Puerto Rico Credit Cardholder's Report of Lost or Stolen Credit Card After Notice by Telephone

Description

How to fill out Credit Cardholder's Report Of Lost Or Stolen Credit Card After Notice By Telephone?

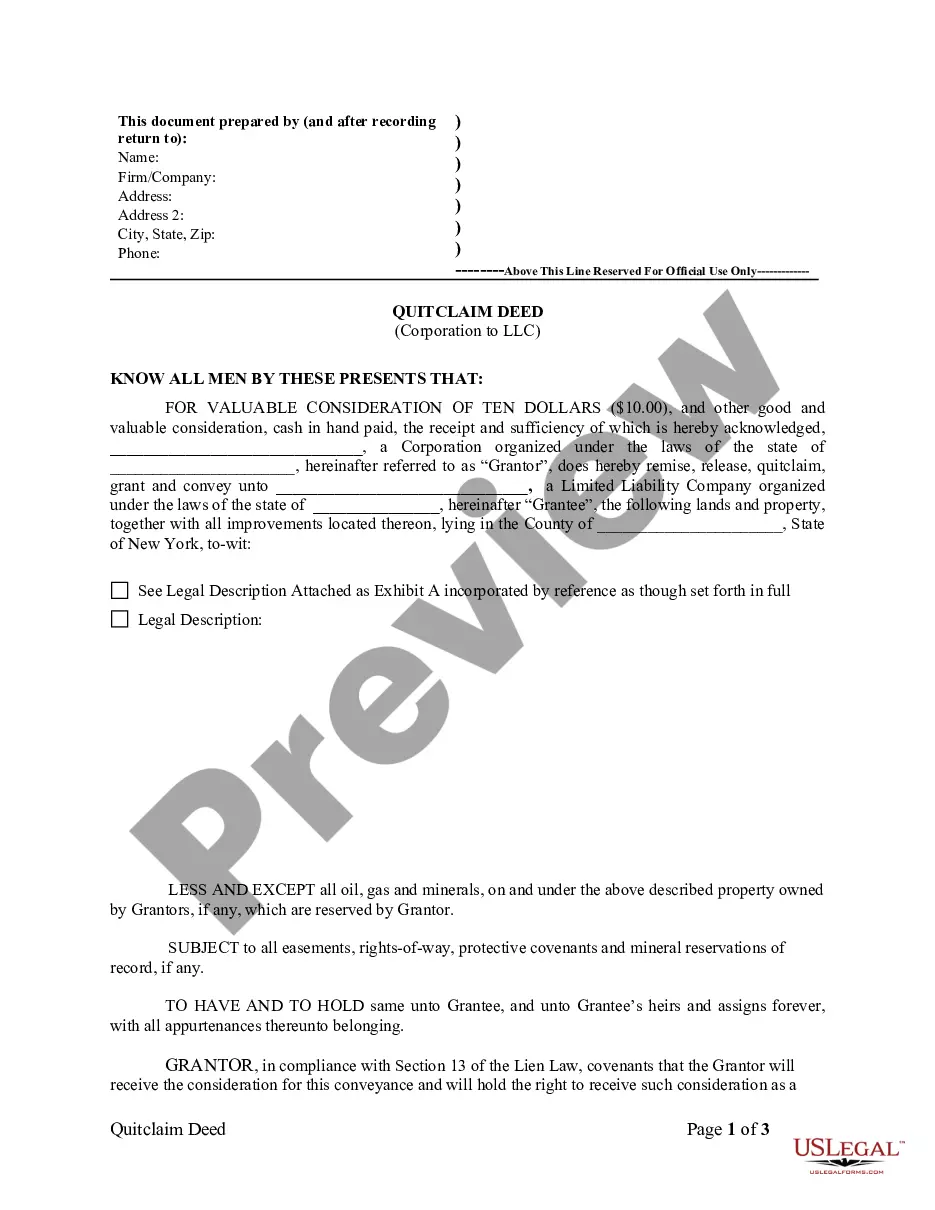

Are you in the situation where you need to have documents for sometimes company or specific uses nearly every working day? There are a variety of authorized papers web templates available on the net, but getting ones you can depend on isn`t straightforward. US Legal Forms delivers thousands of form web templates, such as the Puerto Rico Credit Cardholder's Report of Lost or Stolen Credit Card After Notice by Telephone, that are published to fulfill federal and state specifications.

Should you be already acquainted with US Legal Forms internet site and also have an account, basically log in. Afterward, you are able to download the Puerto Rico Credit Cardholder's Report of Lost or Stolen Credit Card After Notice by Telephone web template.

Unless you offer an accounts and need to start using US Legal Forms, follow these steps:

- Obtain the form you will need and make sure it is to the correct metropolis/region.

- Utilize the Preview key to review the shape.

- Read the outline to ensure that you have selected the proper form.

- In case the form isn`t what you are seeking, utilize the Look for area to find the form that meets your requirements and specifications.

- When you find the correct form, just click Acquire now.

- Select the rates prepare you desire, fill in the necessary details to produce your money, and pay money for the transaction with your PayPal or credit card.

- Select a handy file file format and download your copy.

Locate each of the papers web templates you possess bought in the My Forms food list. You may get a further copy of Puerto Rico Credit Cardholder's Report of Lost or Stolen Credit Card After Notice by Telephone whenever, if needed. Just click on the needed form to download or printing the papers web template.

Use US Legal Forms, the most comprehensive assortment of authorized forms, to save some time and steer clear of mistakes. The assistance delivers expertly produced authorized papers web templates which you can use for a range of uses. Make an account on US Legal Forms and begin generating your lifestyle a little easier.

Form popularity

FAQ

Also, if an unauthorized charge to your ATM is reported to your bank statement, you are liable for the full amount unless you report the charge within 60 days of the date the statement is sent to you. In other words, report the loss/theft of your ATM card immediately.

Notify your bank or credit union. As soon as you're reasonably certain you won't find your card, contact your bank or credit union and request a replacement. Typically, you can do this by phone or by visiting a branch location. Your lost card will be canceled, and it may take up to seven days to receive a new one.

Call ? or get on the mobile app ? and report the loss or theft to the bank or credit union that issued the card as soon as possible. Federal law says you're not responsible to pay for charges or withdrawals made without your permission if they happen after you report the loss.

A Visa representative will be able to assist you in filing a lost or stolen card report. Call us toll-free (1-800-847-2911) or call one of our global toll-free numbers from the drop-down menu at the top of this page.

If you can see what bank the card is through, then drop it off at one of those branches, and the will get it to the owner. Or you can drop it off at the police station. You could cut it up and throw it away as another option.

Got some time to spare? Call the number on the back of the card and tell the credit card company that you found it. They'll contact the card's owner for you. It's possible that the card was already reported as lost anyway, and the card company will issue a new card with a new number.

In most instances, a credit card reported as lost is completely deactivated and a new one is issued. Some issuers allow cardholders to lock the card, either online or by requesting it through customer service. This option ensures that the card isn't usable if someone finds it, but can be reactivated it if you find it.

If you find your missing credit card, you can contact the card issuer at the number on the back of the card to let them know you've found it. Depending on timing, they may instruct you to destroy and dispose of the card and begin using the replacement card that they've arranged to be sent to your address.