Puerto Rico Restricted Endowment to Religious Institution is a specific designation that refers to a type of financial arrangement or fund established to support religious institutions and their activities in Puerto Rico. It involves setting aside a certain amount of money or assets which are solely dedicated to the benefit and advancement of religious organizations in the region. This endowment offers churches and religious institutions a sustainable and reliable source of funding to carry out their various programs, initiatives, and maintenance needs. The restricted nature of this endowment means that the funds or assets cannot be used for purposes other than those aligned with the religious institution's mission and objectives. The restrictions aim to ensure that the financial resources are utilized solely for religious endeavors, supporting activities such as providing religious services, expanding community outreach programs, maintaining and improving worship spaces, funding religious education, or supporting charitable initiatives organized by the religious institution. Different types of Puerto Rico Restricted Endowment to Religious Institution can include: 1. General Endowment Fund: This primary type of endowment serves as a long-term investment pool from which religious institutions can draw funds to support multiple aspects of their operations. It provides financial stability and fosters sustainable growth while ensuring resources are consistently available for the institution's religious activities. 2. Capital Campaign Endowment: This type of endowment is specifically established to support capital-intensive projects such as constructing or renovating worship buildings, acquiring land, or expanding facilities. It allows religious institutions to fund large-scale projects that may not be possible through regular annual giving alone. 3. Scholarship or Education Endowment: Some religious institutions establish endowments specifically focused on supporting educational or scholarship initiatives within their community. This type of endowment provides financial assistance to individuals pursuing religious studies, theological education, or scholarships for community members attending religious educational institutions. 4. Benevolence or Charitable Endowment: Certain religious institutions create endowments to effectively address social issues and provide charitable assistance to those in need. Funds from this type of endowment can be used to support community outreach programs, provide aid to vulnerable populations, or contribute to disaster relief efforts. By establishing and maintaining Puerto Rico Restricted Endowments to Religious Institutions, religious organizations in Puerto Rico can ensure the continued financial stability and growth of their institutions, enabling them to fulfill their religious mission and positively impact their communities.

Puerto Rico Restricted Endowment to Religious Institution

Description

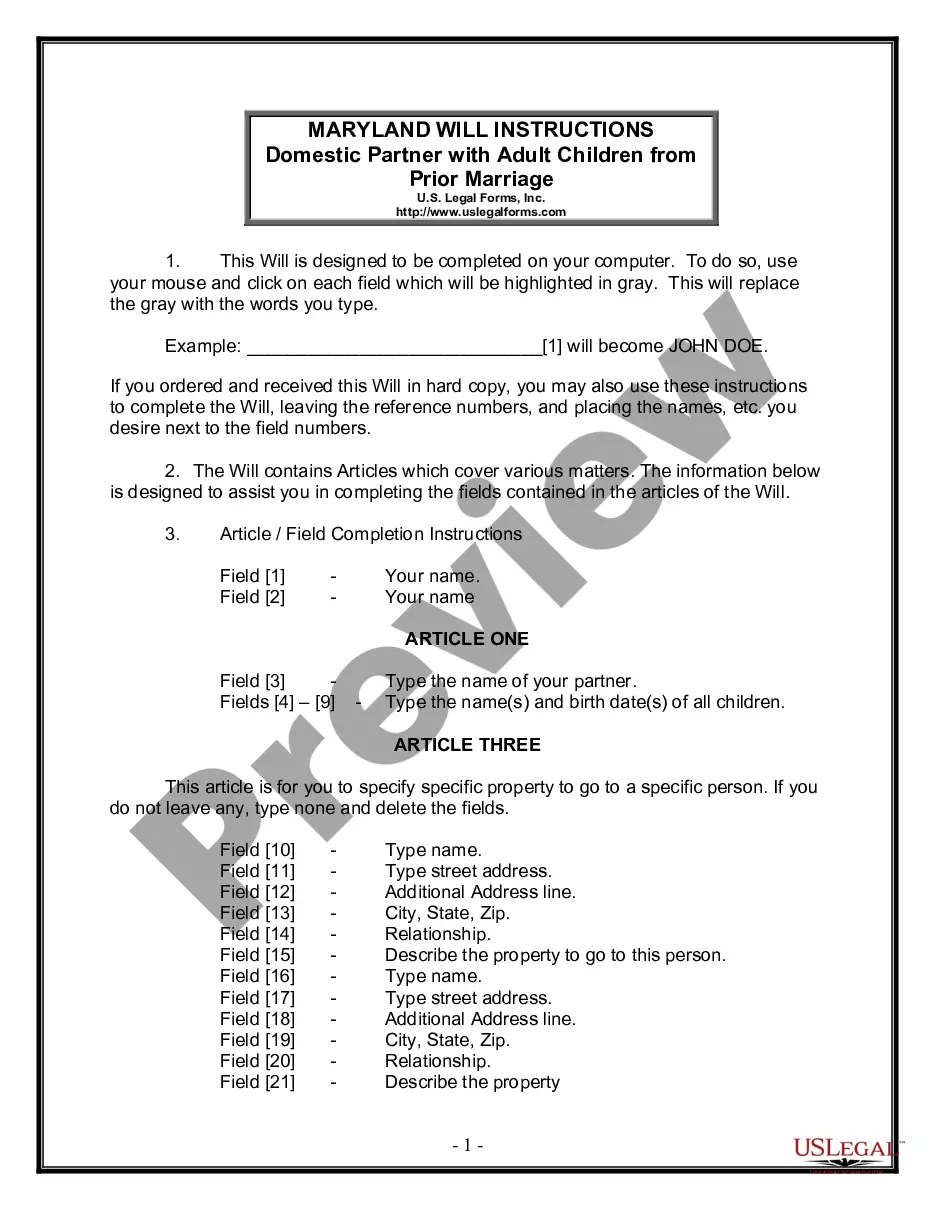

How to fill out Puerto Rico Restricted Endowment To Religious Institution?

Are you situated in a location where you often require documentation for business or specialized tasks? There are numerous credible document templates accessible online, but finding reliable ones can be challenging.

US Legal Forms offers thousands of template options, such as the Puerto Rico Restricted Endowment to Religious Institution, designed to fulfill federal and state regulations.

If you are already familiar with the US Legal Forms website and have an account, simply Log In. You can then download the Puerto Rico Restricted Endowment to Religious Institution template.

Choose a convenient document format and download your copy.

Access all the document templates you have purchased in the My documents menu. You can download an additional copy of the Puerto Rico Restricted Endowment to Religious Institution anytime you wish. Simply click on the required form to download or print the document template.

- If you do not have an account and wish to start using US Legal Forms, follow these guidelines.

- Locate the form you need and make sure it is for the correct city/region.

- Utilize the Preview button to review the document.

- Read the description to ensure you have selected the correct form.

- If the form doesn’t meet your needs, use the Search field to find the document that fits your requirements.

- Once you find the correct form, click Buy now.

- Select the pricing plan you prefer, enter the required information to create your account, and make the purchase using your PayPal or credit card.

Form popularity

FAQ

Endowment funds are treated as long-term investments that require careful management and oversight. Organizations must maintain compliance with legal restrictions and donor intent while ensuring that the funds generate consistent returns. For instances like a Puerto Rico Restricted Endowment to Religious Institution, proper treatment involves rigorous accounting practices and adherence to guidelines to maximize the benefits for the institution.

The three types of endowments include permanent endowments, which require that the principal amount remains intact indefinitely; temporary endowments, which have specific time limits or purposes for the funds; and term endowments, which are set for a fixed period. Each category serves different strategic goals, such as supporting a Puerto Rico Restricted Endowment to Religious Institution. Understanding these types helps organizations leverage their endowment strategy effectively.

In accounting, an endowment refers to a donation made to an organization, where the principal amount is invested, and only the income generated is used for operational purposes. This practice helps provide long-term financial stability, such as for a Puerto Rico Restricted Endowment to Religious Institution. By managing the endowment appropriately, organizations can ensure a steady income stream while preserving the capital for future use.

Endowment funds are typically classified under net assets on the balance sheet. Depending on whether the funds are permanently or temporarily restricted, they will appear in different sections designated for unrestricted, temporarily restricted, or permanently restricted net assets. Properly displaying the Puerto Rico Restricted Endowment to Religious Institution on the balance sheet presents a clear financial picture to stakeholders.

No, an endowment fund is not considered income. Rather, it is a fund established to generate income over time for specific purposes, such as supporting a Puerto Rico Restricted Endowment to Religious Institution. The earnings generated from the endowment fund, however, can be used as income for the organization, helping to sustain its long-term mission.

The accounting treatment of endowment funds involves recording donations as assets, with the intent to use the funds according to donor restrictions, such as the Puerto Rico Restricted Endowment to Religious Institution. These funds require a specific accounting classification to ensure compliance with legal and donor requirements. By following proper guidelines, organizations can manage fund activities effectively and maintain transparency in their financial statements.

Establishing a bona fide residence in Puerto Rico requires meeting specific criteria set by the IRS. You must reside in Puerto Rico for at least 183 days during the tax year and demonstrate an intention to stay. Engaging with the Puerto Rico Restricted Endowment to Religious Institution can also show your commitment to the local community. To ensure compliance and ease the process, consider resources available through uslegalforms that guide you in fulfilling these residency requirements.

Yes, a foreigner can start a nonprofit organization in the US, but they must adhere to specific legal requirements. This includes filing the necessary documents with both state and federal authorities. If the nonprofit has ties to religious initiatives, understanding the implications of the Puerto Rico Restricted Endowment to Religious Institution can help in securing funding. Using uslegalforms can assist you in navigating the complex legal landscape involved in this process.

While many states in the US are welcoming to nonprofit organizations, Delaware is often considered the easiest state to establish one. It has streamlined processes and favorable laws for nonprofits. Understanding the implications of the Puerto Rico Restricted Endowment to Religious Institution can also benefit those looking to fund their nonprofit initiatives effectively. You can find valuable resources on platforms like uslegalforms to guide you through the nonprofit setup process.

Yes, a US citizen can start a business in Puerto Rico. The process offers various advantages, especially with the available tax incentives for businesses. Additionally, the Puerto Rico Restricted Endowment to Religious Institution can provide a framework for funding religious organizations and projects. Utilizing platforms like uslegalforms can simplify the paperwork and legal considerations necessary for starting your venture.

More info

4). “Charitable purpose” refers to the main purpose of the organization, meaning the purpose that most motivates or motivates the staff, volunteers, and donors. The purpose may be to benefit the community in some way, such as providing scholarships or funding medical research. You cannot use the Solo website to determine if an organization's purpose is charitable under the law; instead, it's important to check with a lawyer. Charitable purpose cannot be the same as “charitable tax exemption”, a separate charitable tax exemption available only to non-profit organizations. If an organization has both a “purpose” and “charitable purpose”, the organization will be an “active charity” as defined by law and may not be entitled to tax-exempt status under the Internal Revenue Code, or charitable deduction or tax credits under state or local law. If you need a more technical summary of the law, consult an attorney.