Puerto Rico Guaranty of Open Account - Alternate Form

Description

How to fill out Guaranty Of Open Account - Alternate Form?

If you require to finish, obtain, or print official documents templates, utilize US Legal Forms, the largest assortment of legal forms available online.

Take advantage of the site’s user-friendly and efficient search to locate the documents you need.

Various templates for business and personal purposes are organized by categories and states, or keywords.

Step 4. After you have found the form you need, click the Buy now button. Choose the payment plan you prefer and enter your credentials to register for the account.

Step 5. Process the payment. You can use your Misa or Mastercard or PayPal account to complete the transaction.

- Utilize US Legal Forms to find the Puerto Rico Guaranty of Open Account - Alternate Form with just a few clicks.

- If you are already a US Legal Forms customer, Log In to your account and click the Download button to obtain the Puerto Rico Guaranty of Open Account - Alternate Form.

- You can also access forms you previously downloaded in the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the steps outlined below.

- Step 1. Ensure you have selected the form for the correct city/state.

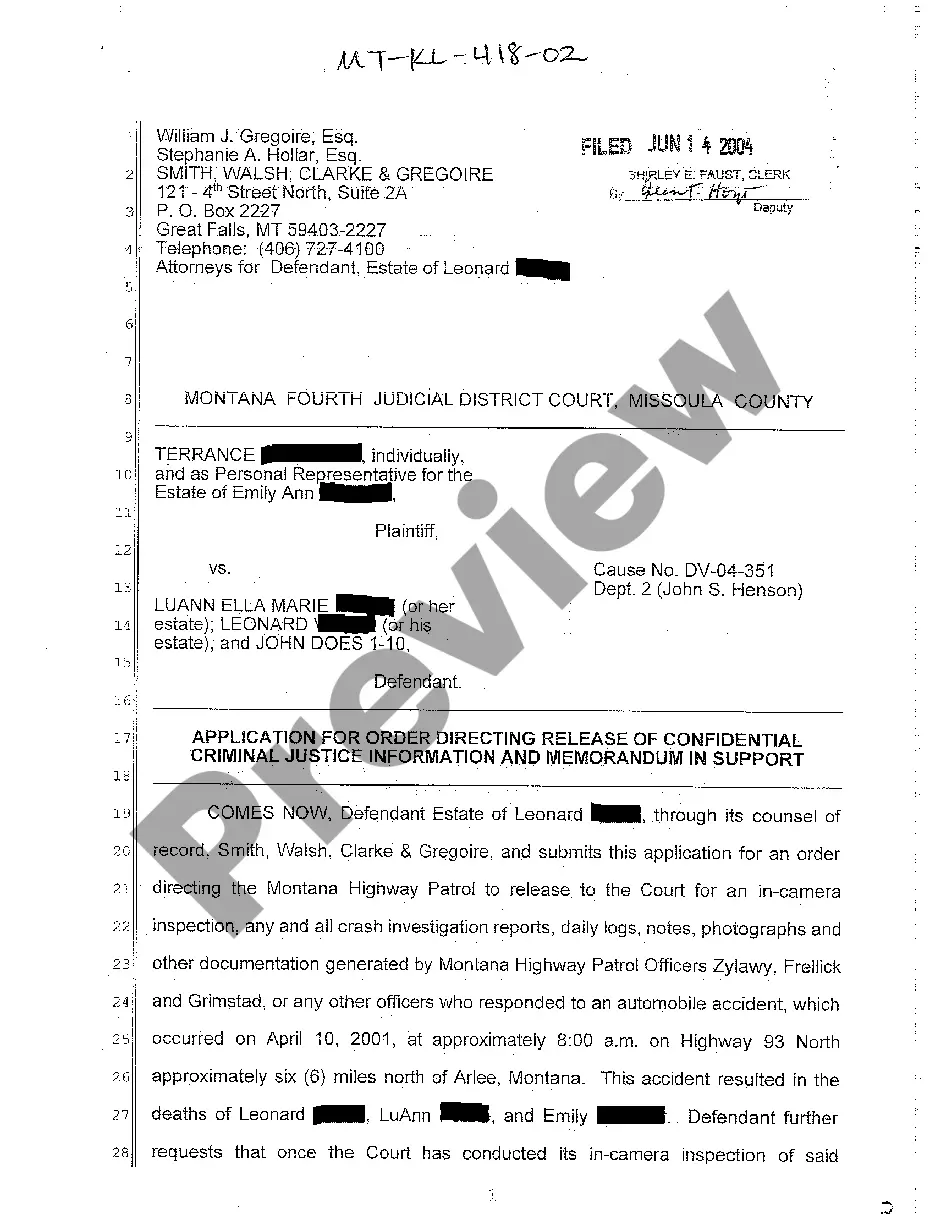

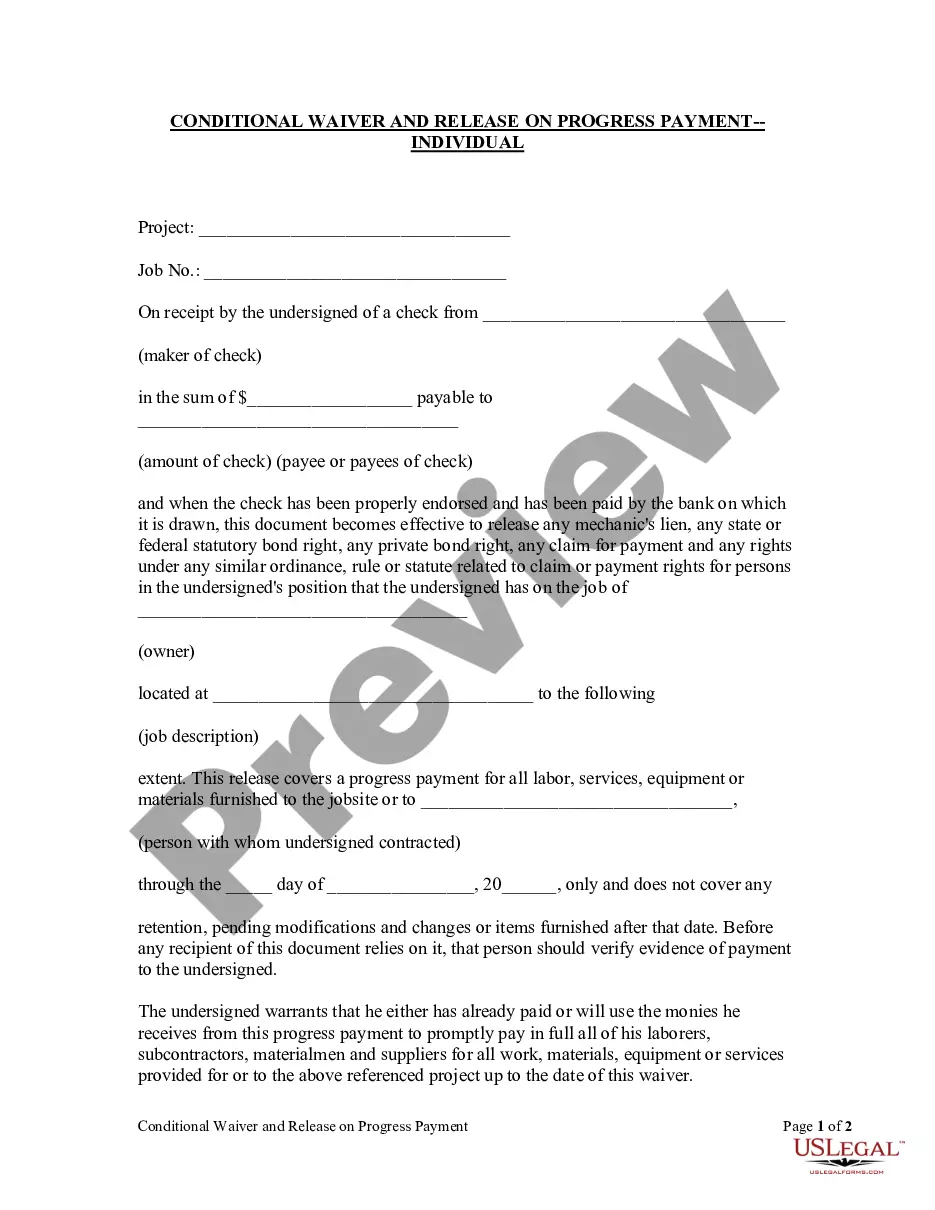

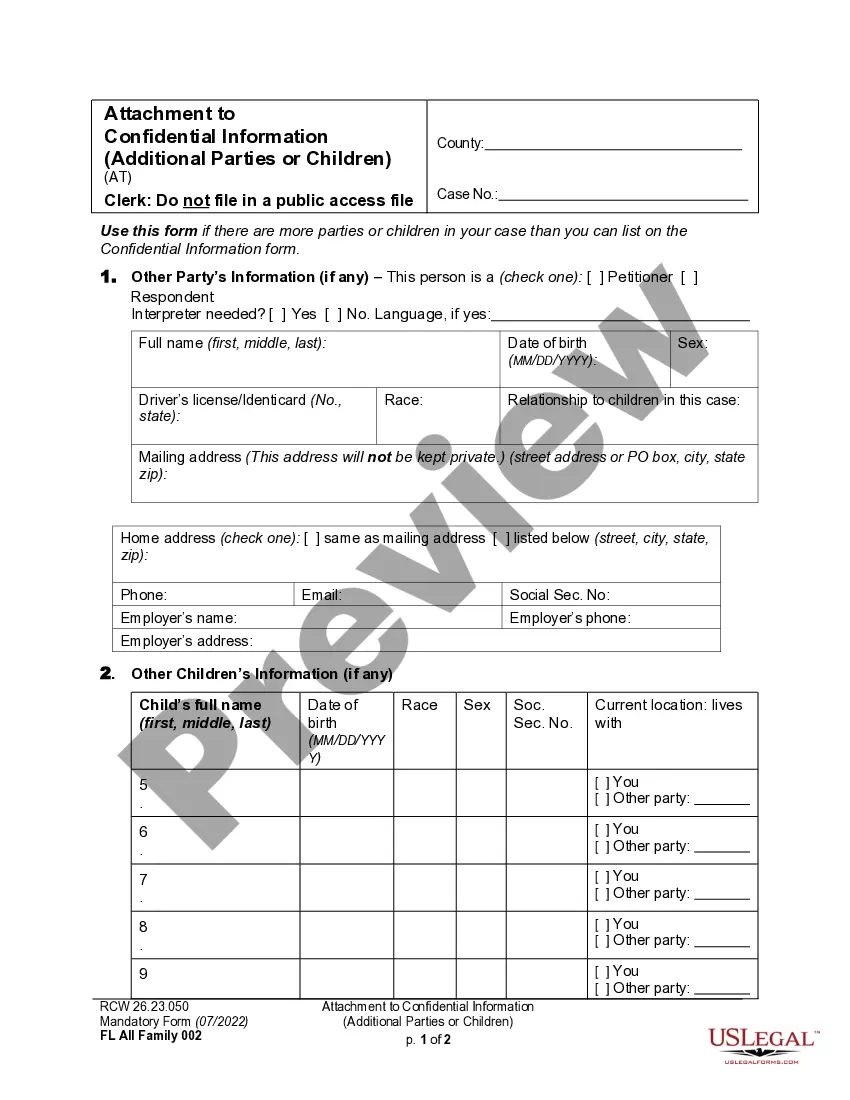

- Step 2. Use the Review option to browse through the form’s content. Be sure to read the details.

- Step 3. If you are not satisfied with the form, use the Search area at the top of the page to find other variations of the legal document template.

Form popularity

FAQ

Filing PBGc form 500 involves several straightforward steps. First, ensure you obtain the form from an appropriate source, such as your bank or US Legal Forms. Complete the form carefully, follow all instructions, and submit it to the relevant authority. If you have questions during this process, reaching out to a legal professional can provide helpful guidance.

To open a bank account at Banco Popular, you will need valid identification, such as a driver's license or passport, and proof of your address. Additional documentation may be required, including the Puerto Rico Guaranty of Open Account - Alternate Form. It's best to consult with a representative at Banco Popular for the most up-to-date requirements.

Yes, Puerto Rico uses US banks that offer full banking services. Many major banks operate in Puerto Rico, providing services like checking and savings accounts. Customers can enjoy the same stability and support found on the mainland. It's also important to consider the Puerto Rico Guaranty of Open Account - Alternate Form when engaging in banking transactions here.

PBGc form 501 is an important document related to the Puerto Rico Guaranty of Open Account. This form helps establish guarantees for open accounts and provides necessary information for businesses conducting transactions within Puerto Rico. For detailed instructions on completing this form, consider visiting US Legal Forms for tailored resources.

Yes, a foreigner can open a bank account in Puerto Rico, provided they meet certain requirements. Most banks will ask for identification, immigration documents, and a proof of address in Puerto Rico. It's advisable to inquire about specific documentation needed for the Puerto Rico Guaranty of Open Account - Alternate Form, as this may vary between banks.

Opening a bank account in Puerto Rico is a straightforward process. Begin by choosing a bank that fits your needs, and gather the required documents, such as a government-issued ID and proof of address. You may also need to provide the Puerto Rico Guaranty of Open Account - Alternate Form during the application process. Once you have everything ready, visit the bank or apply online.

Yes, you can open a Chase account while living in Puerto Rico. Chase offers services that accommodate residents in Puerto Rico. To begin, visit a local branch or their website for detailed instructions. You will need to provide identification and proof of residency.

Act 60, officially known as the Puerto Rico Incentives Code, promotes economic development by providing tax incentives to various sectors, including those utilizing the Puerto Rico Guaranty of Open Account - Alternate Form. This act aims to attract investors and businesses to enhance economic growth on the island. Understanding Act 60 is vital for anyone looking to take advantage of the benefits available while ensuring compliance with local laws.

Section 6072.01 of the Puerto Rico Internal Revenue Code of 2011 outlines the rules regarding the collection and reporting of income arising from the Puerto Rico Guaranty of Open Account - Alternate Form. This section specifies the obligations of individuals and entities involved in open account transactions, thereby enhancing financial transparency. Those who deal with these transactions should understand the implications this section has on tax obligations, ensuring compliance and proper reporting.

Form 482 is a tax document used to report and claim various deductions within Puerto Rico's tax landscape. This form is essential for businesses and individuals seeking to optimize their tax positions. The interplay between this form and the Puerto Rico Guaranty of Open Account - Alternate Form can be significant for your accounting needs. Consult with a tax professional to navigate its complexities effectively.