Puerto Rico Transfer of Property under the Uniform Transfers to Minors Act

Description

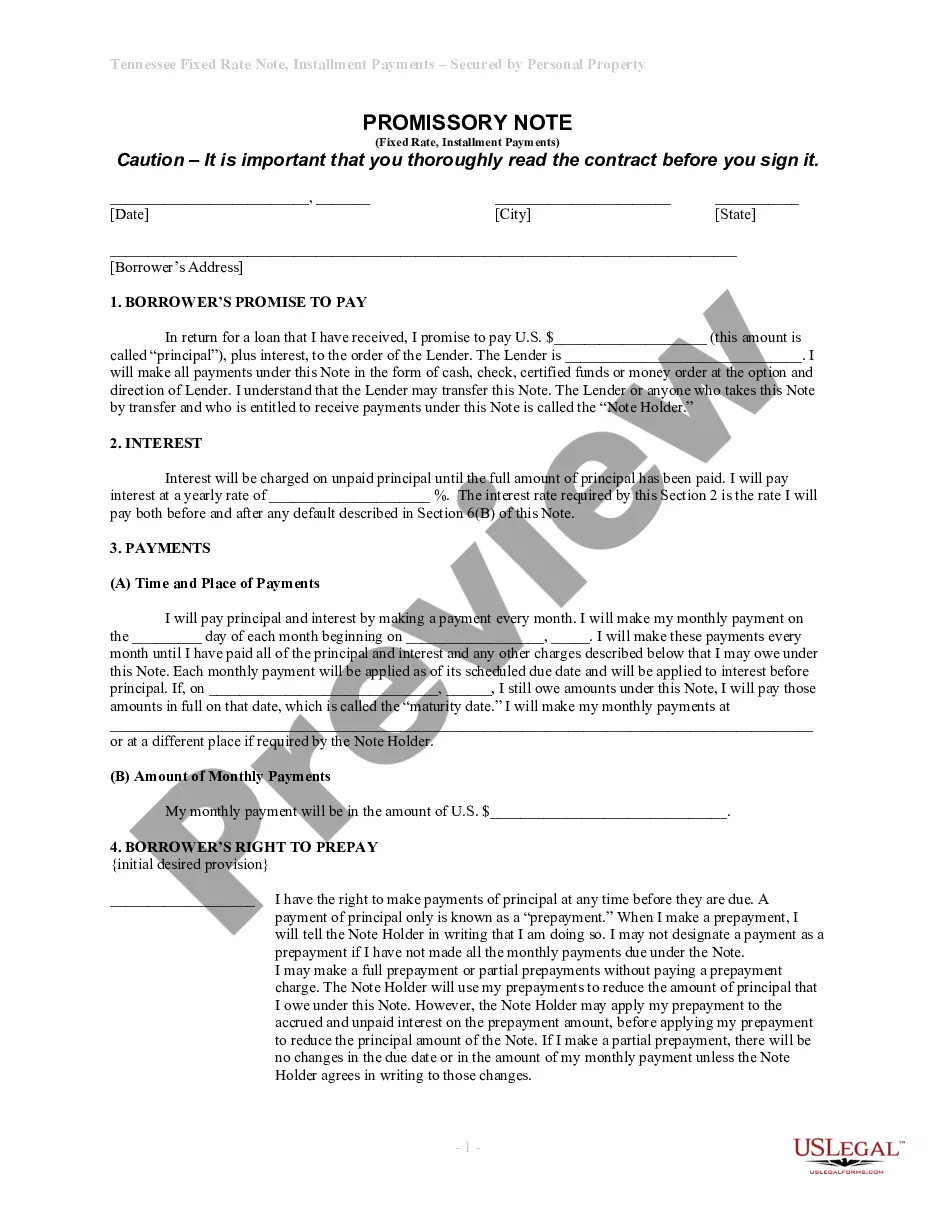

How to fill out Transfer Of Property Under The Uniform Transfers To Minors Act?

US Legal Forms - one of the largest collections of legal documents in the United States - provides a range of legal document templates that you can download or print. By utilizing the site, you will find thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can access the most recent versions of forms such as the Puerto Rico Transfer of Property under the Uniform Transfers to Minors Act in moments.

If you already possess a monthly subscription, Log In and retrieve the Puerto Rico Transfer of Property under the Uniform Transfers to Minors Act from the US Legal Forms library. The Download button will appear on each form you view. You have access to all previously downloaded forms in the My documents section of your account.

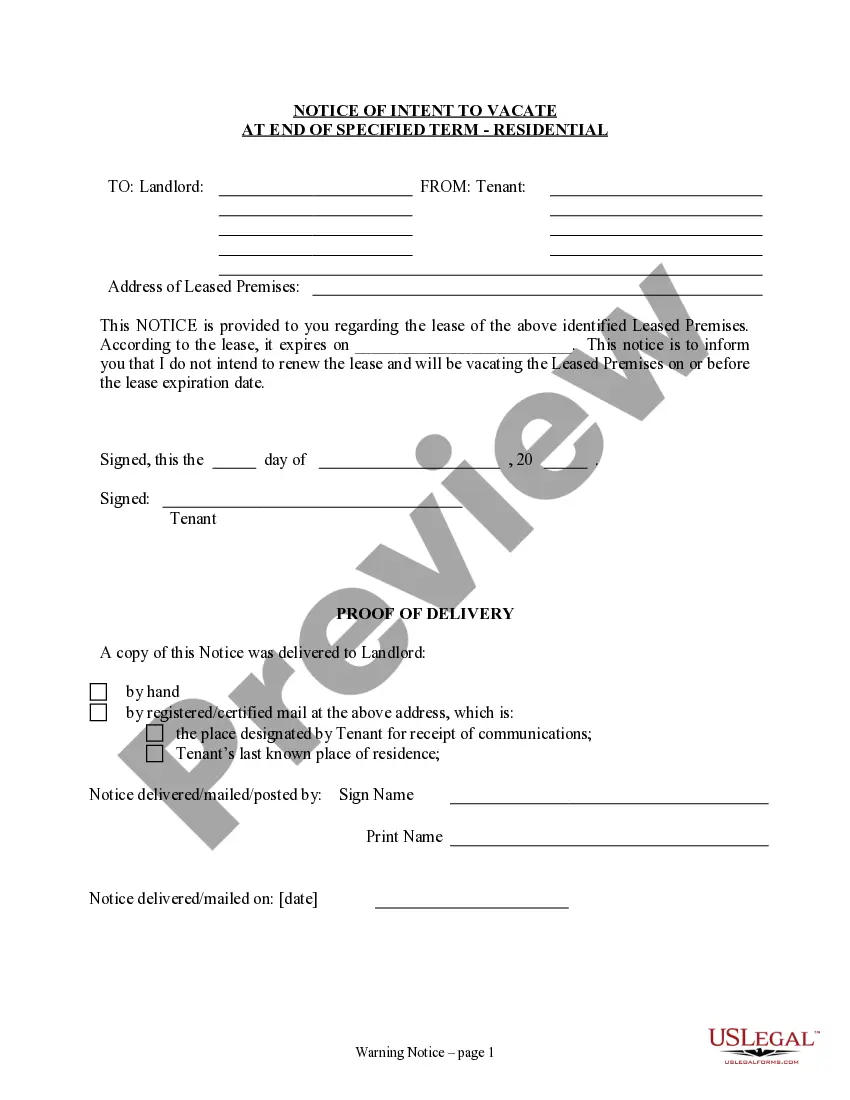

To use US Legal Forms for the first time, here are some basic steps to get started: Ensure you have selected the correct form for your city/state. Click the Preview button to review the form's details. Check the form information to confirm you have chosen the correct form. If the form doesn’t suit your requirements, use the Search field at the top of the screen to find one that does. If you are satisfied with the form, confirm your choice by clicking the Purchase now button. Then, choose the pricing plan you prefer and provide your details to register for an account. Complete the purchase. Use your credit card or PayPal account to finalize the transaction. Select the format and download the form to your device. Make modifications. Fill out, edit, print, and sign the downloaded Puerto Rico Transfer of Property under the Uniform Transfers to Minors Act. Every template you saved to your account has no expiration date and belongs to you indefinitely. Therefore, if you want to download or print another copy, simply go to the My documents section and click on the form you need.

- Access the Puerto Rico Transfer of Property under the Uniform Transfers to Minors Act with US Legal Forms, one of the most extensive libraries of legal document templates.

- Utilize a vast array of professional and state-specific templates that fulfill your business or personal needs.

Form popularity

FAQ

The Uniform Gift to Minors Act (UGMA) was created to provide a means by which title to property could be passed to minors by use of a custodian. The nature of property which could be transferred under the UGMA was limited to securities, cash or other personal property.

The Uniform Transfers to Minors Act (UTMA) allows you to name a custodian to manage property you leave to a minor. The management ends when the minor reaches age 18 to 30, depending on state law.

21 if you live in Wyoming, West Virginia, Wisconsin, Vermont, Utah, Texas, South Carolina, Rhode Island, Pennsylvania, Oregon, North Dakota, North Carolina, New York, New Mexico, New Jersey, New Hampshire, Nebraska, Montana, Missouri, Mississippi, Minnesota, Massachusetts, Maryland, Kansas, Iowa, Indiana, Illinois, ...

South Carolina permits the transfer at age 18. (*) All states repealed their UGMA statutes upon enacting their UTMA statutes. Any UGMA accounts in existence before the date of the repeal are grandfathered using the original UGMA age of termination.

As of April 4, 2022, South Carolina became the last state to adopt the UTMA.

If a minor has reached the age of twenty-one (21) and seeks to withdraw the funds from the UTMA account of which he/she is the beneficiary, the minor must contact the custodian, as the custodian is the only person authorized to make withdrawals or close the account.

The age of majority for an UTMA is different in each state. In most states, the age of majority is 21 ? which means that when a child turns 21, the custodianship of assets will end. But in other states, the age of majority is either 18 or 25. The custodian can also sometimes choose between a selection of ages.

When Can a Child Claim Ownership of an UTMA Account? Depending on the state a UTMA account is handed over to a child when they reach either age 18 or age 21. In some jurisdictions, at age 18 a UTMA account can only be handed over with the custodian's permission, and at 21 is transferred automatically.