Puerto Rico Promissory Note — Payable on Demand is a legally binding document that outlines the terms and conditions of a loan agreement between a lender and a borrower in Puerto Rico. This type of promissory note ensures that the borrower promises to repay the loan in full to the lender on demand. The Puerto Rico Promissory Note — Payable on Demand specifies important details such as the principal loan amount, interest rates, repayment schedule, and any associated fees or penalties. This document serves as proof of the borrower's commitment to repaying the loan and protects the rights and interests of both parties involved. In Puerto Rico, there are various types of Promissory Notes — Payable on Demand that cater to specific financial situations and lending requirements. Some commonly observed types include: 1. Personal Promissory Note — Payable on Demand: This type of promissory note is often used for personal loans between individuals. It outlines the terms for loaning money for personal expenses, such as education, medical bills, or unforeseen emergencies. 2. Commercial Promissory Note — Payable on Demand: This promissory note is suitable for businesses in Puerto Rico. It allows the borrowing entity to secure necessary funds quickly while ensuring the lender receives the payment on demand. 3. Real Estate Promissory Note — Payable on Demand: Specifically utilized in real estate transactions, this type of promissory note ensures timely repayment of loans associated with property purchases or real estate investments. 4. Balloon Promissory Note — Payable on Demand: This variant of the promissory note features lower monthly payments throughout the loan term, with a lump sum payment due at the end. It provides borrowers with flexibility in managing their finances while satisfying the lender's requirement for a fixed due date. When drafting a Puerto Rico Promissory Note — Payable on Demand, it is crucial to consult legal professionals with expertise in Puerto Rican laws and regulations. Both parties should carefully review and understand the terms stated in the document to avoid potential conflicts or misunderstandings in the future. In conclusion, a Puerto Rico Promissory Note — Payable on Demand is an essential legal document that ensures the repayment of loans in Puerto Rico. By offering flexibility and protection to both lenders and borrowers, different types of promissory notes cater to various financial needs and purposes.

Puerto Rico Promissory Note - Payable on Demand

Description

How to fill out Puerto Rico Promissory Note - Payable On Demand?

Have you found yourself in a scenario where you require documents for either business or personal purposes almost daily.

There are numerous legal document templates available online, but locating those you can rely on isn't easy.

US Legal Forms offers thousands of form templates, such as the Puerto Rico Promissory Note - Payable on Demand, which can be generated to comply with state and federal regulations.

Choose the pricing plan you desire, fill in the necessary information to establish your account, and finalize your purchase using your PayPal or credit card.

Select a convenient file format and download your copy. You can find all the document templates you have purchased in the My documents section. You can retrieve another copy of the Puerto Rico Promissory Note - Payable on Demand at any time by clicking on the desired form to download or print the document template.

- If you're already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you'll be able to download the Puerto Rico Promissory Note - Payable on Demand template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it applies to your specific area/county.

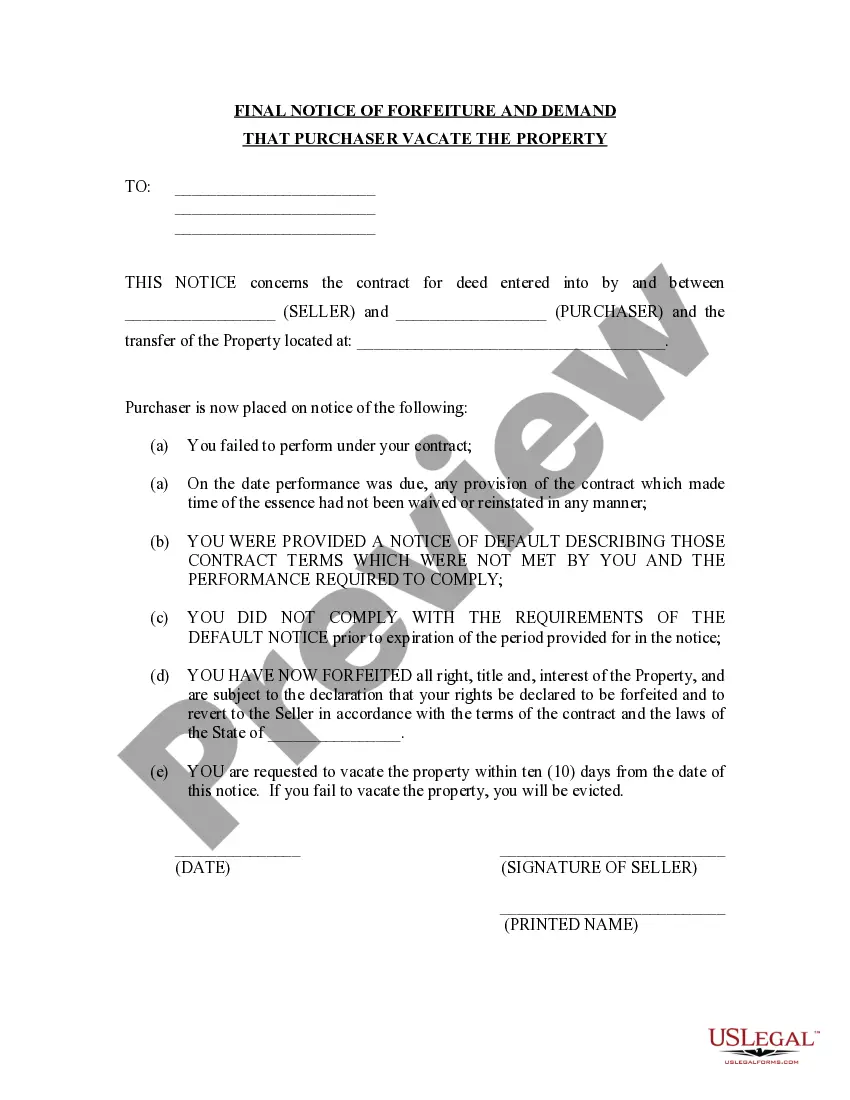

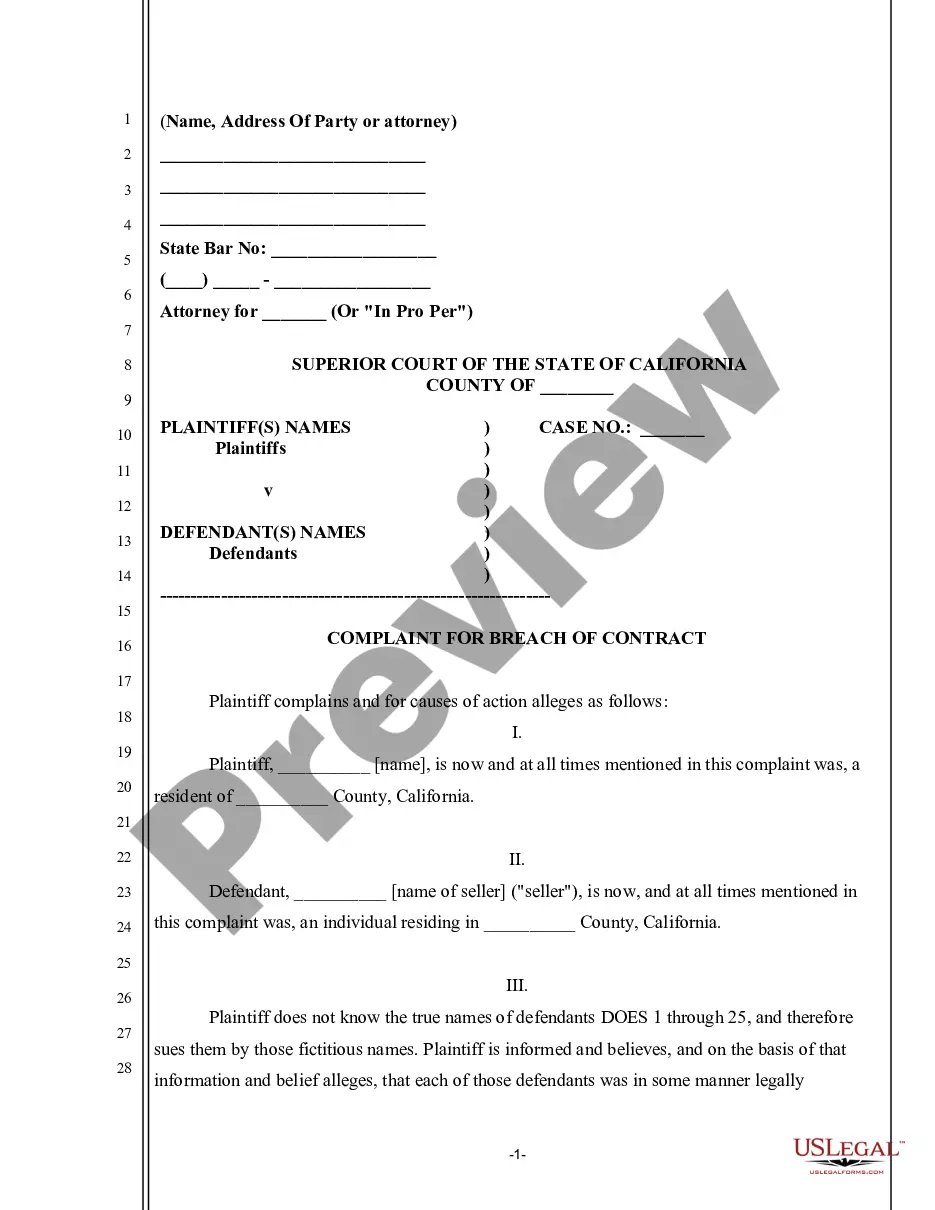

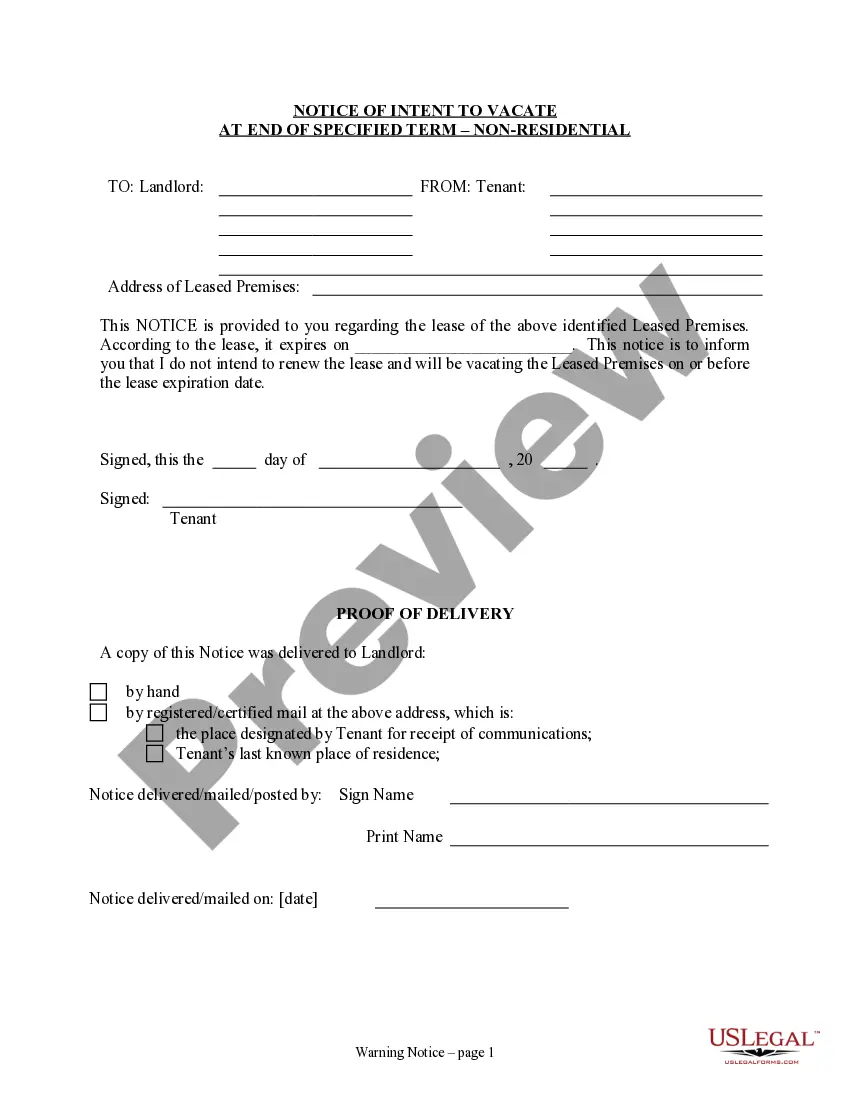

- Use the Preview button to examine the form.

- Review the description to guarantee that you have selected the correct document.

- If the form isn’t what you’re looking for, use the Search field to find the form that meets your needs and requirements.

- When you identify the appropriate form, click Buy now.

Form popularity

FAQ

The format of a promissory note typically includes a header, identification of parties, date, amount, interest rate, payment terms, and signatures. For a Puerto Rico Promissory Note - Payable on Demand, it’s important to clearly outline the conditions under which the lender can demand repayment. Additionally, sections for any collateral, governing law, and late fees can be beneficial. Following a standardized format helps maintain clarity and enforceability.

Yes, you can demand payment on a promissory note once it is due, especially if it is classified as a Puerto Rico Promissory Note - Payable on Demand. The terms outlined in the note will guide the process, ensuring you follow the correct legal steps. If you're unsure about how to proceed, consider consulting with a legal professional for guidance.

Puerto Rico Form 482 is a tax form that focuses on reporting income and expenses for particular transactions. It is used often in conjunction with various financial activities, such as those involving a Puerto Rico Promissory Note - Payable on Demand. Familiarizing yourself with this form can lead to smoother tax processing.

You can file Puerto Rico taxes at the Department of Treasury or through the local tax authority. Filing electronically is growing in popularity due to its convenience and efficiency. If you are managing a Puerto Rico Promissory Note - Payable on Demand, timely filing is crucial to avoid any penalties.

Form 480.6 C is a document used for specific tax declarations, particularly in relation to withholding taxes in Puerto Rico. This form is essential for those receiving payments, such as a Puerto Rico Promissory Note - Payable on Demand. Properly completing this form can minimize your tax liability and ensure compliance.

Several individuals and entities qualify for tax exemptions in Puerto Rico, including certain businesses and residents under specific income brackets. If you engage in financial activities involving a Puerto Rico Promissory Note - Payable on Demand, knowing your eligibility for exemptions can be beneficial. Always consult with a tax professional to understand your unique situation.

The 480.6 sp form is a tax return document specific to certain entities and transactions in Puerto Rico. It is commonly used to declare income, especially when receiving payments like a Puerto Rico Promissory Note - Payable on Demand. Submitting this form correctly can help ensure compliance with local tax laws.

Form 482 in Puerto Rico is a crucial document for taxpayers. It helps individuals and businesses report their earnings, expenses, and tax liability. If you're dealing with a Puerto Rico Promissory Note - Payable on Demand, understanding Form 482 can be beneficial for your overall tax strategy.

A demand note payable is a financial instrument that requires repayment upon the lender's request. This type of note, including a Puerto Rico Promissory Note - Payable on Demand, provides flexibility and speed for lenders who need immediate access to their investment return. Understanding the terms of these notes is crucial for both lenders and borrowers.

Yes, a promissory note can be structured to be on demand, which means the lender can request repayment at any time. A Puerto Rico Promissory Note - Payable on Demand allows for flexible repayment options for both parties. This structure can be advantageous in situations where quick access to funds is needed.

Interesting Questions

More info

Need Byproduct InstructionServiceNow orgTrainingCompany Completion ServiceNow Community Devs Development Company.