Puerto Rico Credit Cardholder's Report of Lost or Stolen Credit Card

Description

How to fill out Credit Cardholder's Report Of Lost Or Stolen Credit Card?

Are you currently within a place the place you require papers for both company or individual uses virtually every time? There are a variety of authorized file layouts available on the Internet, but locating types you can rely on isn`t simple. US Legal Forms provides 1000s of form layouts, much like the Puerto Rico Credit Cardholder's Report of Lost or Stolen Credit Card, that are published to satisfy federal and state demands.

If you are currently informed about US Legal Forms internet site and also have an account, just log in. Afterward, you can acquire the Puerto Rico Credit Cardholder's Report of Lost or Stolen Credit Card template.

Should you not come with an bank account and need to begin to use US Legal Forms, adopt these measures:

- Obtain the form you will need and make sure it is for the appropriate metropolis/state.

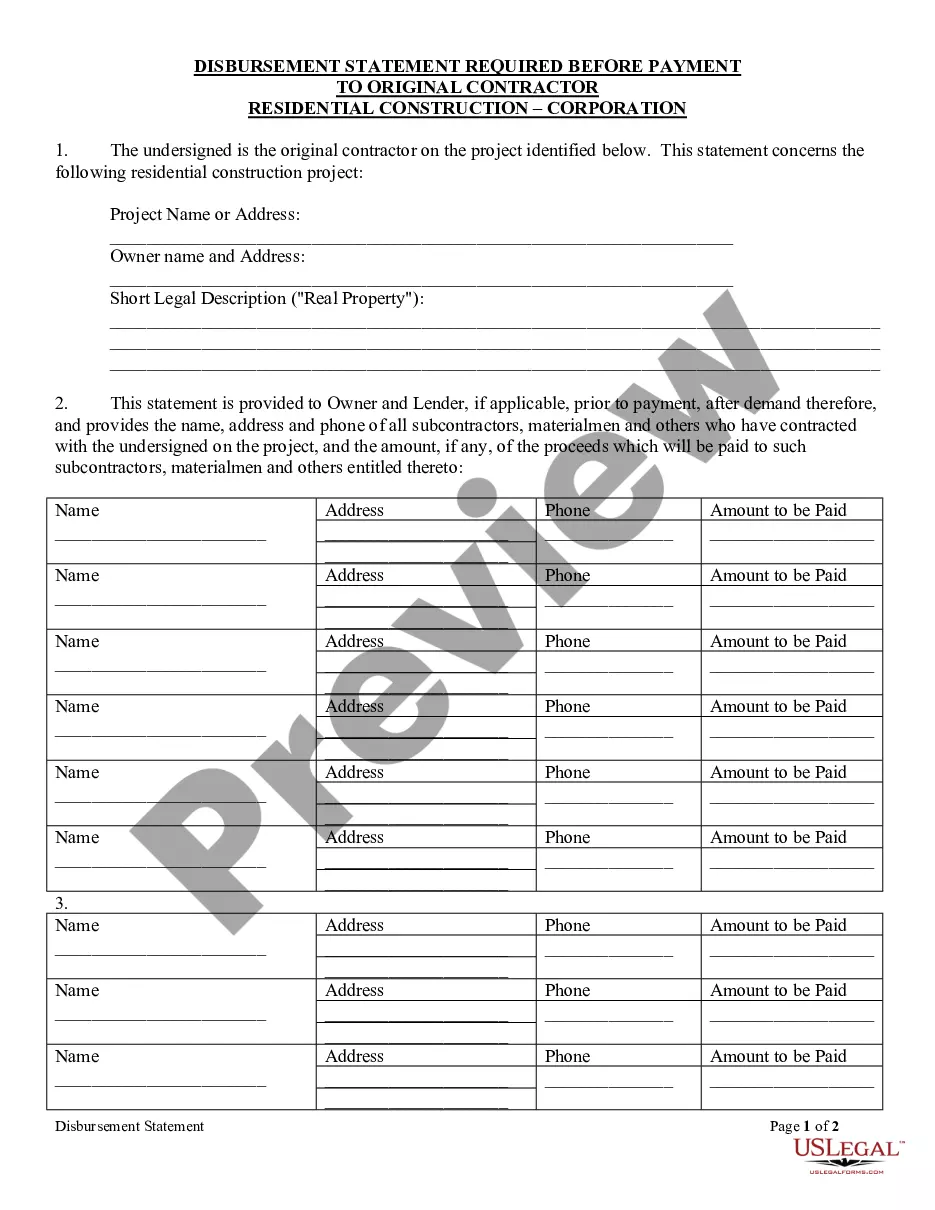

- Utilize the Review key to review the shape.

- See the outline to ensure that you have selected the right form.

- In the event the form isn`t what you`re searching for, take advantage of the Search industry to find the form that suits you and demands.

- Once you get the appropriate form, simply click Get now.

- Select the pricing strategy you need, fill out the required information and facts to produce your account, and pay for the transaction utilizing your PayPal or charge card.

- Decide on a convenient data file structure and acquire your backup.

Locate all the file layouts you have bought in the My Forms food list. You can obtain a extra backup of Puerto Rico Credit Cardholder's Report of Lost or Stolen Credit Card at any time, if necessary. Just click the required form to acquire or print out the file template.

Use US Legal Forms, one of the most comprehensive variety of authorized types, to save some time and steer clear of blunders. The assistance provides skillfully made authorized file layouts that can be used for an array of uses. Produce an account on US Legal Forms and begin making your daily life easier.

Form popularity

FAQ

Online: The card issuer's website usually has an option to request a new credit card online. Mobile app: You can use many credit cards' mobile apps to request a replacement credit card directly within the app.

5 steps to take immediately if your credit card is lost or stolen How to report credit card fraud. ... Contact your credit card issuer. ... Change your login information. ... Monitor your credit card statement. ... Review your credit report and dispute any fraud on it. ... Protect yourself from future credit card fraud. ... Bottom line.

Call ? or get on the mobile app ? and report the loss or theft to the bank or credit union that issued the card as soon as possible. Federal law says you're not responsible to pay for charges or withdrawals made without your permission if they happen after you report the loss.

Scammers can use a lost credit card to make fraudulent purchases. But they can also use the information on your card to scam your lender or bank into giving them access to your funds or even opening new accounts in your name.

When you lose your credit card, you can avoid an impact to your finances by reporting the card lost or missing immediately. In general, a lost or stolen credit card will have no impact on your credit score. In most cases, you will not be held responsible for charges on a lost or stolen card.

What to Do If Credit Card Theft Happens to You. In the event that your credit card is stolen in the United States, federal law limits the liability of cardholders to $50, regardless of the amount charged on the card by the unauthorized user.

When you report a card as lost or stolen, your credit card company will deactivate or cancel your current credit card number. The card number previously assigned to you will no longer be active and you will be mailed a replacement credit card with a new number.

Step 1. Call your credit card issuer. Call your credit card issuer immediately to report the loss or theft of your missing card. Typically, you would check the back of the card for the telephone number to call.