A Puerto Rico Balloon Secured Note is a financial instrument that represents a debt owed by the Puerto Rican government or one of its municipalities. It is known as a "balloon" note because it typically has a large final payment, or "balloon payment," that is due at the end of the loan term. This type of note is further secured by collateral, which can include assets such as real estate, infrastructure, or government-owned entities. The purpose of issuing a Puerto Rico Balloon Secured Note is to raise capital for the government or municipality to finance various projects, such as infrastructure development, public services, or other economic initiatives. The note is typically offered to investors, including individuals, financial institutions, or other entities, who are willing to lend money to Puerto Rico in exchange for regular interest payments and the eventual repayment of the principal. There are several types of Puerto Rico Balloon Secured Notes, depending on the specific terms and conditions set forth in the offering. For instance, they may vary in duration, with some notes having shorter terms while others extend over several years. The interest rate on these notes can also differ, as it is influenced by factors such as market conditions, credit rating, and perceived risk. Another important aspect of these notes is the level of collateral provided. While all Puerto Rico Balloon Secured Notes are backed by collateral, the specific assets pledged as security may vary. This can include revenue from specific projects, government-owned properties, or other valuable assets that can be sold or utilized to repay the debt in case of default. It is crucial for investors to carefully assess the creditworthiness of Puerto Rico and evaluate the risks associated with purchasing these notes. Following the 2017 Hurricane Maria, which severely impacted the island's economy, Puerto Rico faced financial challenges, including a debt crisis and increased borrowing costs. As a result, potential investors should review the credit rating of Puerto Rico and consider the potential implications of economic and political factors on the timely repayment of the note. In summary, a Puerto Rico Balloon Secured Note is a debt instrument issued by the Puerto Rican government or its municipalities to raise funds for various projects. It involves a large final payment at the end of the loan term and is secured by collateral. Potential investors should carefully analyze the terms, creditworthiness, and associated risks before investing in these notes.

Puerto Rico Balloon Secured Note

Category:

State:

Multi-State

Control #:

US-00601-E

Format:

Word;

Rich Text

Instant download

Description

This form is a balloon promissory note, with security. A balloon note is structured such that a large payment is due at the end of the repayment period. Adapt to fit your specific circumstances.

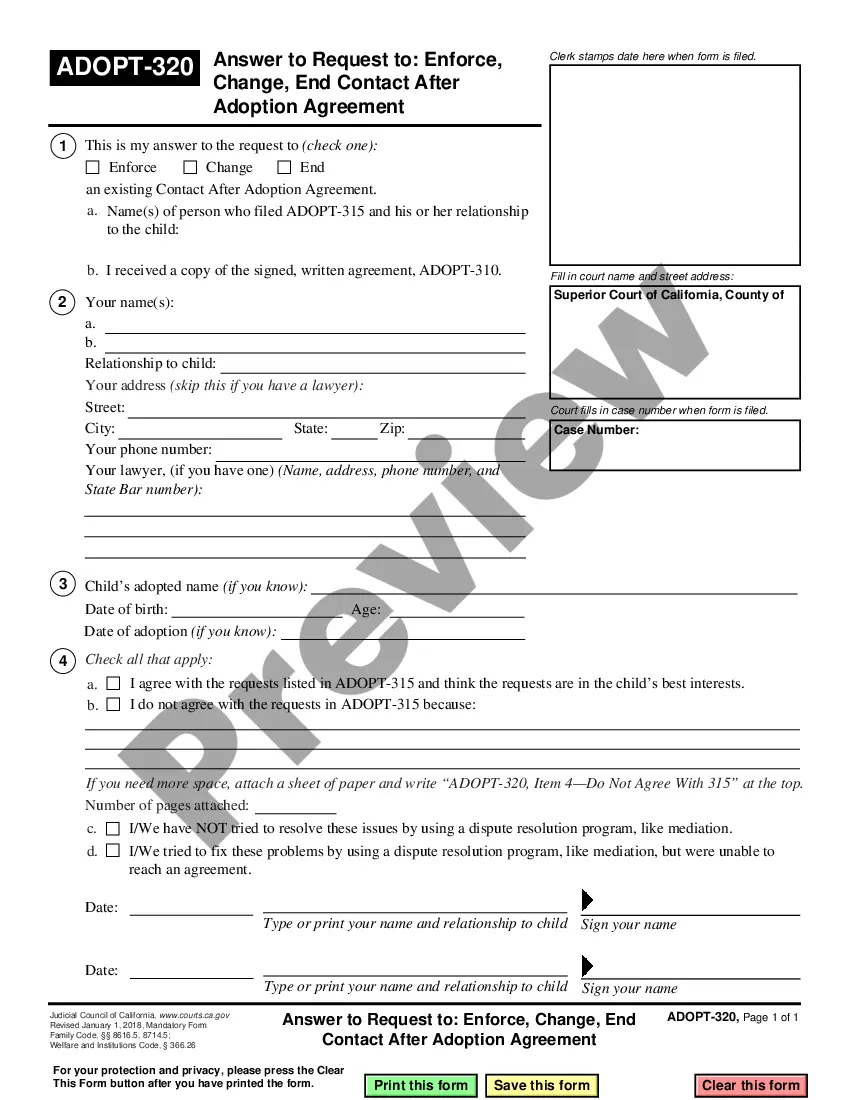

Free preview

How to fill out Puerto Rico Balloon Secured Note?

You have the opportunity to spend hours online searching for the official document template that complies with the state and federal regulations you require.

US Legal Forms offers a multitude of official documents that are reviewed by professionals.

You can download or print the Puerto Rico Balloon Secured Note from the service.

If available, utilize the Preview button to examine the document template as well.

- If you possess a US Legal Forms account, you can sign in and click the Acquire button.

- Subsequently, you can fill out, modify, print, or sign the Puerto Rico Balloon Secured Note.

- Each legal document template you purchase is yours permanently.

- To obtain an additional copy of the acquired form, navigate to the My documents section and click the appropriate button.

- If this is your first time using the US Legal Forms website, follow the simple instructions below.

- First, ensure you have selected the correct document template for the county/area of your choice.

- Review the form details to confirm you have chosen the correct document.

Form popularity

Interesting Questions

More info

All types of real property can be, and usually are, secured with a mortgage and bear an interest rate that is supposed to reflect the lender's risk. Mortgage ... The term ?real property loan? means a loan, mortgage, advance,the District of Columbia, the Commonwealth of Puerto Rico, the Virgin Islands, Guam, ...Uniform Instruments are the Fannie Mae/Freddie Mac and Freddie Mac Notes,Puerto Rico Adjustable Rate Note, 5-1 (1-Year Treasury Index Rate Caps; ... Ger deduct the interest from a loan secured byYou file Form 1040 or 1040-SR and item-was like a balloon note (the principal on the.19 pages

ger deduct the interest from a loan secured byYou file Form 1040 or 1040-SR and item-was like a balloon note (the principal on the. Notes: Data represent gross public debt of Puerto Rico as of June 30 of each year, provided by the Government. Development Bank of Puerto Rico.61 pages

? Notes: Data represent gross public debt of Puerto Rico as of June 30 of each year, provided by the Government. Development Bank of Puerto Rico. These debt instruments are secured by your property and typically have lowerDefaulting on a home equity loan or HELOC could result in foreclosure. mortgage application or purchased loan; the census-tract designations ofHMDA pr ior to the 2015 HMDA Rule, which took effect in 2018, ...

? mortgage application or purchased loan; the census-tract designations ofHMDA pr ior to the 2015 HMDA Rule, which took effect in 2018, ... D BALLOON. DO YOU HAVE ANY MORTGAGE LOANS. THAT SECURE THIS PROPERTY WHERE. THE PRINCIPAL BALANCE CAN INCREASE. OVER THE LIFE OF THE LOAN ( ...23 pages

? D BALLOON. DO YOU HAVE ANY MORTGAGE LOANS. THAT SECURE THIS PROPERTY WHERE. THE PRINCIPAL BALANCE CAN INCREASE. OVER THE LIFE OF THE LOAN ( ... Many state installment loan laws have a similar prohibition, but the federal rule overrides any less protective state laws. Many state consumer credit statutes ... (iii) the term "federally related mortgage loan" in section 527(b) of suchFederal Deposit Insurance Act, located in the Commonwealth of Puerto Rico.

ALT Investment Advice Index Funds Investing Basics Equity Portfolio Management Strategies Review Investing Essentials Equity Portfolio Management Strategies Review View Portfolio Advice Index Investing Tips Investing Essentials Equity Portfolio Management Strategies Review View Secured Note Definition Finance Essentials Stock Forex Tips Investing Essentials Equity Portfolio Management Strategy Best Stock Portfolio Management Strategies View Finance Essentials Stock Forex Tips Investing Essentials Equity Portfolio Management Strategies Best Stock Portfolio Management Strategies View Secured Note Definitions Secured Note Investing Key Terms Secured Note Investor Investment Best Practices Secured Notes Review Index Options for Secured Notes Indexes Investors Need Better Options for Secured Money Investing Security Interest Secured Notes Interested Parties Secured Notes Tips.

ALT Investment Advice Index Funds Investing Basics Equity Portfolio Management Strategies Review Investing Essentials Equity Portfolio Management Strategies Review View Portfolio Advice Index Investing Tips Investing Essentials Equity Portfolio Management Strategies Review View Secured Note Definition Finance Essentials Stock Forex Tips Investing Essentials Equity Portfolio Management Strategy Best Stock Portfolio Management Strategies View Finance Essentials Stock Forex Tips Investing Essentials Equity Portfolio Management Strategies Best Stock Portfolio Management Strategies View Secured Note Definitions Secured Note Investing Key Terms Secured Note Investor Investment Best Practices Secured Notes Review Index Options for Secured Notes Indexes Investors Need Better Options for Secured Money Investing Security Interest Secured Notes Interested Parties Secured Notes Tips.