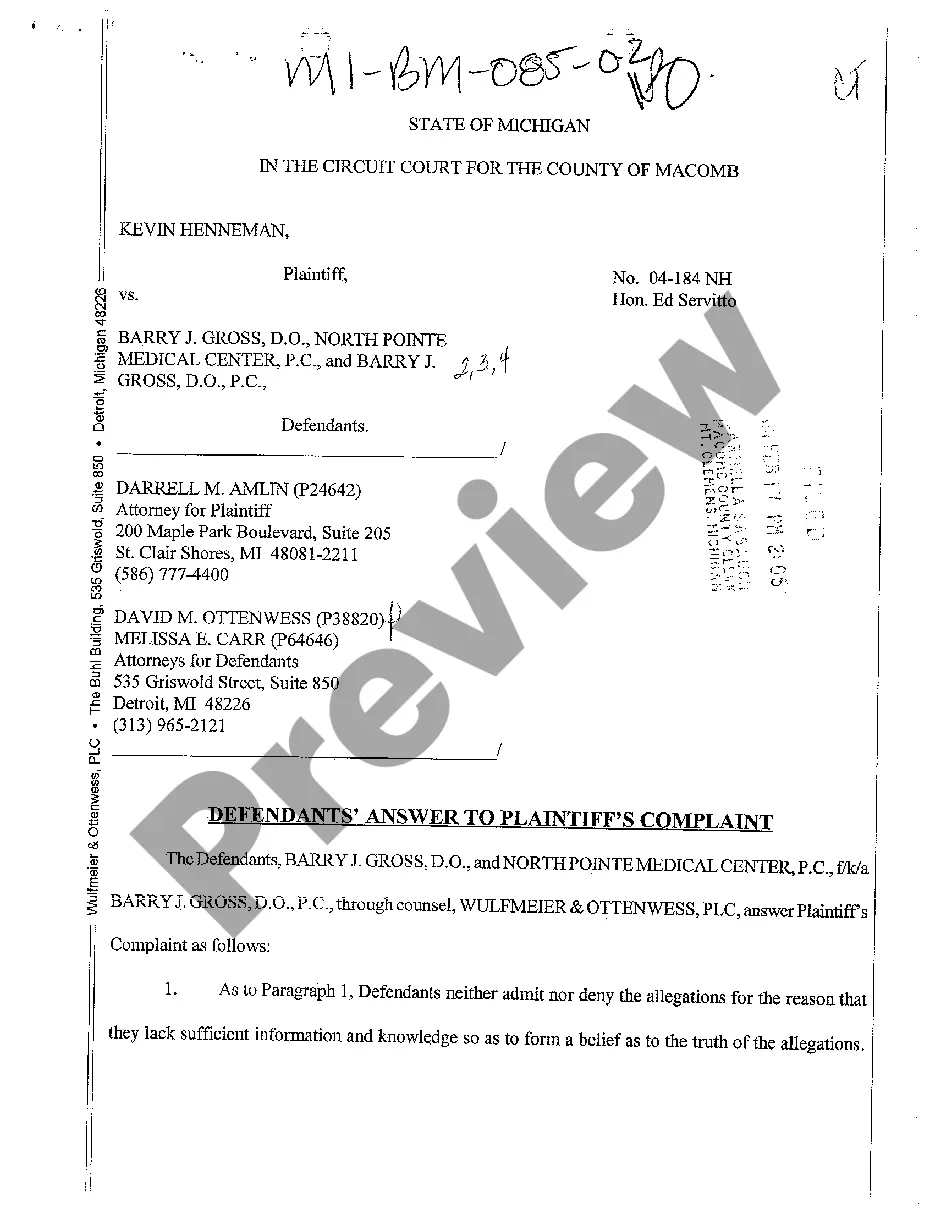

How to fill out Puerto Rico Bill Of Sale For A Coin Collection?

Locating the appropriate legal document template can be a challenge. Obviously, there are numerous templates available online, but how do you identify the legal form you need? Use the US Legal Forms website.

The service provides thousands of templates, such as the Puerto Rico Bill of Sale for a Coin Collection, which you can utilize for business and personal purposes. All the forms are vetted by professionals and meet federal and state regulations.

If you are already registered, Log In to your account and click on the Download button to access the Puerto Rico Bill of Sale for a Coin Collection. Use your account to review the legal forms you have previously purchased. Navigate to the My documents section of your account to obtain another copy of the document you need.

US Legal Forms is the largest repository of legal forms where you can find various document templates. Use the service to obtain appropriately crafted paperwork that comply with state regulations.

- First, make sure you have selected the correct form for your city/region. You can browse the form using the Review button and examine the form description to ensure it is the right one for you.

- If the form does not meet your needs, use the Search field to find the appropriate form.

- Once you are confident that the form is suitable, click the Buy Now button to acquire the form.

- Choose the pricing plan you prefer and input the required information. Create your account and pay for the order using your PayPal account or credit card.

- Select the file format and download the legal document template to your device.

- Complete, modify, print, and sign the obtained Puerto Rico Bill of Sale for a Coin Collection.

Form popularity

FAQ

Why Move to Puerto Rico? Puerto Rico is the only place in the world that follows neither U.S. domestic tax law nor the FATCA. As of January 1st, 2020, island residents enjoy full tax exemptions on Puerto Rican-sourced dividends and capital gains earned from the appreciation of securities like cryptocurrencies.

Both the 2009 P Puerto Rico quarter and 2009 D Puerto Rico quarter are each worth around $0.50 in about uncirculated condition. The value is around $1 in uncirculated condition with an MS 63 grade. Uncirculated coins with a grade of MS 65 can sell for around $2.

That makes the move a no-brainer for some investors, especially as the crypto market's meteoric growth continues and Democrats push for higher taxes on the rich. Puerto Rico offers residents huge tax savings, enticing crypto investors.

Act 22 seeks to attract new residents to Puerto Rico by providing a total exemption from Puerto Rico income taxes on all interest and dividends realized after the individual becomes a bona fide resident of Puerto Rico.

Act 22, or the Individual Investors Act, targets high net worth investors with the promise of 0% tax on interest, dividends, and capital gains obtained while residing in Puerto Rico as a bona fide resident.

After one hundred years of use of the United States monetary system, Puerto Ricans still refer to the dollar, as the "peso"; to "quarter" (25 cents), as "peseta"; to "nickel" (5 cents), as "vellon" or "ficha" and to the cent, as "chavo" or "perrita".

There's no denying that some cryptocurrency traders have become millionaires thanks to their successful investments. What's not as often discussed is the great number of people who have lost significant sums trying to become rich by investing in crypto.

The announcement is related to Act 22, which seeks to attract new residents to Puerto Rico by providing a total exemption from Puerto Rico income taxes on all passive income once an individual becomes a resident of Puerto Rico.

The stars are aligned for a prosperous, brighter future for Puerto Rico, says Pierce, a prominent local crypto investor. Most countries and cities have to invest massively to get the intellectual capital that exists in Puerto Rico. It is the intellectual capital of the financial future.

If you expect to sell crypto and avoid taxes on your earnings, you cannot wait until the end of the taxable year. You need to act now to establish your bona fide residency. The date you enter Puerto Rico later becomes the date you are considered a bona fide resident of Puerto Rico.

Interesting Questions

More info

—use User decodeURIComponent escape catch document write style top display none eBay Deals Help Contact Current language EnglishFrançais Current language English Français Sell Watch ListExpand Watch Misleading Sign your user information Loading Sign your user information eBayExpand eBay Summary Recent Viewed Bids Offers Watch List Purchase History eBay Deals Help.